Solana ETF Shockwave

Derivatives Drive BTC

The Digital Gold Rush Is Here

And more…

This Update is Brought to You from ByBit!

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign⭐ Refer a friend and grab up to 30 USDT ⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

SOLANA ETF SHOCKWAVE😱

Analysts signal Solana ETFs could be imminent following a wave of amended filings

The Bitcoin and Ethereum ETFs are already trading. But what about Solana?

According to top analysts, Solana ETFs may be just weeks away.

On Friday, a surge of amended filings hit the SEC, with major players like Fidelity, Franklin Templeton, Bitwise, Grayscale, VanEck, CoinShares, and Canary Capital all updating their S-1s for spot Solana ETFs.

This wasn’t random. Analysts argue the coordinated updates suggest regulators and issuers are deep in talks — pointing to approvals in the coming weeks.

“Solana ETFs likely coming to an exchange near you in coming days/weeks.”

Nate Geraci, president of ETF Store, suggested mid-October as the key window — already a month full of crypto catalysts.

But this time, filings included something major: staking.

Fidelity’s update revealed plans to stake some or all SOL holdings to generate yield, potentially making Solana ETFs more attractive than both Bitcoin and Ethereum ETFs. Analysts believe this could pave the way for long-awaited ETH ETF staking approval as well.

Why It Matters

Institutions have historically under-owned Solana vs BTC and ETH.

That’s shifting: REX-Osprey’s Solana Staking ETF drew $300M AUM this summer.

Bitwise’s European Solana product raised $60M in 5 days.

Pantera Capital says Solana is “next in line” for institutional adoption.

With U.S. spot ETFs looming, Solana looks set to be the breakout altcoin of this cycle.

Bottom Line: Bitcoin had January. Ethereum had July. Now it’s Solana’s turn — with approvals possibly in October, staking integrated, and institutions circling.

🚀 This is the dawn of Solana’s institutional era.

The best crypto app to secure your tokens: Ledger

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

These wallets physically store your private keys within a chip inside the device itself.

The beauty of using a crypto wallet is the security it provides to your private keys.

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys

DERIVATIVES DRIVE BTC 📈

Market analyst James Van Straten says derivatives — especially options — could help push Bitcoin (BTC) toward a $10 trillion market cap by improving institutional access and liquidity.

Options contracts give investors the right, but not the obligation, to buy or sell at preset prices, creating more ways for institutions to express views without holding spot BTC.

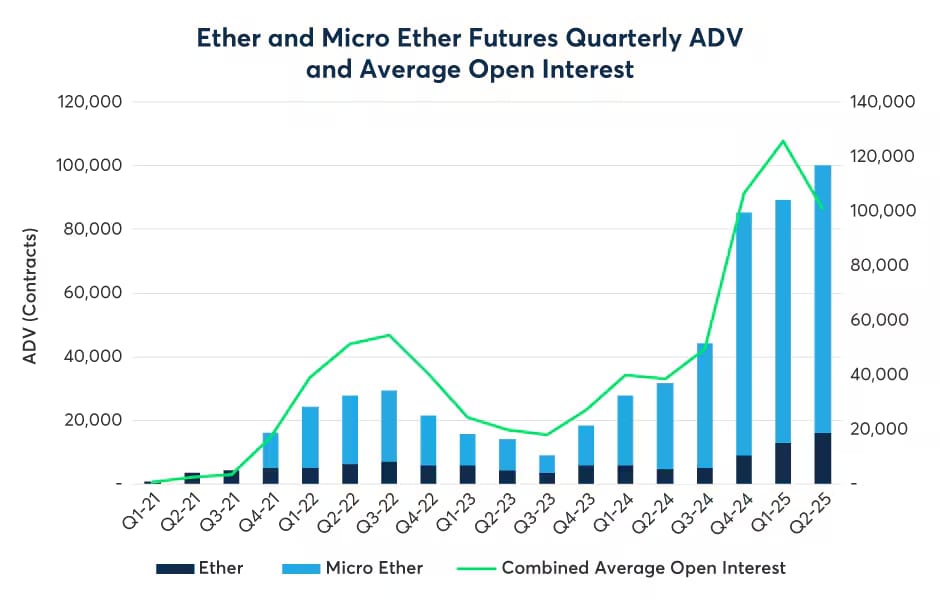

Van Straten points to rising open interest in regulated venues as evidence that institutions are piling in: CME Group reported a record quarter for notional Bitcoin options open interest in Q2 2025.

