US Credit Rating Slashed

Huge Crypto New Update

Brand New Asset Class Launched

BTC Supply Shock Is Bigger Than You Think

And more…

Market Data Prices as of 3:00am ET

This Update Is Brought To You By Bitcoin Well

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

U.S. CREDIT RATING SLASHED

BREAKING: For the first time in history, Moody’s has downgraded the credit rating of the United States, citing unsustainable levels of debt.

According to the agency, by 2035, the U.S. will spend nearly 30% of its federal revenue just on interest payments.

📉 A Pattern Emerges

This isn’t the first downgrade overall—just the first by Moody’s.

In 2011, S&P downgraded the U.S. from AAA to AA+

→ S&P 500 dropped ~8% in two months

→ 10-year yields fell ~35%In 2023, Fitch followed suit

→ S&P 500 fell 10%

→ Russell 2000 dropped 17%

→ This time, bond yields surged ~23%

The shift?

Investors no longer treat U.S. debt as a guaranteed safe haven.

📊 Moody’s Key Warnings

Deficit to hit 9% of GDP by 2035

Debt-to-GDP ratio to rise to 134% (from 98% in 2024)

Interest costs to consume 30% of government revenue (up from 18%)

These are unsustainable fiscal dynamics—and Wall Street is finally acknowledging it.

₿ Why Crypto Bulls Are Watching Closely

For Bitcoin and the broader crypto market, this marks a significant moment.

The U.S. is facing:

✔ Dollar debasement

✔ An accelerating debt spiral

✔ Institutional loss of confidence

This downgrade validates the original Bitcoin thesis:

A non-sovereign, decentralized store of value becomes more attractive as sovereign credit risk grows.

Moody’s may have just made the most bullish Bitcoin case in years.

HUGE CRYPTO NEWS UPDATE

The Trump White House is still aiming to sign major crypto legislation before the August recess — including bills on stablecoins and market structure.

At Consensus, top advisor Bo Hines said:

“I’m extremely optimistic. We’re working hard to get this to the President’s desk.”

Hines, a key voice on crypto policy, dismissed concerns about the Trump family’s crypto activity:

“There’s no conflict... This is the next generation of finance.”

He also confirmed that plans for a U.S. Strategic Bitcoin Reserve are still in development.

💥 Why this is MASSIVE

If passed, this legislation could unlock the door for institutional investors to flood the market.

✅ Regulatory clarity

✅ Stablecoin certainty

✅ Market structure improvements

All this points to one thing: bullish momentum.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

