Ethereum Gas Fees Hitting New All Time Lows

Is Bitcoin Poised to 100x? 💥

Is Smart Money Still Buying Bitcoin?

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $59,694 | -1.97% | +41.19% |

Ethereum (ETH) | $2,603 | -2.07% | +14.07% |

Solana (SOL) | $143 | -2.52% | +41.30 |

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

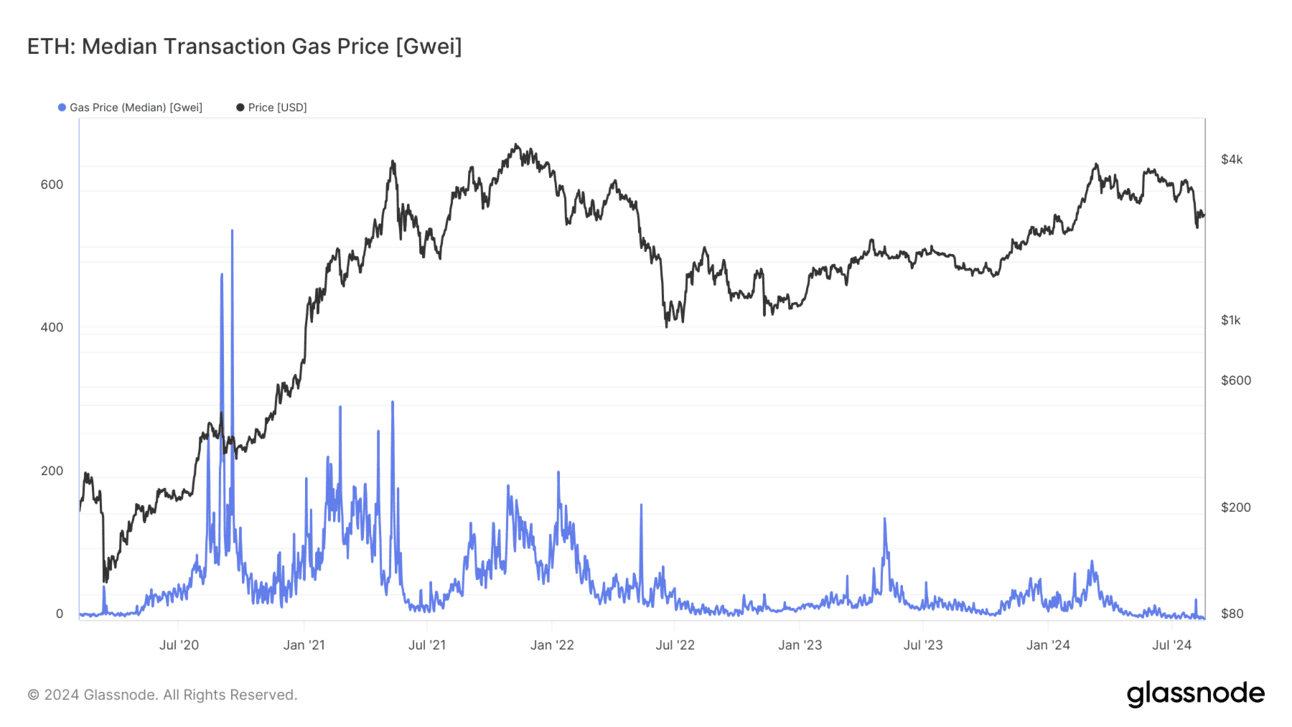

ETHEREUM GAS FEES

HITTING NEW LOWS

Ethereum gas fees have been nosediving since March 2024, recently reaching their lowest levels in half a decade.

Ethereum Transaction Gas Fees

This development has sparked debate among crypto enthusiasts about its impact on ETH.

For newcomers, gas fees are the transaction costs on the Ethereum network.

The current decline in these fees is mainly due to reduced demand for block space on Ethereum.

But is this a bad omen for Ethereum? Far from it.

