Rate Cuts Are Coming

Why Rate Cuts Are Extremely Bullish For Bitcoin💥

RFK Endorses Trump

And more…

Market Data Prices as of 8:20am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $62,448 | -2.38% | +47.40% |

Ethereum (ETH) | $2,621 | -4.34% | +14.85% |

Solana (SOL) | $153.83 | -4.33% | +51.53% |

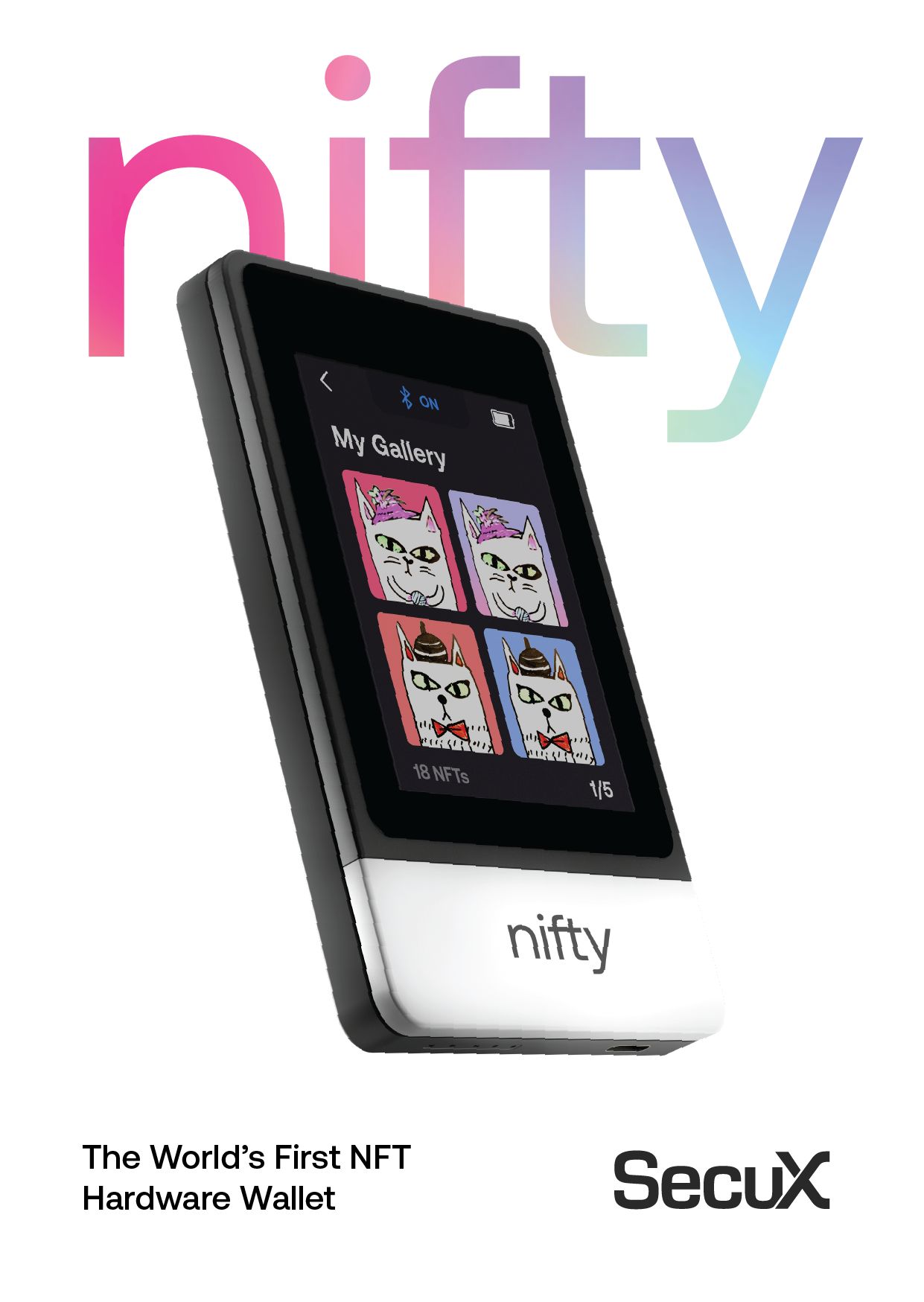

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

RATE CUTS ARE COMING

BREAKING: Jerome Powell Announces Imminent Interest Rate Cut With More Likely To Occurr In September

Federal Reserve Chair Jerome Powell spoke on Friday about the likelihood of an imminent start to interest rate cuts, citing concerns over the potential impact of a further cooling job market.

