The Corporate Bitcoin Landgrab

Long Term Hodlers On The Move?

AI Will Push Investors To Bitcoin

Why Bitcoin Is Safer Than You Think

And more…

This Update is Brought to You By Bitbo

Bitbo launched a FREE live version of the Bitcoin Power Law

THE CORPORATE BITCOIN LANDGRAB 🏦

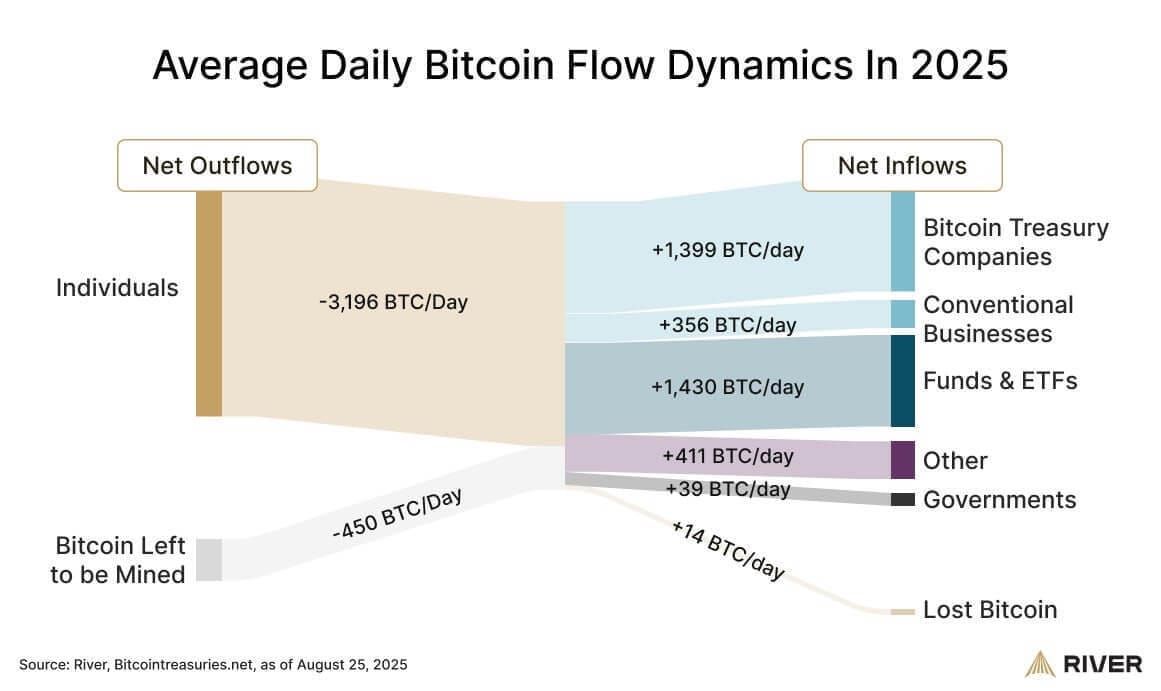

According to River’s latest data, businesses are buying 1,755 BTC per day in 2025—that’s nearly 4x faster than miners can produce it.

Add in ETFs snapping up 1,430 BTC/day and governments absorbing another 39 BTC/day, and the imbalance becomes staggering: 3,200 BTC bought daily vs only 450 mined.

This isn’t a retail FOMO frenzy. It’s a corporate-led supply squeeze.

In Q2 alone, businesses added 159,107 BTC, raising corporate holdings to 1.3M BTC. And leading the charge is Michael Saylor’s Strategy, now holding 632,457 BTC.

Analysts say Saylor is “synthetically halving Bitcoin” through his relentless accumulation.

What’s more, Strategy’s corporate treasurer Shirish Jajodia confirmed their buying is continuous and OTC, ensuring markets barely notice the drain.

But as exchange reserves fall, the inevitable becomes clear: supply shock meets demand surge—and history shows that only ends with one thing.

🚀 Bitcoin price liftoff.

LONG TERM HODLERS ON THE MOVE?

