Fake News Moves Billions

Market Meltdown: What’s Going On?

All Your Bitcoin Models Are Wrong

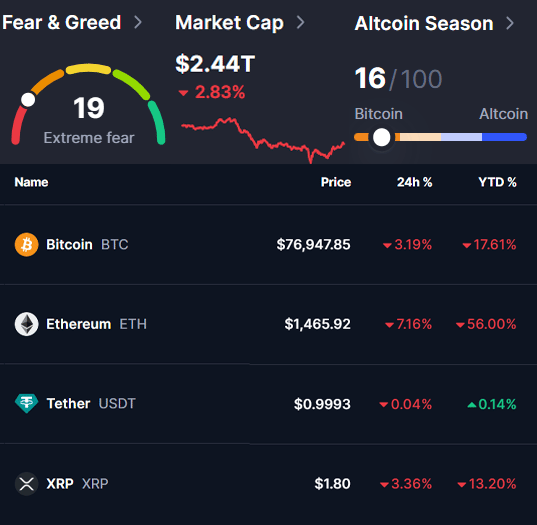

Market Data Prices as of 8:30am ET

This Update Is Brought To You By Bitcoin Well

The bitcoin price drop appears to be stabilizing at current levels. Now is a perfect time to buy some discounted sats!

Nothing about Bitcoin has changed! Bitcoin remains decentralized and uniquely scarce, with zero storage costs or annual taxes.

Now is an excellent opportunity to stack cheap sats!

FAKE NEWS MOVES BILLIONS

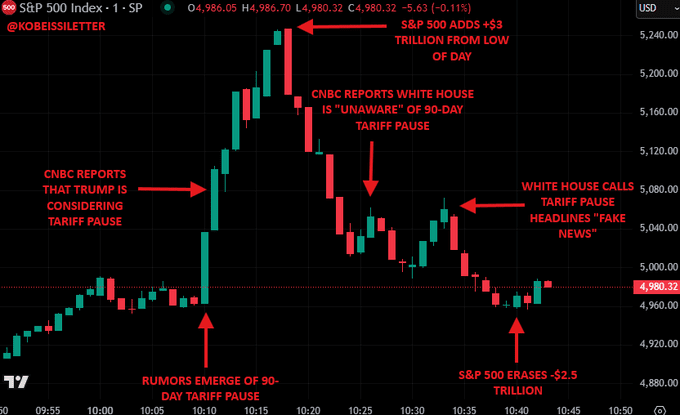

Bitcoin, stocks, and altcoins all went haywire this week in what’s now being called a “fake news fiasco.”

The chaos started when a tweet from Walter Bloomberg on X claimed Trump was considering a 90-day pause on tariffs, excluding China.

Within moments, major news outlets like CNBC and Reuters amplified the post.

Markets erupted:

S&P 500 rallied 8%

Nasdaq leapt 9.5%

Bitcoin shot from $74.4K to $80.8K

Ethereum (ETH) and XRP rose over 10%

But just as fast as it rose, the rally collapsed.

The White House responded, calling the report “fake news.”

Markets reversed sharply—Bitcoin and equities tumbled.

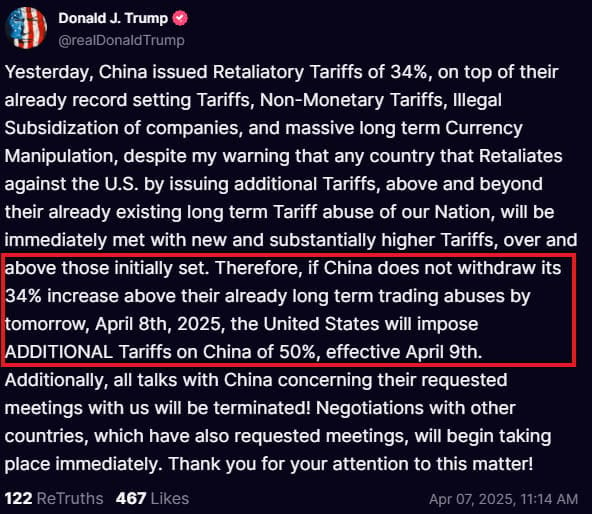

Then came the real news:

Trump issued a warning—China must drop its 34% retaliatory tariffs, or face an additional +50% U.S. tariff.

That would bring the total to a stunning 104% tariff on Chinese imports.

