Most Cryptos Are Trash, Here’s Why..

Crypto Isn’t Equity—Here’s Why That Matters

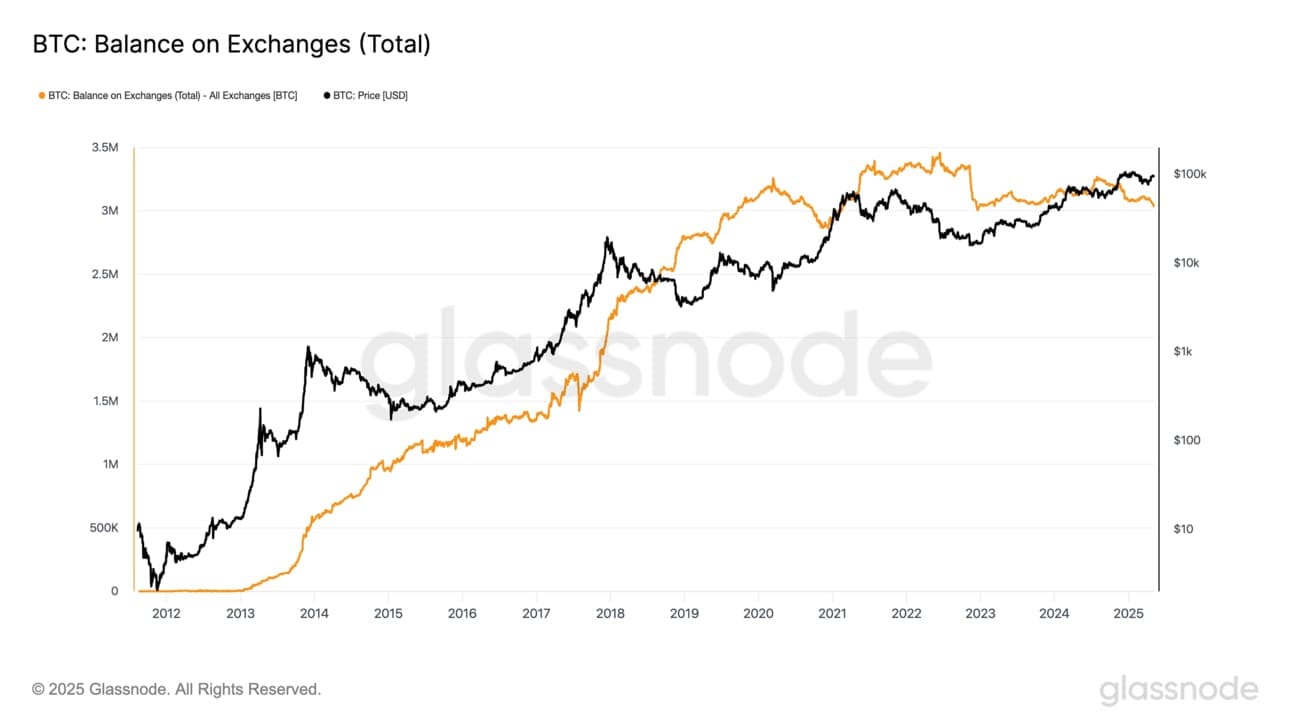

Bitcoin On Exchanges Hits 5 Year Low

And more…

Market Data Prices as of 3:00am ET

This Update Is Brought To You By Bitbo

We are excited to announce Bitbo’s newest trading chart:

The Mayer Multiple is used for technical analysis in Bitcoin investing.

It is used in order to determine whether Bitcoin is overbought (red), fairly priced (yellow), or undervalued (green).

The Mayer Multiple is calculated by taking the price of Bitcoin and dividing it by the 200 day moving average value.

MOST CRYPTOS ARE TRASH: HERE’S WHY..

The crypto market is exciting, fast-moving, and packed with innovation. '

But here’s the problem: when you strip out Bitcoin ($BTC), the rest of the market consistently underperforms traditional equities.

📉 Crypto ex-BTC has lagged behind stocks through much of this bull market.

Source: Trading View

Why?

Because tokens are a very different beast from stocks—and that’s what trips up most retail investors.

👉 Tokens give you access to early-stage projects...but they also come with baggage. Anyone can create a token, slap a roadmap on it, and pump hype.

The result?

A market full of noise, dilution, and misleading signals.

Here’s a real-world example:

Back in 2021, a token surged from a $12M market cap to over $3.2B.

A 266x jump—on paper.

But in reality, the price only went from $1 to $6.

