Using Tariffs To Buy Bitcoin

Bitcoin Goes Corporate

Why Stablecoins Matter

Last Chance To Buy The Dip

And more…

Market Data Prices as of 4:30am ET

This Update Is Brought To You By Bitbo

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

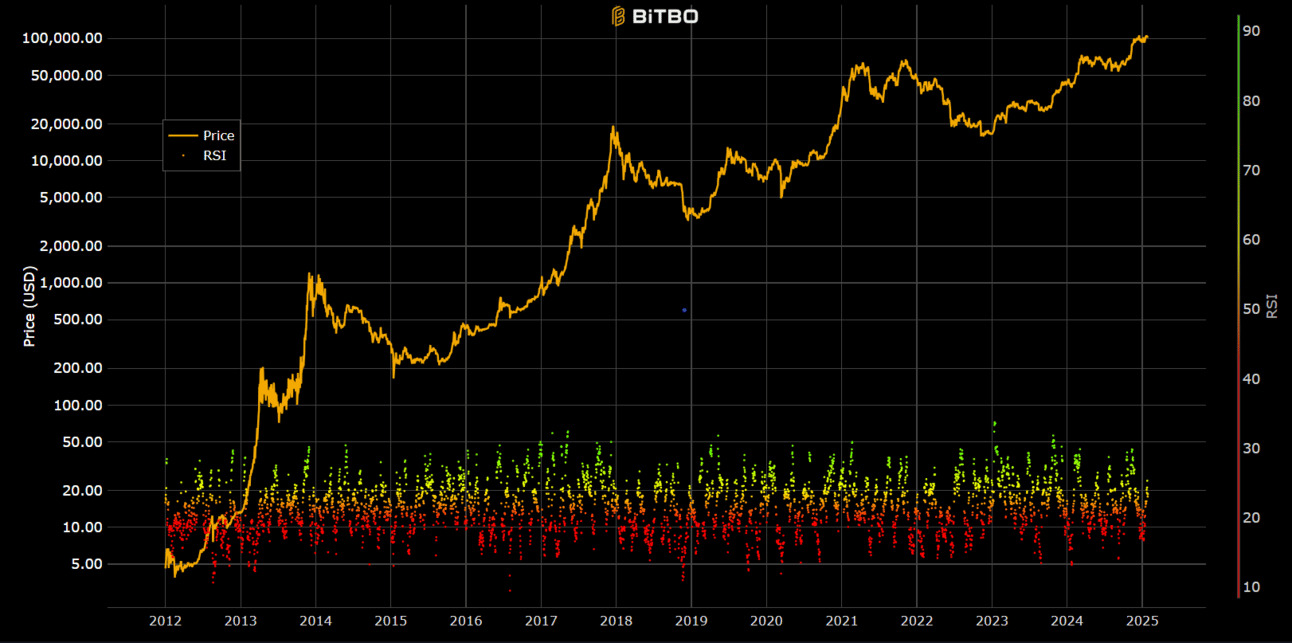

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

USING TARIFFS TO BUY BITCOIN

President Trump’s Executive Director on Digital Assets just made a bold statement that’s shaking up the crypto world.

The U.S. doesn’t just want to accumulate more Bitcoin—they’re actively brainstorming budget-neutral ways to do it.

One standout idea? Tariffs. 👀

Who is Bo Hines?

If you haven’t heard of him, Bo Hines is the man leading this charge:

Former college football athlete 🏈

2022 Congressional candidate 🎤

Vocal advocate for digital assets, economic innovation, and U.S. sovereignty 🇺🇸

In a recent interview with Anthony Pompliano, Hines made it clear:

“We want as much [Bitcoin] as we can get. And we’re going to find budget-neutral ways to make that happen.”

This isn’t just talk. According to Bo, top-tier teams across Treasury and Commerce are already exploring strategies to accumulate Bitcoin without burdening taxpayers.

What’s on the Table?

💰 Selling gold reserves

💼 Restructuring federal assets

🌍 Leveraging tariff revenue to buy Bitcoin

“There are countless ways to do this… and we’re looking at every single one.”

Bo Hines isn’t being subtle:

“We want as much as we can get.”

