Market Whiplash

CPI Cools But Markets Shrug It Off

How Crypto Can End Income Tax

And more…

Market Data Prices as of 8:30am ET

This Update is Brought to You By Bitbo

Check Out These Brand New Indicators:

On top of our free standard stock to flow chart, Bitbo is excited to now offer stock to flow on Bitbo Terminal.

Bitbo Terminal is a live interactive tool that allows you to draw, customize and add even more traditional indicators along with your favorite Bitbo charts.

MARKET WHIPLASH🏦

BREAKING: Bitcoin Stays Steady as White House Sends Confusing Signals on Tariffs

Well, it’s another week of tariff turmoil…

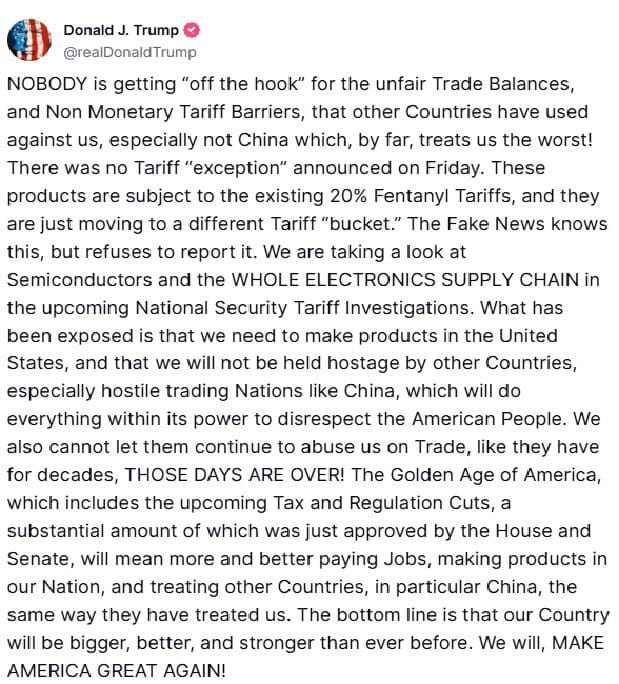

Over the weekend, President Trump reignited market anxiety with a back-and-forth over China trade policy.

Here’s the lowdown:

China is currently staring down a 145% tariff on exports to the U.S.

But Friday brought a curveball: the White House quietly exempted electronics—including smartphones and semiconductors—from that harsh rate.

These products now face just a 20% tariff.

Commerce Secretary Howard Lutnick confirmed the move…

But then quickly backtracked—saying these electronics will still be hit with new semiconductor-focused tariffs in 1–2 months.

And to top it all off, Trump added even more confusion by claiming there was no exemption—just a reshuffling into a “different tariff bucket.”

Result:Chaos.

U.S. businesses are left scrambling—how can they plan investments when policy shifts every two days?

Through it all, Bitcoin remains rock-solid, still hovering around $84,500.

Ethereum also rebounded to $1,637, after a brief dip below $1,600.

On the macro front, U.S. inflation is cooling—CPI came in at just 2.4% YoY, the lowest in four years.

Under normal circumstances, that’s rocket fuel for risk assets. And yes, Bitcoin is up about 3.17% since that report…

But with the trade war back in focus, investor attention is elsewhere.

For now, Bitcoin’s resilience is impressive.

But buckle up—volatility isn’t going anywhere.

CPI COOLS — BUT MARKETS SHRUG IT OFF

Breaking News: Inflation just posted another soft reading—and yet, the market's not celebrating.

Here’s the breakdown:

March CPI rose just 2.4% YoY

Core inflation came in at 2.8%

That’s the lowest in 4 years!

So why aren’t stocks flying?

Instead, they’re sinking:

S&P 500: -3.5%

Nasdaq: -4.2%

Bitcoin: briefly dipped below $79,000, now back above $80,000

Total crypto market cap? Down $100 billion overnight.

Markets should be pumped about the lower inflation, but here’s the issue:

The trade war isn’t over.

Last week’s 90-day tariff pause was a temporary high.

Over the weekend, reality set in:

10% tariffs on global imports

25% tariffs on cars, steel, aluminum, and goods from Canada & Mexico

A jaw-dropping 145% tariff wall on Chinese imports

No wonder traders are skittish.

But there is one silver lining: The odds of a rate cut at the upcoming FOMC meeting just jumped to 37.7%.

Bitcoin is showing some strength, holding above $84.7K lows.

Still, this market’s looking for a signal...

Until then, expect turbulence.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

HOW CRYPTO CAN END INCOME TAX

In a market stormed by volatility, Chamath Palihapitiya offers a surprisingly clear solution: $750 billion.

Long fixated on the lower $250 billion mark, Wall Street may have been looking in the wrong place all along.

Palihapitiya asserts that this larger financial benchmark is more than symbolic—it’s the point at which both Bitcoin markets and U.S. economic policies can undergo real transformation.

He envisions a future where this number makes bold reforms like abolishing income tax not just idealistic, but financially achievable.

This insight could anchor investor trust, reduce volatility, and empower governments to adopt smarter, more forward-thinking strategies.

Embracing the $750 billion threshold might be the missing key to financial peace in the crypto world.

Watch clips from Chamath’s latest update to find out more:

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

The Conservative Case For Bitcoin - Mitchell Askew

Contributions to Philosophy (Of The Event) - Martin Heidegger

Liberty and Property - Ludwig Von Mises

Concept of the Political - Carl Schmitt

OTHER NEWS

📚 Saifedean Ammous Joins Forces with Lomond School – Author of The Bitcoin Standard teams up with Lomond School to roll out an Austrian economics curriculum launching in autumn 2025.

💰 Saylor's Strategy Snaps Up More Bitcoin – Michael Saylor’s firm acquires 3,459 BTC for $285.5M, pushing total holdings past 531K BTC amid market uncertainty.

📈 Bitcoiners Stay Ahead of the Economic Curve – Early spotting of flaws in US data puts Bitcoin advocates in a strong position, says Anthony Pompliano, as tariffs spark fresh volatility.

🚀 Big Tech Defectors Launch Bitcoin Startups in Austin – Ex-Apple, Google, and Cash App talent leave the giants to build Bitcoin ventures at Bitcoin Commons, backed by VCs and a crypto-friendly Trump era.

🏫 Lomond School Becomes UK’s First to Accept Bitcoin Tuition – Scottish private school pioneers BTC payments and integrates Austrian economics into its education model.

⚖️ New York Considers Allowing Bitcoin for State Payments – State assembly puts forward legislation to authorize crypto payments for government transactions.

🍔 McDonald’s Skips on Bitcoin Treasury Proposal – SEC greenlights McDonald's move to reject a shareholder push to add Bitcoin to the company’s reserves.

🤝 Grayscale & Osprey Settle ETF Dispute – The two crypto firms bury the hatchet, ending a two-year legal battle over Bitcoin ETF marketing strategies.

📊 Mechanism Capital Doubles Down on Bitcoin – Founder Andrew Kang increases his BTC position to $200M, betting on gains post-US tariff policy shifts.

💱 China Pushes Digital Yuan Amid Economic Pressure – With the yuan at a 17-year low and tariffs at 145%, Beijing promotes CBDC adoption during escalating trade tensions.

🤔 Voorhees Challenges Protectionist Bitcoiners – Bitcoin OG Erik Voorhees questions support for economic protectionism, calling it a deviation from core libertarian principles.

🏦 Metaplanet Expands Bitcoin Holdings – The firm adds another $26.3M in BTC, growing its stash to 4,525 coins in its latest buy-in.

MEMES OF THE WEEK

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.