Fed Rate Cuts Are Here

How The Market Is Reacting

Why Ethereum Is Heading To Zero

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $63,071 | +5.89% | +49.15% |

Ethereum (ETH) | $2,430 | +5.32% | +6.50% |

Solana (SOL) | $141 | +10.98% | +39.71% |

This Update is Brought to You by Heatbit

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

FED RATE CUTS ARE HERE

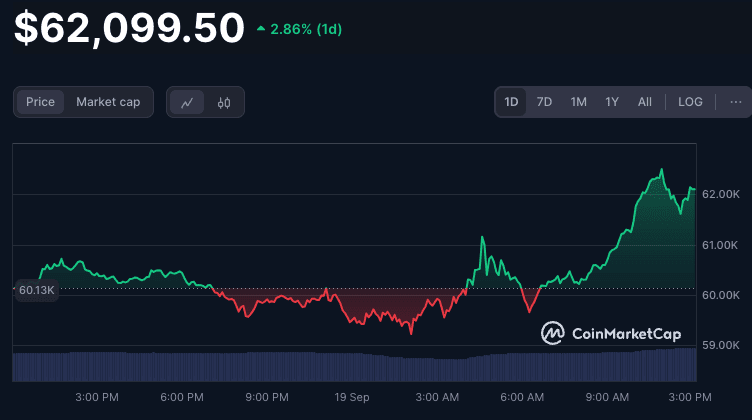

BREAKING: Bitcoin above $62,000, after 50 basis-point rate cut

Here it is, as expected:

Historically, reductions in interest rates have been a catalyst for risk assets like cryptocurrencies, often leading to price spikes for BTC.

In the past 24 hours, Bitcoin has risen 4.35% to over $62,000, while the broader digital asset market has increased by 5%, as reported by the CoinDesk 20 Index (CD20).

Notably, Ethereum (ETH) and Solana (SOL) led the way among altcoins, rising 5.8% and 7.4%, respectively.

While the rate cut has provided a boost, some traders remain skeptical about the longevity of this rally.

They argue that despite the initial market optimism, larger economic challenges, such as a potential recession and geopolitical risks, could prevent sustained growth in cryptocurrency prices.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

HOW THE MARKET IS REACTING…

Here are some takes, reactions and thoughts from around the market:

1/ “Recession? No. Banana Zone.” – The High Yield Market

2/ 2025 GDP forecast: unchanged 💪

A 50 bp cut into what the Fed sees as a healthy economy = great news

3/ Eager for additional cuts? There's more good news coming your way…

/

The Federal Reserve has stated its "confidence" that inflation will continue its downward trend to 2%, while unemployment stabilizes as they fine-tune their policy stance.

Translation: Jerome Powell thinks he can achieve a soft landing, meaning he aims to lower inflation without tipping the economy into a recession.

That’s all the info we have for now! These rate cuts were announced only an hour ago, so we’ll keep you posted on any new developments.

Stay Ahead of the Trend in Digital Assets with Glassnode

Join Glassnode and Access a suite of metrics which describe the foundational components and performance of the Bitcoin blockchain. Metrics cover supply, on-chain activity, transfer volumes, mining performance, and transaction fees.

WHY ETHEREUM IS HEADING TO 0

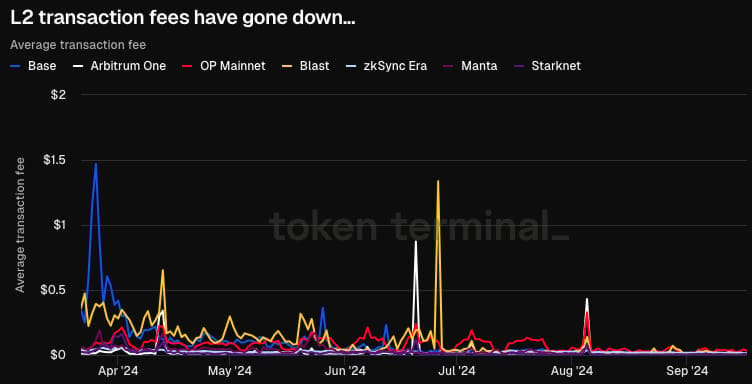

One of the most significant improvements to the Ethereum network in 2024 has been the rise of Layer 2 (L2) networks, which have drastically reduced transaction fees and improved usability.

In the previous cycle, users often faced exorbitant gas fees—sometimes exceeding $200—for high-priority transactions, a major criticism against Ethereum.

But now, thanks to Layer 2 solutions, Ethereum’s transaction fees have dropped down to almost 0:

Speaking at Token 2049, Vitalik Buterin (Ethereum’s founder) emphasized this transformation:

“From being somewhere between $10 and $0.50 to being under $0.01, basically zero.”

This reduction in fees has made Ethereum far more user-friendly, allowing for much cheaper and faster transactions. Layer 2 networks have also led to significant improvements in transaction confirmation times.

According to Vitalik😀 :

“One of the things that the merge did is it also cut in half the average waiting time until the next block… These days I quietly have my transactions confirmed in 5 to 15 seconds.”

This enhanced scalability, combined with lower costs, has led to an explosion in transaction volume on Layer 2 networks like Base, Arbitrum, and Optimism (OP).

The number of Layer 2 transactions has soared, demonstrating the growing adoption of these solutions. 🚀

With these developments, it’s clear that Ethereum is evolving to meet the demands of a growing user base.

As we noted earlier: Don’t count out Ethereum just yet.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

OTHER NEWS:

Dave Birnbaum, VP of product at Coinbits, highlights how Donald Trump's involvement with World Liberty Financial risks undermining Bitcoin’s progress by confusing it with speculative DeFi projects, potentially alienating both Bitcoin supporters and conservative followers

Alex Bergeron, a chaos maximalist, publishes ‘The Financial Anarchist Manifesto’, explaining that a financial anarchist is someone who challenges centralized financial power by promoting decentralized alternatives like Bitcoin, Nostr, and Chaumian ecash

Shane Neagle, editor-in-chief of The Tokenist, argues that urgent Bitcoin tax reform is essential to remove disincentives for everyday use, making low-value transactions exempt from capital gains tax and fostering broader adoption in commerce

DarthCoin, an irreverent Bitcoin OG and educator, explains how to effectively manage lightning wallets by emphasizing liquidity distribution, regular movement of funds, and avoiding long-term stacking to optimize spending and support a healthy LN ecosystem

Alex Fulton explores the complex interconnections between Bitcoin, Saturn, and synchronicity, illustrating how these themes reveal deeper meanings about time, money, and the nature of existence in the digital age

Zaprite, a Bitcoin payments company, features a Q&A with Frontside Consulting, highlighting their journey into Bitcoin, the benefits of accepting it as payment, and how their digital marketing services align with the values of decentralization and financial freedom

Foundation, a hardware wallet manufacturer, publishes a thread debunking 5 common Bitcoin security myths, emphasizing the importance of self-custody, privacy, and selecting the right wallet to ensure greater control and protection over your Bitcoin

DesertDave, a Bitcoiner on Stacker News, showcases how he mines Bitcoin off-grid on an extreme budget using repurposed solar panels, a salvaged trailer, and affordable lithium batteries, demonstrating a DIY approach to solar-powered mining

Daniel Batten publishes a post on X highlighting 19 impactful benefits of Bitcoin, including humanitarian aid, financial inclusion, energy independence, environmental improvements, and support for liberal democracies

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

Cryptosovereignty - Erik Cason

Liberty and Property - Ludwig Von Mises

The Conservative Case For Bitcoin - Mitchell Askew

Debt: The First 5000 Years - David Graeber

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.