Massive Ethereum Update - ETFs Launch Date Confirmed💥

Bitcoin Bulls Aim for $70,000 Following Surge to $66,000

BTC ETFs Register 7 Day Record Inflows

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $64,703 | +0.12% | +57.84% |

Ethereum (ETH) | $3,447 | +0.05% | +55.12% |

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

ETHEREUM ETFS LAUNCH

DATE CONFIRMED💥

BREAKING: SEC Gives July 23 Approval Date to Ethereum ETFs

Exciting news for the Ethereum community!

The SEC has granted "preliminary approval" to Ethereum ETF applications from BlackRock, Franklin Templeton, and VanEck. Issuers must submit their final S-1 filings, including proposed fees, by Wednesday.

All eight potential Ethereum ETFs are scheduled to debut together, targeting a launch date of Tuesday, 23rd July.

This news has led to a 2.54% increase in Ethereum’s value, pushing it to around $3,423 in the last 24 hours.

However, there are still some steps to complete…

Step 1: S-1 filings needed to be submitted by Wednesday, July 17th at 5:30 pm EST.

Step 2: Issuers need to request “effectiveness” by Monday, the 22nd.

This step ensures that all relevant details are disclosed to the public.

ETF analyst Eric Balchunas highlighted that while the 23rd July date might change if last-minute issues arise, the ETFs have been ready for approval for quite some time, suggesting minimal risk of delays.

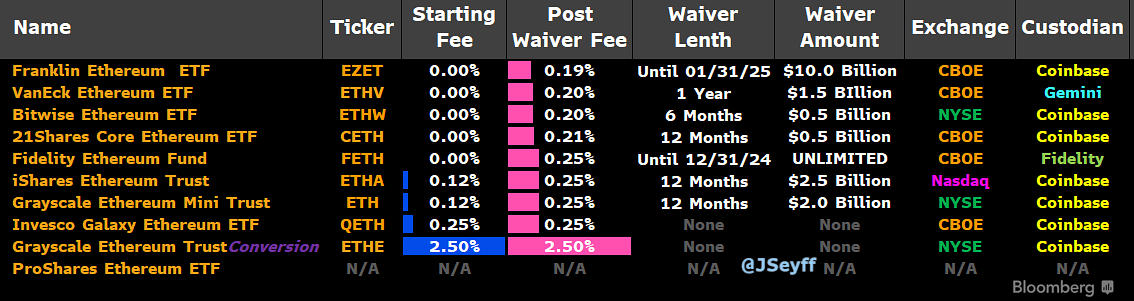

As we await the remaining S-1s, the main concern is fees.

Why? Because higher fees mean more costs for customers to invest in these ETFs. Lower fees attract more investors, which leads to more $ETH being purchased from exchanges.

Three S-1s have been filed with specific fees so far:

21Shares (CETH): 0.21%

VanEck (ETHV): 0%

Franklin Templeton (EZET): 0.19%

Filings are still pending from:

Blackrock (ETHA)

Fidelity (FETH)

Bitwise (ETHW)

Invesco (QETH)

Grayscale (ETHE)

A notable point: VanEck is creating a buzz with zero fees on their $ETH ETFs, though a fee might be introduced later.

Some fees are comparable to $BTC ETF fees but are lower than major asset class ETFs such as:

High Yield ETF (HYG 0.49%)

Gold ETF (GLD 0.40%)

Silver ETF (SLV 0.50%)

Small Caps ETF (IWM 0.19%)

Fee competition is expected to intensify this week with all eight contenders entering the market! 🔥

Currently, the SEC has given preliminary approval to at least three out of the eight asset managers.

However, all eight are expected to launch simultaneously. 💥

Only one more week until the Ethereum ETF market revolution begins!

BITCOIN BULLS AIM FOR $70,000 FOLLOWING SURGE TO $66,000

Bitcoin traders are aiming for a short-term price target of $70,000 after BTC briefly surpassed $66,000 during the Asian trading hours.

It then pulled back to $65,000 by the European morning, yet remained 2.2% higher than the previous day.

