Bitcoin Breaks Through $100K

XRP Becomes Top 3 Crypto

Ethereum Ready For Take Off🚀

Saylor’s Winning Strategy: Buy & Hold

And more…

Market Data Prices as of 6:30am ET

This Update Is Brought To You By Bitbo

Check Out These Bitbo Black Friday Deals

📈 30% off Bitbo Pro yearly plans - use code BFCM24

⚡ 25% off Bitbo Store - use code BTC25

We are excited to announce Bitbo’s newest trading chart:

The HODL Waves are one of the earliest and most insightful on-chain analysis tools, visualizing the age distribution of Bitcoin's entire supply over time.

This chart displays the age distribution of Bitcoin's UTXO (Unspent Transaction Output) set from the genesis block onwards:

Warmer colors (reds, oranges) at the bottom show recently moved Bitcoin

Cooler colors (blues, greens) at the top show Bitcoin that hasn't moved in years

The y-axis shows the percentage of total supply in each age band

The white line shows the USD/BTC price (logarithmic scale)

BITCOIN BREAKS THROUGH $100K

It’s official—Bitcoin has hit $100,000 for the first time ever, marking a pivotal moment in the evolution of digital assets.

Just over a decade ago, Bitcoin was a niche idea trading at a mere $1. Today, it’s a foundational pillar of the global economy.

Jerome Powell, Chair of the US Federal Reserve, recently shared his thoughts on Bitcoin—and surprisingly, they weren’t negative!

During The New York Times’ DealBook Summit, Powell made a striking comparison:

"People use bitcoin as a speculative asset, right? It's like gold… It's just like gold only it's virtual, it's digital."

He elaborated further, emphasizing the unique position of Bitcoin in the financial ecosystem:

"People are not using it as a form of payment or as a store of value. It’s highly volatile. It’s not a competitor for the dollar. It’s really a competitor for gold, that’s how I really think about it."

This acknowledgment from the head of the Federal Reserve is significant. Comparing Bitcoin to gold not only aligns with the views of many in the crypto community but also signals growing recognition of Bitcoin as "gold 2.0."

Even traditional finance firms and now government voices are starting to view Bitcoin as a digital counterpart to gold, reinforcing its potential role as a store of value in the modern financial system.

Several factors have paved the way for this meteoric rise:

Institutional Adoption: Governments and Fortune 500 companies are weaving Bitcoin into their long-term strategies. The idea of a Bitcoin Strategic Reserve is gaining traction among world powers.

Regulatory Clarity: Once met with skepticism, Bitcoin now enjoys increasing regulatory legitimacy worldwide.

Unmatched Security: A soaring hash rate has solidified Bitcoin’s blockchain as the most secure in existence.

This incredible milestone is not the summit but a stepping stone toward an even brighter future for the cryptocurrency that started it all.

XRP BECOMES TOP 3 CRYPTO

Let’s talk about Ripple’s $XRP, which just claimed the #3 spot in the crypto world.

With a massive $255 billion FDV, it’s leaving Solana and Tether in the dust.

Here’s what’s happening on Coinbase..

And here’s the wild part: Google searches for “XRP” are now exceeding those for “Crypto.”

How Did $XRP Get Here?

The Ripple vs. SEC Saga

The SEC lawsuit in 2020 was a turning point for Ripple. It sent $XRP into a nosedive, cutting its price from $0.50 to $0.21.

Recently, however:

Ripple won its legal battle against the SEC.

Gary Gensler’s resignation removed a key regulatory obstacle.

A pro-crypto administration introduced tax breaks for US-based blockchain projects.

These developments ignited an 82% rally in one week:

Fundamentals Remain Stagnant

Despite the hype, $XRP hasn’t changed much. It still operates as a fast, cost-effective method for international money transfers—a revolutionary concept in 2013.

But today? Stablecoins like USDC dominate the cross-border payment space, rendering $XRP less essential.

Final Takeaway

Ripple’s $XRP is a reminder that even “old-school” cryptocurrencies can stage a comeback—especially when freed from regulatory shackles.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

ETH READY FOR TAKEOFF🚀

It’s no secret.

Ethereum has significantly underperformed Bitcoin this year:

Bitcoin: +142.68%

Ethereum: +68.45%

This disparity has led many to proclaim: "Ethereum is dead."

But renowned macroeconomic expert Raoul Pal thinks otherwise. According to him, Ethereum is on the verge of a massive breakout.

Raoul Pal, a former hedge fund manager and respected macro strategist, has a stellar track record in the crypto market.

He bought his first Bitcoin in 2013, back when it traded at just ~$200.

His early prediction that it could reach $100,000 proved prophetic, solidifying his reputation in the space.

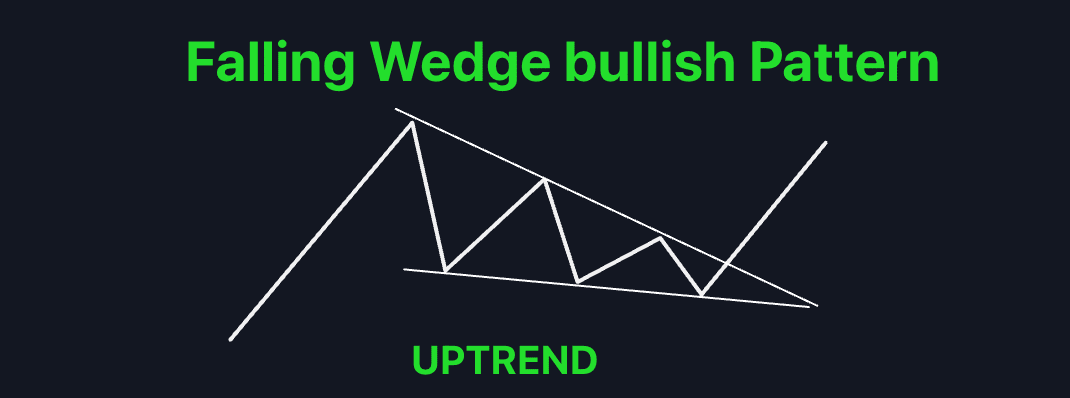

This week, Raoul highlighted a critical signal in Ethereum's chart: a massive Falling Wedge pattern—a well-known bullish signal in technical analysis.

When this pattern resolves, it often results in an explosive upward move.

The Bullish Case for Ethereum

Backing Raoul's prediction is another prominent macroeconomic thinker, Dan Tapiero.

He pointed out that the Ethereum ecosystem is stronger than ever, with record levels of activity and adoption.

Both experts agree: the future of Ethereum looks incredibly bright.

So buckle up. The next move for Ethereum could be spectacular. 🚀

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

SAYLOR’S WINNING STRATEGY: BUY & HOLD

MicroStrategy’s Executive Chairman, Michael Saylor, has a clear message for Bitcoin enthusiasts: buy and hold.

The firm, already renowned for its massive Bitcoin investments, recently completed a $3 billion offering of 0% convertible senior notes due December 2029.

This bold strategy supports their mission to further increase their Bitcoin holdings. Initially targeting $1.75 billion, overwhelming demand boosted the figure to $2.6 billion, ultimately finalizing at $3 billion.

The offering, priced with a 0% coupon and a 55% premium, includes an implied strike price of $672 for MicroStrategy’s Class A stock.

Take a look at the video below to hear highlights of Saylor’s most recent update:

Despite skepticism surrounding this aggressive investment approach, the results speak for themselves.

Michael Saylor confidently encourages others to adopt a similar Bitcoin strategy, emphasizing that long-term holding minimizes risk and maximizes potential rewards.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.