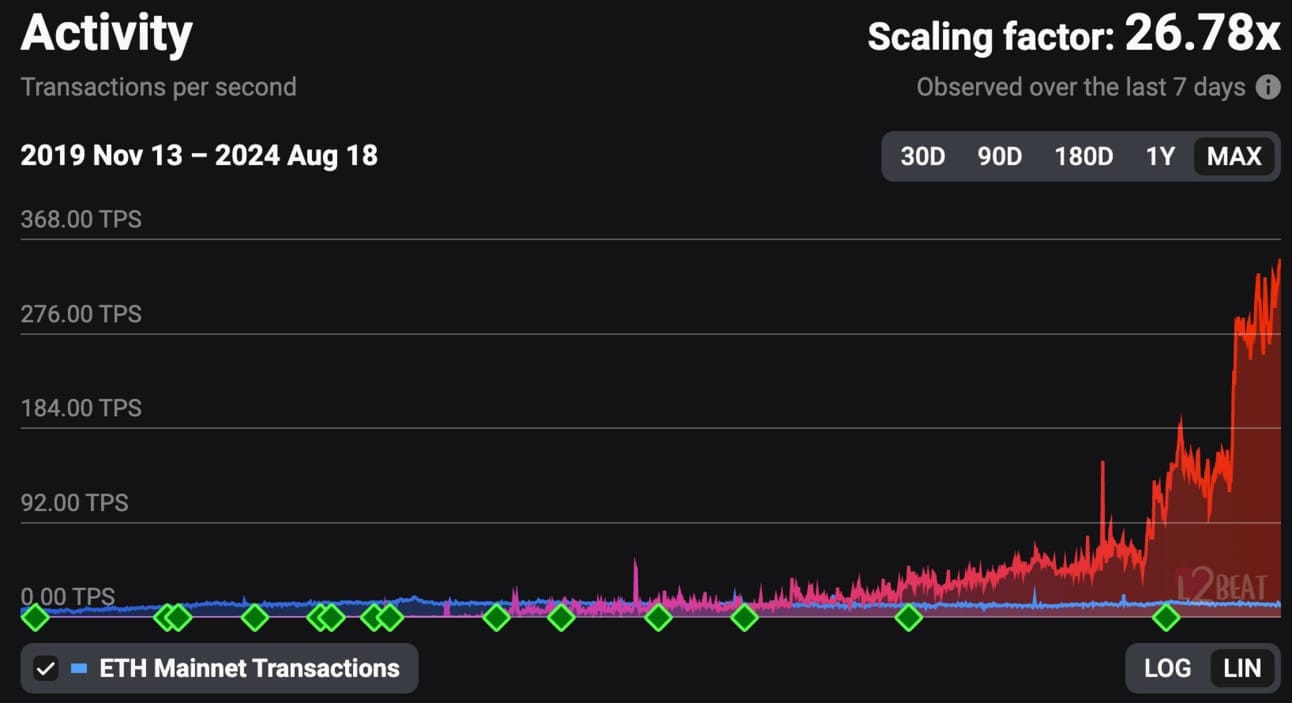

Layer 2 Transaction Count

The growth of Layer 2 networks, which offer faster and cheaper transactions, is a key factor.

These networks enhance the efficiency of the Ethereum blockchain, and their transaction counts are climbing.

Ethereum’s Transactions per Second (TPS), when including Layer 2s, have never been higher, showing the network’s growing capacity.

Ethereum Transaction Activity (# of Transactions per second)

