Milei And The $LIBRA Rug Pull

Solana In Freefall

BTC Hodlers Are Tightening Their Grip

Inflation Is Dead: Crypto Is Set To Explode

And more…

Market Data Prices as of 4:30am ET

This Update Is Brought To You By Bitbo

CloudAICrypto is excited to announce Bitcoin Terminal →

This new tool gives you a live look at the Bitcoin price, with all traditional technical indicators and candle types.

MILEI AND THE $LIBRA RUG PULL

Crypto Scandal: Argentina’s President & A Massive Token Pump & Dumo

The cryptocurrency world has seen its fair share of rug pulls, but what just happened in Argentina might go down as one of the biggest in history.

Late last Friday, Milei’s X account promoted LIBRA, a new meme coin built on the Solana blockchain.

(This tweet has since been deleted.)

Initially, traders rushed in, driving its value up to $4.5 billion.

At first, many suspected Milei’s account had been compromised—similar to what happened during the Trump memecoin launch.

However, this was no hack.

Shortly after Milei’s tweet, several other Argentinian politicians amplified the message, fueling speculation that this was an official initiative.

According to the $LIBRA website, the project was designed to “boost the Argentine economy by funding small projects.”

Skepticism over its legitimacy led to a rapid price collapse and within just three hours, the truth came out.

Data from DexScreener shows that LIBRA peaked at $4.50 before nosediving to $0.50, shedding 89% of its value.

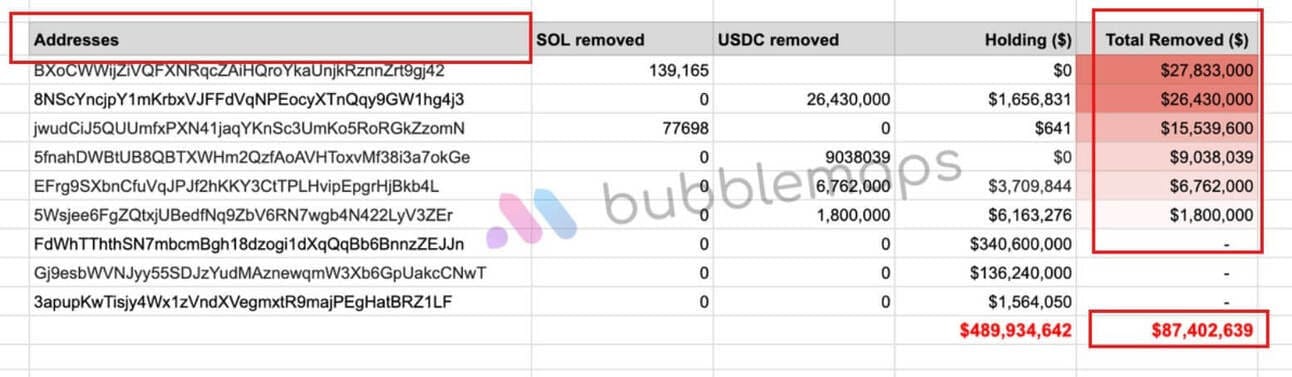

Blockchain analytics platform Bubblemaps revealed that insiders had already cashed out $87.4 million almost immediately.

To make matters worse, 82% of the token’s supply was controlled by a single cluster of interconnected wallets.

With no clear tokenomics and a massive sell-off happening in real time, investors quickly realized they had been scammed.

What was supposed to be a crypto-driven economic boost turned into one of the most blatant examples of political-backed fraud in recent history.

Milei retracted his endorsement of LIBRA, a Solana-based meme coin, after deleting his X post on Friday night.

He claimed that he had not been fully informed about the project before promoting it to his 3.8 million followers.

He further blasted critics, declaring, "To the political caste trying to exploit this, you only prove how despicable politicians are. This only strengthens our fight to get rid of them."

Following Milei’s retraction, LIBRA’s market cap plummeted to $167 million, reflecting a 96% drop from its peak.

Despite the crash, the token recorded $1.1 billion in trading volume.

The situation mirrors the TRUMP token launch in January, which also led to a trading frenzy before investors questioned its legitimacy.

Unlike LIBRA, Trump’s token was later confirmed as legitimate.

