Bitcoin Trump’s All

Stagflation Fears Fuel Bitcoin Rally

The Bull Case For This Market

The Bear Case For This Market

And more…

Market Data Prices as of 7:00am ET

This Update Is Brought To You By Bitbo

We are excited to announce Bitbo’s newest trading chart:

The Mayer Multiple is used for technical analysis in Bitcoin investing.

It is used in order to determine whether Bitcoin is overbought (red), fairly priced (yellow), or undervalued (green).

The Mayer Multiple is calculated by taking the price of Bitcoin and dividing it by the 200 day moving average value.

STAGFLATION FEARS FUEL BITCOIN RALLY

No rate cut. No hike.

Just another Fed hold at 4.25%–4.50%.

But don’t be fooled — this isn’t a nothingburger.

Bitcoin (BTC) is charging past $100K territory, up 2%, and gaining steam.

Why?

Because the real drama isn’t in what the Fed did — it’s in what they fear:

Stagflation = rising inflation + sluggish growth

In their own words: “Uncertainty about the economic outlook has increased further.”

They’re boxed in.

Cut rates? Risk higher inflation

Hike rates? Slam the brakes on growth

That’s exactly the storm that Bitcoin thrives in.

Grayscale’s Zach Pandl nailed it:

“The Fed is worried about stagflation. We think that outcome would be good for Bitcoin.”

Meanwhile, Powell is watching Trump’s new tariffs and says it’s still “not time to cut.”

But here's the kicker:

Truflation data shows real inflation has already collapsed in 2025.

So the Fed’s blind, the market knows it, and Bitcoin is on the move.

This is what it does.

It climbs when confidence cracks. 🚀

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

BITCOIN TRUMPS ALL

Trump-affiliated crypto adviser David Bailey is taking Bitcoin investing to the next level.

The BTC Inc. CEO has reportedly raised $300 million for a new firm called Nakamoto — a nod to Bitcoin’s mysterious creator, Satoshi Nakamoto — with plans to go public and invest heavily in BTC.

The raise, split between $200 million in equity and $100 million in convertible debt, positions Nakamoto as one of several emerging players attempting to follow in MicroStrategy’s footsteps by converting capital into Bitcoin holdings.

Set to debut on the public markets via a reverse merger with a Nasdaq-listed company, the firm’s announcement is expected in the coming days, according to CNBC.

Bailey declined to comment directly, posting simply “No comment” on X (formerly Twitter).

The timing aligns with a broader resurgence of institutional Bitcoin enthusiasm.

Fellow players like Twenty One Capital — backed by Jack Mallers, Tether, SoftBank, and Cantor Fitzgerald — and Strive Asset Management, founded by Vivek Ramaswamy, have also made recent moves toward becoming Bitcoin treasury firms.

With global ambitions and a stacked advisory board of prominent figures from finance and crypto, Nakamoto could quickly become a major player in Bitcoin finance — just as investor appetite for digital asset exposure returns to the spotlight.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

THE BULL CASE FOR THIS MARKET

The bulls and bears are both making noise—but let’s be real: volume doesn’t equal accuracy.

(If that were true, my 3-year-old nephew Jeffrey would be the new Fed chair. He swears the Federal Reserve won’t cut rates this year… clueless!)

So, what’s got the bulls charging right now?

1/ US-China relations are quietly warming up

Just last week, China lifted tariffs on 25% of US imports—a meaningful first move in dialing down the trade war tensions.

2/ Trade talks are back on

US and Chinese officials are scheduled to meet this Friday to discuss trade deals, hinting at a potential reset of global economic cooperation.

3/ Liquidity is on the rise

China just dropped interest rates from 1.5% to 1.4% and cut the bank reserve requirement by 0.5%, pushing more cash into the system and boosting lending.

4/ The Fed might follow China’s lead

If the US economy shows signs of slowing, expect the Federal Reserve to consider rate cuts to keep things moving.

More cuts = more money circulating globally.

Source: @Cointelegraph / @DTAPCAP

All this together? Bulls are looking pretty smart right now…

So why are the bears still growling?