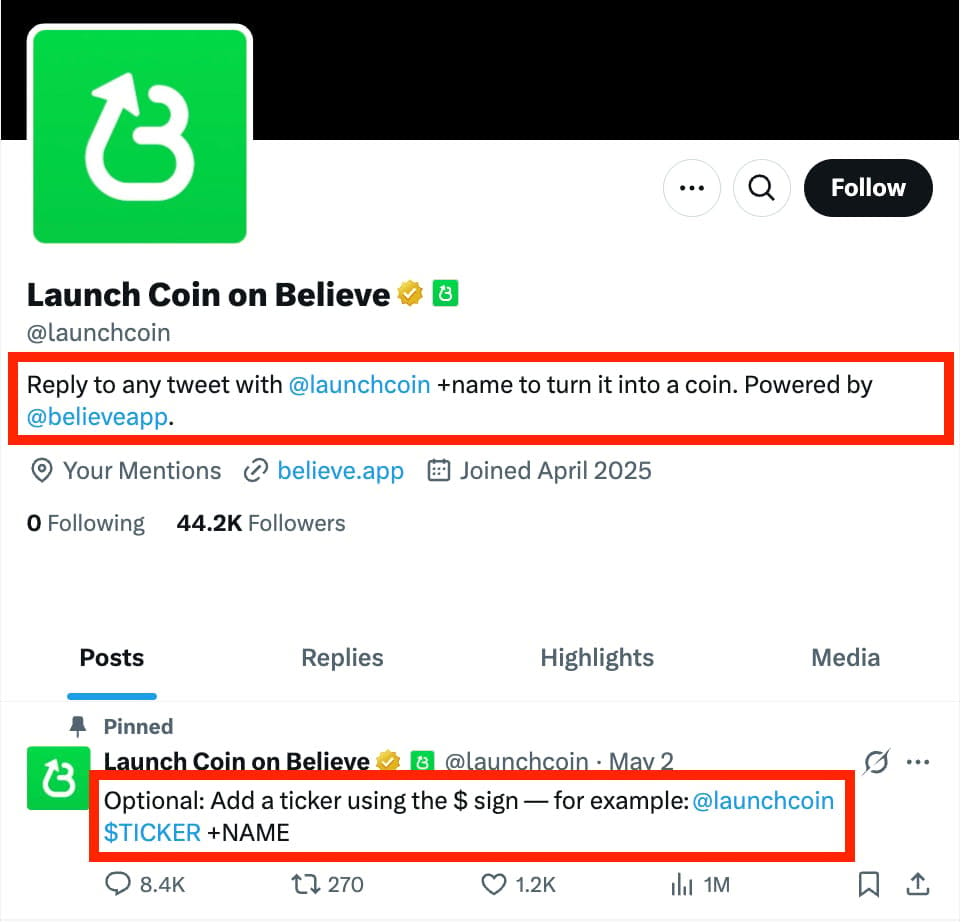

BRAND NEW ASSET CLASS LAUNCHED

An Internet Capital Market (ICM) token lets anyone monetize an idea—be it software, content, or a meme—instantly.

Post on X, tag @launchcoin, and your token fair-launches.

Creators retain 50 % of fee revenue; investors trade from block one.

Why This Matters

Democratized fundraising: AI-generated MVPs and on-chain liquidity compress months of venture outreach into a single tweet.

Lower barriers: No coding expertise, minimal capital, and near-zero go-to-market friction.

Key Risks

Regulatory exposure: Unregistered tokens tied to promoter effort invite securities scrutiny.

Quality dilution: Absence of due diligence means the market must price risk in real time—often poorly.

Bottom Line

ICM tokens could redraw early-stage capital formation.

But expect volatility, regulatory heat, and plenty of noise before clear winners emerge.

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

BTC SUPPLY SHOCK IS BIGGER

THAN YOU THINK

What if Bitcoin’s scarcity is even more extreme than you thought?

That’s exactly what Samson Mow, CEO of Jan3, is warning in his new 2025 outlook.

While the protocol ensures a hard cap of 21 million BTC, reality tells a different story.

Thanks to lost private keys, damaged hardware, and abandoned wallets, Chainalysis estimates that 3 to 4 million coins are lost — possibly forever.

That means true supply is far lower than most assume.

Yet demand is not slowing down. Spot Bitcoin ETFs in the U.S. have pulled in billions already, with BlackRock and Fidelity at the forefront.

And Glassnode data shows that over 70% of Bitcoin is held by those unwilling to sell — long-term holders.

The result? A shrinking supply, growing demand, and drying exchange liquidity.

As Samson Mow puts it, “The market is mispricing scarcity. And when it catches up, it won't be a gentle move — it’ll be a shock.”

Watch the video below for the full breakdown — because if Mow's prediction is right, Bitcoin’s next move could change everything.

