Crypto ETFs To Watch In 2025

ETH Whales Reach Record Levels

Van Eck Forecast 2025 Crypto Surge

Eric Trump: $1M Bitcoin Is Coming

And more…

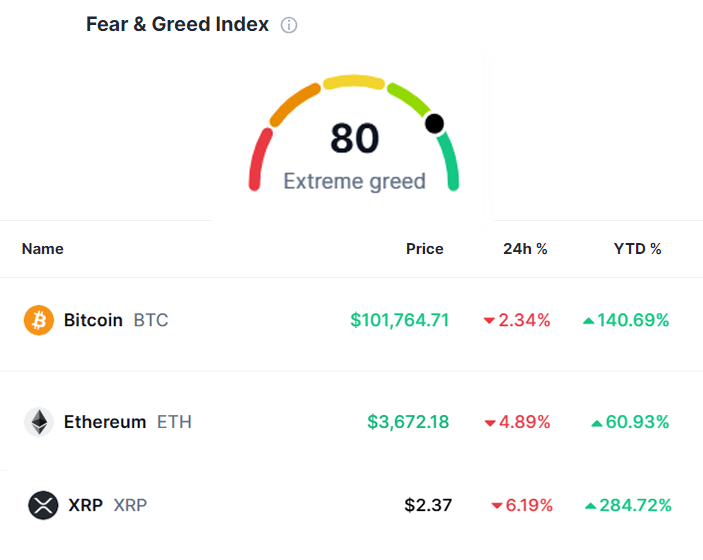

Market Data Prices as of 4:30am ET

This Update Is Brought To You By Ledger

HOLIDAY PROMOTION ALERT

Are you ready to level up your crypto security? Meet Ledger, the brand trusted by over 7 million users and protecting 20% of the world’s crypto assets.

This holiday season, Ledger is offering something extraordinary. Introducing:

Ledger Stax: A sleek device with touchscreen functionality, wireless charging, and top-notch efficiency.

Ledger Flex: A pocket-sized, touchscreen wallet designed for both convenience and affordability.

And the holiday magic doesn’t stop there! When you purchase a Ledger Flex, you’ll receive $70 worth of Bitcoin, for free.

Act quickly—this exclusive offer is only available while supplies last. Secure your Ledger Flex now and enjoy the gift of $BTC this season!

CRYPTO ETFS TO WATCH IN 2025

The success of Bitcoin and Ethereum ETFs has set the stage for the next wave of crypto innovation.

But which coins are set back by regulatory hurdles, and which already have a foot in the door? 🚪

Eric Balchunas and James Seyffart of Bloomberg foresee exciting developments:

1. Dual Bitcoin & Ethereum ETFs

Expect combo ETFs from Bitwise, Franklin Templeton, and Hashdex. With individual approvals already in place, this evolution seems straightforward.

2. Litecoin and HBAR: The Dark Horses

Litecoin’s status as a Bitcoin fork and HBAR’s neutral classification by the SEC make them strong contenders. As James Seyffart notes:

“Litecoin may be viewed by the SEC as a commodity. The SEC isn’t calling Litecoin or HBAR a security anywhere.”

The demand question, however, looms large.

3. XRP and Solana ETFs Await Regulatory Clarity

Pending lawsuits and complex legalities keep XRP and Solana ETFs on ice. James Seyffart explains:

“Legal issues relating to their status as securities need resolution before progress can be made.”

With Gary Gensler stepping down and a potential Trump administration, 2025 could introduce even more innovation—perhaps even a Dogecoin ETF.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

ETH WHALES REACH RECORD LEVELS

Ethereum’s whale wallets are making waves, now holding 57% of the total supply—the highest level ever recorded.

According to Santiment, the 104 largest wallets collectively manage around $333 billion worth of Ether.

Meanwhile, mid-sized wallets have hit a historic low, and smaller wallets holding less than 100 ETH now represent just 9.19% of the supply.

The shift in ownership dynamics is seen as a bullish indicator for long-term growth.

Ethereum’s daily address creations surged to 130,200 in December, a sign of growing adoption.

