December Could Be Big For Crypto

The Banana Zone Is Here!

Is There Still Time To Invest?

Mark Moss: Huge Bitcoin Shift Ahead

And more…

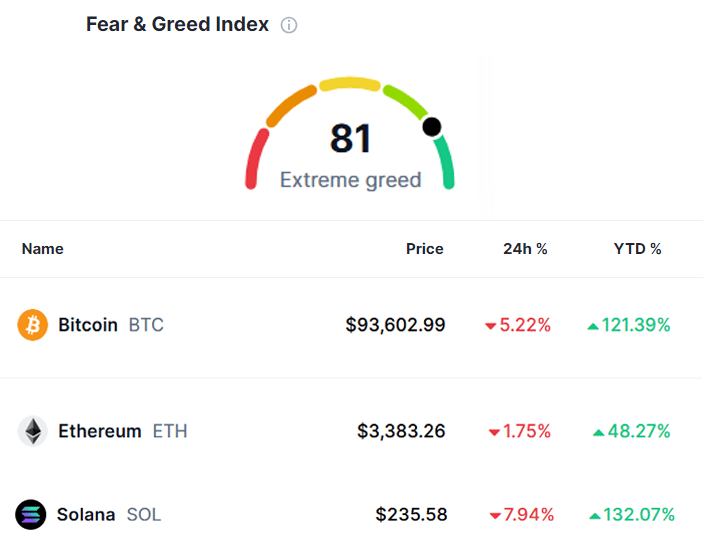

Market Data Prices as of 4:30am ET

This Update is Brought to You By Bitbo

Invest in & trade Bitcoin with data, not guesses

That's right - $100 off of all Bitbo Pro annual plans:

📈 Unlock 20+ private charts - more added weekly

⚡ Faster chart updates - go from 1 hour to 10 seconds

📝 Reports - monthly Bitcoin price analysis by Jordan, CEO of Bitbo

🔔 Live alerts - on key indicators and charts

🎁 Private TradingView indicators - lifetime access

All for $20/mo only through Monday at midnight

Get started with this incredible deal, and you'll be able to take advantage of Bitbo's suite of powerful features all through 2025

DECEMBER COULD BE BIG FOR CRYPTO

Despite Bitcoin’s promising rise toward the $100K level, its recent pullback has confirmed what some analysts predicted.

With the year winding down and the momentum from the U.S. election fading, the market is split on whether we are entering a deeper phase of cooling or if another rally is imminent.

In addition to Bitcoin, several other cryptocurrencies have posted losses in recent days, amid trading errors, significant liquidations, and heightened market volatility.

The same factors that sparked previous rallies are now contributing to the current declines.

Nevertheless, many experts believe the market is unfolding as expected.

Looking forward, historical data and prediction platforms suggest a strong December for cryptos - especially in Decembers immediately following the Bitcoin halving.

Additionally, Dogecoin is poised for potentially significant movements, and investor optimism surrounding ETFs continues to bolster Bitcoin’s dominance.

We remain cautious, awaiting clearer signals from the market.

THE BANANA ZONE IS HERE!

Well, it’s finally here – the crypto bull market (affectionately known as the Banana Zone) is back and in full swing.

The Banana Zone is a term coined by Macro Investor, Raoul Pal and is commonly used in the crypto world to describe a Bitcoin price surge that occurs in a parabolic shape.

During this phase, Bitcoin’s value escalates dramatically, and crypto adoption grows rapidly. This period often leads to market chaos, triggering widespread interest in the cryptocurrency space.

According to Raoul Pal, the Banana Zone is typically defined by the following key characteristics:

Liquidity Growth: The Banana Zone begins with an increase in liquidity, often coinciding with what Pal refers to as the macro summer.

Exponential Growth: This phase sees exponential price growth, coupled with an atmosphere of market chaos.

Regret: Those who are hesitant to invest in Bitcoin during this time often feel regret as they see prices soar.

Price Escalation: One of the most notable aspects of the Banana Zone is a dramatic price escalation.

This marks the 5th crypto bull market since the inception of blockchain technology.

The Banana Zone is where the biggest crypto gains are made.

As the industry undergoes a complete repricing in the coming weeks and months, expect to see astronomical growth in your crypto portfolios – doubling, tripling, and even quadrupling in value at an unprecedented pace.

No other industry offers gains as rapid or as significant as cryptocurrency during these surges.

If you managed to get into crypto before November 5th, the official start of the Banana Zone, take a moment to give yourself credit.

Allocating capital during times of fear, uncertainty, and doubt—as crypto experienced over the last few years—is never an easy feat.

You’ve shown real courage and conviction in making this move before it became "obvious."

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

IS THERE STILL TIME TO INVEST?

It’s clear: The Banana Zone has arrived!

Of course, we’re slightly exaggerating the title, but crypto is undoubtedly on a long-term, secular rise, and we’re still early in this journey.

