Ethereum’s ‘Bitcoin 2017’ Moment

The Next 90 Days For Crypto

Global Liquidity Squeeze

Bitcoin Will Crush The S&P 500 Forever

And more…

Market Data Prices as of 3:30am ET

This Update Is Brought To You By Bitbo

We are excited to announce one of Bitbo’s newest trading charts:

Bollinger Bands are a technical analysis tool that was invented by John Bollinger in the 1980s.

They are used to measure the volatility of a financial asset, like Bitcoin, over a specified period of time.

Bollinger Bands comprise three lines:

A middle band representing a simple moving average (typically 20-day)

Two outer bands that are standard deviations away from the middle band

ETHEREUM’S ‘BITCOIN 2017’ MOMENT

Fundstrat’s Tom Lee says Ethereum is experiencing what Bitcoin went through in 2017 — a breakout moment that could redefine the crypto market.

Back then, Bitcoin was trading below $1,000 before Wall Street embraced the “digital gold” narrative.

It surged 120x by 2025, hitting $120,000. Now, Lee argues, Ethereum is on the same trajectory, fueled by three major developments:

The Genius Act – recently passed legislation that green-lights stablecoins. It’s being called the “ChatGPT moment” for crypto, but it requires smart contracts — something Bitcoin doesn’t have. Ethereum, however, was built for it.

SEC’s Project Crypto – regulators are asking Wall Street to migrate the entire financial system onto blockchain rails. Ethereum’s track record of zero downtime since launch, combined with its compliance recognition in the US, makes it the preferred platform.

Mass Adoption by Financial Giants – JPMorgan’s stablecoin, Robinhood’s tokenization, and custody banks’ digital asset services are all being built on Ethereum.

Ethereum’s price has rallied to over $4,200 since a yearly low of $1,472 back in April:

Lee also sees Ethereum as the bridge between AI and crypto — as token economies become essential for controlling autonomous systems and robotics, Ethereum’s infrastructure is already hosting that future.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

THE NEXT 90 DAYS FOR CRYPTO

We’re heading into what could be one of the most unpredictable seasonal phases in crypto history. Historically, August brings trouble, September is even worse, but October often turns sharply bullish. This year, though, three wildcards could dramatically shift the playing field. Let’s break it down.

