Is It Time To Buy Or Sell

SOL Rev Crash Worrying For DeFi

3 Catalysts Behind A SOL DeFi Revival

The Only Bitcoin Chart You’ll Ever Need

Market Data Prices as of 3:00am ET

This Update Is Brought To You By Bitcoin Well

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

CRYPTO MARKET SIGNALS:

IS IT TIME TO BUY OR SELL?

Understanding where we are in the crypto market cycle is everything.

Without that context, it's nearly impossible to make informed decisions on when to buy or sell.

One of the clearest tools to determine market phase?

The MVRV Z-Score.

What Is MVRV?

Market Value (Market Cap) = Current BTC price × Circulating Supply

Realized Value = Aggregate cost basis (price at which each coin last moved)

When market value exceeds realized value by a wide margin (the red zone), the market is typically overvalued — a possible sell signal.

When the market value dips far below realized value (the green zone), the market is likely undervalued — historically the best time to buy.

This Week’s Signal:

MVRV Ratio rose from 2.56 → 2.86

Follows Bitcoin’s new all-time high at around $107K

Still below the Dec 2024 peak, and far from the red zone

📈 Conclusion:

Momentum is building. The green light is still on.

We are not at a top — bullish signs all around.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

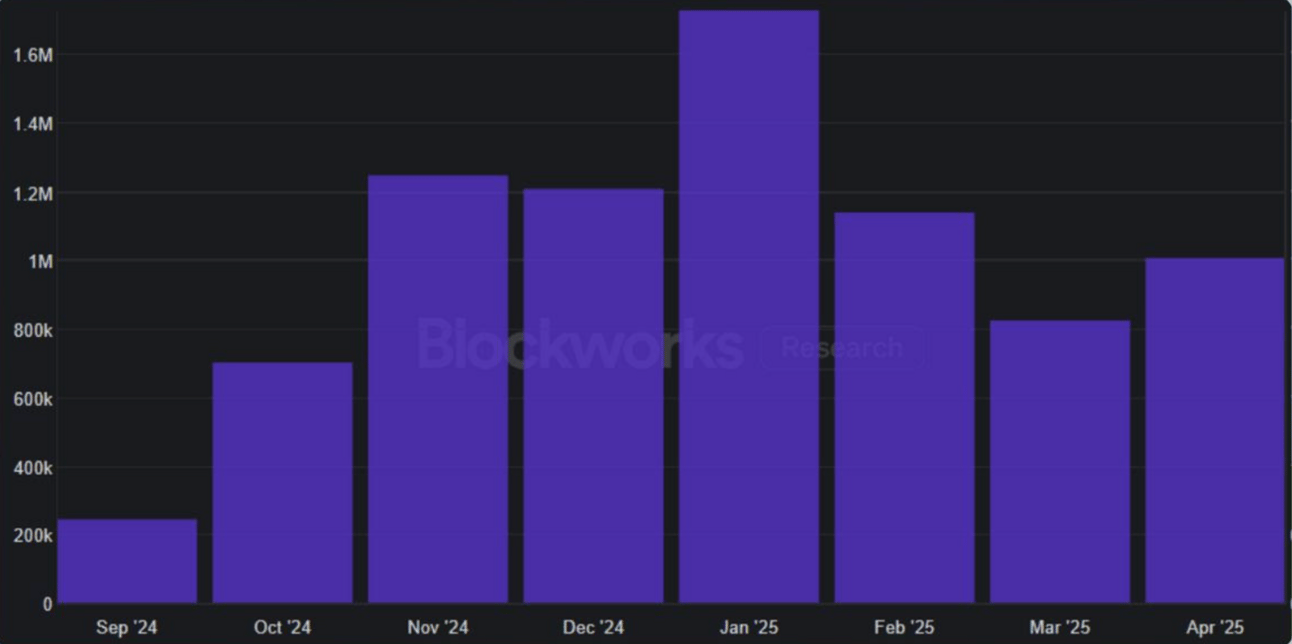

SOL REV CRASH WORRYING FOR DEFI

We love the hype around Solana DeFi—but let’s get real: the chain’s core metrics are tanking, fast.

In the last few months, Solana’s app revenue dropped by more than 50% compared to its peak from Nov 2024 to Feb 2025.

Source: Blockworks

That’s not just a dip—that’s a red flag.

Look at DEX trading:

January? $392 billion.

April? A measly $102 billion.

Source: Blockworks

Even worse? REV (Real Economic Value)—the ultimate signal of on-chain economic health—has fallen 84%. From $551M in January to just $88M in April.