“The rebound in Bitcoin price indicates the market has a more positive outlook on the near-term macro environment . The market’s optimism was bolstered by Donald Trump’s vice president selection, hinting at a more crypto-friendly future administration and policies.”

Additionally, Bitcoin may be experiencing heightened bullish sentiment as traders anticipate less selling pressure with the commencement of Mt. Gox creditor repayments.

Either way, sentiment looks extremely strong for Bitcoin going into the second half of 2024.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

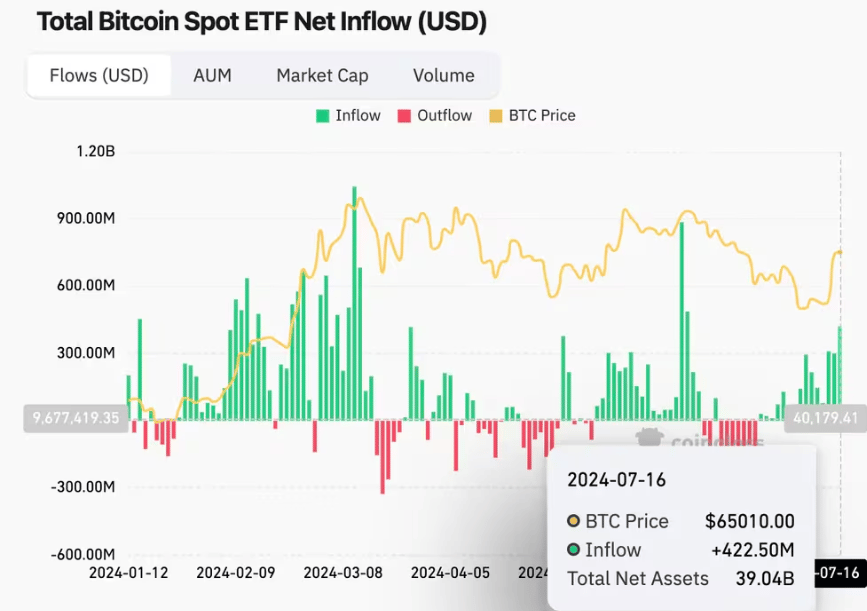

BITCOIN ETFs REGISTER

7 DAY RECORD INFLOWS

Bitcoin ETFs have extended their seven-day winning streak, with Tuesday seeing $422.5 million in inflows, the highest since June 5.

BlackRock's IBIT dominated with over $260 million.

Collectively, the ETFs have gathered over $1 billion in the last three days, underscoring increasing confidence in bitcoin's price prospects.

This period of inflows coincides with a 20% rise in Bitcoin Price.

Additional contributing factors include Donald Trump's improved presidential prospects and the end of the supply overhang from German state Saxony.

The crypto market is also catching up with the rally in technology stocks on Wall Street.

XRP HISTORIC BREAKOUT INCOMING

XRP has seen a notable increase of over 12% in the last 24 hours, significantly outpacing other major cryptocurrencies.

The wider crypto market, as indicated by the CoinDesk 20 Index, has climbed about 4.2%. Over the past week, XRP has achieved gains of roughly 40%, ending a prolonged period of underperformance compared to the broader digital asset market.

"The reversal of sentiment in crypto has sparked a rise on steroids in the once-largest altcoin."

The upward momentum for XRP began last week following the announcement by CME and CF Benchmarks of new indices and reference rates for XRP.

This news has resulted in a triangle pattern on long-term price charts, which some well-known traders predict could lead to bullish action in the upcoming weeks.

OTHER NEWS:

Bitcoin transaction fees will surpass block subsidy predicts Marathon CEO Fred Thiel.Thiel outlines Marathon’s global foray and views on Bitcoin’s economic and political landscape.

Dogecoin, Solana Lead Crypto Majors Plunge as Bitcoin Falls Below $66K. The lack of immediate catalysts to prop up markets in the near-term are likely weighing down token prices, one trader said.

VanEck to Launch First Bitcoin ETF on Australian Securities Exchange. After three years of effort, the firm is bringing Bitcoin ETFs to Australia's largest trading exchange on Thursday.