What To Watch in Crypto This Month

Historic Highs in July?

Top 5 Blockchains in 2024 by the Numbers

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $60,267 | -3.82% | +43.28% |

Ethereum (ETH) | $3,300 | -4.19% | +44.36% |

This Update is Brought to You By Swan Bitcoin

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

WHAT TO WATCH IN CRYPTO THIS MONTH

June hit crypto prices hard, leaving many feeling betrayed. So, what’s next for July? Will prices go up 🔼 or down 🔽?

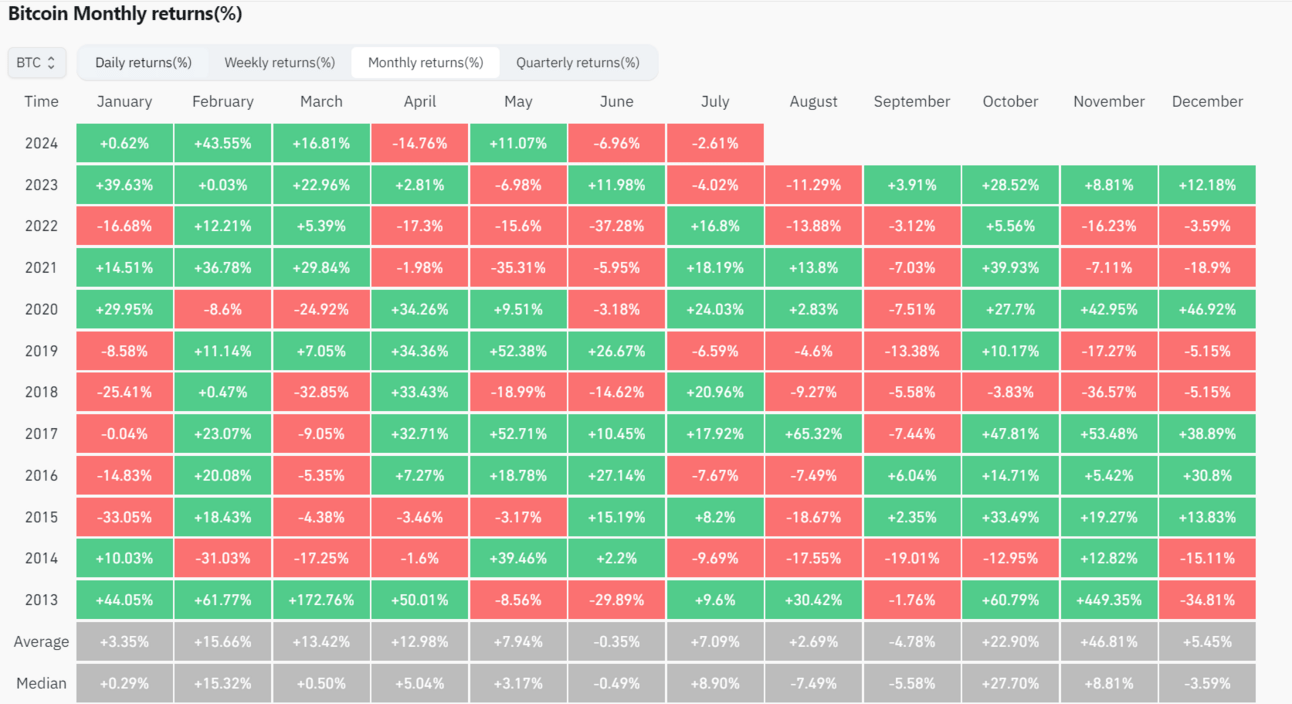

Here’s a peek into historical trends:

July is the 3rd most bullish month for Bitcoin (after October and February), according to historic median returns. When June performs poorly, July tends to bounce back. Just like the old saying… After rain, comes the sunshine & rainbow. 🌈

Here's what else to keep an eye on this month that could impact prices ⤵️

1/ Macro stuff 📊

Powell's Speech - July 2: Insights from Jerome Powell at the Fed.

FOMC Minutes - July 3: A detailed look at the Fed's recent decisions.

Non-Farm Payrolls - July 5: A key jobs report, crucial for gauging economic health.

CPI Data Release - July 11: Inflation data. Check out how consumer prices are shifting.

PPI Data Release - July 12: Following the CPI, this gives insight into future consumer prices.

FOMC Meeting - July 31: The big Fed meeting. Possible rate cuts? Let’s hope so. 🤞 Expect significant market reactions based on their policy updates.