China’s Commerce Ministry responded forcefully:

“China will never accept this… we will fight to the end.”

Despite the drama, Bitcoin ended the day +5.96%. Altcoins did even better.

⚠️ Key Insight:

Markets moved on a tweet. Just imagine the impact of actual trade progress. 🚀

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

MARKET MELTDOWN - WHAT’S GOING ON?

Turn off your Twitter notifications — not because you should ignore the news, but because it’s overwhelming out there.

Let’s make sense of it:

💣 Crypto & Stock Market Freefall

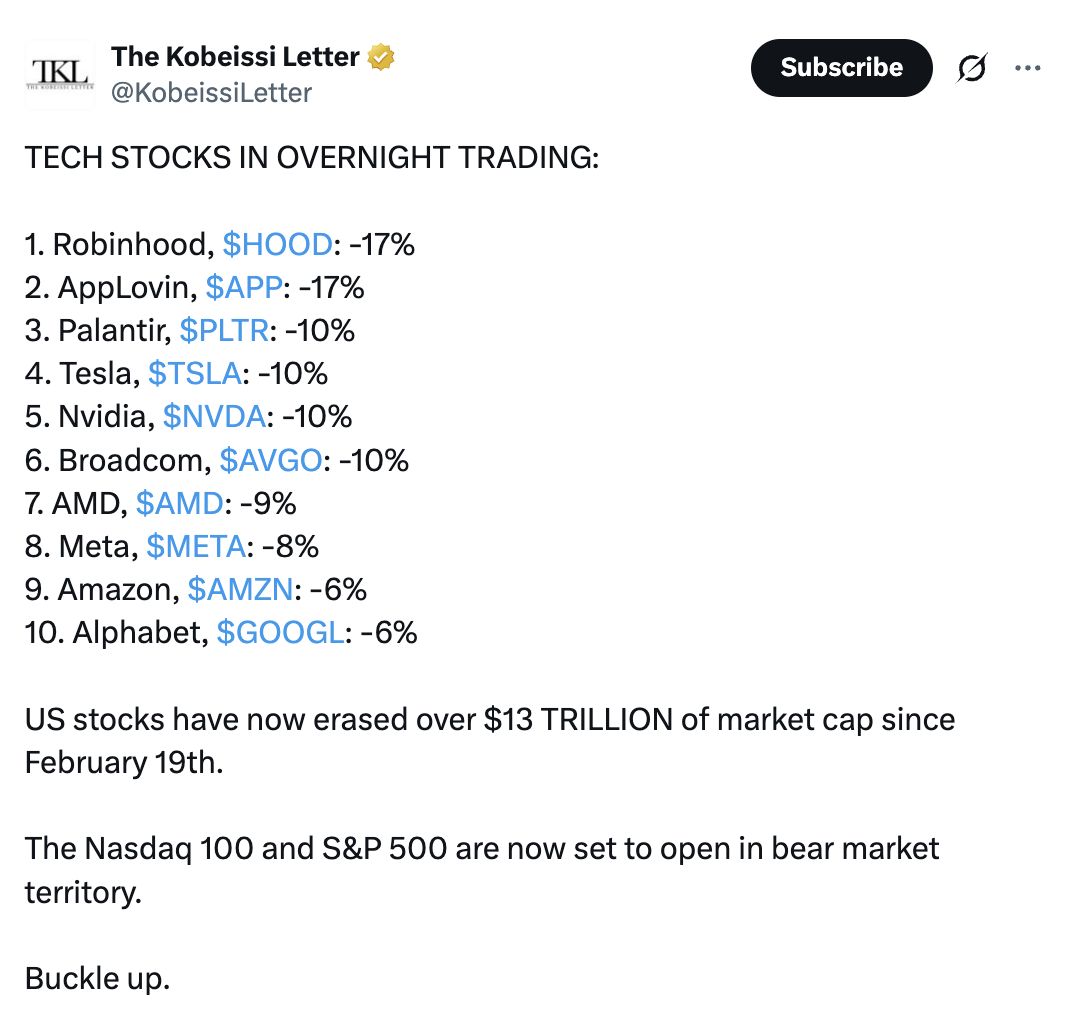

A massive $1.35B was liquidated from crypto markets, rising to $1.58B within hours.

Meanwhile, stock markets worldwide suffered historic single-day crashes, with multiple circuit breakers triggered.

