MicroStrategy Increase Bitcoin Holdings…. Again!💥

Traders Preparing for Massive 2025 Bitcoin Price Rally

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $63,824 | -2.96% | +51.89% |

Ethereum (ETH) | $3,492 | -2.54% | +52.83% |

Check Out Ledger - The best crypto app to secure your tokens

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

These wallets physically store your private keys within a chip inside the device itself.

The beauty of using a crypto wallet is the security it provides to your private keys.

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys on the

MICROSTRATEGY INCREASE BITCOIN HOLDINGS….. AGAIN!💥

BREAKING: MicroStrategy completes $800M note offering to buy more Bitcoin

Remember a few days ago when MicroStrategy announced a private offering of convertible senior notes?

Well, they’ve now completed that offering and raised approximately $800 million.

Any guesses on what they did with the funds? 😂

No surprises here: they bought more Bitcoin.

Yesterday, MicroStrategy announced the purchase of an additional 11,931 BTC for around $786 million.

This acquisition brings MicroStrategy’s total Bitcoin holdings to 226,331 BTC, acquired for about $8.33 billion at an average price of $36,798 per coin.

MicroStrategy has never sold any of its Bitcoin.

Take a look at this chart which shows Microstrategy’s Total Bitcoin Holding - clearly showing why Saylor has 100% conviction in Bitcoin.

MSTR BTC This is literally the definition of going all-in.

The best crypto app to secure your tokens: Ledger

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys

Traders Preparing for Massive 2025 Bitcoin Price Rally

BREAKING: Bitcoin options market isn't convinced by BTC's price decline, showing a preference for $100K calls.

Crypto options traders are strategically placing bets that contradict the ongoing downtrend in bitcoin's (BTC) price.

In the past 24 hours, the leading cryptocurrency by market value has declined over 1% to $64,500, extending the pullback from recent highs near $72,000, according to CoinDesk data.

Despite this, the flow in bitcoin options listed on the leading exchange Deribit has shown a bias toward call options with strike prices well above the current market rate.

This may indicate that sophisticated investors expect the current price weakness to pave the way for a more significant rally.

In the options market, there has been an unusually large buying flow of $90,000 to $100,000 call options expiring in December and March over the last 24 hours.

"We believe this suggests the market is calling the bottom and positioning itself for a sustained rally, possibly lasting into 2025," Singapore-based QCP Capital noted in a market update.

A call option gives the purchaser the right, but not the obligation, to buy the underlying asset, BTC, at a predetermined price at a later date. A call buyer is implicitly bullish on the market.

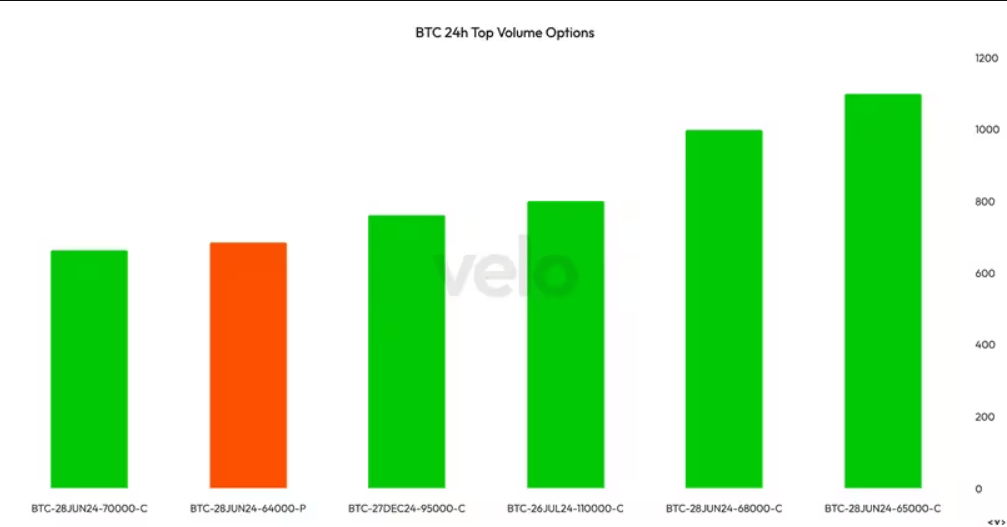

The chart shows the most active bitcoin options on Deribit over the past 24 hours. The activity has been mostly concentrated in June expiry calls at $65,000, $68,000, and $70,000, a July expiry call at $110,000, and a December expiry call at $95,000.

The divergence in options market sentiment and bitcoin's price is more strongly evident in the call-put skew, which indicates what traders are willing to pay to acquire an asymmetric payout in the upward or downward direction.

Per Amberdata, the one-, two-, three-, and six-month skews have held consistently positive through the recent BTC price pullback, suggesting a bias for calls or upside. Only the seven-day skew has flipped negative, signaling demand for downside protection.

Bitcoin has decoupled from Nasdaq's uptrend in recent weeks, largely due to long-term holders and miners selling coins and growing chatter about the non-directional nature of the ETF inflows.

Either way, it looks like traders are forecasting serious price rallies in the not too distant future…

….keep an eye out here for more information!

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

OTHER NEWS:

Bitcoin transaction fees will surpass block subsidy predicts Marathon CEO Fred Thiel. Thiel outlines Marathon’s global foray and views on Bitcoin’s economic and political landscape.

Dogecoin, Solana Lead Crypto Majors Plunge as Bitcoin Falls Below $66K. The lack of immediate catalysts to prop up markets in the near-term are likely weighing down token prices, one trader said.

VanEck to Launch First Bitcoin ETF on Australian Securities Exchange. After three years of effort, the firm is bringing Bitcoin ETFs to Australia's largest trading exchange on Thursday.