Milei told Bloomberg Línea that while he did share the LIBRA launch, he has no direct involvement with the project.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

SOLANA IN FREEFALL

Solana (SOL) Faces Massive Shorting as Memecoin Turmoil Deepens

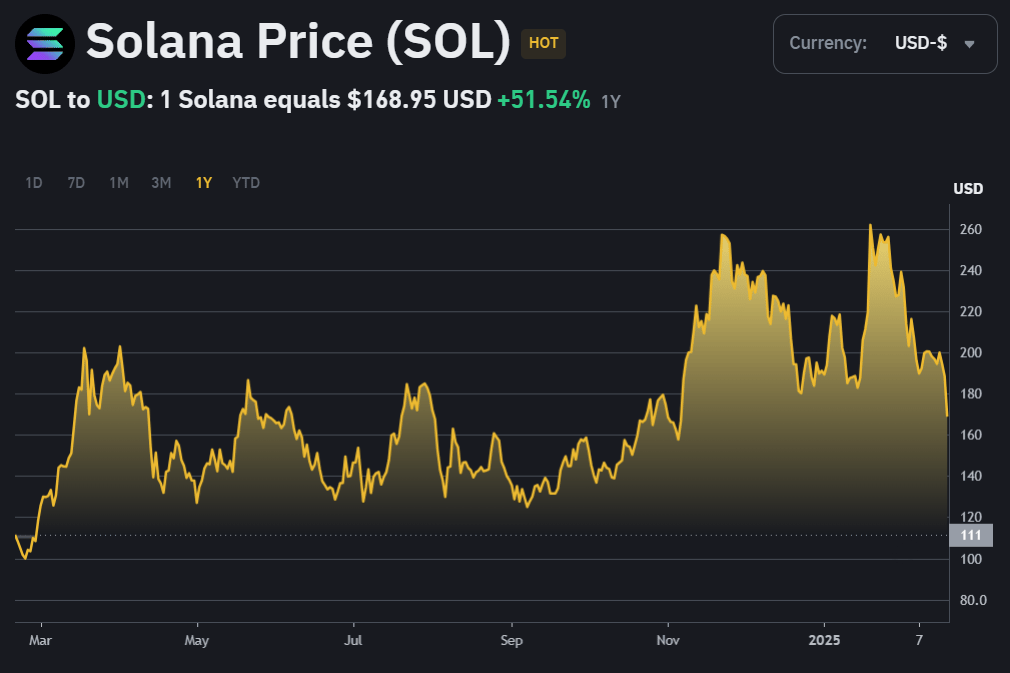

The Solana blockchain is under intense scrutiny as short positions surge amid a wave of memecoin scandals. Market data shows a significant increase in bearish bets, signaling investor distrust.

Traders Bet Against SOL

On February 17, the Solana futures market experienced a dramatic shift. Coinalyze data reveals the long-to-short ratio dropped sharply from 4 to 2.5.

The situation is even worse on Binance, where traders are shorting Solana at a 4:1 ratio, anticipating a steep price decline. Reflecting this sentiment, SOL’s price plunged 6% in a single day.

Memecoin Chaos Sparks Fears

Despite a 213% revenue surge in late 2024, Solana’s memecoin sector is now embroiled in controversy:

The LIBRA token collapsed by $4.4 billion, allegedly tied to Argentine President Javier Milei’s misleading promotions.

The Official Trump (TRUMP) memecoin inflicted $2 billion in losses, affecting 800,000 wallets, with 80% of tokens concentrated among insiders.

Will Solana Recover?

While Solana had previously outpaced Ethereum in total locked value revenue, recent developments raise serious concerns.

If the blockchain cannot restore investor confidence, its future could be at risk.

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

BTC HODLERS ARE TIGHTENING THEIR GRIP

One of the strongest on-chain signals for Bitcoin’s price direction is the amount of BTC held on exchanges.

📊 Here’s how traders view this metric:

Falling Bitcoin reserves → A bullish signal 🐂 as investors prefer holding over selling.

Rising Bitcoin reserves → A bearish indicator 🐻 as BTC is more likely to be sold.

As of today, only 2,728,384 BTC remains on exchanges—just 13.76% of Bitcoin’s circulating supply.