CME’s crypto derivatives volume & open interest in Q2 2025 — showing rising institutional engagement:

That increasing derivatives activity, he says, can reduce day-to-day volatility and deepen liquidity.

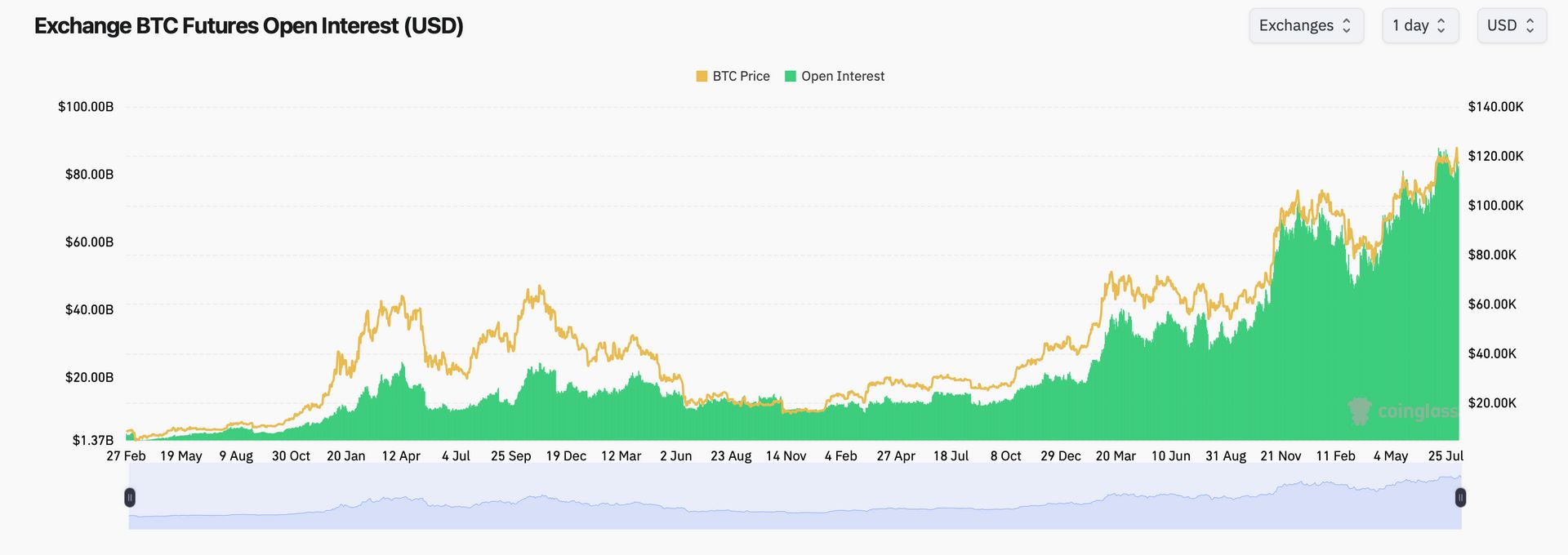

At the same time, aggregated futures and options open interest across venues has climbed, according to market data platforms tracking exchange OI — a sign of growing leverage and institutional participation.

Glassnode + CME: derivatives and realized cap trends, H1 2025:

Higher open interest can stabilise price discovery, but it also raises the stakes when deleveraging events occur.

BTC futures open interest hitting ~$82B as options also rise:

Critics warn that reduced volatility “cuts both ways”: while institutions benefit from steadier markets, the era of explosive returns for traders could be over.

Skeptics including some industry CEOs argue that investor psychology, news cycles, and crowd sentiment will still drive major BTC moves — meaning derivatives may change structure but not remove human behaviour from markets.

Stay Ahead of the Trend in Digital Assets with Glassnode

Join Glassnode and Access a suite of metrics which describe the foundational components and performance of the Bitcoin blockchain. Metrics cover supply, on-chain activity, transfer volumes, mining performance, and transaction fees.

THE DIGITAL GOLDRUSH IS HERE

For more than two decades, projections suggest Bitcoin will rise by about 30% annually—a rate that outpaces every other global asset.

Michael Saylor frames this trajectory as nothing short of revolutionary: just as oil underpinned industrial empires, Bitcoin is becoming the bedrock of the digital financial system.

As governments, corporations, and institutions pour capital into Bitcoin, the contrast between depreciating money and appreciating digital capital grows starker.

Unlike currencies vulnerable to printing or assets like real estate burdened by costs, Bitcoin compounds through scarcity and adoption.

Every coin embodies a slice of a network immune to duplication and inflation. In an unstable monetary era, Bitcoin’s reliability sets it apart.

