The Start Of Memecoin Mania

Massive Bullish Signal

Czech National Bank Eyes BTC Reserve

Utah’s Bold Bitcoin Move

And more…

Market Data Prices as of 5:00am ET

This Update Is Brought To You By Bitbo

We are excited to announce Bitbo’s newest trading chart:

The Mayer Multiple is used for technical analysis in Bitcoin investing.

It is used in order to determine whether Bitcoin is overbought (red), fairly priced (yellow), or undervalued (green).

The Mayer Multiple is calculated by taking the price of Bitcoin and dividing it by the 200 day moving average value.

THE START OF MEMECOIN MANIA

The crypto ETF landscape is expanding once again!

Bitwise has officially filed an S-1 registration with the SEC for a Dogecoin ETF, taking another step toward bringing the popular memecoin to traditional investors.

This move follows last week's filing for a Dogecoin Trust in Delaware, setting the stage for today's SEC submission.

What’s Next for the Dogecoin ETF?

While this is a major step, it’s important to note that the SEC won’t have an approval deadline until Bitwise submits a 19b-4 filing—the final regulatory hurdle before launch. Once submitted, the approval process could take up to 135 days.

But the big question remains:

Is There Demand for a Dogecoin ETF?

According to Matt Hougan, Bitwise's Chief Investment Officer, the answer is a resounding yes.

In a recent Financial Times interview, he highlighted the massive trading volume and market position of Dogecoin, stating:

“The reality is that there are a lot of people that want to invest in Dogecoin. It’s the sixth-largest crypto asset (excluding stablecoins) in the world by market cap and trades over $1 billion a day.”

While some critics question the legitimacy of memecoin investments, Bitwise is already making moves in other areas.

They have pending ETF filings for Solana (SOL), XRP, and their broader Bitwise 10 Crypto Index Fund, which tracks the top 10 cryptos by market cap (excluding stablecoins).

With the SEC facing increasing pressure to approve crypto investment vehicles, investors are left wondering:

👉 How far will the SEC go in approving memecoin ETFs?

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

MASSIVE BULLISH SIGNAL

Stablecoin Supply Hits New Highs – What It Means for Crypto Investors

The stablecoin market is a crucial barometer for crypto liquidity and overall market sentiment.

These digital assets facilitate instant transactions on both centralized and decentralized platforms, serving as a key gateway to the broader crypto economy.

So, what’s happening with stablecoin supply right now? Let’s dive in.

🟢 When stablecoin supply increases, it indicates growing demand and fresh capital entering the crypto market—a bullish sign. 🐂

🔴 When supply contracts, it suggests capital is leaving digital assets, often signaling a downturn. 🐻

🚀 Breaking New Highs:

On January 15, 2024, the stablecoin market cap stood at $188.91 billion.

Today, it has jumped to $195.62 billion—a $6.71 billion increase in just two weeks. 📈

This marks an all-time high, reinforcing strong momentum in the space.

But that’s just part of the story...

Since the U.S. election on November 5, 2024, the stablecoin market cap has grown by a staggering $33.66 billion—a near-vertical climb. This suggests that institutional and retail capital is flooding into crypto at an accelerated rate.

For investors, this is a powerful signal. Stablecoin liquidity is one of the clearest indicators of an upcoming altcoin bull run.

📊 Bottom line: More stablecoins in circulation = greater liquidity and stronger price movements in altcoins. Stay ahead of the trend!

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

CZECH NATIONAL BANK

EYES BITCOIN RESERVE

Aleš Michl, head of the Czech National Bank (CNB), proposes investing a portion of the country's foreign reserves into bitcoin.

Despite concerns about volatility, Michl argues that bitcoin adoption by major financial institutions like BlackRock makes it a valuable alternative investment.

The CNB could allocate up to 5% of its €140 billion in reserves to bitcoin, potentially boosting returns while increasing portfolio risk.

Diversifying Czech Reserves with Bitcoin

Earlier this month news broke that Aleš Michl, the governor of the Czech National Bank, is advocating for a shift in the country’s monetary strategy by proposing an investment in bitcoin.

If approved, the CNB may allocate up to 5% of its €140 billion reserves into the leading cryptocurrency.

Michl believes that while bitcoin's price swings are unpredictable, its long-term value and increasing adoption make it a compelling reserve asset.

He sees this move as part of a broader effort to enhance the CNB's investment returns and ensure a diversified portfolio.

Weighing the Risks of Bitcoin Investments

"There's a wide range of possible outcomes, from bitcoin going to zero to reaching unprecedented heights," Michl admitted.

The CNB already holds 22% of its portfolio in equities, a riskier strategy compared to most central banks, which typically prefer government bonds and gold.

Michl’s plan could increase the bank's annual returns by 3.5 percentage points, though it may also double portfolio volatility.

Despite the potential market risks, Michl argues that gradual investment is key to managing exposure. By phasing in bitcoin purchases, the CNB can mitigate potential disruptions in the crypto market.

