The Future Is Crypto!

Trump’s Day 1 Crypto Friendly Orders

Multiple States Embrace BTC Reserve

Bitcoin Price Is About To Rip!

And more…

Market Data Prices as of 3:30am ET

This Update is Brought to You By SecuX

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

THE FUTURE IS CRYPTO

Big News in the Crypto World: The former U.S. President has launched his own memecoin, and it's already making major waves!

When Donald Trump tweeted about his new token, many people initially thought his account had been hacked.

But surprise! It was the real deal, and the launch was completely legitimate.

In less than two days, Trump’s memecoin skyrocketed to a market cap of around $14 billion, propelling it into the top 15 cryptocurrencies.

This meteoric rise saw the coin surpass well-known competitors like Toncoin, Polkadot, and Shiba Inu, all without any prior warning!

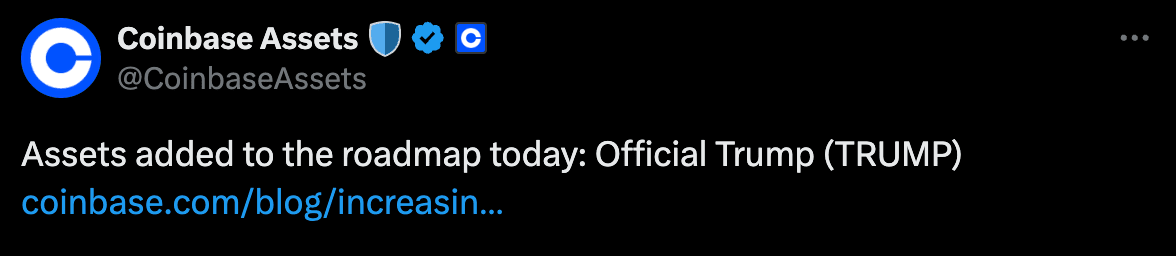

This unprecedented move has had a significant impact on the market, and now, both Coinbase and Binance are preparing to list $TRUMP.

Clearly, Trump is signaling his strong commitment to the crypto space.

Looking back, during his pre-inauguration speech, Trump made waves by highlighting Bitcoin’s stellar performance, even predicting it would break the $100,000 barrier.

Now, it seems Trump is all in on the crypto trend.

But here’s the twist: Just after the $TRUMP token launch, Melania Trump followed suit with her own memecoin – the $MELANIA token.

In a surprising move, Melania’s launch caused $TRUMP to plummet by 48%, falling from a high of $73 to $38.

What’s next for the Trump family in crypto?

Keep an eye out for more developments, including insights on the Bitcoin Strategic Reserve.

TRUMP’S DAY 1 CRYPTO FRIENDLY ORDERS

President Trump is preparing for a dramatic shift in policy as he steps back into office, with 100 executive orders slated for his first day.

These orders aim to swiftly reverse Biden-era regulations and push forward the promises Trump made during his campaign, including in the realms of cryptocurrency and TikTok.

One of the most significant moves expected is the creation of a crypto advisory council, aimed at fostering a crypto-friendly policy environment.

This initiative could reshape the future of digital assets in the U.S., with sources revealing that the council could include up to 20 members to guide future government strategies.

Trump is also looking to counteract regulations that have hindered the cryptocurrency sector, including directing the Securities and Exchange Commission (SEC) to rescind SAB 121, which made it costly for financial institutions to hold cryptocurrency for third-party clients.

Additionally, Trump is expected to dismantle Operation Choke Point 2.0, a move aimed at easing restrictions on crypto companies and integrating them into the broader financial system.

These policy shifts are expected to put cryptocurrency on a faster path to mainstream adoption, in stark contrast to Biden’s administration, which has sought to regulate and protect consumers by cracking down on crypto fraud and money laundering.

The move to deregulate cryptocurrency is just one of several areas Trump plans to tackle through executive orders, promising immediate action and signaling the administration's priorities for its second term.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

MULTIPLE STATES EMBRACE BTC RESERVE

Wyoming and Massachusetts made headlines this weekend by unveiling bills that would allow their states to invest heavily in Bitcoin.

