Uptober Begins

They Say Uptober Is All Hype

Crypto’s Next Move Could Change Everything

And more…

This Update Is Brought To You By Bitbo

We are excited to announce one of Bitbo’s newest trading chart:

The Mayer Multiple is used for technical analysis in Bitcoin investing.

It is used in order to determine whether Bitcoin is overbought (red), fairly priced (yellow), or undervalued (green).

The Mayer Multiple is calculated by taking the price of Bitcoin and dividing it by the 200 day moving average value.

UPTOBER BEGINS

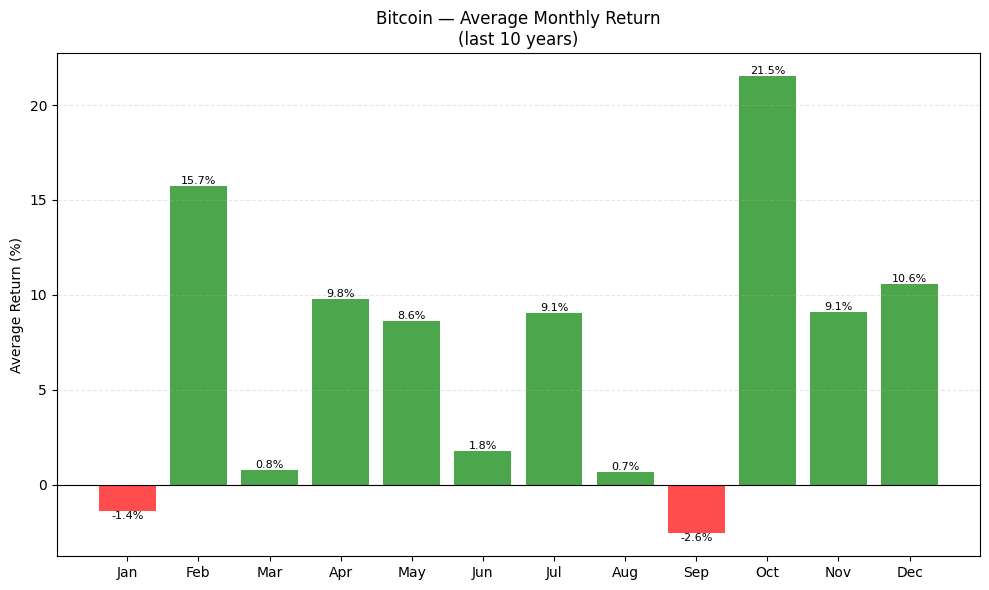

The crypto market is surging in October 2025, largely on the back of the seasonal phenomenon dubbed “Uptober” — historically, a month in which Bitcoin and the broader market tend to outperform.

As of October 5, 2025, Bitcoin has broken past $125,000 (a fresh all-time high) driven by a blend of macro uncertainty, hopes for Federal Reserve rate cuts, and renewed institutional appetite — all amplified by the Uptober narrative.

This bullish momentum is not limited to BTC. Ethereum is also gaining traction (with upward revisions in institutional forecasts), and altcoins like BNB are pushing toward new highs.

Uptober: Definition & Historical Context

“Uptober” refers to a recurring seasonal pattern in which crypto gains tend to cluster in October, especially for Bitcoin.

Analysts point out that since 2013, October has been positive in most years, with BTC showing gains in 8–10 of the past 12 Octobers.

Backtests indicate an ~83% win rate for October rises (excluding anomalies like 2022), and average returns of ~12% during the month.

Key Drivers Behind the 2025 Rally

The U.S. government shutdown has elevated demand for alternative assets like Bitcoin amid risk-off sentiment.

Interest rate expectations are tilting dovish, weakening the U.S. dollar and making crypto more attractive as a non-yielding asset.

Analyst upgrades for Ethereum (e.g. Citigroup boosting its outlook) reflect rising optimism about ETH adoption and value capture.

Sentiment, Risks & Self-fulfilling Effects

While Uptober exerts strong sentiment influence, it is not foolproof.

Heavy positioning raises the risk of sharp pullbacks. The pattern itself can become self-fulfilling — investors pile in expecting gains, thereby fueling the rally — but it can also amplify reversals if macro shocks arrive.

Traders must be cautious of crowded trades, overleveraged positions, and the fact that markets have already run strongly in September.

Beyond Bitcoin: Ethereum, BNB & Altfolio

The Uptober effect is broadening. Ethereum benefits from strong staking metrics, deflationary burns, and institutional interest.

