Ross Ulbricht Free

50 State Strategic Bitcoin Legislation

Memecoin ETFs On The Horizon

It’s Still Early To Buy Bitcoin

And more…

Market Data Prices as of 5:00am ET

This Update Is Brought To You By Bitbo

We are excited to announce one of Bitbo’s newest trading charts:

The HODL Waves are one of the earliest and most insightful on-chain analysis tools, visualizing the age distribution of Bitcoin's entire supply over time.

This chart displays the age distribution of Bitcoin's UTXO (Unspent Transaction Output) set from the genesis block onwards:

Warmer colors (reds, oranges) at the bottom show recently moved Bitcoin

Cooler colors (blues, greens) at the top show Bitcoin that hasn't moved in years

The y-axis shows the percentage of total supply in each age band

The white line shows the USD/BTC price (logarithmic scale)

ROSS ULBRICHT FREE

BREAKING NEWS: Trump signs executive order to pardon Ross Ulbricht – Bitcoin has a reason to celebrate!

In a stunning turn of events, former President Trump has granted a pardon to Ross Ulbricht, the founder of the notorious Silk Road marketplace.

The announcement was made on Truth Social, where Trump shared his decision to free Ulbricht, sending shockwaves through the crypto world.

Ross Ulbricht, who had been serving multiple life sentences for his role in operating Silk Road, is now a free man. Silk Road, launched in 2011, was a peer-to-peer exchange that facilitated the exchange of Bitcoin for illicit goods, including drugs, which led to its infamous reputation as the "Amazon of Drugs."

The crypto community has long advocated for Ulbricht’s release, with many arguing that his punishment was excessive.

Trump, who had previously promised to pardon Ulbricht during his campaign, finally delivered on this pledge, bringing relief and joy to many in the Bitcoin ecosystem.

Who is Ross Ulbricht?

For those unfamiliar, Ross Ulbricht was arrested in 2013 and convicted in 2015 for running Silk Road.

His life sentence sparked an outcry, particularly within the Bitcoin community, which saw his actions as pioneering rather than criminal.

His case raised important questions about the intersection of blockchain technology and the law.

While Silk Road helped popularize Bitcoin, it also linked the cryptocurrency with illicit activities, leading to significant controversy in its early days.

The Importance of This Pardon

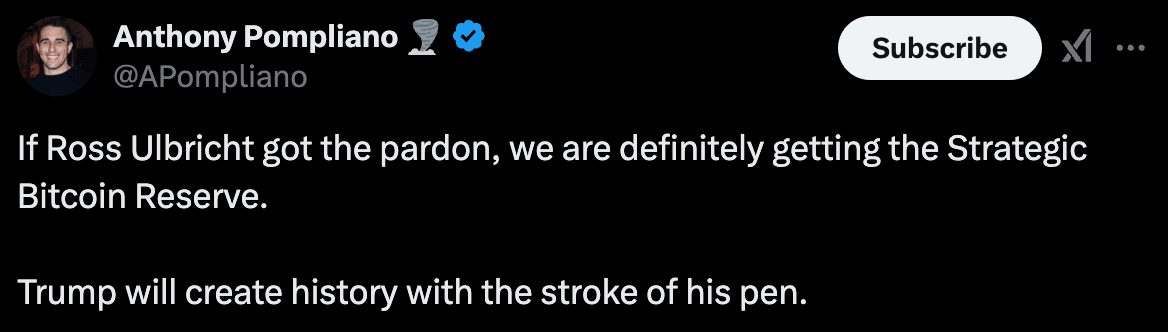

This executive order marks a pivotal moment for crypto enthusiasts. Trump’s decision to pardon Ulbricht serves as a strong signal that the former president recognizes the growing influence of Bitcoin and may be more inclined to support crypto innovations in the future.

The Bitcoin community has been rallying for years, and Trump’s action is seen as a victory.

The next step?

Many, such as David Bailey, CEO of Bitcoin Magazine, hope that he will follow through on his promise to establish a Strategic Bitcoin Reserve😀

This move would further cement the relationship between government and cryptocurrencies.

50 STATE STRATEGIC BITCOIN LEGISLATION

MARA Holdings CEO Fred Thiel is leading a groundbreaking initiative to establish Strategic Bitcoin Reserves (SBR) across the entire United States, including the federal government.

This ambitious project is already gaining momentum, with eleven states introducing SBR legislation, such as Florida, Alabama, Utah, Wyoming, and Massachusetts.

With Bitcoin (BTC) reaching new all-time highs and the Trump administration showing a favorable stance toward Bitcoin and crypto, the timing of this initiative is crucial.

This plan was unveiled following remarks by Jayson Browder, SVP of Government Affairs & Social Responsibility at MARA.

Browder emphasized that the SBR initiative is a top priority for the company, highlighting that MARA Holdings is working closely with the Trump Administration to move this forward.

Additionally, Browder stated that MARA will continue to support Bitcoin advocacy organizations.

The CEO echoed this sentiment, reiterating that the company is working to expand the scope of the Strategic Bitcoin Reserve.

In a parallel development, the Bitcoin Voter Project recently reported that eleven US states have introduced legislation related to Strategic Bitcoin Reserves.

