The Trump Effect

Tesla Moving Bitcoin

Bitcoin To 20x THIS Cycle

And more…

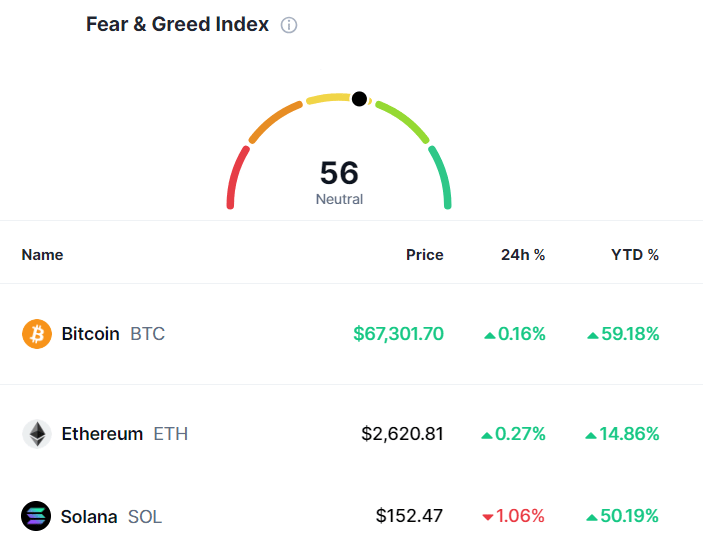

Market Data Prices as of 4:30am ET

This Update is Brought to You By Bitbo

Bitbo launched a FREE live version of the Fear & Greed index

THE TRUMP EFFECT

Former U.S. President Donald Trump expanded his lead in the 2024 election race, Bitcoin surged to a new 2.5-month high.

The price of BTC climbed nearly 10% in the past week, reaching over $68,200—its highest since the end of July, Cointelegraph data reveals.

This price surge came after Trump’s lead over Vice President Kamala Harris grew significantly in decentralized prediction markets, where his winning odds hit 60.2%.

Meanwhile, Harris saw her odds decline to 39.8%, per Polymarket data on October 16.

The growing correlation between Trump’s political trajectory and Bitcoin’s performance is drawing attention in the cryptocurrency world, with experts speculating that Bitcoin may be increasingly influenced by political factors.

Thomas Fahrer, CEO of the reviews platform Apollo, is noticing a strong correlation between Trump's rising election odds and Bitcoin's price movements.

In his Oct. 16 X post, Fahrer stated:

“For every 1% increase in Trump's chances of winning, Bitcoin's price jumps by $1,000.”

Fahrer’s insight underscores how crypto investors' sentiment would appear to be closely tied to the political landscape, particularly Trump's electoral outlook.

The best crypto app to secure your tokens: Ledger

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

These wallets physically store your private keys within a chip inside the device itself.

The beauty of using a crypto wallet is the security it provides to your private keys.

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys

TESLA MOVING BITCOIN

Tesla Transfers Entire $760 Million Bitcoin Stash to Unknown Wallets

In a surprising move yesterday, Tesla transferred its entire $760 million Bitcoin balance to unknown wallet addresses, stirring curiosity across the crypto community.

Earlier in the day, Bitcoin briefly surpassed $68,000 before settling at around $67,000.

This shift by Tesla, as reported by Arkham Intelligence, involves 11,509 BTC and marks the first time in two years that the company has moved its Bitcoin.

All of these coins were sent to unknown wallets, raising questions about Tesla's intentions.

As one of the biggest corporate holders of Bitcoin, this action could signal several possibilities.

Some believe Tesla may be preparing to sell more of its Bitcoin stash, while others suggest the transfer could be a strategic move to cold storage, ensuring tighter security for the cryptocurrency.

To recap, Tesla initially invested $1.5 billion in Bitcoin in early 2021.

However, by mid-2022, they sold 75% of their holdings, taking a loss in the process.

The motive behind this latest transfer remains a mystery for now.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

BITCOIN TO 20X THIS CYCLE

Fred Kreuger, a prominent Bitcoin maximalist and former Wall Street professional, is confident that Bitcoin could experience a 20x increase from its cycle low of around $15,000.

Kreuger is a strong advocate of the Bitcoin Power Law, a mathematical model that maps Bitcoin's historical price patterns and emphasizes the correlation between time and price.

According to Kreuger, the Power Law is one of the most reliable tools for understanding Bitcoin's past performance, tracking its adoption, and predicting future price movements.

His outlook remains extremely bullish, with predictions based on the Power Law suggesting that Bitcoin could hit between $250,000 and $350,000 this cycle, with the potential to reach $1 million in an ideal bull market scenario.

Kreuger believes all of this could happen before the market cycle concludes in late 2025.

Here are some clips from Kreuger’s interview where he walks through some of his projections using the Bitcoin Power Law:

Kreuger is so confident in Bitcoin's price trajectory that he even made a $100,000 bet—in Satoshis—with anyone willing to take it, wagering that Bitcoin will pass $70,000 ahead of the US election this November.

If you disagree, all you need to do is send 100k sats to @BeagleBitcoin, who will serve as a custodian for the bet. Kreuger will do the same!

Looking forward to seeing how this one is going to play out!

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

Metaphysics Of War - Julius Evola

Contributions to Philosophy (Of The Event) - Martin Heidegger

Liberty and Property - Ludwig Von Mises

Concept of the Political - Carl Schmitt

Digital Gold - The Untold Story Of Bitcoin - Nathaniel Popper

OTHER NEWS

J.T. Woodhouse, a freedom tech novelist, contrasts the selfless legacy of Bitcoin's anonymous creator, Satoshi Nakamoto, with today's clout-chasing culture, highlighting the importance of giving to the world without seeking recognition or reward

Brian Cubulis from Early Riders in an exceptional research report argues that companies with strong cash flows and competitive advantages can effectively ‘mine’ bitcoin more efficiently than traditional miners by allocating profits to direct bitcoin purchases, enabling long-term accumulation without operational risks

Shane Neagle, Editor In Chief at The Tokenist, emphasizes that Bitcoin’s transparency, while integral to its security, necessitates privacy upgrades like Taproot and Silent Payments to ensure true final settlement, protecting users from surveillance, seizure, and criminal activity

Thomas Eddlem, an economist and freelance writer, shows how inflation benefits the wealthy by transferring wealth from the middle class and working poor through rising real estate profits and suppressed wages, perpetuated by the Federal Reserve's policies

Alex Lari of Bitcoin News covers how Michael Saylor aims to transform MicroStrategy into the leading Bitcoin Bank, leveraging its 252,000 BTC reserves and $16B investment to capitalize on Bitcoin’s potential as a revolutionary financial asset

Pete Rizzo, Bitcoin journalist and historian, explores Murad Mahmudov's shift from Bitcoin maximalism to advocating for a ‘memecoin supercycle,’ suggesting that a chaotic crypto landscape may precede Bitcoin's rise as the dominant global asset

@runningbitcoin on Stacker News posts a comprehensive guide at the hand of Michael Bazzell’s famous book, ‘Extreme Privacy: What it takes to disappear’, for enhancing one’s digital privacy by transitioning to Pop!_OS Linux, installing privacy-focused applications, implementing backup strategies, and optionally setting up a dual-boot system with Windows

George Ford Smith, writing for Mises Institute, argues that the Federal Reserve, created in 1913 through political and banking partnerships, has manipulated currency and inflation for decades, making it time to let the free market take over

MEMES OF THE WEEK

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.