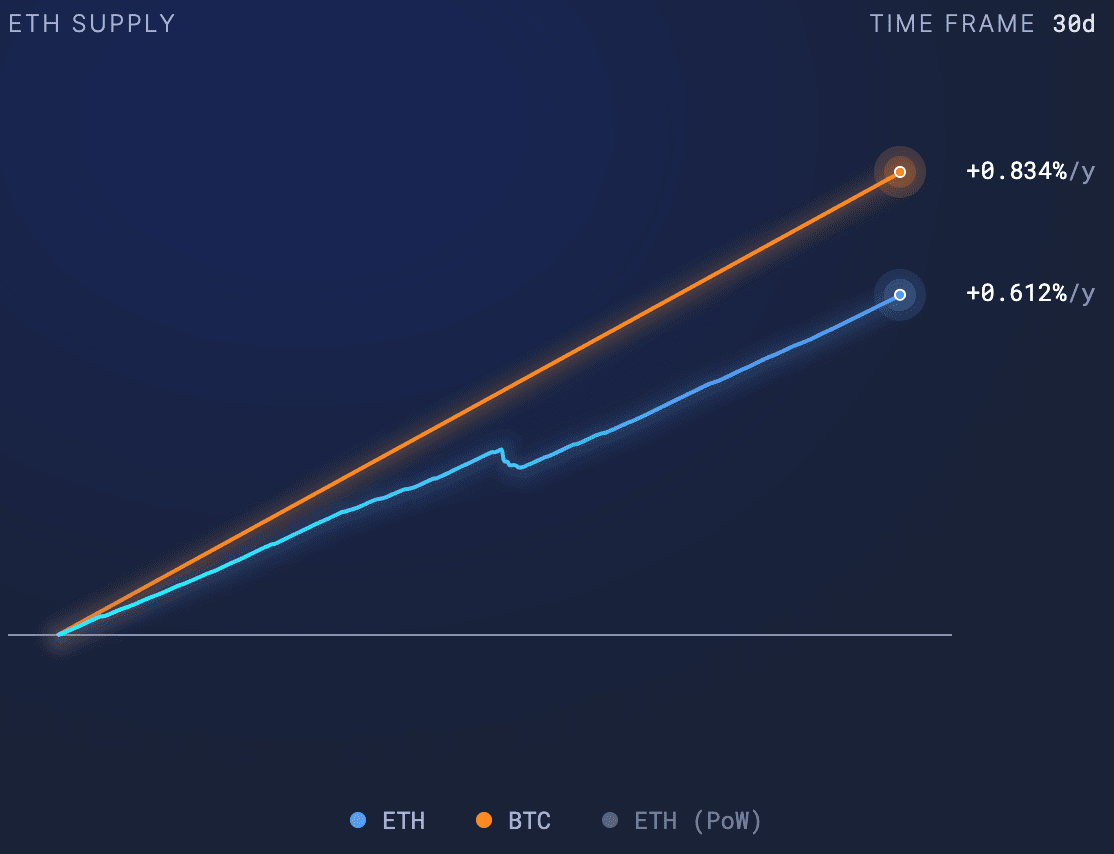

However, there’s a downside to lower gas fees: they lead to less ETH being burned, which makes Ethereum inflationary.

Over the last 30 days, Ethereum’s inflation rate has been 0.612% per year.

Yet, this drop in gas fees might also signal a potential bullish trend.

According to Ryan Lee, Chief Analyst at Bitget Research, historically low gas fees often precede a price bottom, followed by a strong recovery.

“Every time ETH gas fees drop to rock bottom, it has often signalled a price bottom in the mid-term… ETH prices tend to strongly rebound after this cycle, and when this moment coincides with an interest rate cut cycle, the market's wealth effect is full of possibilities.”

Is Ethereum on the verge of a price surge? 🚀

IS BITCOIN POISED TO 100X? 🛸

Over the last quarter-century, gold managed to achieve a 10x increase in its price.

Looking forward, Bitcoin could potentially do a 100x in the next 25 years.

That’s the latest prediction from Fred Krueger, a successful entrepreneur and passionate advocate for Bitcoin.

In his latest market update, Fred shared a fascinating observation.

In 1999, gold was priced at roughly $250 per ounce. By 2024, its price had soared to $2,500 per ounce—a 10x increase in value over 25 years.

While this performance is impressive, Fred argues that Bitcoin will surpass it by a large margin.

“Gold did a 10x in 25 years. Bitcoin will do 100x,”

Fred’s belief in Bitcoin stems from its characteristics that outshine gold in various ways:

Verifiable scarcity 🌐

Accessibility and portability 🔒

Divisibility 🧩

Fred also pointed out an intriguing pattern. Today, gold reached a new all-time high of $2,500.

When you compare the price of Bitcoin with gold, but with a 3-month lag, the trends appear to be closely aligned:

Fred suggests that gold has a unique ability to detect inflation earlier than other assets, which causes its price to rise first, followed by Bitcoin about three months later.