As we reported earlier this week, states such as Florida, Alabama, Utah, Wyoming, and Massachusetts are at the forefront. It remains to be seen which other states will follow suit in the push for Bitcoin reserves.

Coincidentally, Coinbase CEO Brian Armstrong also voiced his support for Bitcoin as a reserve asset. In a recent media interaction, Armstrong argued that any country that holds Gold should also consider Bitcoin as part of their reserve strategy.

He expressed confidence that the US implementing a Bitcoin Strategic Reserve would inspire other G20 nations to adopt a similar approach.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

MEMECOIN ETFS ON THE HORIZON?

In a significant development for the cryptocurrency market, Osprey Funds and Rex Shares have submitted filings with the U.S. Securities and Exchange Commission (SEC) to launch a range of new cryptocurrency exchange-traded funds (ETFs).

Among these proposals is an ETF based on the highly talked-about TRUMP coin, a new cryptocurrency that launched on Jan. 18, 2025.

Along with the TRUMP coin ETF, the filing also includes funds for major cryptocurrencies like Bitcoin, Ethereum, Solana, XRP, and popular memecoins like Dogecoin and Bonk.

The TRUMP coin quickly made waves, soaring to a fully diluted valuation of $80 billion within just a day of its launch, before stabilizing at approximately $42 billion.

Its rapid price movements have sparked interest and debate, particularly due to the coin’s ties to Donald Trump and its speculative nature.

The Solana blockchain platform, which hosts the coin, faced congestion as the coin’s trading volume surged following its debut.

The TRUMP ETF would be a groundbreaking financial product, as it would be the first to provide institutional investors access to the speculative world of memecoins.

According to the filing, the fund will allocate at least 80% of its assets to TRUMP coin and associated derivatives.

While memecoins like TRUMP are known for their price volatility, they offer institutional investors a new way to engage with emerging digital assets in a more regulated and structured manner.

In addition to the TRUMP coin ETF, the filing includes proposals for ETFs investing in well-known cryptocurrencies like Bitcoin, Ethereum, and Solana, as well as memecoins like Dogecoin and Bonk.

These funds would primarily invest in spot cryptocurrencies and related instruments.

However, regulatory approval remains a key hurdle.

While the SEC has approved Bitcoin and Ethereum ETFs in the past, approval for memecoin ETFs remains uncertain.

With President Trump’s recent push to make the U.S. the "crypto capital," the SEC’s approach under the new administration could potentially be more favorable to these types of funds.

This latest filing from Osprey Funds and Rex Shares is part of a growing trend, with over a dozen cryptocurrency ETFs awaiting SEC approval.

The eventual approval of memecoin ETFs, including TRUMP, could provide valuable insights into how the SEC plans to regulate cryptocurrency-based financial products in the future.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

IT’S STILL EARLY TO BUY BITCOIN

Bitcoin is far from reaching its peak, and now is the moment to jump in, says Fred Krueger, a Wall Street veteran and mathematician.

With less than 1% of wealthy individuals holding Bitcoin, the potential for growth is enormous.

Krueger believes we are just beginning a 20- to 30-year period of significant returns.

Despite concerns about being too late, history shows that Bitcoin continues to grow, even at $100,000.

He compares it to being in the first inning of a long game.

Tune in to the video below for more valuable insights from Krueger on Bitcoin’s future.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

OTHER NEWS

Retail investors drive Bitcoin’s rise toward the $110,000 mark, while long-term holders maintain their positions amid a record-breaking rally.

Michael Saylor and MARA executives engage with Trump’s team to discuss strategies for a potential national Bitcoin mining expansion and reserve initiative.

The SEC forms a task force led by Hester Peirce to establish clearer regulations for U.S. digital assets, including Bitcoin and the broader crypto industry.

MicroStrategy, a Bitcoin-focused business intelligence firm, increases its Bitcoin holdings to 461,000 BTC through a $1.1 billion purchase at $101,191 per coin.

Balaji Srinivasan, former Coinbase CTO, criticizes Trump-themed memecoins as speculative and warns they fail to create sustainable wealth in the current market frenzy.

BTC Inc. CEO forecasts Bitcoin reaching $1M during a potential Trump presidency, advocating for the implementation of Strategic Bitcoin Reserves in global economies.

Elon Musk supports a pardon for Roger Ver, the 'Bitcoin Jesus,' following Trump’s pardon of Ross Ulbricht.

NBA legend Scottie Pippen calls Bitcoin ‘dirt cheap’ at $100K, predicting it could reach $10 million as BTC achieves new all-time highs.

Trump’s World Liberty Financial acquires $47 million in Wrapped Bitcoin and other crypto assets during Trump’s inauguration, bolstering its “sh!tcoin” treasury.

WisdomTree highlights Bitcoin’s growing institutional adoption, noting portfolios with Bitcoin allocations outperform, bolstered by increasing ETF momentum in 2025.

Analyst Van Straten predicts Bitcoin could surge to $1M by year-end based on historical patterns and cycle analysis following Trump’s potential victory.

Arthur Hayes, former BitMEX CEO, questions the practicality of a U.S. Bitcoin reserve under Trump, citing limited resources, competing priorities, and economic challenges.

Mark Cuban criticizes Trump’s memecoin as speculative hype, warning it poses risks to crypto’s legitimacy while suggesting the introduction of another “shitcoin.”

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.