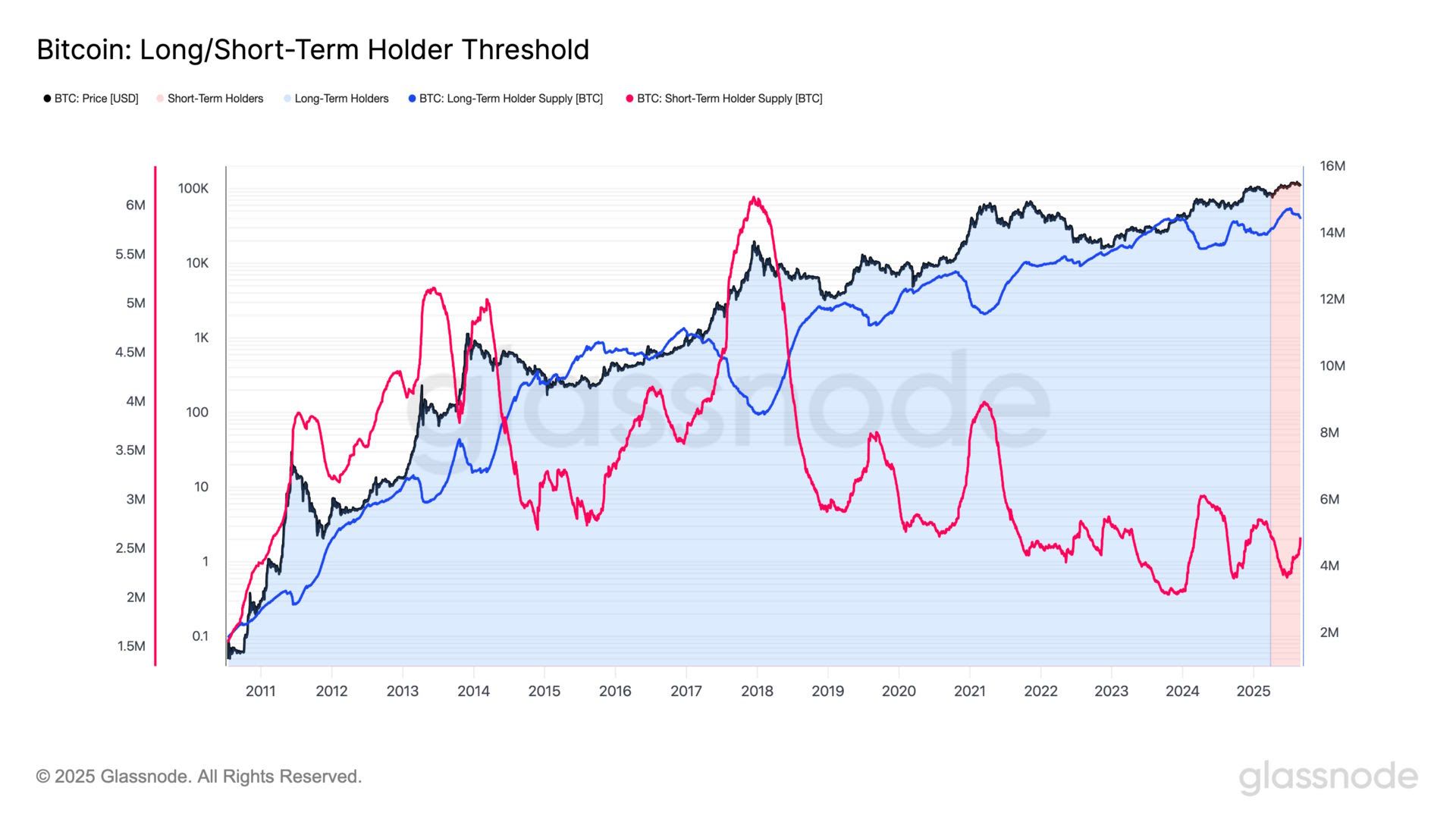

Time to revisit the Long vs. Short-Term Holder Threshold — a crucial on-chain indicator.

Here’s the framework:

🔴 STHs: Coins held under 155 days

🔵 LTHs: Coins held over 155 days

🟥 STH Cost Basis: Entry price of recent buyers

🟦 LTH Cost Basis: Entry price of seasoned holders

Source: Glassnode

The cutoff date just shifted: March 29, 2025 (when Bitcoin traded near $83K).

That means:

Pre-March 29 → Long-Term Supply

Post-March 29 → Short-Term Supply

By the numbers:

Long-Term Holders: 14.42M BTC (72.42% of circulating supply)

Short-Term Holders: 2.61M BTC (13.11% of supply)

Interestingly, in just two weeks, LTHs released 141,397 BTC back into circulation. This is most likely profit-taking as we approach September, which has historically been a volatile month.