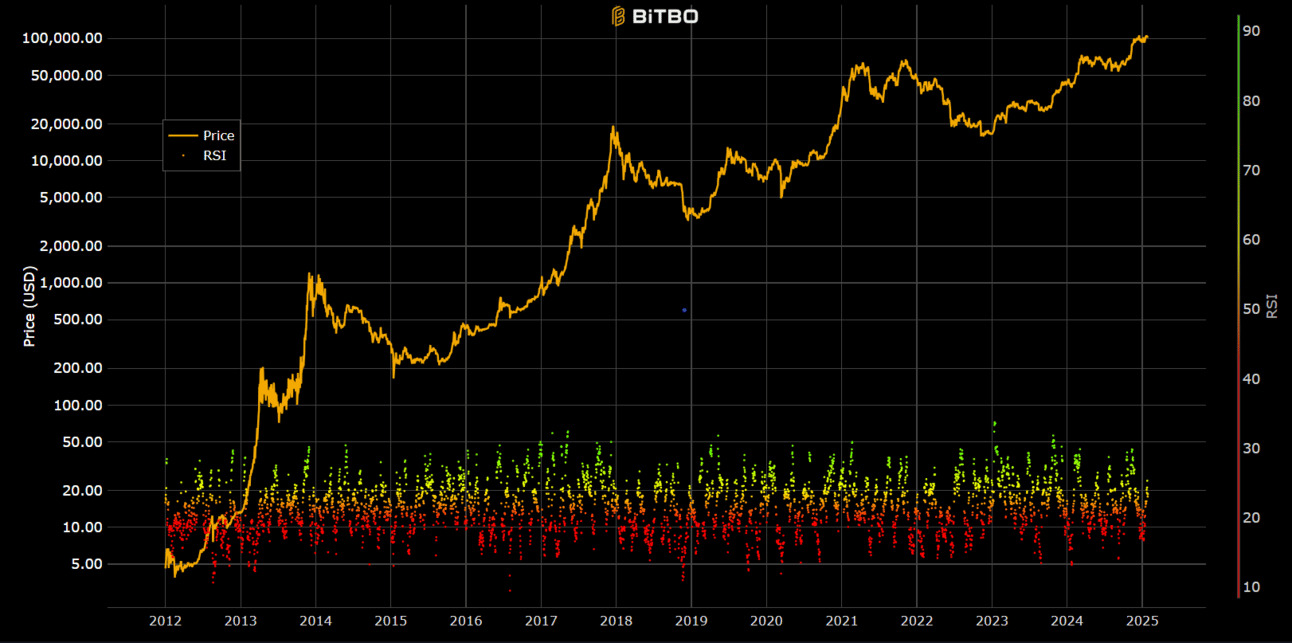

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

OTHER NEWS

✂️ Bitcoin Booms to $150K After US-China Tariff Ceasefire

💥 Global market peace sends BTC into orbit!

🥊 McGregor Joins Bukele’s Corner in Irish Bitcoin Push

🍀 Bitcoin enters the Octagon with an Irish twist.

🐢 Coinbase Plays it Cool, Misses Out on Mega Saylor Stack

🧊 Playing defense as others go all-in.

⚖️ UK Court Slams Door on Faketoshi’s Claims—Finally

🔨 Legal hammer drops on Craig Wright.

🇺🇸 Trump’s Bitcoin Blitz: Public Mining Moves Begin

🚩 The U.S. stakes a flag in Bitcoin territory.

💊 Nakamoto + KindlyMD Unleash $710M Bitcoin Treasury Duo

🧬 Crypto meets health in powerhouse partnership.

🇦🇪 Dubai Goes Full Bitcoin—Payments Now Welcome

🕌 Desert state goes digital-first.

🐳 Tether Supercharges Twenty One Capital’s Bitcoin Buy-In

🚀 Whales keep stacking big.

🥊 Core Clash: Bitcoin Data Debate Sparks Node Battle

⚔️ Tensions flare in the code trenches.

♾️ Tim Draper Declares Fiat Doom: Bitcoin Forever

🧢 Dollar down, BTC to the moon.

🇺🇦 Ukraine Speeds Toward Building Bitcoin Reserves

🛡️ Digital gold for uncertain times.

🥇 Asia’s Wealthy Pivot to Bitcoin & Gold Over Dollars

🐉 Shifting reserves to harder assets.

🎣 Coinbase Insider Leak Exposes Centralized Exchange Risks

🔐 Phishing attack spotlights KYC flaws.

💨 Top Bitcoin Dev Loses X Account in OP_RETURN Firestorm

🌀 Social media skirmish over protocol politics.

🇦🇪 Abu Dhabi Drops $408M into Bitcoin ETF Investment

💼 Gulf state steps deep into crypto finance.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.