And they’re not afraid to get creative to get it done.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

BITCOIN GOES CORPORATE

While attention remains fixed on inflation and tariff talk, another powerful trend is emerging: publicly listed companies are increasing their Bitcoin (BTC) reserves at a rapid pace.

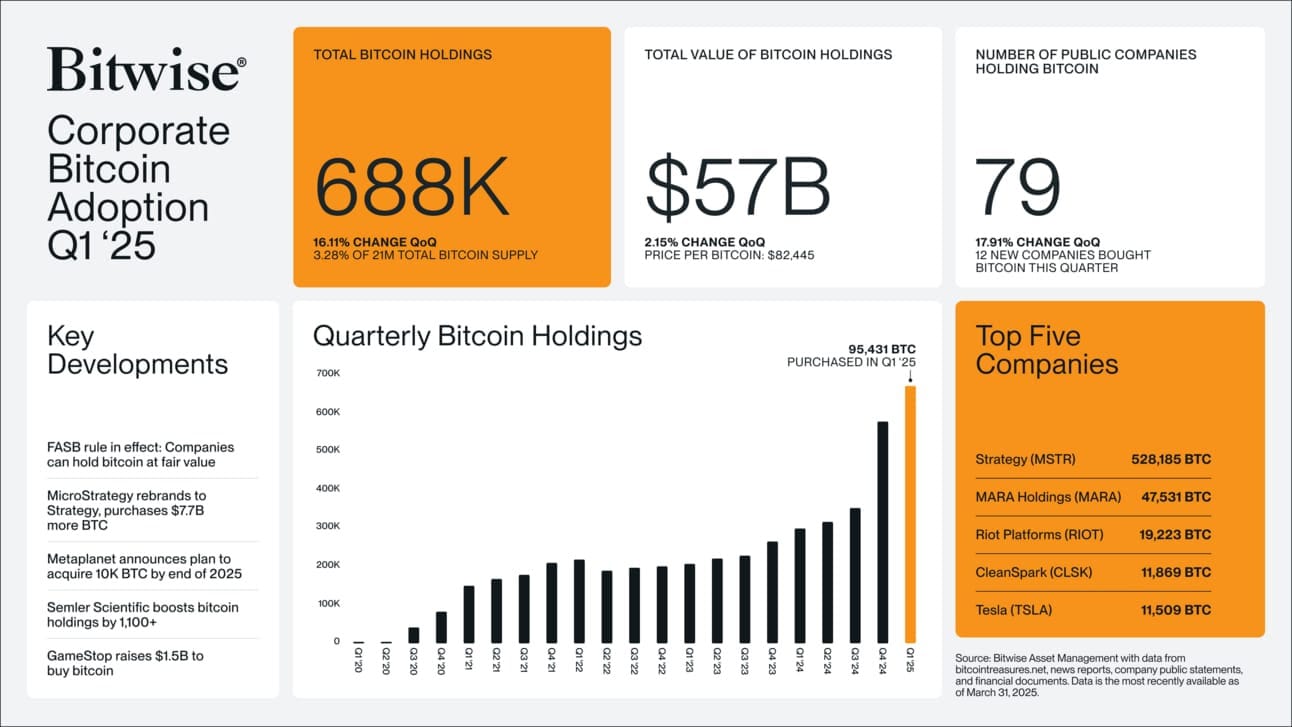

According to Bitwise, corporate Bitcoin holdings rose 16.1% in Q1 2025, reaching 688,000 BTC—equivalent to approximately $57 billion.

Currently, 79 public firms hold BTC on their balance sheets, with 12 new entrants in the first quarter alone.

Notably:

Ming Shing, a Hong Kong construction firm, acquired 833 BTC, becoming the largest new holder.

Rumble, the alt-platform rival to YouTube, purchased 188 BTC.

In a surprising move, HK Asia Holdings bought just 1 BTC—and saw its stock price nearly double in a day.

Elsewhere, Japan’s Metaplanet added 319 BTC, increasing its total to 4,525 BTC and entering the global top ten of public holders.

Yet Strategy (formerly MicroStrategy) remains the dominant force. Under Michael Saylor, the company acquired 3,459 BTC between April 7–13—a purchase worth $285.8 million.

Strategy now holds 531,644 BTC, accounting for more than 2.5% of Bitcoin’s total supply.

