Japan Leads Crypto Surge

Bitcoin Trading Volume Reaches Record Highs💥

Bitcoin Price Will Reach $1M

And more…

Market Data Prices as of 8:00am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $58,179 | +3.18% | +37.61% |

Ethereum (ETH) | $2,358 | +1.44% | +3.32% |

Solana (SOL) | $134.91 | +2.67 | +32.89% |

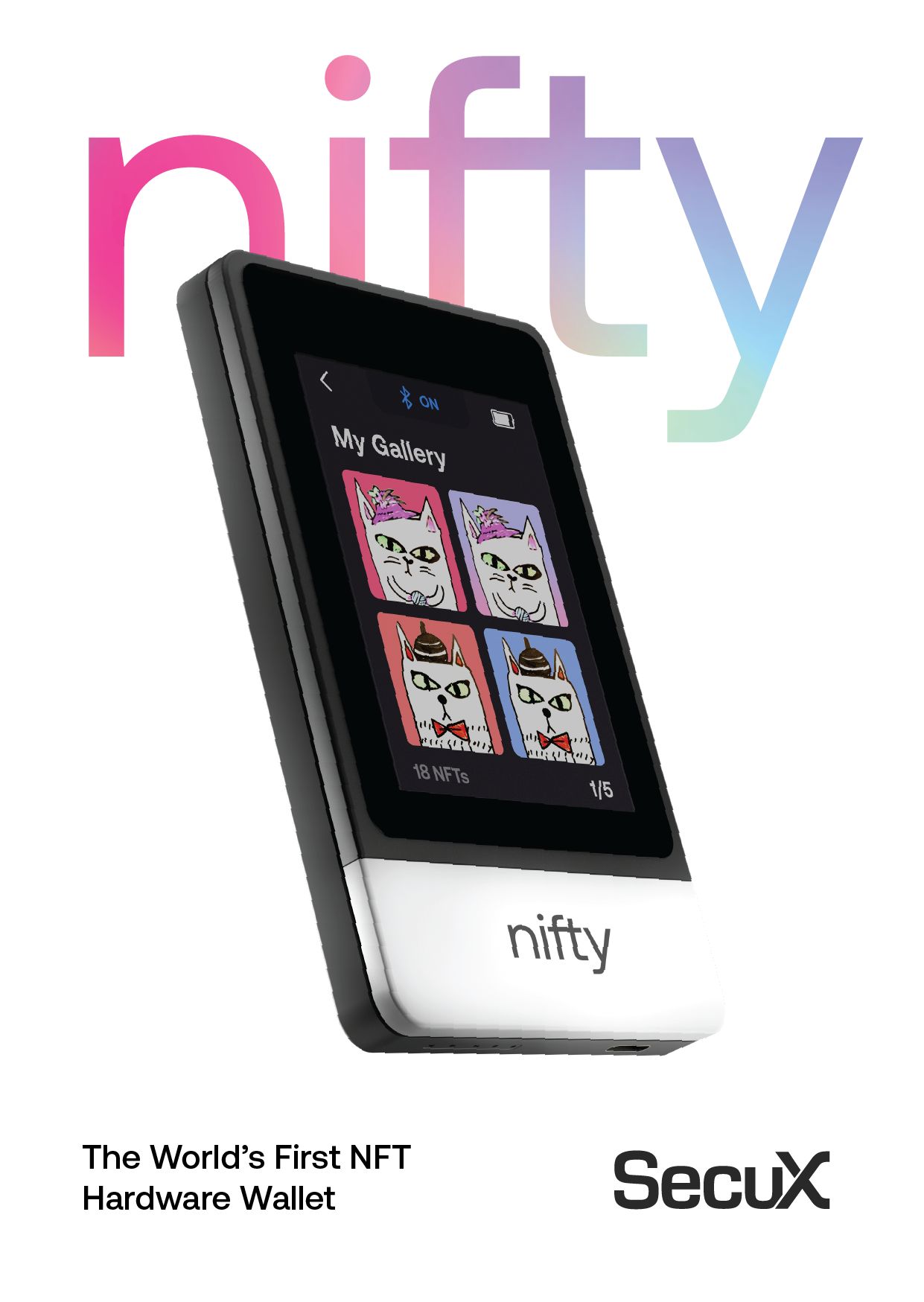

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

JAPAN LEADS CRYPTO SURGE

BREAKING: Metaplanet Adds Millions More in Bitcoin

Japan's ongoing economic struggles are fueling a crypto renaissance, with companies like Metaplanet leading the charge.

