Is The Cycle Over?

Bitcoin’s Next Move? Look to Gold

Ethereum Supply Crunch

And more…

This Update is Brought to You By Bitbo

Bitbo launched a FREE live version of the Bitcoin Power Law

Using this chart, two conclusions (or perhaps, assumptions) are made:

1. The price will reach $100,000 per bitcoin no earlier than 2021 and no later than 2028. After 2028, the price will never drop below $100,000.

2. The price will reach $1,000,000 per bitcoin no earlier than 2028 and no later than 2037. After 2037, the price will never drop below $1,000,000.

IS THE CYCLE OVER?

Crypto sold off this week.

Bitcoin slipped ~5%. Ethereum dropped ~10%.

Cue the panic.

But let’s be real — is the cycle really over? 🤨

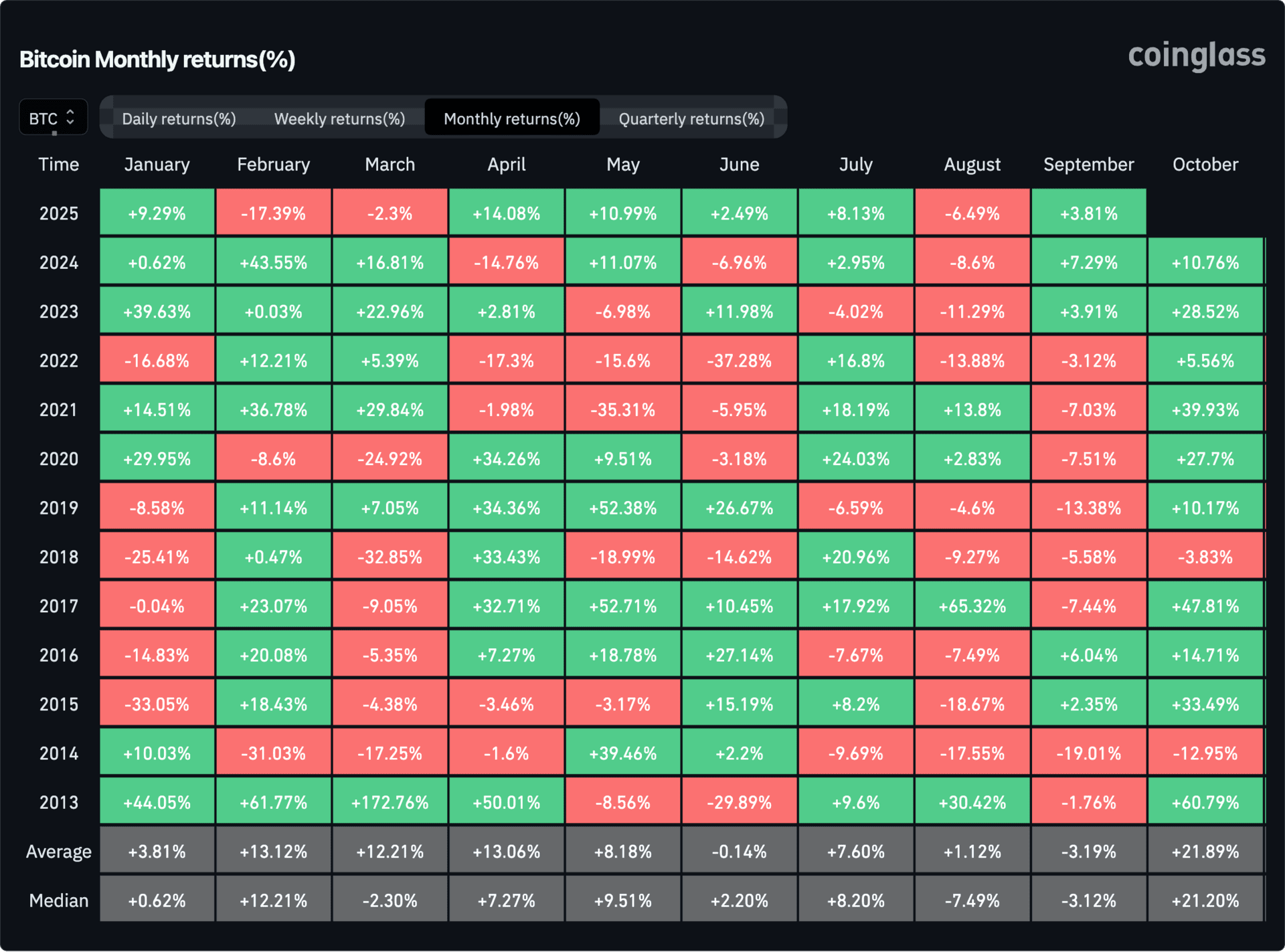

We’ve been calling for September volatility all month. Historically, September has been the worst month for crypto by far.