That’s because of token unlocks and massive dilution that crushed real returns.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

CRYPTO ISN’T EQUITY, HERE’S WHY THAT MATTERS….

Let’s get one thing straight: tokens ≠ equities.

They’re both digital assets, but that’s where the similarities end.

If you want to navigate both traditional markets and crypto investing like a pro, you need to understand how they really differ.

Here’s a clear side-by-side comparison.

📊 Equities vs. Tokens – Key Differences

Feature | Equities | Tokens |

|---|---|---|

Legal Ownership | Yes – you own part of the company | No – usually no legal claim |

Regulation | High – overseen by authorities | Low – often unregulated |

Purpose | Ownership and profit-sharing | Governance and network participation |

Transparency | Audited financials | Blockchain visibility, no financial audits |

Trading Hours | Limited (market hours) | 24/7 trading |

Liquidity | High for major stocks | Variable – can be very low |

Dilution Protection | Often present | Rare – frequent unlocks dilute holders |

Custody | Through brokerages | Self-custody with private keys |

Why it matters: Stocks offer a mature, regulated environment.

Tokens offer innovation—but also volatility and risk.

Don’t dismiss tokens.

Just know what you’re buying.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

BITCOIN ON EXCHANGES HITS 5 YEAR LOW

Today, we're examining the amount of Bitcoin available for sale on crypto exchanges — a key on-chain metric with serious market implications.

Here’s how it works:

Decreasing exchange balances = Bullish 🐂: More BTC is moving off exchanges into cold storage, showing confidence and long-term holding.

Increasing exchange balances = Bearish 🐻: More BTC on exchanges increases the chance of near-term selling pressure.

Currently, just 3,033,989 BTC — or 15.28% of the total supply — is held on exchanges.

👉 That’s the lowest level since 2019.

Translation: There’s not much Bitcoin left for sale.

In the past 30 days alone, over 57,551 BTC (worth roughly $5.93 billion) has been withdrawn.

The signal?

Investors are accumulating.

Exchange reserves are vanishing.

And historically, a tight supply has led to one thing:

Explosive upside moves.

This cycle is following the same playbook.

The setup is here.

History is rhyming.

We’re just getting started. 😎

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

STRATEGY BUYS $1.4BN BITCOIN

In a recent statement, Michael Saylor, the Executive Chairman of MicroStrategy, Strategy has bolstered its Bitcoin holdings, purchasing 15,355 BTC for $1.42 billion between April 21–27, 2025, at an average price of $92,737 per coin.

This move raises the company’s total Bitcoin position to 535,555 BTC, now valued at more than $50 billion, and marks a 3% increase in holdings.

The acquisition is Strategy’s largest since its March 2025 purchase of 22,048 BTC for $1.92 billion.

The firm’s BTC yield — a measure of growth in Bitcoin per share — stands at 74% for 2024, with a target of 15% set for 2025.

During the same period, the Bitcoin market saw an 8% price increase, climbing from $87,000 to nearly $94,000.

Michael Saylor, Strategy’s executive chairman, continued his vocal support, tweeting on April 25th, “you can still buy BTC for under $0.1 million,” followed by “stay humble. Stack sats” on April 27th, alongside a screenshot of recent purchases.

Make sure to watch the video to listen to Michael Saylor’s forecast for 2025 and what could be the most expensive mistake investors make if they ignore bitcoin.

OTHER NEWS

⚖️ Apple Loses Court Battle Over App Fees — Bitcoin Payments Get Green Light

🚫 EU Outlaws Privacy Coins, Demands ID for All Crypto Users

🇸🇷 Bitcoin Vision of Suriname Presidential Hopeful Faces Scrutiny

🔧 Bitcoin Core Removes OP_RETURN Cap Without Community Vote

🕵️ Samourai: DOJ Overlooked FinCEN’s Take on Wallet Classification

🤖 Tether Infuses AI Ventures with Bitcoin Strategy

🏛️ New Hampshire Adds Bitcoin to State Reserves

🇬🇧 UK Opts Out of Bitcoin Reserves — For Now

😴 US Treasury Stalls on Bitcoin Reserve Strategy

🪖 Bitcoin Devs Rally to Knots in OP_RETURN Showdown

🌱 David Bailey Launches $300M Bitcoin Investment Fund 'Nakamoto'

📊 Ramaswamy Pushes Public Markets Bitcoin Strategy

🔓 OCC Opens Bitcoin Access for US Banks

🛡️ Taiwan Considers Bitcoin Hedge Amid FX Volatility

💰 Arizona Taps Lost Property Funds for Bitcoin Investment

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.