REV includes:

Base transaction fees

Priority fees

Jito tips (a critical part of Solana's MEV ecosystem)

Without healthy REV, there’s no real economy on Solana.

Yes, other L1s are hurting too.

But Solana had more to lose—and it’s feeling the pain after the $TRUMP memecoin boom and speculative mania wore off.

If Solana doesn’t bounce back, no amount of DeFi innovation can save it.

The infrastructure must thrive for the ecosystem to survive.

✍ Here's why we’re still optimistic—and where we think Solana’s next wave begins.

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

3 CATALYSTS BEHIND A SOL DEFI REVIVAL

Think Solana’s down bad?

Think again.

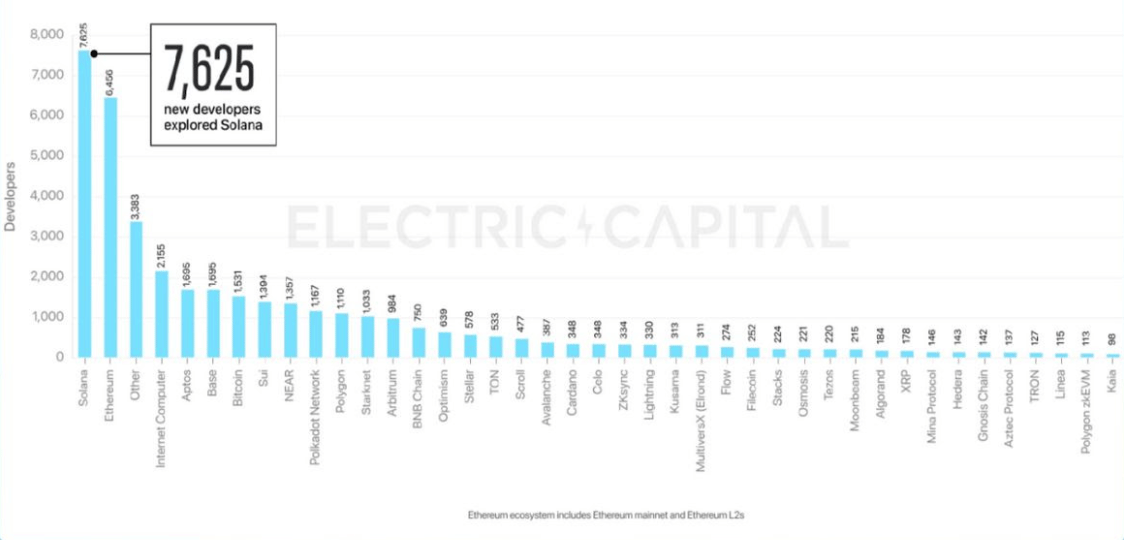

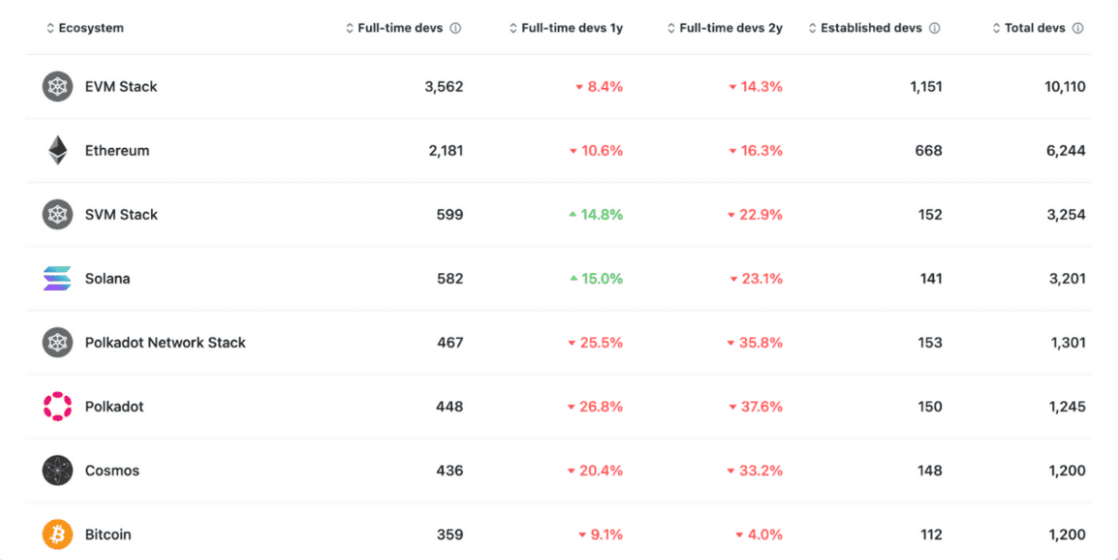

1. Developers Are Flocking In 🧑💻

Solana added more new devs than any chain in 2024 — even Ethereum.