For Saylor, this is not a speculative phase—it’s the dawn of a new wealth paradigm, where digital scarcity becomes the ultimate driver of prosperity.

Make sure to stick to watch this video as Michael Saylor explains why Bitcoin's projected 30% annual growth will drive the digital gold rush from 2025 to 2035.

OTHER NEWS:

1. Singapore & UAE 🌏

Singapore and the UAE take the crown as the most crypto-obsessed nations, driven by record adoption, skyrocketing ownership, and relentless search activity.

Fueled by booming demand, Singapore and the UAE top global rankings as the most crypto-enthusiastic countries.

Singapore and the UAE dominate global crypto adoption, with ownership and search growth setting new highs.

2. Whale withdrawal 🐳

A new wallet pulled 584.72 BTC ($63.9M) from Binance, a move often seen as bullish given reduced sell-side pressure.

Over $63.9M in Bitcoin just exited Binance, signaling possible long-term accumulation by a whale.

Massive BTC withdrawal sparks optimism as big players move coins off exchanges to hold.

3. Novogratz on Fed pick 🏛️

Mike Novogratz says the next Fed chair could spark Bitcoin’s biggest bull run, with potential to reach $200K.

Galaxy Digital’s CEO warns: Bitcoin’s next surge may depend on who replaces Jerome Powell.

Novogratz: A dovish Fed chair could propel BTC to $200,000.

4. Bitcoin strategic reserve warning ⚠️

OKX’s Haider Rafique cautions that a US Bitcoin reserve could destabilize BTC and spark a dollar crisis.

A Bitcoin strategic reserve could backfire, creating price shocks and eroding trust in the dollar, warns Rafique.

OKX exec says a US Bitcoin stockpile risks manipulation and currency instability.

5. NYDIG on mNAV 📉

NYDIG urges treasury firms to scrap the mNAV metric, calling it misleading for investors.

Bitcoin firms should abandon mNAV, which masks debt, assets, and operating realities, NYDIG argues.

NYDIG says mNAV paints a false picture of corporate Bitcoin balance sheets.

6. Ukraine adoption 🇺🇦

EBRD reports Ukraine leads global crypto adoption with $106B inflows and strong institutional activity.

Despite conflict, Ukraine tops global charts for crypto inflows and professional Bitcoin use.

Ukraine emerges as a crypto powerhouse, driving billions into Bitcoin and digital assets.

7. China digital yuan expansion 🏮

China’s central bank opens a Shanghai hub to accelerate digital yuan cross-border payments.

Beijing ramps up its CBDC rollout, with a new Shanghai center driving international adoption.

China expands its digital yuan project, targeting cross-border trade and payments.

8. Kimono maker pivots to BTC 👘➡️💰

164-year-old kimono firm Marusho Hotta rebrands as Bitcoin Japan Corporation, pivoting to BTC treasury strategy.

Backed by Bakkt, Japan’s oldest kimono maker trades silk for Satoshis, adopting Bitcoin as core strategy.

Kimono heritage brand reinvents itself as a Bitcoin treasury operator.

9. Vietnam shifts stance 🇻🇳

Vietnam’s SSI chairman now hails Bitcoin as technology, not speculation, amid new 5-year pilot program.

Once skeptical, Vietnam’s finance leaders now embrace BTC’s decentralization and launch a national pilot.

Vietnam pivots on Bitcoin: from coin speculation to decentralized innovation.

10. $10T Bitcoin market cap 📊

Analyst James Van Straten says options and derivatives could fuel BTC to a $10 trillion market cap.

Institutional interest in derivatives could propel Bitcoin’s value sky-high.

Options trading may be the catalyst that pushes Bitcoin into the $10T club.

11. Dormant wallet moves ⏳

A Satoshi-era wallet awakens after 12 years, moving $44M in BTC.

Another dormant Bitcoin wallet stirs, sending millions after over a decade of silence.

$44M in BTC shifts as an ancient wallet reactivates.

12. NJ bans Bitcoin ATMs 🚫

Gloucester City, NJ bans Bitcoin machines, citing rising scams targeting seniors.

Fears of fraud prompt a New Jersey city to outlaw crypto ATMs.

Gloucester blocks Bitcoin kiosks, warning of scammers exploiting vulnerable residents.

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

Cryptosovereignty - Erik Cason

The Sovereign Individual - James Dale Davidson and Lord William Rees Mogg

Contributions to Philosophy (Of The Event) - Martin Heidegger

Liberty and Property - Ludwig Von Mises

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.