Check out those average September returns…

Yet, despite the expected happening, everyone lost their minds.

“The cycle is over.”

“BTC is going back to $90K!”

“Worst cycle ever!”

But zoom out:

A massive rate cutting cycle just kicked off, with 2 more cuts this year priced in and 3 next year.

Liquidity is finally starting to pick up.

Institutions are launching crypto products left and right.

The regulatory picture is more bullish than ever.

ETFs for altcoins have been green-lit.

Retail hasn’t even arrived yet.

Political and fiscal policy into 2026 looks set to run the economy hot.

Even the SEC is signaling that “Crypto’s time has come.”

When you lay it all out, the environment looks ridiculously bullish.

So… is the cycle really over?

Or are we just getting started? 🧩

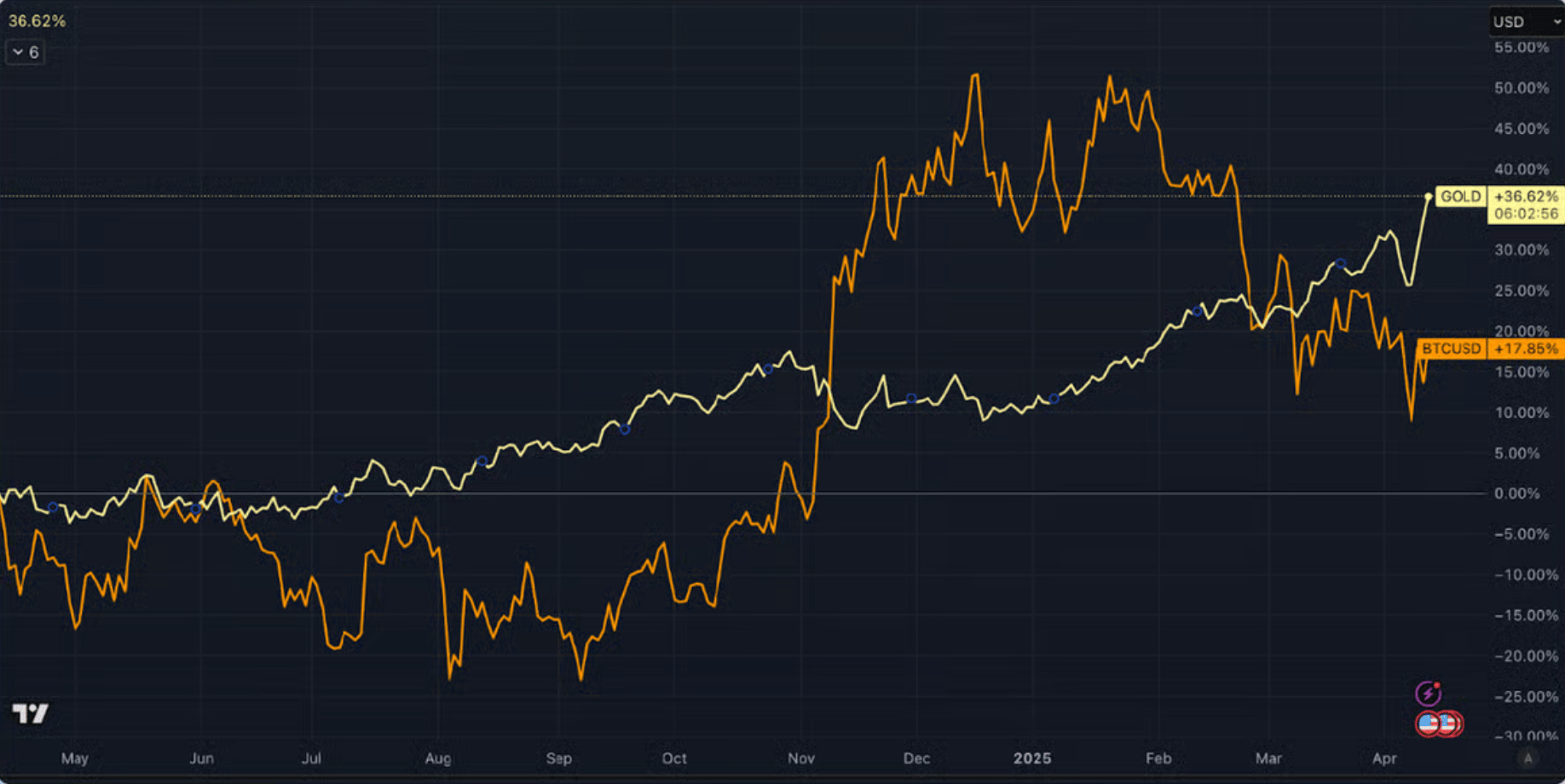

BITCOIN’S NEXT MOVE? LOOK TO GOLD

Both Bitcoin and Gold have been locked inside rising wedge formations since 2020/21. These patterns? Normally bearish.

But in January 2025, Gold broke out upward – a rare bullish reversal.

Fast forward a few months, and Bitcoin is echoing the exact same price action Gold showed before its surge:

Steady rise 📈

Sideways consolidation ⏸️

Last-minute spike? 🔥

If the correlation holds, BTC’s breakout is imminent.

📌 For perspective:

Gold gained ~10% on its breakout.

Bitcoin historically outpaces Gold 5–10x.

That projects a BTC move of +50–100%, with a potential range of $160k–$220k.

The charts suggest the real action begins in October/November.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

ETHEREUM SUPPLY CRUNCH

Ethereum is quietly setting up for a supply shock.

On-chain data shows 35,714,434 ETH is currently staked — up +1.72M ETH this year (roughly $7.1B).

When you map that on the “staked share vs total supply” chart, you see we’ve hit 29.48%. That’s almost one-third of all ETH effectively off the market.

This level of staking participation creates one of the tightest supply squeezes in ETH’s history. The fewer coins left on exchanges, the greater the upside pressure when buyers flood in.

