Weak DXY Is Bullish For Bitcoin

SOL’s Rise On Corporate Balance Sheets

Weak DXY Is Bullish For Bitcoin

BTC Isn’t Rising, Your Dollar Is Dying

And more…

Market Data Prices as of 5:30am ET

This Update Is Brought To You By Bitbo

We are excited to announce one of Bitbo’s newest trading charts:

Bollinger Bands are a technical analysis tool that was invented by John Bollinger in the 1980s.

They are used to measure the volatility of a financial asset, like Bitcoin, over a specified period of time.

Bollinger Bands comprise three lines:

A middle band representing a simple moving average (typically 20-day)

Two outer bands that are standard deviations away from the middle band

A WEAK DXY IS BULLISH FOR BITCOIN

We don’t usually cheer for declines… but when the U.S. Dollar Index (DXY) drops, it’s fair game to celebrate.

Why?

Because a weaker dollar is historically bullish for crypto and other risk assets.

The U.S. Dollar Index (DXY) is a measure of the U.S. dollar’s strength relative to a basket of major foreign currencies, including the euro, yen, pound, Canadian dollar, Swedish krona, and Swiss franc.

When the DXY rises, it means the dollar is gaining strength compared to those currencies; when it falls, the dollar is weakening.

This index is closely watched by investors because a stronger dollar often puts pressure on risk assets like crypto, while a weaker dollar typically supports higher prices for Bitcoin and other cryptocurrencies.

Right now, the DXY is having its worst first half of the year in nearly 40 years – and that’s a big deal.

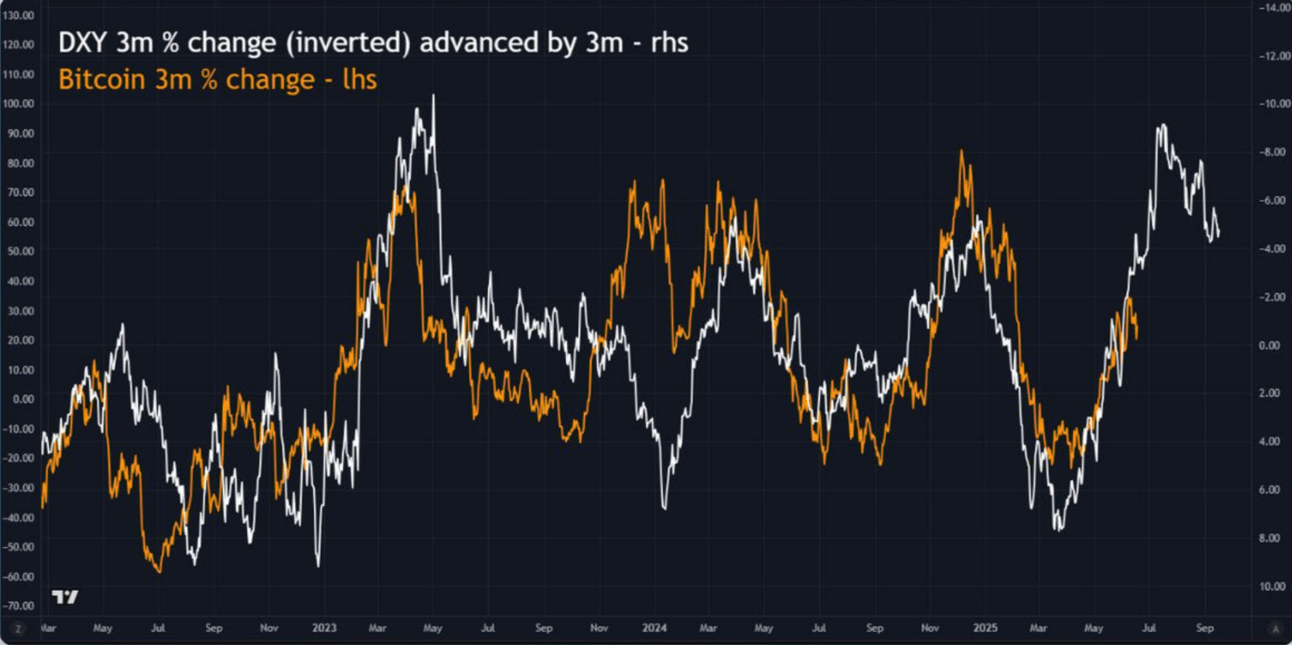

Take a look at this chart to see the correlation:

📉 DXY Down → BTC Up (3 months later)

