It’s Tough Out There

Is It Time To Buy Or Sell DeFi?

Aave: Why We’re Bullish On This DeFi Token

And more…

Market Data Prices as of 5:30am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $58,905 | +0.97% | +39.26% |

Ethereum (ETH) | $2,504 | -0.29% | +9.74% |

Solana (SOL) | $133.69 | +1.63% | +31.70% |

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

IT’S TOUGH OUT THERE

Market Shake-Up: BlackRock's IBIT Reports First Outflow Since May

Current State of Bitcoin

It's been a challenging time for the crypto market. As of now, Bitcoin is just above the $59,000 mark, after touching a low of $58,751 last week.

Adding to the current market woes, Bitcoin ETFs have reported a third straight day of net outflows, with last Friday’s figure at $71.8 million:

Grayscale GBTC: -$22.7 million

Fidelity FBTC: -$31.1 million

BlackRock IBIT: -$13.5 million

Bitwise BITB: -$8.1 million

Valkyrie BRRR: -$1.7 million

Significant ETF Movements

Surprisingly, even BlackRock's IBIT, known for its steady performance, posted a net outflow of $13.5 million at the end of last week —its first since May 1. This is only the second occurrence of a negative day for IBIT in 160 days of trading, underscoring its exceptional track record.

While outflows might seem concerning, it's vital to remember that they are typical for ETFs and don’t necessarily signal a longer-term trend.

What’s Next for Bitcoin?

The recent performance may not feel like a "bull market" with Bitcoin in a holding pattern and ETFs seeing outflows. However, looking at historical data, markets often make significant moves after the U.S. elections, now just 66 days away.

Additionally, Bitcoin is currently ahead of its historical cycles, as discussed in our previous reports. Staying the course might just be the key until the next big move.

IS IT TIME TO BUY OR SELL DEFI?

The total crypto market cap is down by just 1%, mainly due to Bitcoin's strong showing. On the other hand, $ETH has seen an 11% drop, and the DeFi sector has declined by 14%.

Does this mean DeFi is in trouble? We don’t think so…

We believe that the DeFi sector is still evolving and that this downturn might just be a temporary setback in a larger growth journey.

Many DeFi projects continue to push the envelope with innovation, laying the groundwork for future achievements. 💪

Indeed, some DeFi projects are achieving notable revenue growth, even as their market valuations fall.

We see that the annualized revenue of two prominent DeFi OGs has reached new all-time highs (ATHs), which has pushed their valuations to historic lows, with a price-to-revenue ratio of 24.

(For comparison, the S&P 500 currently has a price-to-earnings ratio around 32).

This disparity indicates that while market sentiment may lean bearish, the fundamental strength of these projects is solid and improving over time. ⏰

How much longer until DeFi truly takes off?

We have seen initial indicators with $AAVE showing substantial growth, prompting some to speculate that we are at the start of a "DeFi renaissance."

But is DeFi genuinely attracting more interest, or is this an outlier?

Let’s explore the DeFi mindshare data, which tracks how much DeFi is being discussed on Twitter.

Just three months ago, only 7% of Crypto Twitter conversations were about DeFi. Now, that figure has nearly doubled to 13%. 📈

This shift could represent a pivotal moment for the sector.

As DeFi begins to regain its appeal, it’s important to ensure our portfolio is composed of strong projects with sound fundamentals—projects poised to excel in this potential trend.

If our current holdings don't meet these criteria, it might be time to reconsider them.

Let's review one of our DeFi positions to assess recent developments and determine if they validate our bullish stance….. 🔦

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

AAVE: WHY WE’RE BULLISH ON THIS DEFI TOKEN

Big on $ETH? We are too.

But what we find truly fascinating are the undervalued assets that outperform $ETH and then take off. 🚀 Imagine being early on one of these…

The trick? Look at price charts in $ETH rather than in dollars. An uptrend signals the token is outpacing $ETH.

(It’s a strategy for discovering potential winners).

We recently spotted a chart showing $AAVE’s price versus $ETH that caught our attention.

We had to take notice! There’s a lot happening under the radar, and the market hasn’t caught on yet.

This rise isn't from a few retail buys—serious buying pressure is needed to outperform $ETH so decisively.

Plus, Aave’s revenue is on an upward trajectory. 📈

We’re excited about this revenue growth over the past quarters.

New proposals, including updated tokenomics and fee switch activation, are adding more reasons to watch this space closely.

But let's be cautious—could this be a case of temporary hype, or does Aave offer a solid long-term investment? 🤔

Our report focuses on this, alongside other crucial questions like:

Can Aave compete with big names like Goldman Sachs?

How is Aave acquiring 1 million users?

Is Aave still a leader in DeFi lending and borrowing?

What’s driving the revenue growth—sustainable factors or incentives?

Which support and resistance levels are crucial?

P.S. - Don’t miss our upcoming PRO AMA—details below! 👀

Now, let’s get into the details.

WHAT IS AAVE? 🤔

Aave, originally launched as ETHLend in 2017, rebranded in 2020 and has since made waves in the DeFi ecosystem. 👏

Aave is a decentralized lending platform that operates similarly to a bank by connecting lenders with borrowers.

Depositors earn yield, while borrowers provide collateral that exceeds their loan amount to ensure repayment.

The platform generates revenue from the spread between higher interest rates for borrowers and lower interest rates for lenders. 💰

Unlike traditional banks, Aave uses smart contracts to handle transactions—no middlemen, no paperwork. 🤣

The appeal is clear: permissionless, 24/7 access for lending and borrowing—no KYC, no waiting, no approvals.