On September 10, Metaplanet announced the purchase of 38.46 more Bitcoin, valued at roughly $2 million, increasing their total Bitcoin holdings to 398.83 BTC.

This strategic investment has driven Metaplanet's stock price up an astounding 600% year-to-date, as the company seeks to counter Japan's economic woes, including high government debt, negative interest rates, and the weakening yen.

But Metaplanet isn’t alone.

Sony has been making headlines with the launch of Soneium, an Ethereum layer 2 network, as well as plans to introduce a yen-pegged stablecoin through Sony Bank.

Adding to the crypto momentum, Mitsubishi UFJ Bank, Sumitomo Mitsui Banking Corporation, and Mizuho Bank have joined forces to back Project Pax, a platform that will use stablecoins for cross-border business transactions.

In an equally significant move, Agile Energy X, a subsidiary of Tepco, Japan's largest utility provider, has announced plans to use surplus energy for Bitcoin mining, adding another layer to Japan’s growing involvement in the crypto world.

With corporations and financial institutions embracing crypto, Japan is cementing its role as a leader in the global digital asset economy.

BITCOIN TRADING VOLUME REACHES RECORD HIGHS

The bitcoin market recorded a historic spike in trading volume during the January to August period of 2024, with centralized exchanges seeing a total of $2.874 trillion in notional volume, according to data from Kaiko.

This represents a near 20% jump compared to the $2.424 trillion registered in the first eight months of 2021, surpassing previous records.

Kaiko’s report links the surge in trading activity to rising crypto market volatility, particularly within the bitcoin sector.

The increased participation from traders is largely attributed to heightened volatility, as reflected by data from TradingView, which show that bitcoin’s 10-day realized volatility soared to an annualized 100% in April.

Key factors driving this volatility include strong inflows into U.S.-listed spot ETFs and market expectations of Federal Reserve rate cuts.

These developments propelled bitcoin's price beyond $70,000, marking new highs in the cryptocurrency's trading history.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

LEPPARD: BITCOIN PRICE

WILL REACH $1M

Larry Leppard, Managing Partner of Equity Management Associates, predicts that Bitcoin could experience a monumental rise in value, leaving many astonished.

In a recent interview, Larry went on to explain that with global financial assets totalling $700 trillion and Bitcoin's current market capitalization at only $1.3 trillion, Leppard sees considerable potential for appreciation.

He goes so far as to suggest that Bitcoin could reach $1 million per coin—a valuation that would not only change lives but also shake up the financial world.

According to Leppard, Bitcoin holders are particularly loyal and patient, holding on even if the price escalates to $75,000, signalling their belief in its long-term value.

Make sure to watch this video, featuring clips from the interview, where Larry reveals why he is certain that a massive price surge is coming soon.

OTHER NEWS:

Chainalysis, a blockchain data analysis firm, releases a report claiming that Russia's recent legalization of bitcoin mining and international payments is a strategic move to evade Western sanctions and lessen reliance on the US dollar amid rising financial pressures

Shinobi of Bitcoin Magazine emphasizes that privacy is essential for Bitcoin's future, warning that without active user adoption of privacy tools like Coinjoins and Chaumian ecash, Bitcoin risks losing its censorship resistance and fundamental freedoms

Francis Pouliot, founder of Bull Bitcoin, explores a scenario where a Coinbase disaster could lead to a fork instigated by powerful interests who lost their bitcoin, bringing forth ‘BitcoinCucked,’ which node runners would ultimately reject, reinforcing Bitcoin's value and decentralization

Sam Baker of River Financial releases a report covering the business adoption of Bitcoin, which has surged by 30% in just one year, with over 1,000 companies now leveraging Bitcoin for treasury strategies and payments

Nicolas Dorier, founder of BTCPay Server, explores the evolution from Blockchain technologies to the rise of ecash, highlighting how digital assets can thrive without a blockchain by leveraging simpler protocols for better user experience and efficiency

Jameson Lopp, founder and chief security officer at Casa, explores the questionable effectiveness of duress wallets as a defense against physical attacks on bitcoin holders, emphasizing the importance of strong privacy and operational security instead

UTXO Research, research arm of BTC Inc, analyzes the evolving landscape of Bitcoin bridges, highlighting trust models, design innovations, and the competition between sidechains and rollups

Carl B. Menger, Bitcoin and Austrian economics educator, elucidates Bitcoin forks, highlighting their role in facilitating innovation within the Bitcoin network

Shift Crypto, the company behind BitBox hardware wallets, analyzes Silent Payments, a Bitcoin improvement proposal that enables reusable static addresses while ensuring privacy through unique public key derivation for each transaction

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.