Crypto Funds Log 7th Week Of Inflows

Real Estate Wants Crypto

May’s Top 5 Token Backed Apps

Don’t Panic, Bitcoin Surge Is Coming

And more

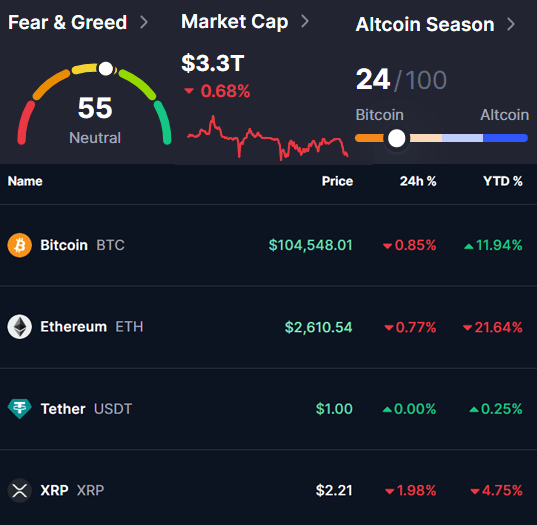

Market Data Prices as of 3:00am ET

This Update Is Brought To You By Bitcoin Well

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

CRYPTO FUNDS LOG 7TH WEEK OF INFLOWS

The streak continues—seven weeks of digital asset inflows and counting.

Last week, digital asset funds pulled in $286 million, extending the current inflow streak to seven weeks, totaling $10.9 billion.

🔹 Total Flows

The standout performer? Ethereum, with a surprising $321.4 million in inflows—its six-week total now sits at $1.19 billion.

In contrast:

Bitcoin saw a modest outflow of $8 million.

XRP registered its second consecutive week of outflows, totaling $28.2 million.

🔹 Flows by Country

The U.S. led again with $199 million in net inflows, followed by:

Hong Kong: $54.8 million

Germany: $42.9 million

Australia: $21.5 million

Meanwhile, Switzerland posted $32.8 million in outflows.

🔹 Market Sentiment

According to CoinShares, Bitcoin began the week with solid inflows, but sentiment shifted midweek after a New York Court ruling deemed U.S. tariffs illegal—reigniting macro uncertainty.

And as always, markets hate uncertainty.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

REAL ESTATE WANTS CRYPTO

Grant Cardone, one of the world’s most recognizable real estate investors with a $4B+ portfolio, recently made waves at Bitcoin 2025 in Las Vegas.

Instead of discussing real estate strategies, Cardone shared a bold projection:

“Bitcoin at $250K by year-end. A correction to $140K. Then in 2–3 years? $500K.”

For someone who built an empire on real assets, cash flow, and leverage, this shift signals something deeper:

A change in institutional mindset.

Cardone’s pivot isn’t isolated.

We’re seeing a broader migration of capital and attention—from real estate to digital assets.

Narratives shift before price does.

When names like Grant start speaking Bitcoin?