THE BEAR CASE FOR THIS MARKET

Let’s break it down. The current bullish optimism hinges on two things:

The trade war ends.

The Federal Reserve starts printing money again.

Neither of these has actually happened yet. And realistically, they may not any time soon.

So while the sentiment has shifted, the underlying fundamentals remain firmly bearish. Is now really the time to go all-in?

Let’s look at what the institutions are doing – and it’s not exactly bullish behavior: 👇

1. Hedge funds are heavily shorting the market

In April, institutional investors placed more short bets on the stock market than at any point in history – even during COVID.

Source: Goldman Sachs

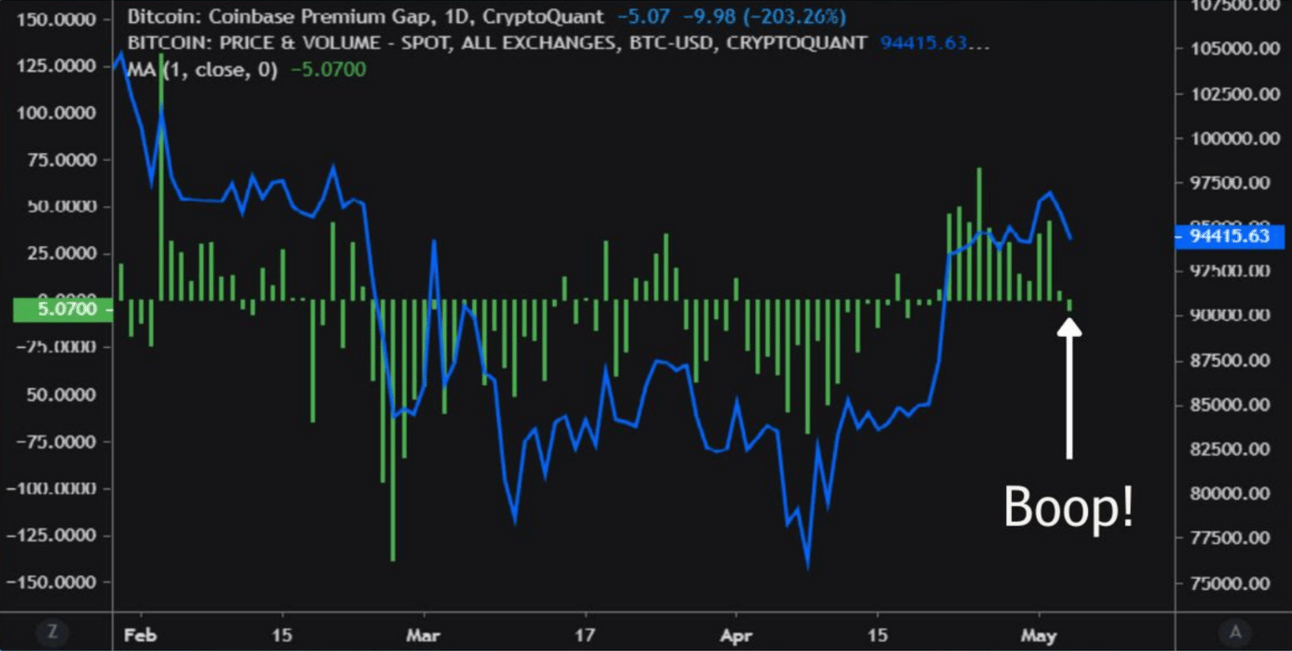

2. The ‘Coinbase Premium’ has turned negative again

The Coinbase Premium compares the price of Bitcoin ($BTC) on Coinbase Pro to other exchanges.

A positive premium means institutional buying.

A negative premium means they’re selling.

Guess what? It just flipped negative.