Wyoming plans to allocate up to 3% of its $30.8 billion in public funds into Bitcoin, while Massachusetts is pushing for a 10% slice of its $8 billion rainy day fund.

As the push grows, California has joined the ranks, making it the 15th state exploring Bitcoin for state reserves.

In Wyoming, House Bill 201, introduced by Representative Jacob Wasserburger, would allow the state to diversify its portfolio with Bitcoin, including its Permanent Wyoming Mineral Trust Fund.

With an estimated $300 million in potential Bitcoin investments, this could be a transformative shift for the state’s financial strategy.

Senator Cynthia Lummis has strongly supported the bill, emphasizing the importance of leading the way in financial innovation.

“Wyoming took its first bold step toward a strategic bitcoin reserve! Thank you Rep. Wasserburger for introducing legislation to allow permanent funds to diversify into Bitcoin. This forward-thinking approach will benefit our state as we lead the nation in financial innovation,”

On the other side of the country, Massachusetts is embracing the cryptocurrency boom with Senator Peter Durant’s Senate Docket 422 (SD422), which proposes that up to 10% of the state’s Commonwealth Stabilization Fund be invested in Bitcoin, amounting to $800 million.

The bill also expands to include other digital assets for broader portfolio diversification and returns.

With Oklahoma and Texas already in the race, California is taking a more cautious approach, appointing the Proof of Workforce non-profit to research Bitcoin’s potential.

VanEck highlights the broader financial implications, suggesting that a national adoption of Bitcoin could lead to a 36% reduction in US debt.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

BITCOIN PRICE IS ABOUT TO RIP!

Bitcoin's limited supply and increasing demand are setting the stage for a massive price surge.

Samson Mow, CEO of JAN3, emphasizes that scarcity is Bitcoin's greatest strength.

While some believe that older Bitcoin holders may be selling, Mao argues that the coins are more likely being moved for security purposes or transferred to new wallets.

This shift indicates that Bitcoin's long-term value is gaining traction, rather than a mass sell-off. The main story here is the dwindling supply of Bitcoin.

With a fixed total of 21 million coins and surging demand from individual investors, institutions, and even entire nations, the supply of Bitcoin is tightening. In the near future, there simply won’t be enough to satisfy the demand.

Don't miss this video, where Samson Mao shares more astonishing insights!

OTHER NEWS

Michael Saylor hints at a potential Bitcoin acquisition in a cryptic tweet on Sunday, which also seems to reference the upcoming inauguration of President Trump: “Things will be different.”

Market analysts forecast a Bitcoin surge beyond $130,000, driven by a sharp price spike that has created a historic 'god candle' pattern amid market volatility related to Trump’s influence on Bitcoin and the broader crypto market.

Korean investors play a key role in driving Bitcoin to a new all-time high of $109K, while U.S. traders remain cautious ahead of President Trump’s inauguration.

The Republican-controlled Congress faces hurdles in advancing Bitcoin and crypto legislation, as partisan divides and competing legislative priorities threaten to stall regulatory progress.

MARA embeds a portrait of President Trump on the Bitcoin blockchain, signaling optimism for a potential shift toward more pro-Bitcoin and crypto policies under the new administration.

Filings for crypto ETFs surge following Gary Gensler's departure from the SEC, fueling optimism about future regulatory clarity under new leadership and Trump's expected pro-industry stance.

Research shows a growing disconnect between Bitcoin's price surge and investments in crypto startups, despite widespread market optimism heading into 2025.

Coinbase CEO Brian Armstrong calls on nations to build Bitcoin reserves as part of a strategy to enhance economic security and global integration.

Treasury Secretary Janet Yellen warns that the U.S. will hit its debt ceiling the day after Trump's inauguration and urges Congress to take swift action to prevent default.

Crypto.com becomes the first to secure a MiCA license in the EU, advancing regulatory compliance and bolstering Bitcoin and crypto offerings across EU member states within a unified legal framework.

El Salvador continues to strengthen its Bitcoin strategy, purchasing 11 BTC to bolster its national reserves and reaffirm its commitment to Bitcoin integration.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.