Smart money listens. 📦

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

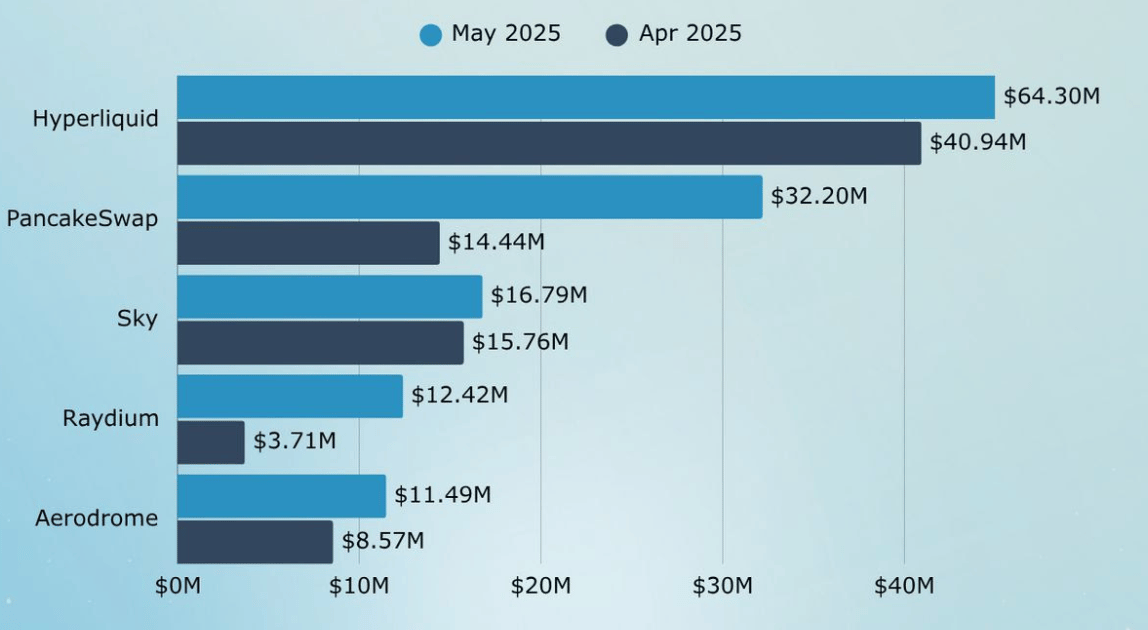

📊 MAY’S TOP 5 TOKEN-BACKED APPS

Curious which crypto projects are raking in the most revenue and have tokens you can invest in?

We’ve got you covered.

Source: DeFi Lama

(All data from DefiLlama.)

🥇 1. Hyperliquid ($HYPE) – $64.3M

Three months at the top and counting.

Hyperliquid continues to lead with powerful momentum. Its token is up 61.4% in the last month alone.

🥈 2. PancakeSwap ($CAKE) – $32.2M

A full-on comeback. With DEX volume back at 2021 levels, PancakeSwap is entering a new golden era.

Pancake Swap DEX Volume: Source DeFiLama

🥉 3. Sky ($MKR / $SKY) – $16.79M

The definition of consistency.

Month after month, Sky delivers steady earnings and unlocks new features for users.

🔢 4. Raydium ($RAY) – $12.42M

From a brutal Q1 to an epic bounce back.

Raydium has tripled its revenue in just two months and reclaims its place among the leaders.

Source: DeFi Lama

✈️ 5. Aerodrome ($AERO) – $11.49M

Don’t sleep on this one. Aerodrome is growing at 30% month-over-month — and climbing fast.