Despite market fluctuations, Strategy's stock (MSTR) surged 10% last Friday. Analysts believe the company could double its BTC stack by 2033.

Conclusion: While headlines focus on short-term volatility, corporations are steadily integrating Bitcoin as a treasury asset. This long-term shift shows no sign of slowing.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

WHY STABLECOINS MATTER

Everyone’s buzzing about what Bo Hines just said to Pomp...

But here’s the thing—most people are totally missing the bigger picture.

Let’s break it down:

→ Bo Hines is the Executive Director of Digital Assets for the U.S. government

→ He wants the U.S. to load up on Bitcoin ($BTC)

→ He mentioned the government might use tariff revenue to buy $BTC

That last point?

It’s what all the headlines are screaming about…

But here’s the truth: that was just a casual “maybe” — barely a concrete proposal.

Meanwhile, the real takeaway got lost in the noise:

The U.S. government sees stablecoins as a key to maintaining U.S. dollar dominance, and is actively building infrastructure to support them—with bi-partisan support.

What does that mean?

It means both Democrats and Republicans are backing blockchain innovation, especially stablecoin frameworks.

Is it exciting like crypto gaming or social platforms?

Not even close. It’s actually kinda boring.

But boring = opportunity.

👉 Track stablecoin adoption → find on-chain users → identify winning blockchain ecosystems.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

LAST CHANCE TO BUY THE DIP

The markets are undergoing serious turbulence, but that might be exactly what seasoned investors are waiting for.

Raoul Pal, CEO of Real Vision, believes the current wave of fear is not the end—but the beginning of a major opportunity.

When markets are dominated by uncertainty, they often overreact.

Whether it’s political drama or economic fears, the emotional response usually causes prices to drop far below their true value. And when the fear fades, markets often rebound sharply.

Pal suggests we may be close to that tipping point. The fear index is sky-high, signaling we could be near a market bottom.

Historically, these conditions are where the biggest gains are made—not when things feel safe, but when they feel most chaotic.

In their latest breakdown, Pal and Real Vision’s CFO Julian Bittel explore the current market dynamics and outline what to watch in the coming weeks.

Take a look at the video below to find out more:

OTHER NEWS

🔒 Blockstream reassures users: Jade hardware wallets remain unaffected by the ESP32 vulnerability.

💼 Meliuz makes a bold move: The Brazilian fintech seeks shareholder approval to adopt Bitcoin as its core treasury asset.

🌏 China taps offshore crypto sales: Local governments begin liquidating seized Bitcoin through private firms to raise funds amid economic challenges.

🏦 Xapo Bank sees BTC surge: The Gibraltar-based bank reports a 14.2% rise in Q1 Bitcoin trading as affluent clients buy the dip.

💱 Italy issues stablecoin warning: Economy Minister Giorgetti calls for EU regulation, saying dollar-backed stablecoins threaten the economy more than trade tariffs.

💸 Russia sees crypto trade benefits: A top economist says rising Bitcoin use in international trade is helping stabilize the ruble and curb USD/Yuan reliance.

⚙️ Bitdeer builds in the USA: The global mining firm invests in American manufacturing to boost self-mining amid tariff-related uncertainties.

🏢 Japanese firm bets on BTC: Tokyo-listed Value Creation plans a ¥100M ($700k) Bitcoin purchase, joining a wave of corporate crypto adoption.

📊 Binance order flow shifts: The Taker Buy/Sell Ratio turns neutral, hinting that bulls may be regaining control as buyer volume rises.

🇸🇪 Swedish MP pushes BTC reserve plan: Another lawmaker suggests using seized assets to add Bitcoin to national holdings, citing U.S. precedent.

🤝 Bitcoin left off Trump–Bukele agenda: The leaders focused on trade and immigration during their White House meet, skipping crypto talks.

🗿 El Salvador honors Bitcoin’s founder: A Satoshi Nakamoto statue debuts in El Zonte, reinforcing the nation's $523.5M Bitcoin commitment.

📞 Crypto scam crackdown in China: Nine sentenced for a $6M telecom fraud targeting over 66,000 Indians with fake crypto investment schemes.

📈 Corporate BTC reserves climb: Bitwise reports a 16% rise in Q1 Bitcoin holdings by public companies, now totaling 79 BTC-holding firms.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.