🗞 Source: @WatcherGuru

📊 US Markets Lose $13 Trillion

The Nasdaq 100 is now down 22.7%, and the S&P 500 is down 18.9% year-to-date. More than $13T in value has been wiped out since February — a stark sign of a developing bear market.

📉 Source: @KobeissiLetter

🔥 What’s Causing It?

Much of the turmoil is tied to fears around a potential global trade war, as Trump remains firm on introducing and maintaining tariffs.

📌 Source: @TrumpDailyPosts

📈 Any Optimism?

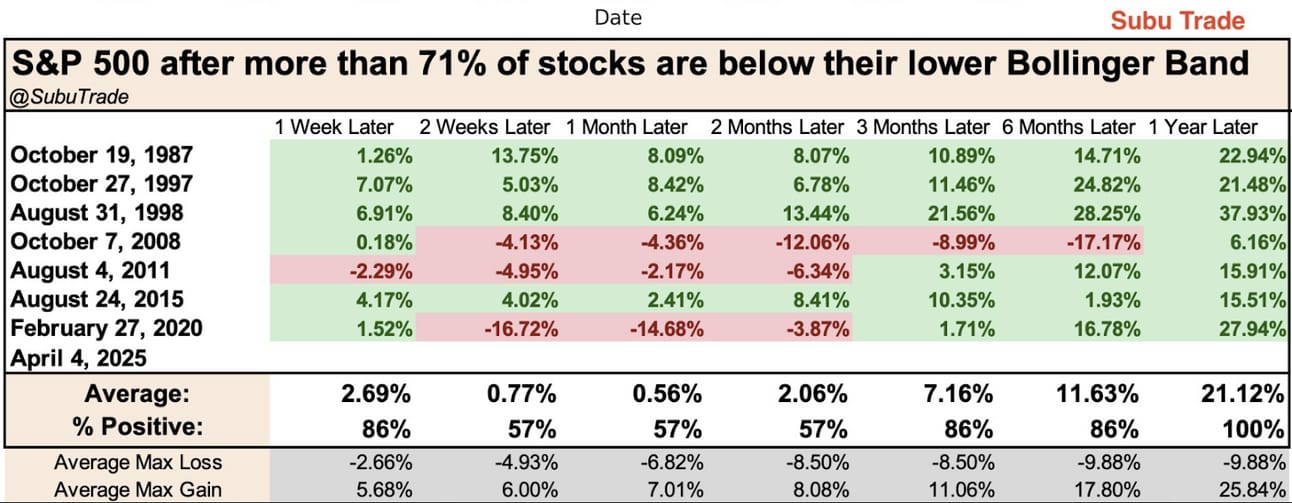

Interestingly, expectations for rate cuts in 2025 have jumped from 2 to 4 since January. These cuts could stimulate growth by making borrowing cheaper — historically a tailwind for stocks and crypto.

🧮 Source: @SubuTrade

🧩 The Big Picture

This isn’t a black swan event. It’s a known issue. Once the US government can refinance $9T of debt at lower interest rates, there may be room to ease tariffs and introduce stimulus measures like Quantitative Easing.

These were critical elements in the 2021 bull market — and could be again.

🧠 Source: @vladtenev

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

ALL YOUR BITCOIN MODELS ARE WRONG?

Anyone who tries to cheat Bitcoin gets wrecked.

It’s a system that can’t be manipulated, no matter how powerful the player.

In a world increasingly run by AI and automation, this matters more than ever. According to Jeff Booth, entrepreneur and founder of Build Direct, Bitcoin is the last stronghold of real value.

Booth warns that reckless monetary policies and an addiction to debt are pushing the traditional financial system to its breaking point.

While Fiat currencies bleed value through inflation, Bitcoin's scarcity and decentralization make it the only escape route from collapse.

As the old system crumbles, Bitcoin is rising.

Booth believes it's the biggest financial transformation in history — and those who don’t adapt risk getting left behind.

