Crypto ETFs Are Heating Up 🔥

Has Crypto Entered Its Golden Age? 🏆

USDT Faces Euro Exchange Ban

72% Of Bitcoin Supply Unmoved in 6+ Months

And more…

Market Data Prices as of 4:10am ET

This Update Is Brought To You By Bitbo

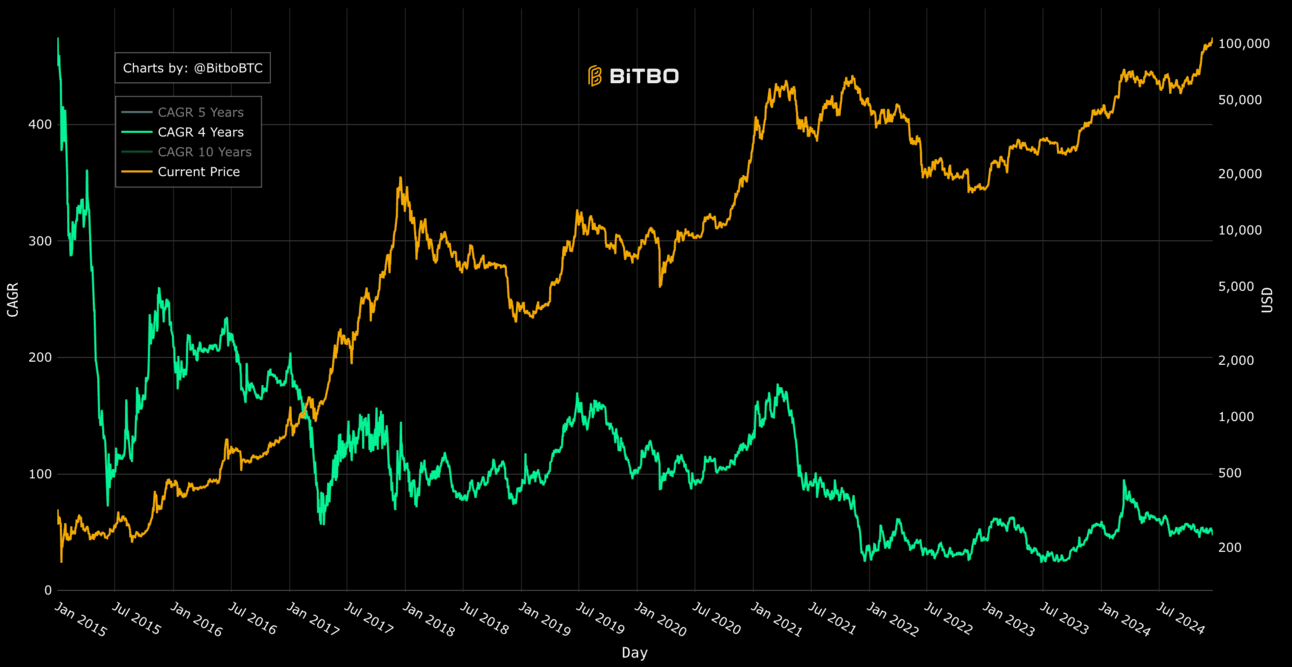

We are excited to announce Bitbo’s newest trading chart:

CAGR (Compound Annual Growth Rate) measures Bitcoin's average yearly growth rate over a specific time period. It smooths out volatility by calculating the rate that would have given you the same final value if the growth had been steady.

CRYPTO ETFS ARE HEATING UP🔥

BREAKING NEWS: Volatility Shares has submitted a filing for a Solana Futures ETF, even though Solana futures contracts are yet to hit the market.

Last week we reported on potential Crypto ETFs to watch in 2025 and Strive Asset Management caught attention with its filing for a Bitcoin Bond ETF.

Highlighting its vision, Strive stated:

“Our Bitcoin bonds provide a unique opportunity for risk-return exposure to Bitcoin, unavailable to most investors today.”

Strive’s focus is clear: mitigate risks tied to the fiat debt crisis, inflation, and global instability, making Bitcoin a cornerstone for long-term investment strategy.

Solana Futures: A Sign of What’s to Come

With $2.38 billion under management, Volatility Shares is making waves by pursuing 3 Solana Futures ETFs.

ETF expert Eric Balchunas remarked:

“The filing itself suggests that Solana spot ETFs could follow soon, similar to how Ethereum Futures ETFs paved the way for spot approvals.”

A Bitcoin Buying Streak

On the horizon, Michael Saylor hints at another significant Bitcoin acquisition, continuing his Sunday ritual of posting from SaylorTrack.com.

HOLIDAY PROMOTION ALERT

Are you ready to level up your crypto security? Meet Ledger, the brand trusted by over 7 million users and protecting 20% of the world’s crypto assets.

This holiday season, Ledger is offering something extraordinary. Introducing:

Ledger Stax: A sleek device with touchscreen functionality, wireless charging, and top-notch efficiency.

Ledger Flex: A pocket-sized, touchscreen wallet designed for both convenience and affordability.

And the holiday magic doesn’t stop there! When you purchase a Ledger Flex, you’ll receive $70 worth of Bitcoin, for free.

Act quickly—this exclusive offer is only available while supplies last. Secure your Ledger Flex now and enjoy the gift of $BTC this season!

HAS CRYPTO ENTERED ITS ‘GOLDEN AGE’? 🏆

As 2024 wraps up, it’s time to reflect on a year of remarkable change and growth.

The crypto market cap, for instance, tells a compelling story:

It soared from $1.5 trillion to $3.3 trillion, an astounding $2 trillion increase.