If this pattern continues, Bitcoin could be on track to achieve new all-time highs by November. The next three months could be very interesting! 🍾

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

IS THE SMART MONEY

STILL BUYING BUTCOIN?

There’s one paramount factor in crypto that surpasses all others.

It’s more significant than the U.S election results in November.

It’s more significant than any forthcoming crypto legislation.

The most crucial factor in crypto is whether or not smart money is still purchasing Bitcoin.

And that’s exactly what Matt Hougan dissected in his latest update.

Matt Hougan, the Chief Investment Officer at Bitwise, oversees the 5th largest Bitcoin ETF.

When it comes to assessing if smart money (institutions, sophisticated investors) is still buying, Matt is the go-to expert.

In his report, Matt shared 3 critical insights:

1. Yes, Institutions Are Still Buying Bitcoin

The introduction and initial quarter of the Bitcoin ETFs shattered records.

However, with Bitcoin's price decline over the past 3 months, there was no assurance this momentum would persist.

Many investors assumed the volatility might scare institutions away from Bitcoin.

But that wasn’t the case at all.

In the last 3 months, the number of institutional investors in Bitcoin ETFs climbed from 965 to 1,100—a 14% increase.

These institutions also raised their holdings in the Bitcoin ETFs, from 18.74% to 21.15%.

Even amidst intense volatility, smart money continues to invest.

“In my view, this is a great sign. If institutions will buy bitcoin when prices are volatile, imagine what could happen in a bull market.”

Matt Hougan

2. The Speed Of Institutional Adoption Is Unmatched

Another revelation from Matt was the rapid pace at which institutions are embracing the Bitcoin ETFs.

This is especially evident when comparing the first 2 quarters of trading among the 10 fastest-growing ETFs in history:

Clearly, Bitcoin is in a class of its own.

3. Most ‘Smart Money’ Are Starting Small

Matt’s final insight is particularly surprising.

What do you think the average portfolio allocation towards the Bitcoin ETFs is for institutional buyers?

10%?

5%?

Even just 1%?

Surprisingly, it’s only 0.47%.

This figure might seem low at first glance. But it’s actually a positive indicator:

“I find this number highly encouraging.... Many start with 1% or less of their portfolio, but that number tends to rise to 2.5% or even 5% over time.”

Matt Hougan

Smart money typically enters the market cautiously, gradually increasing their stake over time.

Matt anticipates this figure will surpass 1% within the next 12 months and will continue to grow from there.

So, in the midst of all the volatility, is smart money still buying?

Without question. 🧠

OTHER NEWS:

Attention Bitcoin Traders, the Japanese Yen Is Strengthening Again. The Japanese yen is rallying against the U.S. dollar in a redux of early August market action that was characterized by sharp losses in global stock markets and bitcoin.

Robin Linus publicizes a new paper on BitVM bridges - a novel and trust-minimized protocol to bridge bitcoins to second layers, which would enhance Bitcoin’s programmability.

CoinGate reports a dramatic rise in Lightning Network adoption among their users, with Bitcoin payments made through Lightning on their platform doubling from 2022 to 2024.

Marathon Digital announces $250M fundraising to expand Bitcoin holdings.

Ben The Carman leaves Mutiny to join Taproot Wizards to help build CatVM, a project that aims to scale Bitcoin.

US government seeks 30-year prison sentence for Roman Sterlingov, amid skepticism over blockchain evidence used in Bitcoin Fog case.

UN Cybercrime Convention criminalizes hacking and whistleblowing while enabling financial surveillance and overriding bank secrecy across member states.

Bitcoin reserves on exchanges decline to a five-year low as $5.96B is withdrawn in just 30 days, emphasizing the shift toward self-custody.

Venezuelan government blocks Binance, limiting access for thousands and impacting crucial peer-to-peer trades.

Nigerian SEC cautiously embraces Bitcoin regulation while James Otudor's lawsuit challenges restrictive crypto laws and advocates for investor rights.

El Salvador announces $1.6B Private Investment - the biggest in the nation's history.

Israeli tourists lose $700,000 in bitcoin to armed assailants in a violent beach attack in Costa Rica.

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.