The Crypto Domino Effect

BlackRock BTC ETF Just Had Its Worse Day Ever

The Bitcoin Retirement Strategy No One Is Talking About

And more…

Market Data Prices as of 3:30am ET

This Update Is Brought To You By Bitbo

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

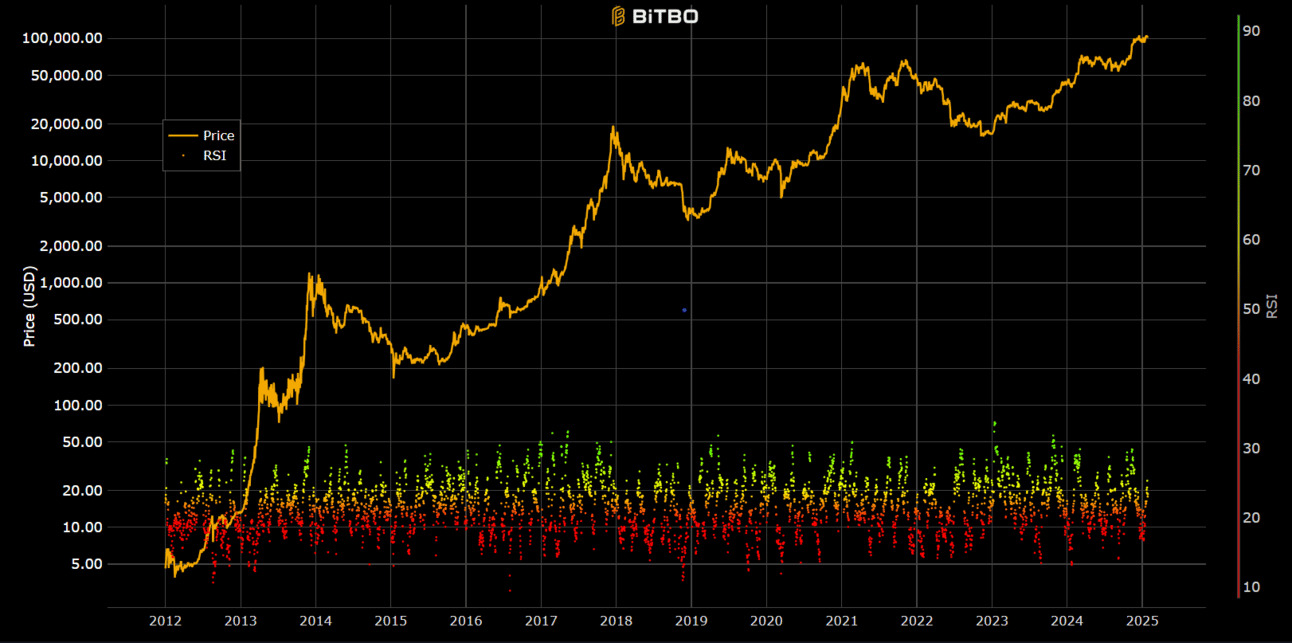

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

THE CRYPTO DOMINO EFFECT

Last week we reported in detail on Strategy’s Bitcoin acquisition model.

This might be a coincidence, but here’s what’s been happening since…

A U.S.-based company is loading up its treasury with billions in Bitcoin by issuing stock and debt—but it’s not MicroStrategy ($MSTR).

It’s the Trump family.

That’s right—a Trump-owned business is going full Bitcoin treasury strategy, and this move could encourage other companies to follow suit.

And it’s not just Bitcoin ($BTC) seeing this trend.

A company called SharpLink Gaming ($SBET) recently announced it would build a $425M strategic reserve of Ethereum ($ETH).

Can you guess when they made that announcement? 👇

Source: TradingView

Yep—$SBET stock is up over 600% since last Friday’s close.

But here’s the twist…

Consensys (the team behind MetaMask) acquired a controlling stake in this sub-$10M microcap, and then dropped the bombshell: a $450M ETH treasury strategy.

So now, the Saylor playbook is being rewritten… but this time for Ethereum.

Except there’s a bonus here: an $ETH reserve can earn staking yield—which creates a whole new financial flywheel. 👇

Let’s zoom out for a second:

Trump’s company going Bitcoin

SBET’s chart going vertical

A shift to corporate crypto treasuries

All this = a massive incentive for other public companies to explore a crypto-backed reserve strategy.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

BLACKROCK BTC ETF JUST HAD ITS

WORSE DAY EVER

ETFs are playing an increasingly critical role in the Bitcoin market.