Meanwhile, BNB is pushing toward $1,100+, and speculative new projects (e.g. “BlockchainFX”) are gaining buzz.

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

THEY SAY UPTOBER IS ALL HYPE…

…but these three charts could prove them wrong.

We want October to be a breakout month — but we refuse to rely on wishful thinking.

In this section let’s dig into the fundamentals to see where crypto markets really stand.

The macro narrative frames our crypto outlook. It helps us spot legitimate trend signals, challenge our biases, and avoid mistaking noise for direction.

That’s how real portfolio managers think — minus the hype. Enough preamble — let’s dive in.

The Business Cycle

The business cycle is our baseline blueprint: it anchors expectations about direction and momentum across markets.

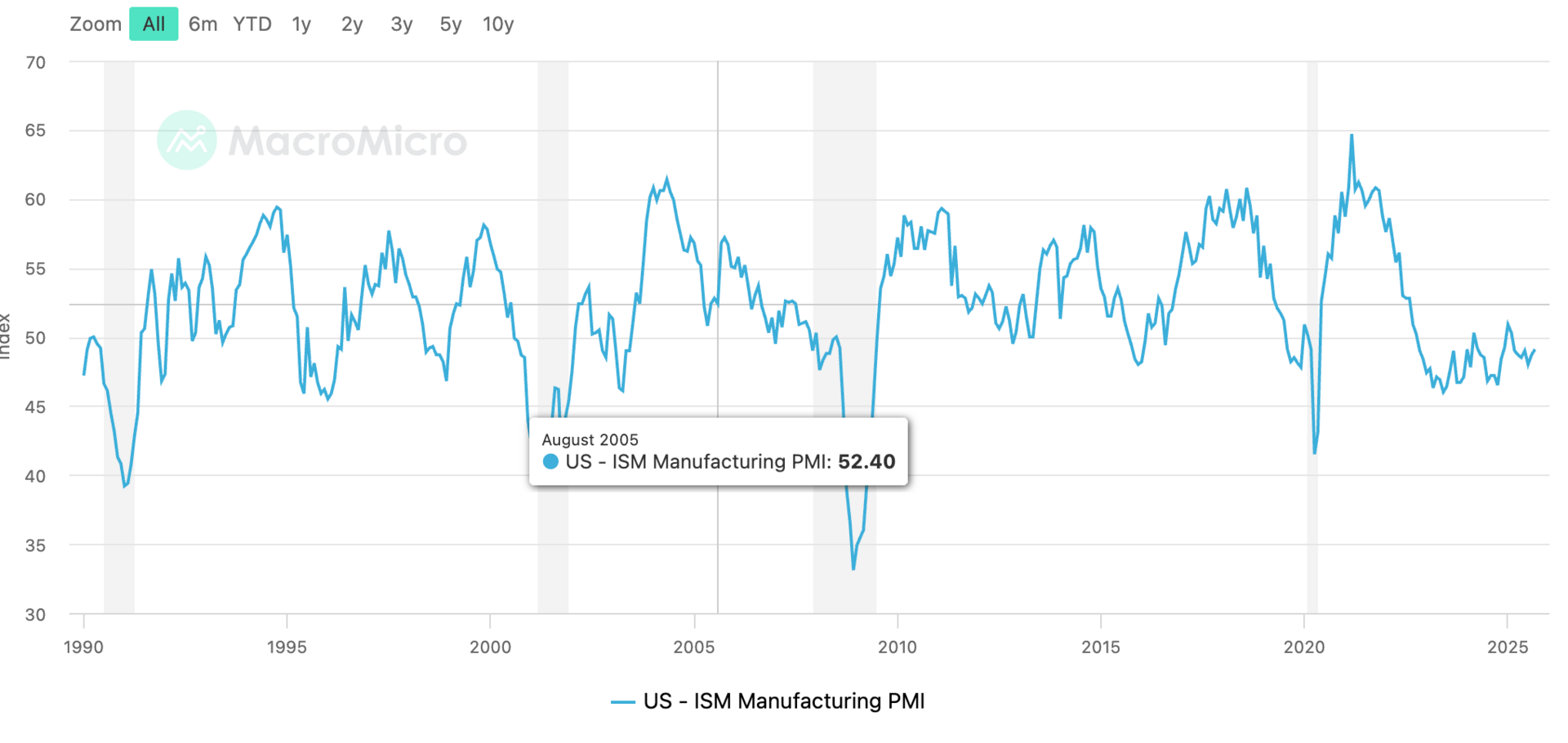

One of our go-to gauges is the ISM Manufacturing PMI — it often leads and reflects where economic activity is heading. A rising ISM suggests an upturn in industrial momentum.