Source: CryptoQuant

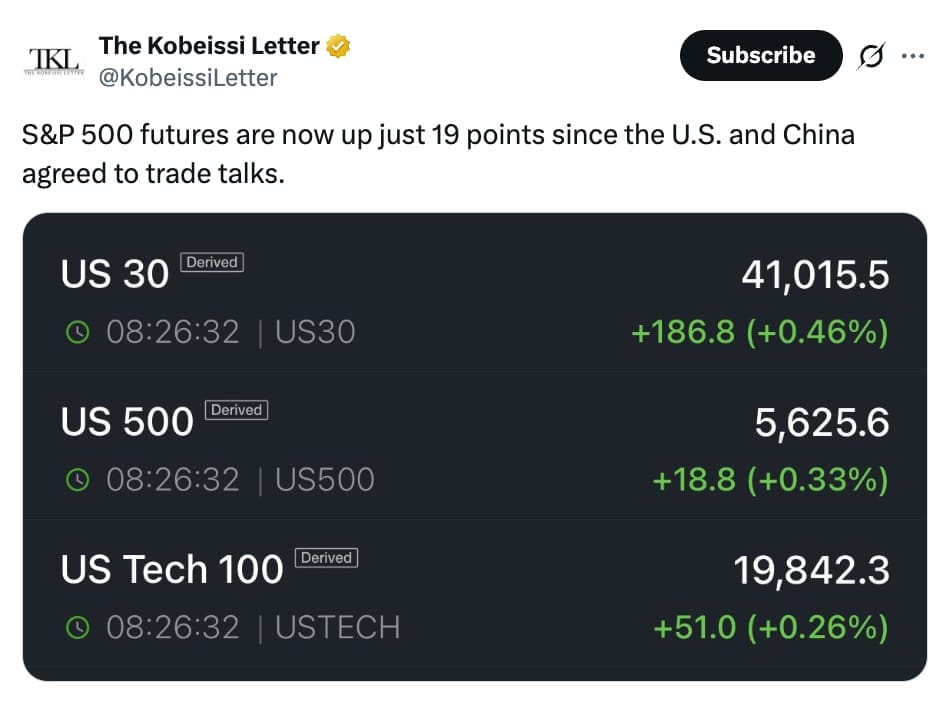

3. Trade talks aren’t moving markets

Despite the optimism in headlines, the stock market isn’t reacting. Why not?

Source: @KobeissiLetter

The PRO Team’s Take:

“Macroeconomic pressures are still real, especially from tariffs. And while investors want to believe the worst is over, there’s no solid evidence to back it up.

If we don’t get positive economic news soon, expect the markets to head lower.”

That said, some are still buying – but caution is king.

OTHER NEWS

📦 BitMEX Research pushes to lift Bitcoin’s OP_Return cap, arguing that miners care more about profits than spam—and that acknowledging this can strengthen mempool function and improve market efficiency.

🎸 Avi Burra likens Bitcoin to prog metal—bold, intense, and unapologetically complex—challenging fiat orthodoxy and giving rise to a subculture of freedom-seeking innovators.

🛒 LNbits details how its Lightning tools enabled DFX to roll out BTC payments at Swiss SPAR grocery stores, bringing practical Bitcoin adoption to retail shelves.

🌐 Shinobi of Bitcoin Magazine emphasizes why a transparent and open mempool is essential for fee discovery, decentralized relay, and resisting centralizing forces in Bitcoin infrastructure.

⚠️ AVB, a Belgian Bitcoin podcaster, calls out the UX failures holding Bitcoin apps back—pointing to sloppy testing and clunky design that risk alienating users, and calling for modern usability standards.

🛡️ Writing for Bitcoin Policy UK, Simon Cain defends Bitcoin as a safeguard for financial freedom, contrasting its decentralized design with the looming threat of CBDCs and institutional overreach.

⚡ Javier, a pseudonymous LN expert, shares a tactical guide for running an efficient Lightning node—from routing optimization to smart fee management, it’s all about staying profitable.

🔧 Solo Satoshi walks miners through the process of upgrading Bitaxe firmware via AxeOS and WebUI tools—boosting both security and operational performance.

🏦 Che Kohler argues that Bitcoin adoption is more than just retail—it’s when global capital starts parking serious reserves in BTC, shifting the foundation of modern finance.

💡 Amboss outlines how the Lightning Network’s speed, low fees, and decentralized architecture make it a powerful contender to lead the global stablecoin infrastructure race.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.