There will be more chances to enter the crypto market, but in the coming days to weeks, the opportunity will soon pass.

To be clear, I believe that crypto is going to keep trending upward for the next 6-12 months. However, knowing when to allocate capital is crucial—it’s all about timing when the risk/reward is favorable.

Today, Bitcoin could experience another 50%+ drop, but its potential upside this cycle might be somewhere between $150k and $250k. That’s only a 2x gain from current prices, meaning the risk/reward of investing in crypto majors like Bitcoin is rapidly diminishing.

Although we expect the market to rise further, risk management is becoming more crucial.

A pullback will eventually happen—we just can’t predict when or how severe it will be.

Let’s look at history:

During the last cycle, Bitcoin reached $69k in 2021, a 3.5x increase over its previous high of $20k in 2017. Not bad for anyone who bought at the peak.

However, in 2022, Bitcoin dropped below the previous high, down to $16k, putting anyone who bought at $20k in the red.

To be fair, those who held through the downturn are now sitting on nearly $99k, but that required holding for four years, enduring a 70%+ drawdown, and maintaining conviction during major market crashes like the collapse of FTX, Terra Luna, and 3AC.

For those who bought earlier, such as in 2020 or during the 2018-2019 bear market, the retracement to $16k didn’t change much.

They were still well up on their investment, even throughout the 2022 bear market.

And it’s easier to take profits in the Banana Zone when you’ve bought in at much lower levels.

If you’re still on the fence or waiting for a pullback—stop waiting!

Get in now, take the profits while you can, and when the next bear market arrives, be ready to allocate again at better prices for the next cycle.

Remember, long-term success in crypto relies on consistent, disciplined investment. Quick profits might sound tempting, but if you aim for long-term growth, you’re much more likely to succeed.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

MARK MOSS: HUGE BITCOIN SHIFT AHEAD

Over the next 12 to 24 months, Bitcoin’s price is set to skyrocket as institutional adoption and nation-state FOMO (fear of missing out) drive it to unprecedented heights.

This bold prediction comes from seasoned market expert, Mark Moss, a recognized investor and entrepreneur.

For those new to Bitcoin, its current price may seem steep, especially when compared to its recent value of $50,000 to $60,000.

But Moss argues that Bitcoin is still undervalued and positioned for substantial growth in the coming months.

He believes banks will soon begin to adopt Bitcoin, with the possibility of them even buying and selling it.

With large corporations, investors, and even entire nations joining the Bitcoin movement, the fear of missing out is expected to reach fever pitch.

Under the leadership of Donald Trump, the U.S. government could play a pivotal role in accelerating this adoption.

Trump has been vocal about his positive views on Bitcoin and even suggested that the U.S. could establish a strategic Bitcoin reserve.

This reserve would serve to enhance financial independence and economic stability, positioning the U.S. as a leader in the emerging digital economy.

As the U.S. moves toward greater Bitcoin integration, other nations will likely follow, propelling its price to record-breaking levels.

Take a look at the video below to hear from Mark Moss as he explains why Bitcoin’s rise is just beginning and how its value could soon reach new heights.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

OTHER NEWS

Allianz, the largest insurance company globally, acquires $742 million in MSTR convertible notes.

Satoshi Nakamoto is now the 18th wealthiest individual, as Bitcoin’s value surged past $99,000 this week.

Bitcoin’s Puell Multiple signals a potential bull market, with analysts predicting significant price growth based on past trends.

On-chain data shows Bitcoin's price bull run continues, with key metrics indicating substantial growth potential in the months ahead.

Major cryptocurrency companies, including Ripple, Kraken, and Circle, are vying for positions on President Trump’s crypto advisory council, which is set to guide policy and help establish a Bitcoin treasury reserve.

China’s Supreme Court recognizes Bitcoin and cryptocurrency as commodities with property rights, making their possession legal.

The BTClock repo is still available after Coinkite removed it following a cease-and-desist order targeting open-source developer Djuri.

AnchorWatch, a prominent bitcoin custody insurer, becomes a Coverholder for Lloyd's of London, enabling them to offer up to $100 million in coverage per client.

Coin Center challenges U.S. Treasury sanctions, arguing that Tornado Cash is non-proprietary code and not subject to property definitions under OFAC regulations.

Michael Saylor is set to present a Bitcoin investment strategy to Microsoft’s board following an activist shareholder proposal.

BlackRock endorses the creation of a U.S. Strategic Bitcoin Reserve.

VanEck joins BlackRock in supporting the creation of a U.S. Strategic Bitcoin Reserve.

President Putin backs Bitcoin mining in regions with surplus electricity but warns miners to avoid areas with strained power grids.

Analysts suggest personal financial advisors could lose clients if they ignore Bitcoin, as retail interest continues to rise.

Senator Lummis unveils a Strategic Bitcoin Reserve proposal, calling for the purchase of 200,000 BTC annually over five years, totaling 1 million BTC.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.