Right now, most indicators — including the ISM — are flashing signs of a cycle pivoting upward. But here’s the caveat: leaning too heavily on one single survey (like ISM) can be risky — it may not fully represent the broader cycle anymore.

Global Liquidity

Global liquidity measures how much capital is sloshing through the system. The faster it grows, the more tailwinds for risk assets like crypto.

In recent months, the U.S. Treasury General Account (TGA) drained nearly half a trillion dollars from markets, which acted as a headwind for liquidity. That drawdown compressed flows and muted market momentum.

Now, with the TGA replenished, that drag has largely vanished. That opens the door for liquidity expansion to resume — and that tends to favor asset price upside.

Global Liquidity Proxy Chart:

Also, a plot of TGA balance over time (e.g. FRED chart of U.S. Treasury General Account) can show the liquidity drain vs. refill.

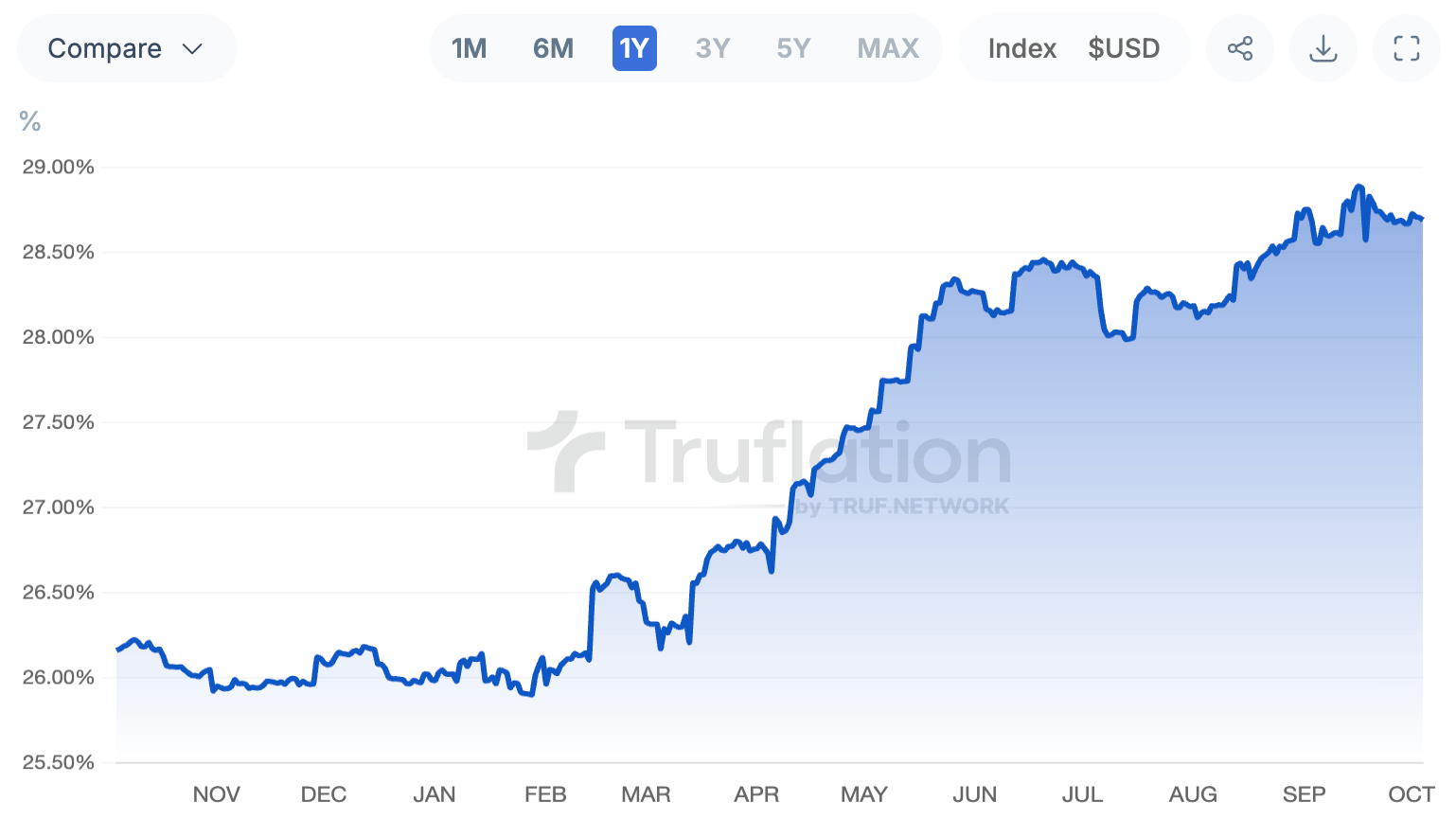

Truflation (Real-Time Inflation)