More devs means more cool stuff gets built.

And that means: more users, more apps, more capital, and yes, more DeFi usage.

2. Stablecoins Are Still Sending It 💵

Stablecoins on Solana are up $6.6B since January – that’s over 129% growth!

And we’re not just talking about memes. $PYUSD from PayPal is booming.

Stablecoins = the fuel for lending, trading, payments — the entire DeFi machine.

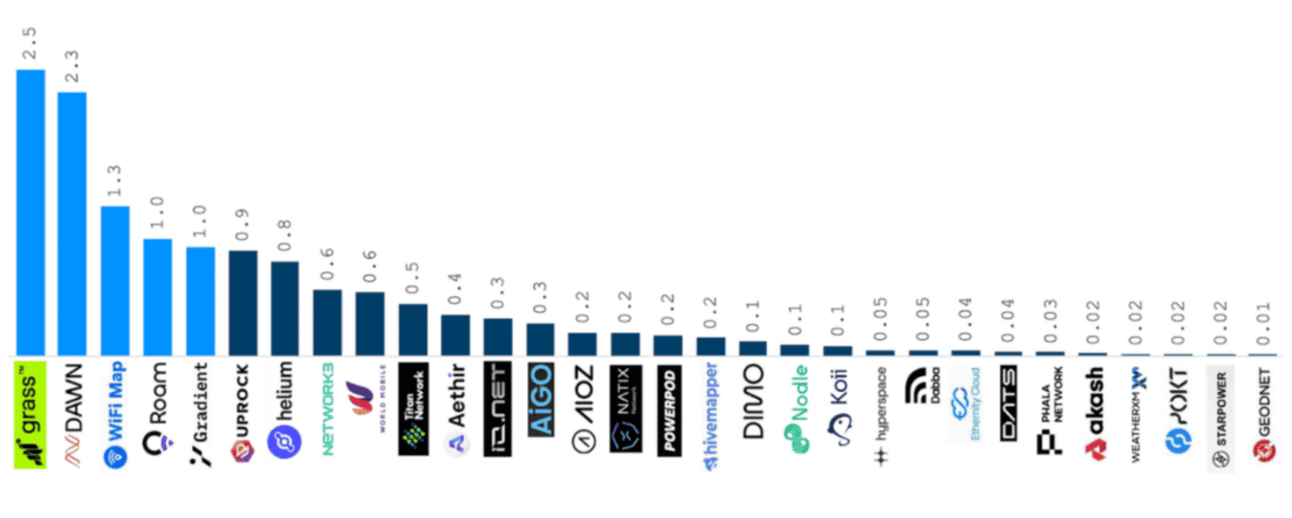

3. The Big 3 Narratives Are Waking Up

→ Memecoins: 1M launched in April.

They still dominate DEX volume.

→ AI: Solana’s perfect for bots, trading agents, and AI-native apps.

→ DePIN: Still growing, still onboarding millions of nodes.

And guess where all this action ends up?

DeFi protocols.

Raydium, Jupiter, Kamino, MarginFi – they’re ready for the inflow.

When the market flips bullish, Solana’s DeFi stack is going to roar back.