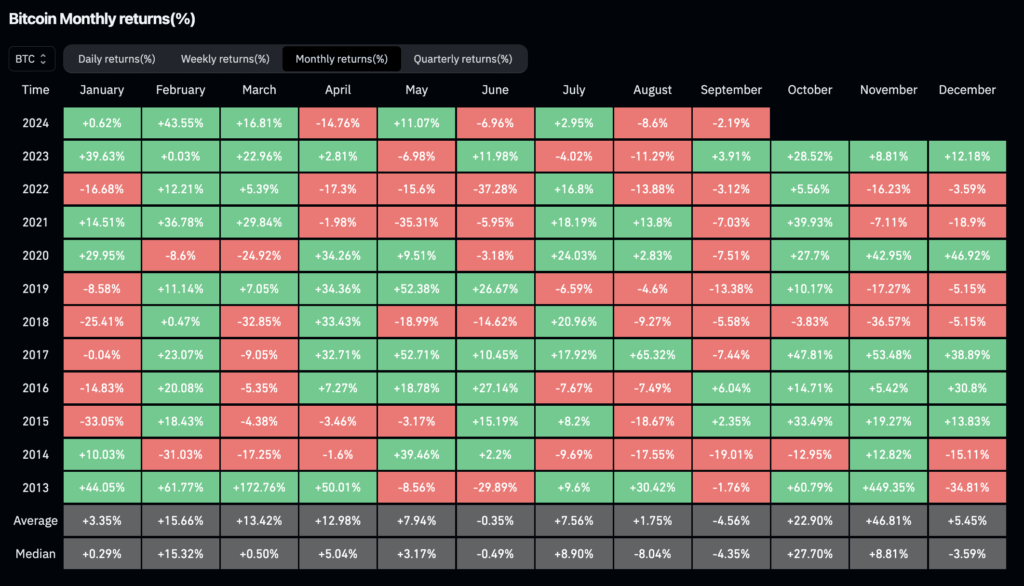

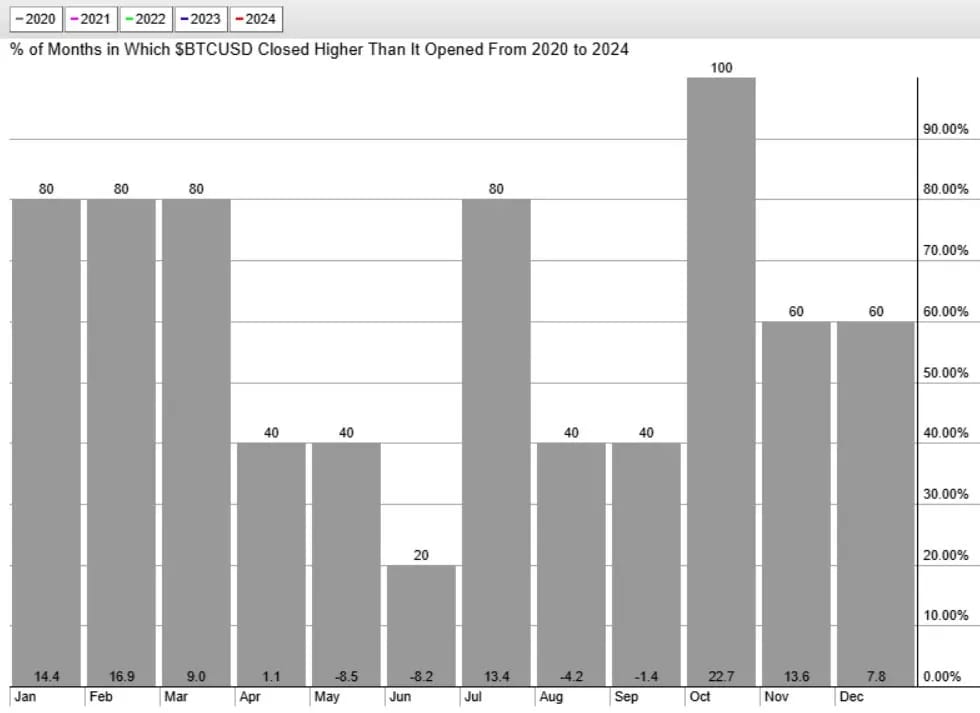

1. Seasonal Patterns: August & September vs. “Uptober” Rallies

August is often seen as a trap—lower volumes and stagnant moves frequently lead to price declines. Data shows that in 8 of the past 12 years, Bitcoin fell in August

September has the dubious title of being crypto’s worst month. Average losses—for instance ~5.9% since 2011—are common, matched by broader market slumps

In stark contrast, October earns its nickname “Uptober.”

It typically delivers strong gains—Bitcoin has risen in 7 of the last 11 years, with standout surges like +61% in October 2013 or nearly +40% in October 2021

2. Macro & Institutional Catalysts: ETFs, Cycle Fractals & Sentiment

The current crypto cycle appears to be aligning with key technical indicators. The Pi Cycle Top points toward bull-run timing, while fractal analysis forecasts a possible October peak as high as $150K

Spot Bitcoin ETFs remain a potent force—strong inflows into ETFs are expected to fuel upward momentum into October

Analysts are also watching macro shifts (like Fed rate outlooks), institutional rotation from altcoins to BTC, and chart consolidation patterns—all aligning for a potential explosive move.