Instead of relying solely on lagging inflation metrics (CPI, PCE, etc.), we lean on Truflation — a real-time inflation aggregator built from millions of data points across sectors.

Inflation is still on our radar. If it spikes too far, the Fed could step in and short-circuit the uptrend. But right now, inflation — by many real-time measures — is elevated but stable, staying below levels that would likely force a serious crackdown.

As long as inflation doesn’t run away again, the bullish momentum has room to breathe.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

CRYPTO’S NEXT MOVE COULD

CHANGE EVERYTHING

Right now, the crypto market feels enormous — but compared to the traditional financial system, it’s barely a blip.

Digital assets total about $4 trillion in value. Meanwhile, real estate is worth $400 trillion, debt about $300 trillion, stocks around $100 trillion, and even gold — the so-called “ancient asset” — sits at $20 trillion.

Raoul Pal believes Bitcoin alone will one day outshine gold.

More importantly, the entire crypto ecosystem is tracking the same adoption curves as revolutionary technologies like the internet and mobile phones. Based on those trajectories, crypto’s market cap could soar to $100 trillion by 2032.

That means this “small” market might be the biggest wealth creation event in modern history.

Take a look at this video where Raoul Pal warns, missing out on this could be the most costly mistake of this generation.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

OTHER NEWS

📜 Nick Szabo Sparks New Firestorm Over Bitcoin Core v30

🪶 Szabo Reemerges on 𝕏, Rekindling Debate Around Bitcoin Core’s Future

⚡ Global Bitcoin Adoption Could Erupt Overnight, Analysts Warn

🌍 Nations on the Brink of a ‘Sudden’ Bitcoin Boom

👏 Vanguard Finally Bows to Pressure, Opens Doors to Bitcoin ETFs

🏦 Wall Street Giant Vanguard Softens Stance on Bitcoin Access

🏴☠️ UK Executes Record $7B Bitcoin Seizure in Criminal Crackdown

💂♂️ Britain Pulls Off World’s Largest Bitcoin Confiscation

🧠 Genius IQ Record Holder Bets Big on Bitcoin Future

💡 World’s Smartest Investor Goes All-In on Bitcoin

🚫 Poland Pushes Harsh Crypto Rules That Outstrip EU Standards

⚖️ Warsaw’s Crypto Crackdown Exceeds Brussels’ Limits

🛠️ US Government Shutdown Sends Investors Flocking to Bitcoin

🔥 Bitcoin Shines as Safe Haven Amid Washington Turmoil

🔧 Bitcoin Core Developers Reverse Course on OP_RETURN Update

⏳ Last-Minute U-Turn: Core Team Pulls OP_RETURN Change Before Launch

🏗️ Tether Doubles Down, Fortifies Its Bitcoin Treasury Reserves

🧱 Stablecoin Giant Builds ‘Bitcoin Fortress’ for the Future

💸 IRS Eases Up: New Bitcoin Tax Rules Show Softer Tone

🪙 US Regulators Loosen Grip on Bitcoin Tax Treatment

🇸🇪 Sweden Signals Interest in Joining Global Bitcoin Reserve Trend

❄️ Nordic Nation Eyes Bitcoin as Strategic Reserve Asset

🏴☠️ UK Targets $7B Bitcoin Stash Linked to Chinese Fraud Ring

💰 London Poised to Profit from Record Crypto Seizure

🥱 JPMorgan Finally Concedes: Fiat is Fading, Bitcoin Rising

😴 Bank Titan Acknowledges the ‘Debasement Trade’ Reality

🇪🇸 Spain’s Banking Titan Launches 24/7 Bitcoin Trading Service

🏦 Spanish Giant Goes All-In on Bitcoin Accessibility

🤡 New York’s Latest Move: Punitive Taxes on Bitcoin Mining

💀 Empire State Doubles Down on Anti-Mining Tax Push

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.