Even more striking, 72,393 BTC (worth nearly $7 billion) has been withdrawn this year alone.

This marks a dramatic shift from previous bull runs, where Bitcoin flowed onto exchanges as traders looked to sell.

But this time, the story has changed…

Investors appear to be holding out for much higher prices, leading to an accelerating rate of Bitcoin withdrawals. 🚀

Could this supply squeeze fuel another leg up in the Bitcoin bull market? Time will tell.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

INFLATION IS DEAD:

CRYPTO SET TO EXPLODE

According to Macroinvestor and CEO of Real Vision Finance, Raoul Pal, the slowdown in wage growth and the delayed impact of home prices will drive down shelter inflation, a key factor in core CPI.

He argues that concerns over rising inflation are misplaced, citing the Cleveland New Tenant Rent Index, which has turned negative.

Pal rejects the notion of a return to 1970s-style inflation, emphasizing that this is part of a typical economic cycle.

Furthermore, he dismisses the idea that tariffs are inflationary and sees market dips as strategic buying opportunities.

On Bitcoin, Pal maintains that it is not overvalued, and historical market cycles suggest a continued strong performance beyond what many expect.

Take a look at the video below to catchup on highlights of Raoul Pal’s recent analysis complete with charts to illustrate why he thinks this is another buying opportunity:

OTHER NEWS

🔄 PlanB Sparks Controversy on Bitcoin 𝕏 – The well-known analyst announces he’s shifting BTC holdings into ETFs for easier management, prioritizing peace of mind over "not your keys, not your coins," triggering heated debates.

📈 STRK Becomes Top US Perpetual Security – Strategy (formerly MicroStrategy) sees its Bitcoin-backed perpetual security, STRK, skyrocket to the #1 spot in just two weeks due to overwhelming market demand.

🚔 US Expands Bitcoin Mining Equipment Seizures – CBP (Customs and Border Protection) broadens its crackdown, now targeting mining hardware from MicroBT and Canaan.

💰 Bank of Montreal's Bitcoin ETF Bet Grows 10x – SEC filings reveal the bank has ramped up its BTC ETF holdings from $13M to $150M, spread across Ark, Fidelity, BlackRock, and Grayscale.

🤝 Nayib Bukele & Michael Saylor Discuss Bitcoin Strategy – El Salvador's President and the Strategy founder meet to talk about BTC holdings, legal reforms, and IMF loan requirements.

🏦 Metaplanet Inc. Strengthens Bitcoin Treasury – The firm adds 269.43 BTC, bringing its total to 2,031.41 BTC as part of a capital markets-driven accumulation strategy.

📊 Strategy Eyes S&P 500 Inclusion – The company could qualify by June if Bitcoin holds above $96,337 in Q1, boosted by FASB’s new digital asset accounting rules.

💥 Bitcoin Mining Bust in Malaysia – An explosion exposes an illegal mining operation stealing electricity, highlighting ongoing enforcement against underground crypto farms.

🕵️ Crypto Kidnapping Case Unfolds in Chicago – Six men are charged for abducting a family and demanding a $15M crypto ransom, with the FBI tracing only $6M so far.

🏛️ Texas Seeks Unlimited Bitcoin Reserves – Proposed Bill SB 21 would remove the $500M annual cap, allowing Texas to massively expand its strategic Bitcoin holdings.

📈 Bitcoin Realized Cap Hits All-Time High – More capital flows into BTC, signaling rising investor conviction and reflecting the true value locked in the network.

⚡ Bitcoin Mining Powers US Economy – The sector now supports over 31,000 jobs, strengthens energy infrastructure, and fuels economic growth, particularly in Texas.

🏛️ West Virginia’s Inflation Protection Act Embraces BTC – A new bill enables the state treasury to allocate 10% of public funds to Bitcoin, stablecoins, and precious metals as a hedge against inflation.

🏎️ Coinbase Joins Formula 1 with USDC Sponsorship – The exchange secures a high-profile deal with Aston Martin’s F1 team, challenging Crypto.com’s dominance in motorsports sponsorships.

📉 US Debt Interest Surges to $100B Monthly – The government's annual debt burden now exceeds $1.2T, outpacing spending on defense, Medicare, and Social Security as the crisis escalates.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.