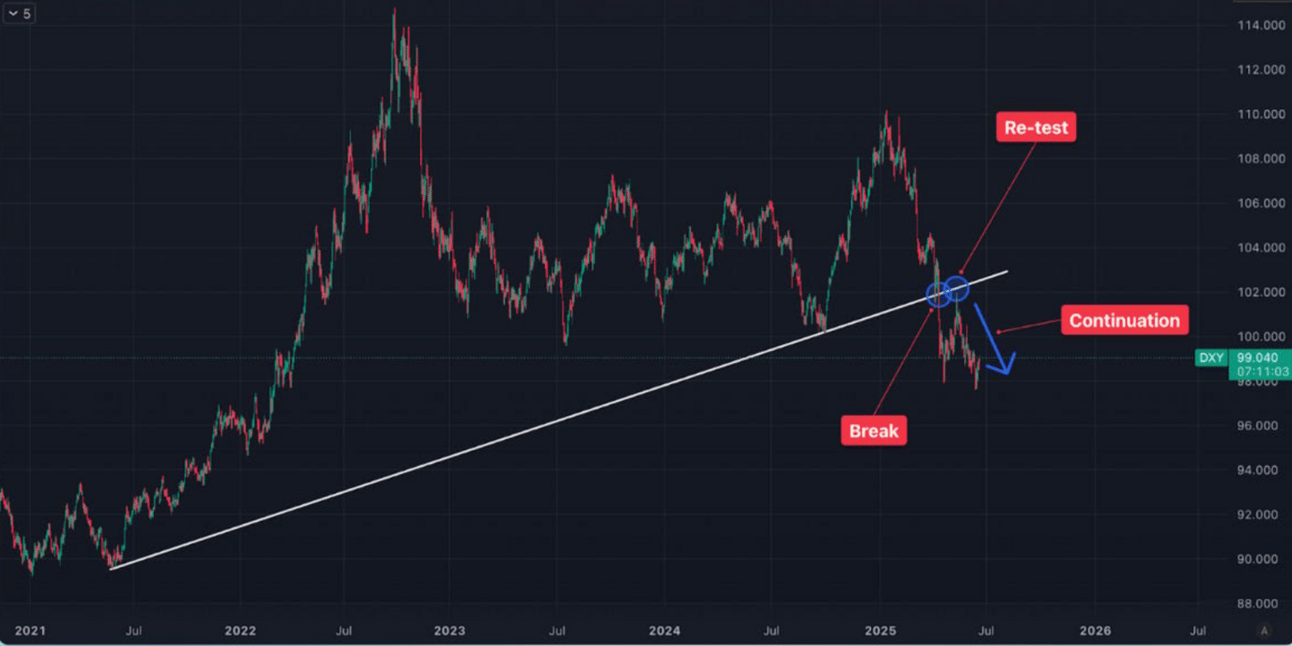

It’s not just a dip. The DXY has broken its multi-year uptrend, confirmed with a break → retest → continuation pattern.

Bottom line:

If this trend holds, we could see significant upside for crypto in both the short- and long-term.

So yeah, now’s a good time to be paying attention.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

SOL’S RISE ON CORPORATE BALANCE SHEETS

We’ve talked at length about Bitcoin and Ethereum as treasury assets.

But Solana ($SOL)?

Not so much.

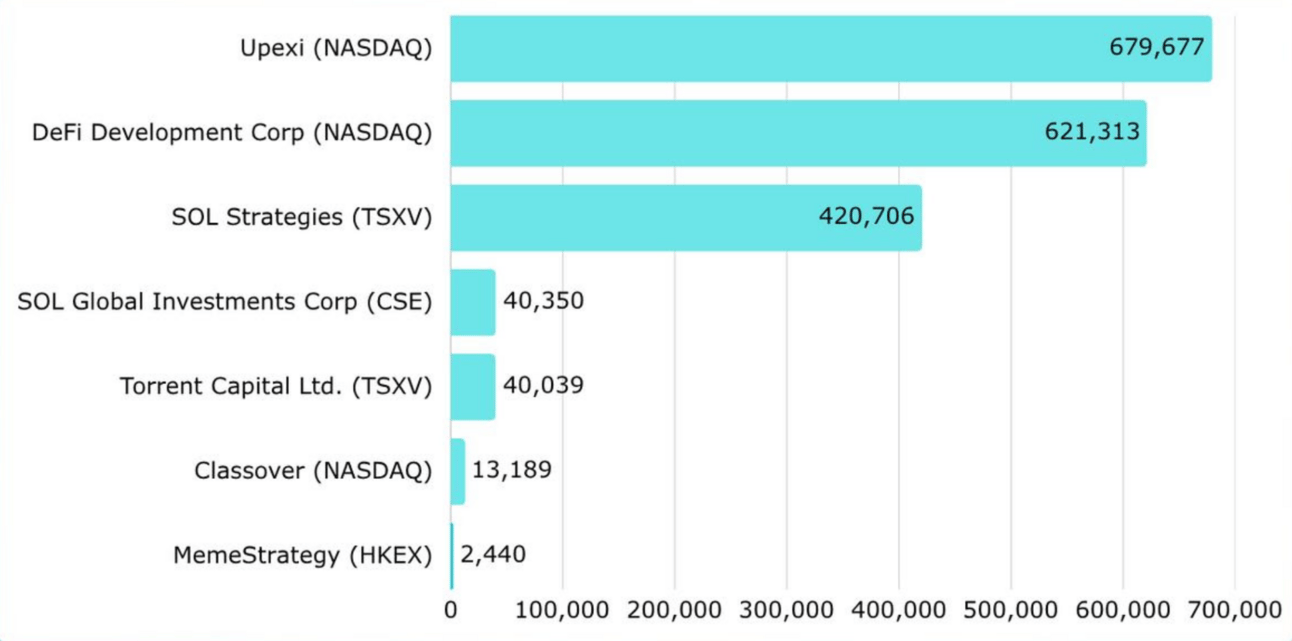

Today, that changes. Here are the publicly listed companies already holding $SOL.X ( ▼ 2.18% )

Source: Globenewswire

Now, why would they do that?