Still, the headline is clear: the majority of Bitcoin (70%+) remains untouched in long-term hands.

The foundation of conviction hasn’t cracked.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

AI WILL PUSH INVESTORS TO BITCOIN

Artificial intelligence (AI) is accelerating the innovation cycle so quickly that traditional stocks may soon become obsolete, according to analyst and investor Jordi Visser.

Visser explained that public companies will struggle to keep up in a world where innovation moves at the speed of weeks, not years:

“If the innovation cycle is now sped up to weeks, we are in a video game where your company never hits escape velocity. In that world, you don’t invest — you trade.”

Instead, Visser believes Bitcoin (BTC) offers a stronger long-term bet. Unlike companies that may vanish, Bitcoin is a belief system — and beliefs, he argues, endure far longer than ideas.

“Gold has lasted thousands of years. There are no companies from 100 BC in the S&P 500. Bitcoin will be around for a long, long time,”

He predicts AI could shrink what normally takes a century into just five years, reshaping the future of finance and strengthening the role of blockchain in the global economy.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

WHY BITCOIN IS SAFER THAN YOU THINK

To most, Bitcoin volatility looks terrifying.

Daily swings of 5–10% make it feel like a dangerous gamble compared to the “stability” of the dollar.

Michael Saylor flips this view upside down. He argues that what appears as chaos in the short term is simply the natural motion of a high-speed growth engine.

Measured over a 10-year horizon, Bitcoin’s performance has been remarkably consistent—roughly 60% annual growth against the dollar.

Meanwhile, someone holding a million dollars in cash will still have a million dollars in a decade, while a million in Bitcoin could multiply fourfold or more simply by holding.

The paradox is this: volatility protects upside. If Bitcoin’s growth were smooth and guaranteed, everyone would flood in, capping returns.

Its chaotic price action is what keeps the asymmetric opportunity alive.

For Saylor, the only true risk is the possibility of a catastrophic, extinction-level event.

Short of that, Bitcoin’s volatility isn’t a weakness—it’s the feature that fuels exponential gains.

Find out more from Michael Saylor here..

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

The Conservative Case For Bitcoin - Mitchell Askew

Contributions to Philosophy (Of The Event) - Martin Heidegger

Liberty and Property - Ludwig Von Mises

Concept of the Political - Carl Schmitt

OTHER NEWS

🐍 Cøbra, veteran maintainer of Bitcoin.org, warns that Knots could dethrone Core as Bitcoin’s main reference client as disputes over data storage intensify.

✨ Bitcoin prints a weekly Golden Cross, with analysts eyeing a potential rally echoing past surges of +264% to +2,200%.

🛰️ El Salvador spreads its 6,284 BTC treasury across 14 wallets in a bid to guard against quantum threats and security risks.

🎓 The University of Hong Kong will now accept Bitcoin for tuition and donations, joining a small but growing group of major universities adopting sound money.

💼 Bitplanet, formerly a South Korean financial firm, unveils the nation’s first institutional BTC treasury, backed by Lobo Ventures, with a $40M debt-free allocation.

💅 Tokyo-listed nail salon chain Convano rolls out a $3B Bitcoin acquisition plan, aiming to stack 21,000 BTC by 2027 as the yen weakens.

🍻 PubKey, NYC’s Bitcoin-themed bar, now offers a 21% discount on food, drinks, and merch for those paying in BTC.

🏧 Bankless Bitcoin launches Kenya’s first Bitcoin ATM at Two Rivers Mall, expanding grassroots adoption through education and access.

⚖️ (Micro)Strategy investors drop class action lawsuit tied to alleged misleading accounting, following clarity on new FASB rules for BTC valuation.

📈 Bitwise projects Bitcoin to hit $1.3M by 2035, predicting $1T–$5T of institutional inflows over the next decade.

🏠 Luke Broyles of The Bitcoin Adviser claims skepticism will persist even if BTC hits $10M, noting psychological hurdles and new frontiers like real estate financing.

🌍 (Micro)Strategy now holds more BTC than the top six sovereign nations combined (~527k BTC vs. US ~207k, China ~194k, plus the UK, Ukraine, Bhutan, and El Salvador).

MEMES OF THE WEEK

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.