According to data from David Lawant of FalconX, the combined trading volume from the 11 U.S.-listed spot BTC ETFs now accounts for over 40% of total spot market volume.

This trend reinforces the theory that “Bitcoin ETFs are the new marginal buyer,” as highlighted by Andre Dragosch, Head of Research – Europe at Bitwise.

IBIT’s Inflow Streak Ends With $430.8M Outflow, Its Largest Yet

The historic inflow streak for BlackRock’s iShares Bitcoin Trust (IBIT) has officially ended.

On May 30, the fund posted a $430.8 million outflow, its largest single-day loss since inception in January 2024.

This marks the end of a 31-day inflow streak and reflects broader sentiment in the spot Bitcoin ETF market.

📉 ETF Market Snapshot:

Combined outflows across 11 U.S. spot Bitcoin ETFs: $616 million (May 30)

Weekly net outflows: $144.8 million

A rare shift after months of sustained positive flows

📊 Context Matters:

IBIT remains a dominant player with nearly $70 billion in BTC holdings

May alone added $6.2 billion in inflows to the fund

Bitcoin is up 9.14% month-over-month, despite recent turbulence

🔍 Market Commentary:

Some analysts expected Bitcoin’s price to respond more aggressively.

But as Nick Forster of Derive points out:

“Inflows don’t guarantee immediate price action—especially in deep, maturing markets.”

✅ Conclusion:

The outflow, while notable, is part of the normal ETF cycle. The underlying bullish momentum in Bitcoin ETF adoption remains strong.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

THE RETIREMENT STRATEGY NO ONE IS TALKING ABOUT

Michael Saylor, Executive Chairman of MicroStrategy, asserts that Bitcoin (BTC) is on the brink of a historic bull run.

With the U.S. economy drowning in debt and currency printing, Saylor sees Bitcoin as a hedge against inflation.

He highlights that corporate adoption is accelerating, and predicts a wave of institutional investment, including sovereign wealth funds and government entities.

In his view, Bitcoin will soon become a standard on corporate balance sheets, catalyzing the largest wealth transfer in history.

Make sure to watch this video to hear Michael Saylor explain how Bitcoin might become the centerpiece of the largest shift in global wealth we’ve ever seen—a moment that could redefine financial markets forever.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

OTHER NEWS

🔌 IMF Flags Pakistan's Crypto Power Move

The IMF questions Pakistan’s plan to allocate 2,000 MW of electricity for Bitcoin mining, raising concerns during critical bailout discussions.

🗳️ Poland Elects Bitcoin-Friendly President

Karol Nawrocki wins Poland’s presidential race, becoming the country’s first openly pro-Bitcoin head of state.

🚫 Meta Shareholders Say ‘No’ to Bitcoin Treasury

A Meta proposal to add Bitcoin to its $72B reserves flops, with over 95% of shareholders voting against it.

🏆 Bitcoin Breaks Record at BTC2025 Conference

Bitcoin sets a Guinness World Record with 4,001 POS transactions in just 8 hours at the Bitcoin 2025 event.

🕵️ NYPD Under Scrutiny in Bitcoin Kidnapping Case

Several NYPD detectives are under internal review for potential ties to the SoHo Bitcoin torture case involving an Italian millionaire.

🏛️ NYC Comptroller Dismisses Bitcoin Bond Plan

NYC’s Brad Lander rejects Mayor Adams's Bitcoin-backed bond proposal, calling it “legally shaky and financially reckless.”

⚖️ US Gov Urges Supreme Court to Deny Coinbase User’s Privacy Claim

The DOJ asks SCOTUS to dismiss James Harper’s Bitcoin privacy case, asserting no constitutional protection for exchange-based data.

💼 Czech Minister Quits Over Shady $45M BTC Donation

Justice Minister Pavel Blazek resigns after taking a $45M Bitcoin donation from a convicted trafficker without vetting the source.

🏢 Metaplanet Enters Top 10 Corporate BTC Holders

Metaplanet buys 1,088 BTC for $117.9M, making it the world’s eighth-largest corporate Bitcoin holder with over 8,888 BTC.

🧠 ZachXBT Uncovers Origins of $30M Ross Ulbricht BTC Transfer

Blockchain sleuth ZachXBT finds that Ulbricht’s $30M BTC came from dormant wallets with exchange ties—not anonymous donations.

💰 Meliuz Files for $26M Raise to Buy Bitcoin

Brazilian fintech Meliuz seeks to raise $26.45M through a share offering aimed at fueling Bitcoin purchases—pricing set for June 12.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.