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

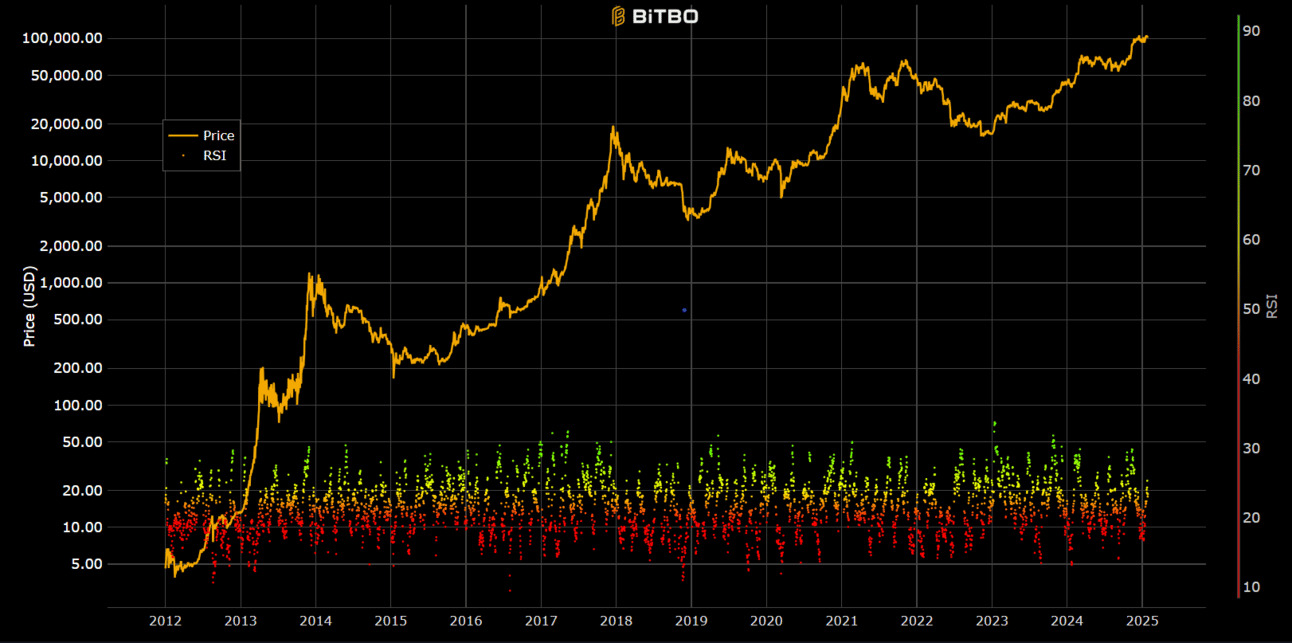

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

DON’T PANIC, THE BITCOIN SURGE IS COMING

As the global economy faces mounting debt and unrelenting currency debasement, Bitcoin stands out as a rising force.

Michael Saylor, Executive Chairman of MicroStrategy, urges investors to stay calm—because what's coming could be historic.

Saylor sees the current surge in corporate Bitcoin purchases as just the tip of the iceberg.

He predicts the real momentum will come when sovereign funds, big businesses, and governments join in, making Bitcoin a strategic asset on a global scale.

In Saylor’s eyes, this moment could mark the beginning of the largest wealth transfer in modern history.

Don't miss the full breakdown of what he believes lies ahead in 2025 in the video below.

OTHER NEWS

📉 "The US is Falling Behind," warns Samson Mow of JAN3, as countries like Pakistan move ahead by adding Bitcoin to their strategic reserves.

🏛️ Pakistan-US diplomacy heats up as officials meet at the White House to discuss Bitcoin integration, digital assets, and decentralized infrastructure.

💧 Sygnum Bank reveals a 30% drop in Bitcoin’s liquid supply over the past 18 months—pointing to rising institutional demand and state reserve adoption.

☀️ SolarBank, a top North American clean energy company, has announced it’s adding Bitcoin to its treasury reserves.

📜 In a unanimous vote, the California State Assembly passes a bill requiring state agencies to accept Bitcoin and crypto payments.

🛡️ Coinbase reportedly delayed disclosure of a massive data breach involving outsourced agents in India, who were allegedly bribed to leak sensitive customer data.

💰 Robinhood finalizes its $200M acquisition of Bitstamp, boosting its institutional crypto services in Europe, the UK, and Asia.

🏗️ Reitar Logtech Holdings, a Hong Kong real estate tech firm, unveils a $1.5B Bitcoin acquisition plan to support treasury diversification and global expansion.

🕵️♂️ ZachXBT casts doubt on Ross Ulbricht's receipt of 300 BTC ($31.4M), noting wallet activity during his imprisonment and questionable transaction origins.

📦 Following his presidential pardon, Ulbricht may owe gift and back taxes on over $30M in Bitcoin, crypto, and art donations.

🏦 Tether and Bitfinex transfer $2.7B in BTC to Twenty One Capital ahead of the firm's Bitcoin treasury equity raise.

📈 (Micro)Strategy buys 705 BTC for $75.1M, using proceeds from preferred share sales, boosting its holdings to 580,955 BTC worth over $60B.

📊 (Micro)Strategy unveils plans to issue 2.5M new preferred shares under the ‘Stride’ program to fund further Bitcoin purchases and working capital.

🚀 Norwegian Block Exchange stock soars 138% after disclosing a Bitcoin treasury strategy, beginning with a 6 BTC buy and expansion roadmap.

⚠️ Coinbase CEO Brian Armstrong warns that if the US debt (now $36.9T) goes unchecked, Bitcoin could replace the dollar as the global reserve currency.

☕ Vanadi Coffee SA, a major Spanish coffee chain, announces a bold pivot to Bitcoin, investing $1.1B to transform its business model around the digital currency.

🏦 Blockchain Group, Europe’s first Bitcoin treasury firm, increases its BTC holdings by $68M, now owning 1,471 BTC.

📦 Locate Technologies, an Australian last-mile delivery startup, becomes the first public company in Australia to adopt Bitcoin on its balance sheet.

⚡ Russian authorities seize $88,500 in Bitcoin from a former power executive who illegally mined using stolen electricity.

📜 Malikie Innovations, owner of 32,000 BlackBerry patents, sues major Bitcoin miners like Marathon Digital and Core Scientific over crypto IP infringements involving Elliptic Curve Cryptography.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.