So, what does the future hold for Aave?

AAVE’S GROWTH POTENTIAL 📈

Aave has attracted significant liquidity, bolstering its status in DeFi.

The Total Value Locked (TVL) showcases the amount of money currently deposited in the protocol.

With about $12 billion in TVL, Aave’s scale might seem small next to giants like JPMorgan ($2.1 trillion) or Goldman Sachs ($363 billion).

But this perspective misses the point. Aave represents an untapped market opportunity. 👀

…How does Aave stack up against traditional finance giants like JP Morgan or Goldman Sachs?

It boils down to one thing: efficiency.

Aave manages 30 times less TVL than Goldman Sachs with 750 times fewer employees. Compare the number of employees per $1 billion in TVL:

Aave: 5 employees

JPMorgan: 114 employees

Goldman Sachs: 123 employees

See the disparity? That's the efficiency edge that could disrupt traditional finance.

Now, let’s understand Aave’s business model.

AAVE BUSINESS MODEL 🤓

Aave’s model is simple yet effective: they provide yield to lenders, charge borrowers a higher interest rate, and the difference is the protocol’s revenue—similar to traditional banks.

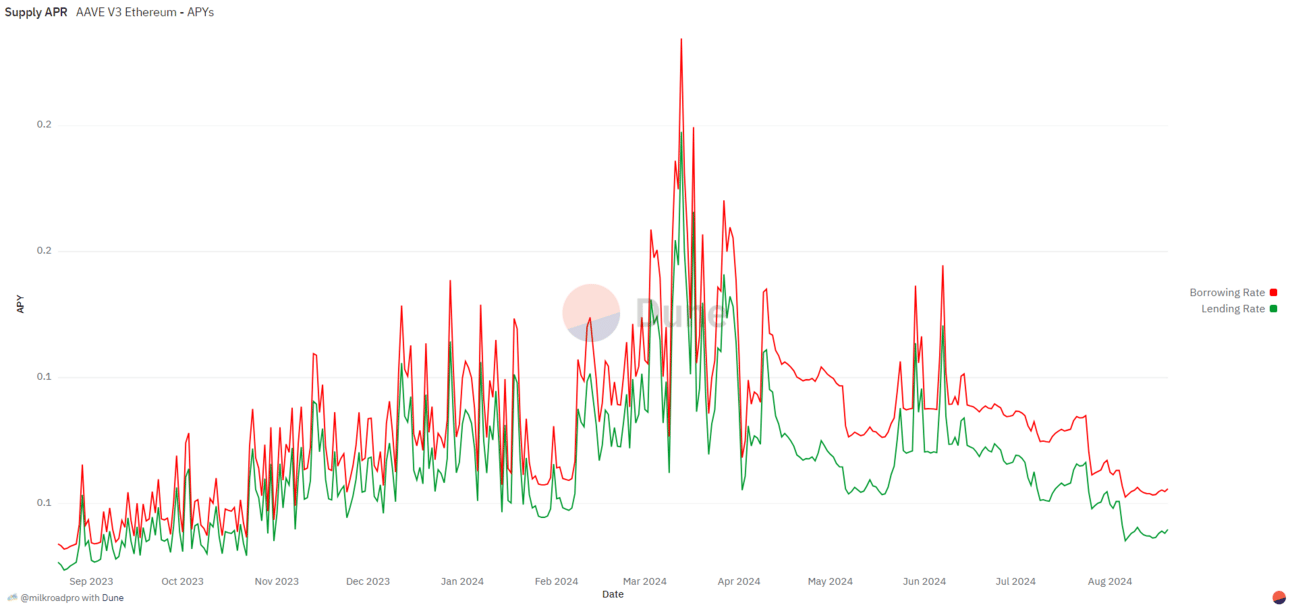

Look at the chart below for the interest rates on $USDC.

Notice the green line (yield for lenders) is consistently lower than the red line (interest for borrowers). This margin is Aave’s revenue. 🤑

For example, lending $USDC on Aave yields 5.8%, while borrowing costs 7.6%. These rates fluctuate based on market dynamics.

We won’t go into the complex math...

But when borrowing is high and reserves are low, rates adjust upwards to draw in more deposits and deter borrowing (or vice versa).

Smart system, right?

Now that we understand Aave’s potential and revenue model, it's hard not to be excited. 🤣

OTHER NEWS:

Binance admits to seizing Palestinian assets at the request of Israeli authorities.

Solo miner mines a block worth 3.275 BTC.

Trump’s new crypto business, World Liberty Financial, apparently offers ‘high-yield’ investments on a DeFi platform, urging users to ‘join the financial revolution today.’

European Securities and Markets Authority proposes stringent disclosure regulations for bitcoin mining, targeting operations with over 17 rigs and discouraging future commercial bitcoin mining.

Zaprite launches new Point-of-Sale feature to simplify bitcoin payments in-person, supporting seamless transactions on mobile devices with customizable branding and wallet integration.

Geyser launches major UX update with email notifications, enhanced project pages, and improved platform navigation to boost user engagement and community interaction.

Arthur Hayes, BitMEX co-founder, suggests Fed rate cuts would propel Bitcoin prices to potentially $100,000.

OpenSats announces support for the Tor Project to enhance online privacy, promoting internet freedom and security for users worldwide.

Mi Primer Bitcoin, Salvadoran Educational non-profit, risks running out of funds in September.

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.