Powell conveyed confidence that inflation is close to the U.S. central bank's 2% target, suggesting that the economy might be in a favourable position for easing monetary policy.

His statement hints at a potential policy shift aimed at stabilizing the job market while achieving sustainable inflation levels.

"The time has come for policy to adjust… The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

And, in all honesty, given the news last week - does the Fed really have a choice…

The financial world was buzzing with the news: the US dollar has reached its lowest point in 2024.

News arrived after the US Labor Department last week revised job growth figures down by a shocking 818,000 jobs for the year ending March 2024.

This revision is nearly 30% lower than initially reported, the largest such adjustment since 2009.

Adding to the economic uncertainty, the unemployment rate unexpectedly rose to 4.3% last month — the highest since October 2021.

These developments have led to a sharp decline in the US dollar index (DXY).

However, this may be good news for Bitcoin. 📈

Take a look at the chart below: Historical patterns suggest that when the DXY drops (red), Bitcoin often experiences a significant rally (green).

The latest charts confirm this relationship: when DXY loses support, Bitcoin typically enters a bull market.

WHY RATE CUTS ARE EXTREMELY BULLISH FOR BITCOIN

Historically, periods of monetary easing have been very favourable for investment assets like gold, stocks, and Bitcoin, often driving substantial gains.

With current economic signals pointing towards another such period, Bitcoin could be on the brink of a major breakthrough.

The chart below shows the impact of rate cuts on the price of bitcoin during the last two cycles:

With low interest rates (~1.5%) in 2017, Bitcoin price sky-rocketed to a then all-time high of $17,000.

Soon afterwards, as Rates were increased, the price per Bitcoin began to fall.

In the chart below, we see that similarly in the 2019-20 Cycle the price of Bitcoin began to rise as interest rates began to decline from 2%.

By the end of 2020 Bitcoin had reached a new all time high of $68,991 as the 2 year real interest rate moved into the negative.

Several powerful forces are converging to set the stage for a potentially dramatic price surge in Bitcoin:

Institutional money is flowing into the market at unprecedented levels

A new halving cycle is expected to decrease the supply of new Bitcoin,

There is growing speculation around potential interest rate cuts by the Federal Reserve.

All these factors are creating a perfect environment for Bitcoin to experience an explosive run over the next 12 to 24 months. The market is primed, and Bitcoin could be ready to take off.

"Demand is going to increase, supply is going to contract... this is fairly unprecedented in the history of Wall Street ... so if you've got a 12-month to 48-month time horizon, this is a pretty ideal entry point into the asset.”

Now might be a good time to buy Bitcoin while it's still available at these prices.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

RFK ENDORSES TRUMP

Without doubt, the spike upwards in Bitcoin price to $64,000 gauged the market’s reaction to the news over the weekend.

However, we would be amiss if we failed to point out yet another additional bullish factor.

RFK Jr. made headlines by endorsing Donald Trump, reinforcing his reputation as a crypto-friendly advocate.

Despite Kennedy's endorsement, the latest data indicates the presidential race remains a close 50/50 contest.

The election odds provided by platforms such as Polymarket show that both Trump and Kennedy have voiced support for Bitcoin and the broader crypto ecosystem.

This contrasts with the current stance of the Harris campaign, which has yet to make any statements about Bitcoin or cryptocurrencies.

Rumour has it that the Harris team might be preparing to introduce a crypto strategy, recognizing the growing importance of this issue among voters.

Over the weekend, Kennedy’s endorsement of Trump, along with these speculative developments, drove a notable uptick in Bitcoin's price.

OTHER NEWS:

Telegram's TON token tumbles following arrest of CEO; messaging app calls the charges against him "absurd"

Bitcoin ETFs Log $250M Net Inflows, Highest Since July, After Rate Cut Signal at Jackson Hole

How Trump was ‘orange-pilled’ by three bitcoiners in Puerto Rico and the promise of $100 million

AI Tokens Lead Crypto Market Ahead of Nvidia Earnings

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.