Simply put: Ethereum isn’t just holding steady — it’s coiling like a spring.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

The Conservative Case For Bitcoin - Mitchell Askew

Contributions to Philosophy (Of The Event) - Martin Heidegger

Liberty and Property - Ludwig Von Mises

Concept of the Political - Carl Schmitt

OTHER NEWS

📰 Atlas21 explores how Trump's pro-Bitcoin messaging hides a dual policy: legitimizing stablecoins while risking Bitcoin user privacy, revealing a strategy to maintain dollar dominance over true freedom.

💻 El Flaco explains that Bitcoin's censorship-resistant power relies on free users exercising choice through open-source software, making user autonomy central to its decentralized governance.

⚡ Ivan Makedonski highlights how the Lightning Network’s instant and split payments could transform compensation systems, rewarding productivity over traditional time-based salaries.

⛏️ Shinobi argues that Bitcoin Knots supporters claim to promote decentralization and monetary use but undermine both by creating proprietary mining protocols and filtering Layer 2 transactions.

💰 Dilip Kumar Patairya showcases how five solo Bitcoin miners earned over $350K each in 2025, proving that individuals can still compete in Bitcoin’s decentralized network.

🛠️ Jameson Lopp catalogs controversial actions and statements by Bitcoin developer Luke Dashjr, raising questions about his leadership of the Bitcoin Knots project.

🔑 Laan Tungir emphasizes Nostr’s strength in physically securing private keys and treating hardware as expendable, allowing users to maintain sovereignty over their digital identity and communications.

🏦 Jonathan Newman critiques the Federal Reserve’s creation as serving banking elites’ self-interest rather than economic necessity, arguing that growing economies can thrive on commodity-based currency.

🌍 Renee Sorchik & Jacob Langenkamp examine how 27 countries hold bitcoin through mining, reserves, or wealth funds, while 13 pursue strategic reserve legislation, highlighting Bitcoin’s rise as a sovereign macroeconomic asset.

MEMES OF THE WEEK

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.