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

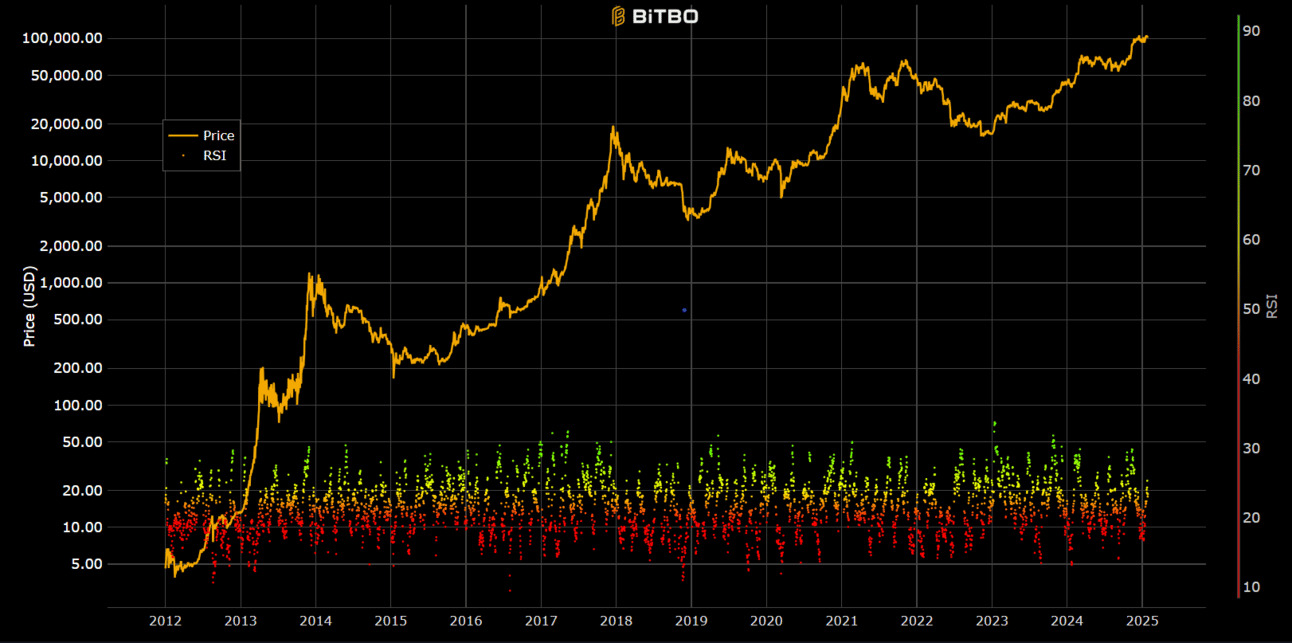

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

THE ONLY BITCOIN CHART YOU’LL EVER NEED

Every crypto run has its skeptics.

Every correction gives rise to fear.

The voices are loud: “It’s over. The bull is dead.”

But the truth lies in the numbers—and the numbers show inflow, strength, and opportunity.

This isn’t just another phase—this is the banana zone.

The messy middle where conviction is tested, and fortunes are forged. R

aoul Pal describes this moment as one that could reshape the entire market—a cash flood unlike anything we've seen before.

In 2017, a perfect storm sent Bitcoin soaring.

The signals today?

Strikingly similar.

Could we be standing at the edge of another historic breakout? Don’t miss the insights.

Take a look at the video below to learn why this might be the only Bitcoin chart you’ll ever need…

OTHER NEWS

🏙️ Panama City Mayor Eyes Bitcoin for City Treasury

📌 Local leader signals intent to hold BTC as a reserve asset

🔄 Bitcoin Unit Battle: Sats or Bits? Debate Intensifies

📌 Community wrestles with which should be Bitcoin’s base unit

🚫 Author of The Bitcoin Standard Takes Aim at BTC Spam

📌 Saifedean Ammous blasts ‘spam attacks’ on the network

💸 Aussie Court Declares Bitcoin Legal Money, Scraps CGT

📌 Landmark ruling redefines BTC as currency, not an asset

⚖️ Tornado Cash Prosecutors Accused of Evidence Cover-Up

📌 New claims emerge in the controversial crypto case

👀 UK Plans to Monitor Bitcoin Users for Tax Starting 2026

📌 HMRC to demand KYC reporting from exchanges

🐍 Malicious Printer Malware in China Targets Bitcoin Wallets

📌 Stealthy software linked to stolen BTC from connected devices

🧱 U.S. Keeps Tight Grip on Bitcoin Rules & Regulation

📌 American regulators flex control over global crypto markets

👑 Sovereign Buyers Quietly Stack BTC via MicroStrategy

📌 Nation-states allegedly using MSTR as a proxy for BTC exposure

🚀 Bitcoin Hits New ATH Backed by Spot Demand, Not Leverage

📌 Market surge driven by real buyers, not borrowed money

⚖️ Poll: Americans Want Gold Swapped for Bitcoin Reserves

📌 Citizens support BTC over gold as national store of value

💰 Texas Launches Bitcoin Treasury w/ Public Funding Option

📌 State opens donation channel for BTC reserve initiative

🚔 Fake Uber Driver Robs American Bitcoiner in London

📌 Victim drugged & mugged in crypto-targeted attack

🔓 South Africa Court Ruling Frees Bitcoin from FX Controls

📌 BTC no longer bound by outdated exchange restrictions

📈 Deribit Sees $42.5B in Bitcoin Options as BTC Tops $111K

📌 Record-breaking open interest signals strong market activity

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.