3. Uncertain Terrain: Historical Bears Meet New Bulls

Analysts caution that August and September may still deliver downside pressure before any upturn. Institutional events, like ETF distributions or leadership announcements, could further distort price dynamics. For example, prior sell-offs tied to Mt. Gox distributions and German government moves echoed through those months in 2023

In contrast, entering October, event-driven catalysts and broader sentiment shifts create the perfect storm for rally potential—but timing and magnitude remain uncertain.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

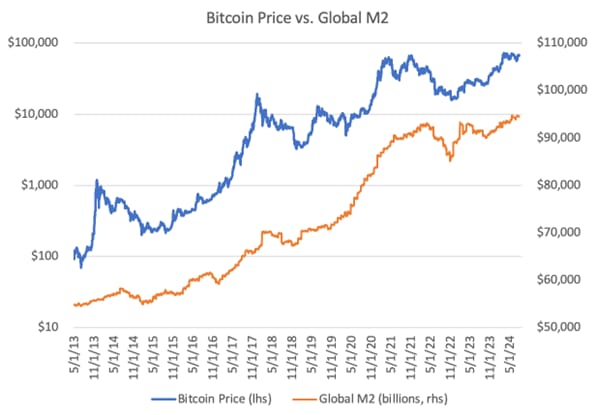

GLOBAL LIQUIDITY SQUEEZE

Global liquidity reflects how much capital is flowing into markets, and its rise typically fuels risk-on assets like Bitcoin.

When the money supply (M2) grows, Bitcoin often follows.

Recently, M2 growth has slowed—not the bullish signal we’d hoped for.

This may be influenced by a strong U.S. dollar and the Treasury General Account (TGA) refill, which is draining liquidity—with about $300B still to go.

If you follow our macro updates, this isn’t news—we anticipated both a stronger dollar and the TGA refill. We remain bullish and optimistic; markets rarely rise in a straight line.

Adding fuel to the optimism: the odds of a September rate cut are increasing. That said, if inflation doesn’t stay under control, it could dampen the outlook.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

