Massive Update for Solana

Why Bitcoin Could Hit $1M This Cycle

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $60,889 | -0.94% | +44.91% |

Ethereum (ETH) | $3,391 | -1.45% | +48.31% |

This Update is Brought to You By Ledger

The best crypto app to secure your tokens

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

These wallets physically store your private keys within a chip inside the device itself.

The beauty of using a crypto wallet is the security it provides to your private keys.

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys on the

MASSIVE UPDATE FOR SOLANA

BREAKING: Van Eyck Files for First Solana ETF in the US

On Thursday, VanEck, a financial firm managing nearly $102 billion in assets as of March 31, submitted a filing for the first U.S. spot Solana (SOLUSD, 1.44%) ETF.

Solana, often seen as a rival to Ethereum (ETHUSD, -0.10%), is praised for its high transaction speed and low costs.

Following the announcement, the Solana token surged by 8% to approximately $147.95, according to Dow Jones Market Data, marking a 42% increase this year.

Matthew Sigel, VanEck's head of digital-assets research, highlighted the Solana ecosystem's wide range of applications—from decentralized finance to non-fungible tokens—emphasizing SOL’s utility and value as a digital commodity in a post on X on Thursday.

Despite the positive momentum, David Tawil, president and co-founder of ProChain Capital, noted that the likelihood of the SEC approving a Solana ETF by the end of this year is slim.

Tawil pointed out in a phone interview that the SEC has yet to approve any ETFs investing in Solana futures.

In contrast, ETF analyst Eric Balchunas believes there’s a chance of approval with a change in the SEC staff. (following the election)

Perhaps something to watch out for in 2025.

Ether futures ETFs also debuted in October last year, and while the SEC approved rule changes in May to list spot Ether ETFs, issuers like VanEck are still awaiting SEC approval of their registration statements.

Exciting times for the crypto industry.

Stay tuned for more major updates.

WHY BITCOIN COULD HIT $1M THIS CYCLE

Bitcoin could hit $1,000,000 this cycle.

That’s the latest outlook from Jack Mallers.

Jack Mallers Jack Mallers is the CEO of Strike, a Bitcoin investment and payments company.

In his latest interview, Jack explained why Wall Street’s sudden interest in Bitcoin is a huge deal.

“It’s a huge deal and kind of validates everything we’ve been saying. This level of government spending isn’t sustainable. These guys aren’t gonna try and protect the purchasing power of the currency. They’re going to have to print their way out. Hard assets are going to be the winner.”

Jack Mallers With US debt currently at $34.86 trillion and interest payments skyrocketing, there is no choice but to print more money.

In the end, hard assets will win.

And what’s the hardest asset of all?

Bitcoin. 🏆

A common criticism against Wall Street entering the Bitcoin space is the fear of centralisation.

What happens if Wall Street ends up owning a significant amount of the supply?

Well, not much actually…

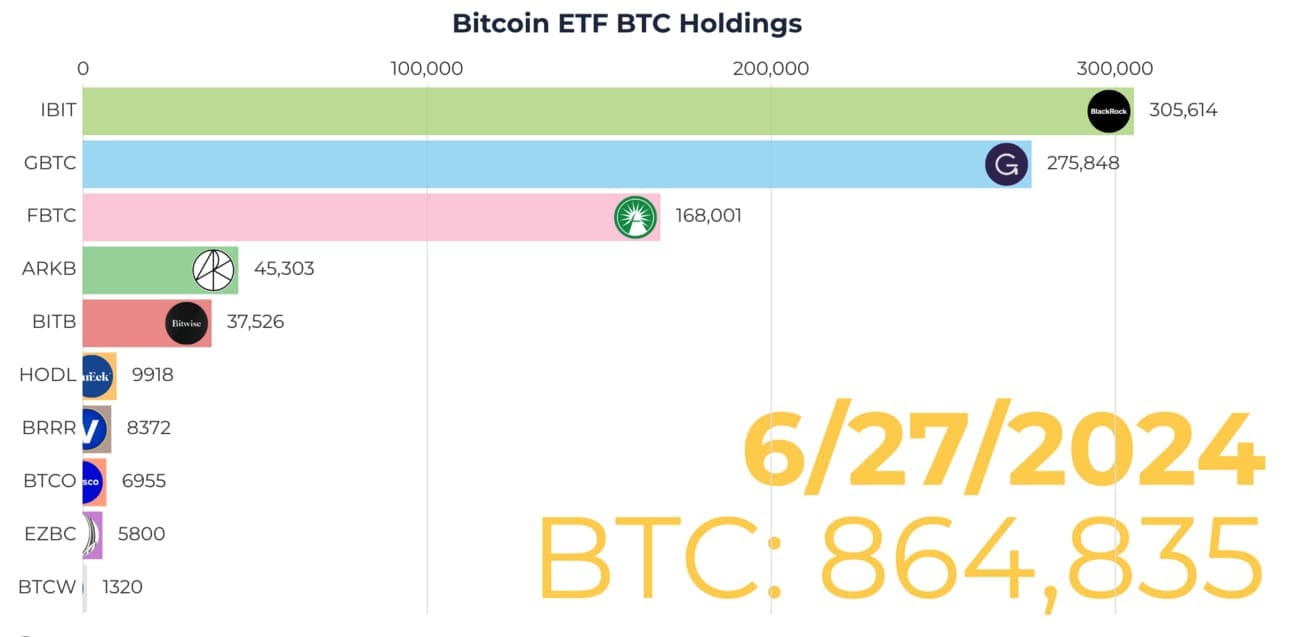

In fact, collectively the ETFs already hold 864,835 Bitcoin, which is 4.12% of the maximum supply.

ETF holdings Mallers explains that it doesn’t matter how many coins they hold:

“The point of proof of work and the way Satoshi designed it, is they have no influence on the system. It doesn’t matter how many coins they have. There’s never been an outside single party threat to Bitcoin.”

Jack Mallers It doesn’t matter if you hold 1,000,000 BTC or 0.1 BTC. Holding more coins doesn’t give you any extra control over the network.

That’s the beauty of Bitcoin.

Closing out the interview, Mallers also gave a price prediction for Bitcoin this cycle:

“I think we could hit $1,000,000 per Bitcoin. I feel super confident in $250,000 at least in this cycle. I do think the high will land somewhere in that range.”

Jack Mallers That’s quite the range...

But Mallers explains that it’s hard trying to price the hardest money ever using pieces of paper that they are rapidly debasing.

Bitcoin is inevitable.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

OTHER NEWS:

The U.S. SEC claims Consensys has been operating as an unregistered broker through MetaMask.

Major crypto projects to unlock $755M in July About $755 million in crypto assets from AltLayer, Arbitrum, Optimism and other projects will be released in July as their vesting period concludes.

Spot Ethereum ETF launch delayed by SEC comments The SEC commented on the S-1 forms and requested resubmissions by July 8, potentially delaying the launch of spot Ether ETFs until mid-to-late July