Watch more insights from Jeff’s recent interview here:

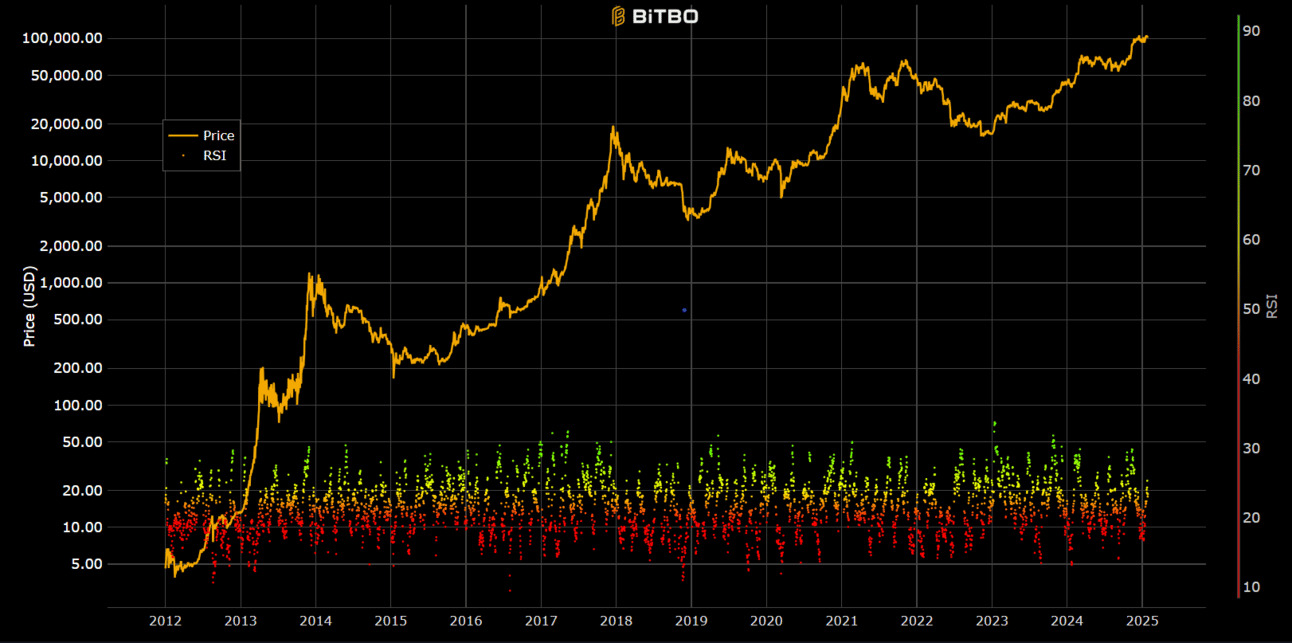

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

OTHER NEWS

💥 Whale Alert: An anonymous wallet moved $159M worth of BTC to Kraken, triggering market volatility and reigniting fears of a potential 'Black Monday' scenario.

🔐 Bitcoin Fork Ahead? A new Bitcoin Improvement Proposal (QRAMP) suggests a hard fork to move BTC into quantum-resistant wallets—potentially stranding or burning legacy coins.

🇨🇳 China Eyes Strategic Bitcoin Reserve: Jan3’s Samson Mow claims China may leverage its nuclear power and mining dominance to build a national Bitcoin reserve.

🚨 Crypto Candidate Vanishes: Maya Parbhoe, Suriname’s pro-Bitcoin presidential hopeful, disappears from 𝕏 after posting a cryptic SOS—raising concerns and speculation.

🎮 Gaming Giant Buys BTC: Japanese developer Enish Co. takes a $680K leap into Bitcoin, marking its first major crypto investment.

🏦 Regulatory Shift: The FDIC quietly withdraws a crypto-related notice—potentially paving the way for broader Bitcoin adoption by U.S. banks.

🛡️ CBDC Pushback: Rep. Tom Emmer’s bill to ban a U.S. Central Bank Digital Currency clears a key committee, highlighting growing opposition to federal surveillance coins.

💰 New ETF Play: Bitwise launches innovative ETFs that generate income via covered calls on Bitcoin treasury stocks like MSTR, MARA, and COIN—blending yield with BTC exposure.

📊 Buffered BTC Exposure: First Trust debuts BFAP, a Bitcoin ETF with built-in guardrails—34.51% upside cap and 15% downside protection—for more cautious investors.

⚖️ Regulatory Power Shuffle: Under a potential Trump-led administration, the CFPB plans to scale back its crypto oversight, leaving the SEC and state regulators in charge.

📉 Déjà Vu or Opportunity? Analysts compare the current crypto slump to 2020’s crash, suggesting that patient investors may be looking at a generational buying window.

🎂 Satoshi Turns 50? Bitcoin’s elusive creator, Satoshi Nakamoto, would be 50 as of April 5—his $91B BTC stash still untouched, his identity still unknown.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.