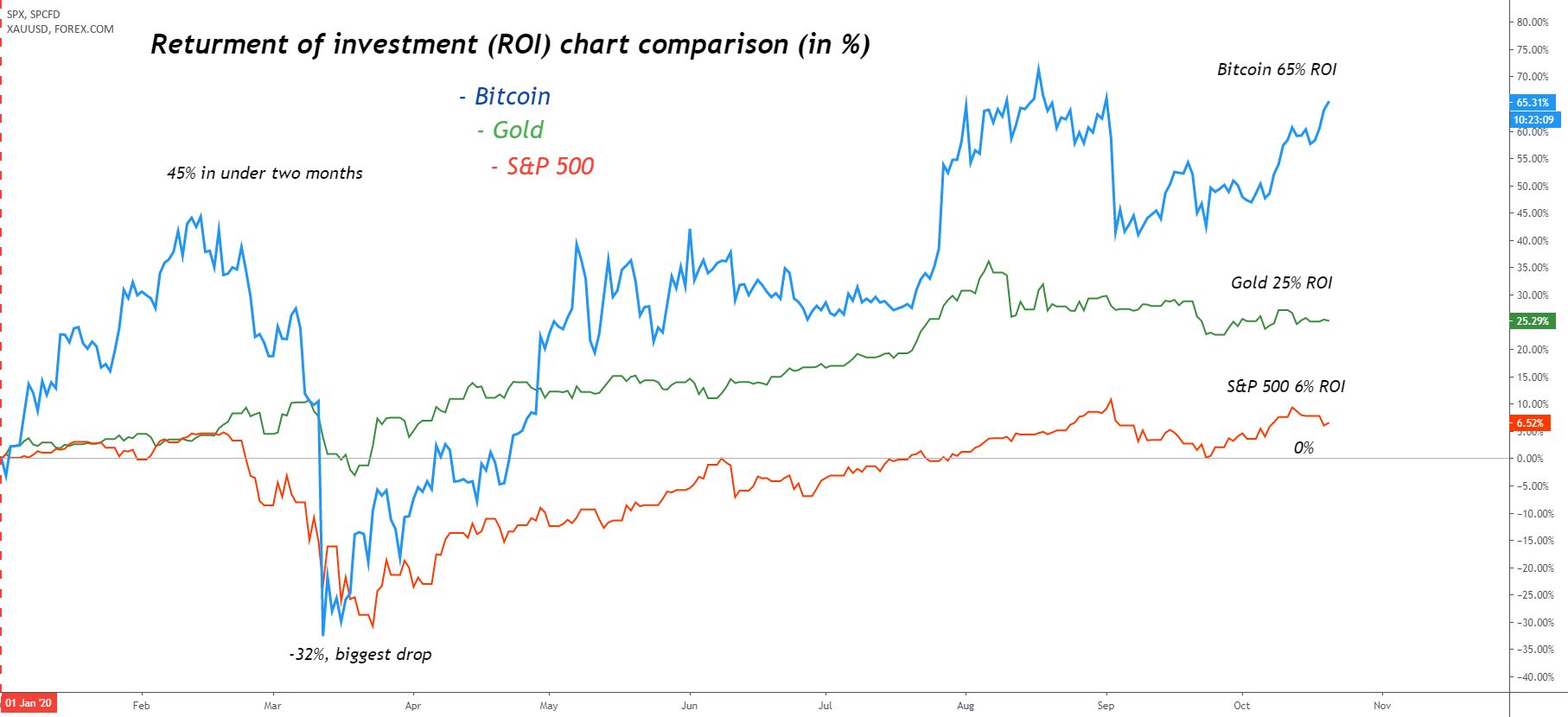

BITCOIN WILL CRUSH THE S&P 500 FOREVER

Michael Saylor isn’t looking to diversify.

For him, the path is crystal clear: Bitcoin beats the S&P 500—now and in the years to come.

Labeling it “digital capital” and the “lowest-risk, highest-return” option on the market, Saylor sees Bitcoin as more than an investment.

It’s the lifeblood of a modern, high-performance portfolio—and in his view, the only logical choice for those seeking enduring outperformance.

He argues that Bitcoin’s fixed supply, growing utility, and global reach elevate it above the volatility of stocks.

By positioning it as the centerpiece—rather than a sidebar—of investment strategy, Saylor champions a philosophy where digital capital becomes the engine that drives superior balance-sheet vitality.

The message is clear: embrace the digital monetary commodity that offers not just growth, but transformational performance.

Check out Saylor’s latest CNBC Interview to find out more:

OTHER NEWS

📺 Coinbase publicly slams UK regulators after its ‘Everything Is Fine’ ad is pulled.

⛏️ Bitcoin mining difficulty climbs to a new high, sparking a global energy realignment.

🕵️ An elaborate theft of 127,000 BTC from a Chinese mining pool finally comes to light.

🏛️ Trump prepares an executive order targeting anti-Bitcoin censorship.

📖 Don’t miss the Stanford speech by ‘Crypto Mom’ Peirce—it’s essential reading.

🗳️ Trump’s Bitcoin advisor launches a potential $200M Super PAC.

🇧🇷 Brazil’s lower house considers a $15 billion Bitcoin reserve.

⚡ Indonesia explores Bitcoin reserves powered by volcanic energy.

🚀 Michigan’s pension fund triples its Bitcoin ETF allocation.

⚖️ Co-founder of Tornado Cash found guilty in landmark case.

⛏️ Trump’s new tariffs deliver a blow to Bitcoin miners.

🏛️ A Trump-friendly Bitcoin advocate eyes the Tennessee governor’s office.

📝 Trump signs an executive order allowing Bitcoin investments in 401(k)s.

🎯 Trump taps pro-Bitcoin Miran for a position on the Federal Reserve Board.

💰 The Fed reviews a proposal to revalue gold for funding Bitcoin purchases.

MEME OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.