🔍 $SOL doesn’t have an ETF, and lacks the institutional track record of $BTC and $ETH. But it does offer something special:

➡️ Price Sensitivity to Capital Inflows

With today’s market caps:

BTC = $2.1T

ETH = $308B

SOL = $78B

What happens when $10B is added?

SOL: +12.8%

ETH: +3.24%

BTC: +0.47%

💡 The takeaway? Smaller assets move more—and $SOL’s upside is magnified when treasury capital comes in.

Sure, that means greater risk. But some companies may see the potential reward outweighing the downside.

As for me? I’m all in on $SOL—despite my team begging me to hedge.

(I’ll let you know if I show up on Monday with a more diversified bag and a suspiciously black eye.)

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

WAR AND BITCOIN: WHAT JUST HAPPENED?

Bitcoin just experienced a dramatic plunge — and a swift recovery — following a sudden escalation in the Middle East.

The U.S. and Israel conducted coordinated airstrikes on Iranian nuclear facilities, triggering immediate retaliation: missiles, drone strikes, and a threat to close the Strait of Hormuz, a key artery for global oil supply.

In the chaos:

Over $1B in crypto positions were liquidated

Bitcoin dropped below $100,000 for the first time in over a month

Ethereum saw nearly $300M in long liquidations

Altcoins, especially AI tokens and small caps, plummeted up to 20%

Then came the turnaround.

By Sunday night, Bitcoin bounced back, oil prices remained stable, and gold even cooled slightly. Iran resumed diplomatic discussions, this time via Moscow.

Swyftx analyst Pav Hundal put it best:

“Uncertainty is the enemy of traders. But if things calm, confidence returns. Wars don’t damage Bitcoin – they underscore its value.”

💡 Bottom Line:

Geopolitical uncertainty shakes markets in the short term. But smart investors know that fiat currencies weaken in war, while Bitcoin’s thesis strengthens. Panic selling during a crisis? Like tossing your lifeboat when the storm hits.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

BTC ISN’T RISING, YOUR DOLLAR IS DYING

Jeff Booth is sounding the alarm: the financial system is shifting beneath our feet.

While most people see Bitcoin’s price rising, Booth says they’re missing the bigger picture.

It's not about Bitcoin gaining—it’s about fiat currencies failing. This isn’t inflation or deflation, he argues—it's a real-time monetary reset.

Booth uses real-world examples to drive it home: houses and energy are getting cheaper in Bitcoin terms.

That means Bitcoin isn’t volatile—fiat is.

He believes that as long as Bitcoin remains decentralized and secure, it will become the ultimate measure of value.

Clinging to fiat is a slow bleed; Bitcoin is the lifeboat.

OTHER NEWS

Texas makes history as Governor Greg Abbott signs Senate Bill 21, establishing the first state-funded Strategic Bitcoin Reserve in the U.S.

Coinbase receives MiCA approval via Luxembourg, unlocking access to all 27 EU member states under a single regulatory framework.

ZachXBT links Garden Finance Bitcoin Bridge to money laundering operations allegedly tied to the North Korean Lazarus Group and major crypto exchange breaches.

A new investor survey shows 73% of Gen Z and Millennials prefer Bitcoin over gold for long-term wealth accumulation.

France reports its 10th ‘wrench attack’ of 2025, after a 23-year-old Bitcoin investor is kidnapped near Paris.

Samson Mow, CEO of JAN3, meets with French lawmaker Sarah Knafo to promote a European Strategic Bitcoin Reserve.

Adam Back of Blockstream defends MicroStrategy’s BTC premium, citing their consistent BTC-per-share growth over 18 months.

Sequans, a top IoT chipmaker, raises $384M and partners with Swan Bitcoin to launch a corporate Bitcoin treasury.

Bitwise CEO Hunter Horsley declares US Treasuries—not gold—are Bitcoin’s true competition, warning that "digital gold" branding may limit adoption.

Alphractal data shows Bitcoin active addresses are matching 2020 pandemic levels, despite the asset trading above $100K.

Cardone Capital adds 1,000 BTC ($101M) to its balance sheet and plans to accumulate 3,000 more by year-end.

KindlyMD, a healthcare startup, raises $51.5M and will merge with Nakamoto Holdings to launch a Bitcoin treasury strategy.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.