This surge isn’t just about numbers—it’s proof that the crypto industry is resilient and innovative, even during challenging market cycles.

Let’s face it: many people only engage during bull markets and vanish when times get tough.

Yet, in 2024, crypto’s potential became undeniable.

For years, we believed in blockchain’s promise to transform industries, but it remained niche.

Perhaps our early optimism was premature.

Now, however, 2024 has set the stage for a new era of crypto built on tangible progress.

Here’s what’s different:

Nations and governments are embracing crypto as a strategic priority.

We’ve achieved fast, scalable, and cost-effective blockchain technology.

The rise of real-world applications is delivering better solutions to everyday problems.

As global conditions stabilize, 2025 is primed for breakthroughs in technology, with crypto ready to seize the spotlight.

Even if market conditions shift, crypto’s reputation has matured—no longer swinging as wildly as before.

2024 will be remembered as the year that marked crypto’s transformation from niche to mainstream.

This is our moment to build, innovate, and scale. With real progress and adoption on our side, the future looks brighter than ever.

Welcome to the new era of crypto.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

USDT FACES EURO EXCHANGE BAN

The clock is ticking for Tether (USDT) to comply with the European Union’s Markets in Crypto-Assets (MiCA) regulations.

As of yesterday concerns are mounting over USDT’s future on European exchanges.

Although no official announcement has labeled USDT non-compliant, its standing remains uncertain.

Juan Ignacio Ibañez of the MiCA Crypto Alliance stated:

“No regulators have explicitly stated that USDT isn’t compliant, but this does not mean that it is.”

The MiCA framework aims to create a unified regulatory environment, but Tether has reportedly struggled to meet its standards.

Analyst Jacob Kinge noted a halt in Tether’s coin issuance, suggesting regulatory roadblocks.

A potential ban could disrupt liquidity and drive up transaction costs, significantly impacting European traders.

Industry experts, including Joseph Hurtado, have expressed concerns about a ban’s broader implications.

“It could weaken Europe’s competitive edge in the cryptocurrency space.”

However, the community remains divided, with some viewing stricter regulations as necessary for stability and others fearing market disruption.

Long-standing criticisms of Tether’s lack of audits by major firms have resurfaced.

Jason Calacanis, host of the All-In Podcast, emphasized the need for greater transparency.

Meanwhile, Paolo Ardoino, Tether’s CEO, defended its practices and highlighted ongoing efforts to expand USDT’s use cases and partnerships.

Coinbase has advised users to convert holdings in non-compliant stablecoins like USDT to alternatives such as USD Coin (USDC), which satisfies MiCA’s regulatory requirements.

The move aligns with MiCA’s mandate for e-money authorization, further pressuring issuers to comply.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

72% OF BITCOIN SUPPLY UNMOVED

IN 6+ MONTHS

Let’s kick off the week with a check-in on the Bitcoin HODL waves! 🌊

Each colored band in the chart represents the percentage of Bitcoin that was last moved within a specific time frame.

As the colors get cooler, the age bands grow older—with purple representing coins last moved more than 10 years ago.

Today, as always, we’re focusing on long-term holders (those holding coins for more than 6 months).

Here’s the breakdown:

6m - 12m: 9.75%

1y - 2y: 8.73% (down)

2y - 3y: 8.08% (up)

3y - 5y: 14.76% (down)

5y - 7y: 7.13% (down)

7y - 10y: 6.77% (up)

>10y: 16.87% (up)

This data shows that ~72.09% of Bitcoin’s supply hasn’t moved in over 6 months!

However, over the last two weeks, long-term holders have declined by ~1.07%. But let’s break this down further:

The 6m - 12m age band has dropped by ~0.60%.

On the other hand, coins held for more than 7 years increased by 0.20%.

The key takeaway?

Ultra long-term holders are standing firm.

They’re clearly waiting for higher prices before making their next move.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

OTHER NEWS

Russia adopts Bitcoin for international trade to bypass Western sanctions, with the Finance Minister predicting broader adoption and development in the coming year.

Failed kidnapping reveals target was the wife of a Bitcoin millionaire. Security expert Jameson Lopp advises: "Avoid flaunting wealth to protect your loved ones."

The IRS finalizes its "broker rule," expanding the definition of brokers to include non-custodial trading services, with implementation set for 2027.

Leading crypto advocacy groups—Blockchain Association, DeFi Education Fund, and Texas Blockchain Council—file a lawsuit against the IRS over the contentious "broker rule."

Consensys legal counsel critiques the IRS "broker rule," calling it a burdensome policy with minimal revenue benefits, predicting sharp congressional scrutiny.

IRS maintains that staking rewards are taxable upon receipt, a stance being contested in court by a Tennessee couple.

Law enforcement busts a dark web operation trading stolen identities paired with biometrics, undermining the effectiveness of KYC systems.

VanEck suggests the U.S. adopt a Bitcoin reserve strategy to reduce national debt by $42 trillion by 2049.

Michael Saylor proposes leveraging Bitcoin reserves to generate $81 trillion for the U.S. Treasury, aiding national debt management.

Binance's Bitcoin reserves hit their lowest levels since January, sparking speculation of a potential 90% surge in BTC prices.

The Bank of Italy raises concerns over peer-to-peer crypto services without KYC, labeling them as enablers of "crime-as-a-service."

Rumble, a free-speech-focused video platform, announces plans to enable Bitcoin tipping for creators after landing a $775 million partnership with Tether.

KULR Technology Group adopts a Bitcoin treasury strategy, acquiring 217 BTC worth $21 million to strengthen its financial reserves.

Israel gears up to launch six Bitcoin mutual funds on December 31, 2024, following regulatory clearance.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.