Ether’s price recently climbed back above $4,000 and is predicted to surpass its previous all-time high of $4,891 by 2025, driven by increased institutional interest and market recovery post-deleveraging.

In the broader market, Bitcoin’s historic rally to $107,800 on Dec. 16 has bolstered confidence across the crypto space.

Ethereum’s dominance in USDT and USDC circulation further solidifies its role as a cornerstone of the blockchain industry.

As whales continue to accumulate, analysts are watching closely, anticipating that this trend could trigger a significant market rally in the coming years.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

VAN ECK FORECAST 2025 CRYPTO SURGE

This week VanEck, managing assets worth over $118.3 billion, has forecasted significant growth for several cryptocurrencies in 2025:

Bitcoin might touch $180,000, with geopolitical factors potentially inflating this further.

Ethereum is expected to break its record at $6,000, thanks to staking and its deflationary status.

Solana could leap to $500, backed by its scalability and rising adoption.

Sui is predicted to double to $10, reflecting a niche but growing interest.

VanEck's foresight also includes a speculative scenario where the U.S. might create a Bitcoin strategic reserve, boosting crypto adoption.

If this comes to pass, VanEck believes $180,000 might just be the beginning for Bitcoin's valuation.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

ERIC TRUMP: $1M BITCOIN IS COMING

Eric Trump, executive VP of the Trump Organization and son of President-elect Donald Trump, has made a bold prediction: Bitcoin will hit $1 million, stunning those who doubted its potential.

During a powerful speech, Eric described Bitcoin as more than just an asset—he sees it as a game-changing shift in our understanding of money and wealth.

With Bitcoin already crossing $100,000, he confidently believes it will revolutionize finance and reach $1 million.

Don’t miss clips, where Eric Trump shares why he’s so certain of Bitcoin’s explosive future.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

OTHER NEWS

L0la L33tz, freedom tech journalist of The Rage, criticizes the Bitcoin Policy Institute’s draft Executive Order for a Strategic Bitcoin Reserve for President Trump’s consideration, arguing against describing Bitcoin solely as ‘a finite store-of-value asset’ and emphasizing its unit of exchange property to avoid incentivizing ossification.

Zack Cohen of the Bitcoin Policy Institute, in a new policy brief, warns that the US Department of Justice’s indictment of Samourai Wallet co-founders for allegedly operating an unlicensed money transmission business sets a concerning precedent by redefining non-custodial wallets as money transmitters under the Bank Secrecy Act.

Che Kohler of The Bitcoin Manual examines how governments and corporations increasingly amassing BTC are raising concerns about centralization and network manipulation, concluding that a 51% attack is unlikely due to the network’s open-source nature and active community involvement.

Saifedean Ammous, responding to a recent comment by Andrew Tate about Bitcoin, argues that Bitcoin’s deflationary nature and its ability to replace central banks make it uniquely valuable, stating that deflation drives economic growth, reduces wasteful consumption, and encourages productive investment.

Daniel Batten, environmentalist and Bitcoin advocate, writes an open letter to progressive commentator Cenk Uygur, correcting his recent remarks about Bitcoin, clarifying its distinction from ‘crypto,’ and highlighting its bipartisan appeal.

Tomer Niv, a Tel Aviv-based investor, writes for Forbes about the increasing accumulation of Bitcoin reserves by nations, sparking a new ‘Cold War’ for digital gold, with the US leading through seizures and nations like Japan exploring it as a strategic reserve.

Reuters journalists analyze President-elect Trump's proposal for a US Bitcoin strategic reserve, discussing its potential establishment, funding sources, and economic benefits, including deficit reduction and strengthening the dollar, while addressing skepticism about its intrinsic value.

Charlie Spears of Blockspace Media writes a guide on the impact of quantum computing on Bitcoin security, outlining potential vulnerabilities in cryptographic keys and proposing strategies to quantum-proof Bitcoin’s infrastructure.

Ansel Lindner, an economist writing for Forbes, addresses concerns about Google’s recent quantum computing breakthrough, explaining why Bitcoin’s adaptability ensures it is not under imminent threat.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.