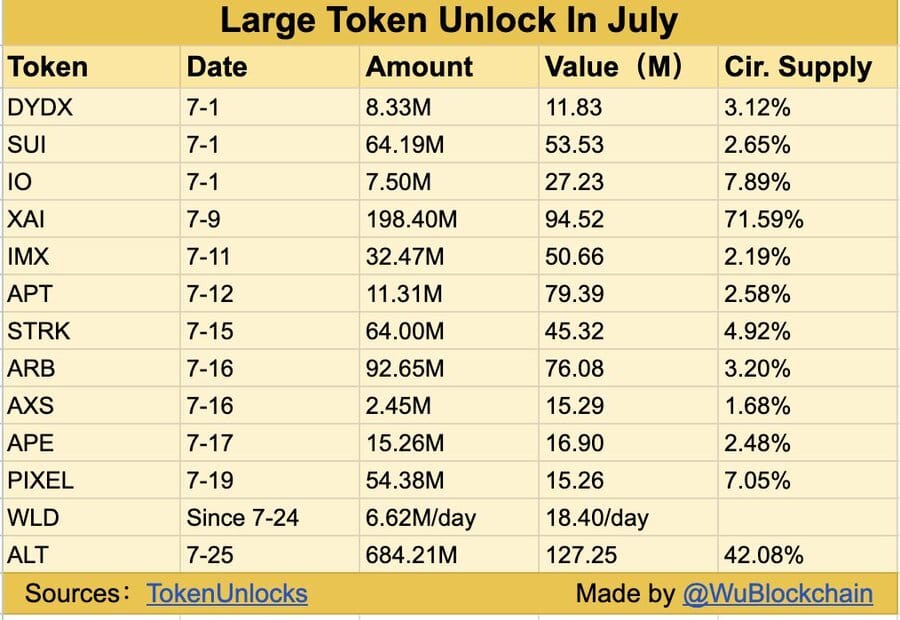

2/ July Unlocks 🔒

July’s token unlocks are massive, totalling $630M!

Topping the list is $ALT with $127.25M, unlocking 42% of its circulating supply! Plus, starting July 24th, $WLD (Worldcoin) initiates a daily $18.4M unlock for an impressive 730 days.

Hold on tight, friends. July is set to be exciting. Let’s hope for a bullish ride. 🚀

HISTORIC HIGHS IN JULY?

Bitcoin advocates have other reasons to be optimistic as we enter July, after a second quarter marked by heavy sales and bearish retail sentiment for BTC.

On the first day of the month, U.S.-listed ETFs saw an impressive nearly $130 million in inflows, the most since early June, following over $900 million in outflows throughout June.

As we saw in the chart above, over the past decade, bitcoin has averaged more than 11% gains in July, achieving positive returns in seven of those ten years.

Currently, bitcoin is trading near $62,600, a modest 0.15% decline over the past 24 hours. The CoinDesk 20 Index (CD20) is also down approximately 0.2%.

According to CoinShares, professional investors have pulled over $120 million from ether-tracked exchange-traded products in the past fortnight.

These products experienced $60 million in net outflows each week, the highest since August 2022.

In contrast, multiasset and bitcoin ETPs recorded inflows of $18 million and $10 million, respectively, hinting at a shift in sentiment.

Ether ETFs are close to becoming available for U.S. trading, pending the SEC's final approval of their S-1 filings.

The best crypto app to secure your tokens: Ledger

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys

TOP 5 BLOCKCHAINS IN 2024 BY THE NUMBERS 🏆

OK, blockchain enthusiasts! Let’s dive into the exciting world of blockchain technology.

The quest for blockchain dominance heats up every year, and 2024 is no exception. We’ve crunched the numbers and created charts to highlight the top blockchains based on five key metrics.

Here are the leaders in the 2024 blockchain race. ⬇️

1/ Monthly Active Users: Solana has surged ahead of Tron, claiming the top spot. Starting the year in 6th place, Solana's rapid rise is notable. Meanwhile, Bitcoin has dropped from 2nd to 5th place, showing a decline in active users.

2/ Number of Weekly Transactions: Solana leads with 1.8 billion weekly transactions, dwarfing other blockchains, all below 50 million. Tron remains second, while TON has rapidly increased its transactions from less than 5 million to over 40 million.

3/ DEX Volume: Ethereum tops the DEX volume metric, with Solana close behind. Base has emerged as a strong contender, now ranking 5th. BNB, Arbitrum, and Base are competing closely, with Arbitrum slightly ahead.

4/ Total Value Locked (TVL): Ethereum dominates TVL, holding 61.2% of the market. Tron and BNB also have significant shares, but the following positions are held by Layer 2 solutions, emphasizing Ethereum’s influence in DeFi.

5/ Fees: Ethereum is the leader in transaction fees, earning nearly $1.75B.

Tron and Bitcoin each generate under $0.8B. Ethereum’s dominance in fees highlights its strong market position.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

OTHER NEWS:

This CRASH Is An Opportunity, Why Bitcoin Is About To 10x | Mathematician Fred Krueger Prediction: The future of money is here and why in over the next 3 to 4 years or so we will see a total of 300 to $400 billion allocated to the Bitcoin ETFs.

Analyst predicts limited impact from Mt. Gox Bitcoin distribution amid market slide. Galaxy's Alex Thorn believes the sell pressure from Mt. Gox's Bitcoin distributions is unlikely to be as severe as the market anticipates.

Bitcoin Miner Riot Platforms Ditches Bitfarms Takeover Bid, Seeks to Overhaul Board. Riot is Bitfarms' largest shareholder, owning 14.9% of the firm.

European Central Bank releases first CBDC progress update. In the first official progress update, the European Central Bank touched on features it is exploring for its proposed central bank digital currency.