Monetary Policy and Economic Independence

In addition to exploring bitcoin investments, Michl is focused on strengthening the Czech Republic’s financial independence.

He remains opposed to adopting the euro, emphasizing the importance of maintaining control over the Czech koruna to better manage inflation.

Furthermore, Michl aims to increase CNB investments in U.S. equities to 50% within three years, reinforcing his commitment to diversification.

He also predicts a 25 basis point interest rate cut, continuing the monetary easing cycle that began in December 2023.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

UTAH’S BOLD BITCOIN MOVE

The Utah House Economic Development Committee has approved a bill allowing the state to allocate public funds to cryptocurrency investments.

The measure, HB 230, was passed with an 8-1 vote on Jan. 28 and now moves to the Utah House for further debate.

Sponsored by Representative Jordan Teuscher, the bill would permit the state treasurer to invest up to 5% of certain public funds in high-cap digital assets, such as Bitcoin and stablecoins meeting strict criteria.

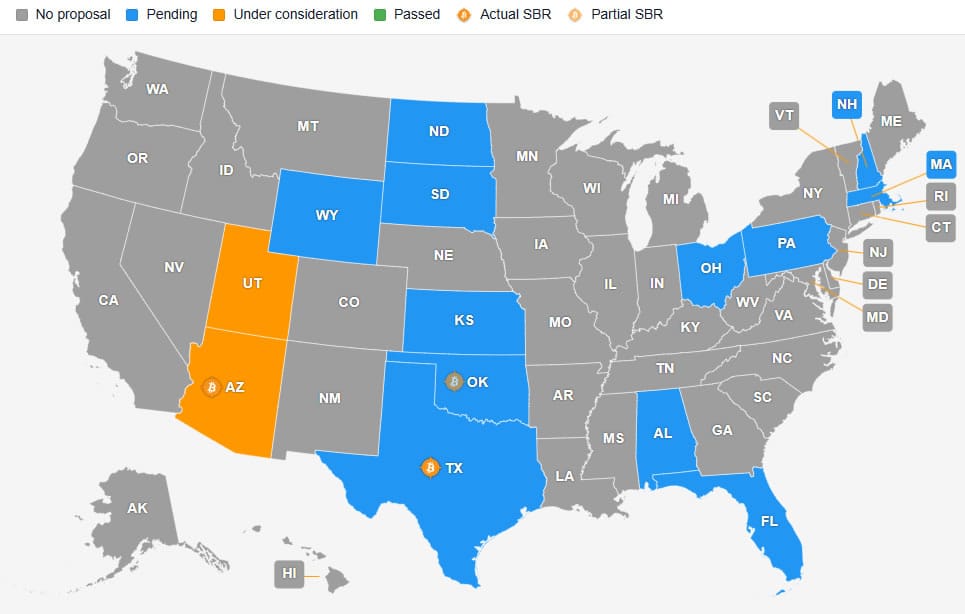

Twelve U.S. states, including Arizona and Wyoming, have proposed legislation allowing their state treasuries to invest in cryptocurrencies, as reported by Bitcoin Reserve Monitor.

As we reported last week, this move aligns Utah with other pro-crypto states like Wyoming and Arizona.

A recent update to the bill also introduces crypto mining zoning regulations, ensuring responsible development of blockchain infrastructure.

If approved by the House and Senate, the bill will head to Governor Spencer Cox, a known supporter of blockchain innovation, for final approval.

Additionally, the legislation aims to prevent state and local governments from banning crypto payments for legal goods and services.

This further cements Utah’s commitment to digital finance adoption.

If the bill is enacted, Utah will become one of the few states actively participating in crypto staking and lending, opening new financial opportunities for the state’s treasury.

The bill is set to take effect on May 7, pending final approvals.

OTHER NEWS

Mathematician and entrepreneur Fred Krueger underscores DeepSeek’s optimistic stance on Bitcoin, arguing that US tech stocks are proving to be less dependable as a long-term store of value.

Despite a market sell-off fueled by DeepSeek AI, Bitcoin remains resilient, reaffirming its role as a key asset in a diversified portfolio.

Standard Chartered suggests that the recent Bitcoin price dip presents a buying opportunity, as its growing correlation with Nasdaq sell-offs adds short-term pressure.

Research indicates Bitcoin could surpass $100K without triggering extreme FOMO, suggesting further growth potential before the next major market correction.

MicroStrategy considers a rebrand to "StrategyB," reinforcing its evolution into a Bitcoin-first company.

UK Chancellor Rachel Reeves weighs using £5B in confiscated Bitcoin from a Chinese fraud case to help plug the country’s budget deficit.

Short-term Bitcoin whales—holding 1,000+ BTC for under 155 days—now control over 60% of the market’s BTC value, shifting market dynamics.

Security researcher Antoine Riard reveals a new type of replacement cycling attack that could let attackers censor transactions from miners’ block templates.

Phemex exchange suffers an $85M loss due to a major hot wallet hack, marking 2025’s most significant centralized exchange security breach.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.