Global Liquidity Reaches ATH📈

Inflation Is Inevitable💵

Bitcoin 6 Figure ATH Coming💥

And more…

Market Data Prices as of 7:00am ET

Trading View launched a FREE live version of the Global Liquidity Index - We will be talking about this chart in today’s article

GLOBAL LIQUIDITY REACHES ATH📈

Global liquidity has reached a new all-time high above $95 trillion, approaching $100 trillion.

Historical data shows expanding liquidity precedes Bitcoin bull runs, potentially signaling a new price surge.

A recent report by Lyn Alden and Sam Callahan detailed Bitcoin's correlation with global liquidity. It really is a captivating read.

Their analysis further reinforced my belief that as monetary expansion increases, more people turn to Bitcoin, driving prices upward.🚀

Their detailed study revealed that over 12-month periods, Bitcoin’s price moves in the same direction as global liquidity 83% of the time, an impressive figure.

This correlation is higher than any other major asset class, positioning Bitcoin as a uniquely accurate barometer for global liquidity trends.

The report analyzed Bitcoin’s relationship with the global M2 money supply, showing an exceptionally strong overall correlation of 0.94 between May 2013 and July 2024.

Bitcoin’s average 12-month rolling correlation came in at 0.51, while other assets like stocks and gold displayed correlations in the 0.4 to 0.7 range.

However, Bitcoin’s correlation isn't flawless. Short-term divergences can occur due to crypto-specific events like exchange hacks or the collapse of Ponzi schemes.

Additionally, supply-demand imbalances can cause brief decoupling when Bitcoin becomes overvalued during market peaks.

Despite these disruptions, the long-term correlation remains intact, as you can see in the chart below:

With liquidity now at unprecedented highs (see chart below), this relationship suggests that Bitcoin could be poised for a major bull run.

While no model can fully capture Bitcoin’s complexity, understanding its role as a warning sign for monetary trends provides valuable insight.

If history offers any clue, Bitcoin’s signals are blaring that a liquidity-driven surge may soon take shape.

We’ll definitely be keeping an eye on this one!

INFLATION IS INEVITABLE💵

Paul Tudor Jones: No matter who wins the election, the next U.S. president will face ongoing debt and deficit issues

This week billionaire hedge fund manager Paul Tudor Jones sounded the alarm on the unsustainable growth of U.S. debt, advising investors to favor bitcoin (BTC), gold, and commodities over bonds.

"I think inflation is the inevitable outcome. That’s why I’m long gold and bitcoin."

He also mentioned his intention to short fixed income, particularly longer-term bonds.

Jones' concerns about the fiscal state of the U.S. align with warnings from figures like Federal Reserve Chair Jerome Powell, who recently called U.S. debt levels unsustainable.

Similarly, famed investor Stanley Druckenmiller recently disclosed that he too is betting against U.S. government bonds.

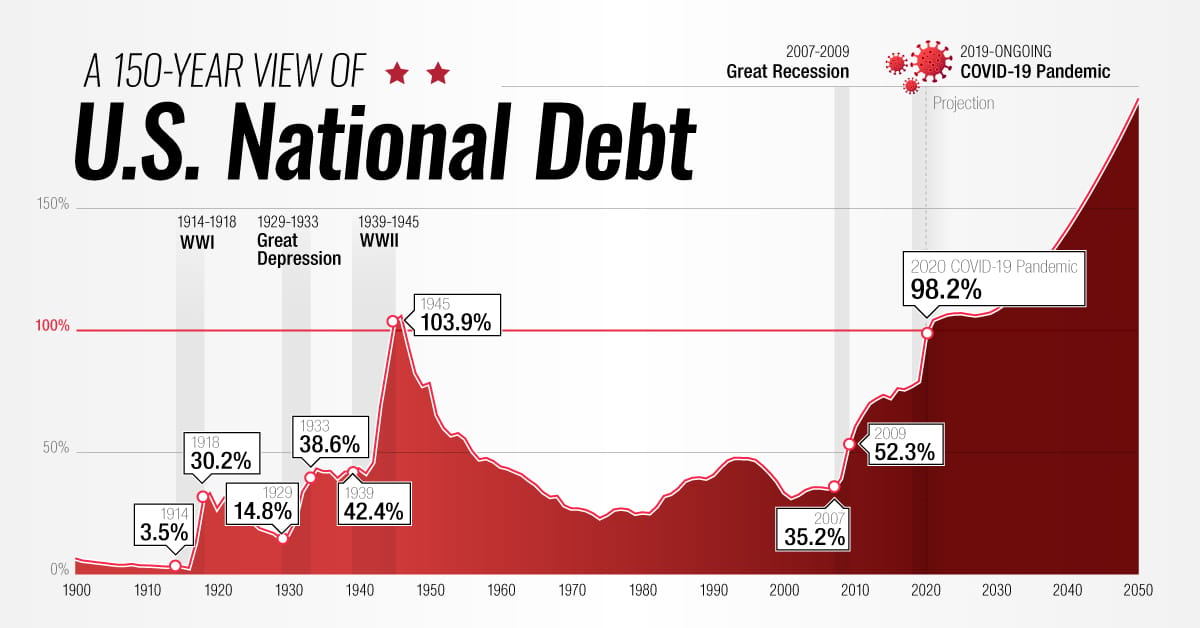

According to Jones, the U.S. is at a critical point in its history, with the national debt now approaching 100% of GDP, a steep rise from 40% 25 years ago.

He noted that the upcoming presidential election would not solve the issue, as both Harris and Trump have proposed plans involving increased spending and tax cuts that would likely worsen the problem.

"We’ll be broke in no time if we don’t get serious about our spending,"

He suggested that the only way out is to rely on inflation to reduce the debt burden.

In his view, the Federal Reserve should keep interest rates low while supporting nominal economic growth.

Jones advised holding a portfolio of gold, bitcoin, commodities, and Nasdaq stocks while avoiding fixed income entirely.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

BITCOIN 6 FIGURE ATH COMING💥

Matt Hougan, a leading voice in the cryptocurrency industry, plays a pivotal role as the CIO of Bitwise Asset Management.

For those of you that don’t know, Bitwise is recognised as the world’s largest provider of cryptocurrency index funds, overseeing more than $1.5 billion in assets.

Hougan’s expertise in ETFs and financial technology positions him as an advocate for crypto-based spot ETFs, which are rapidly changing the landscape of the crypto market.

Recently, with the approval of spot ETFs, Hougan has been celebrating this advancement alongside other market participants.

His firm, Bitwise, has taken a major step forward by filing with the SEC to offer an XRP ETF, a significant move for crypto-focused investors.

Hougan believes that the market is on the verge of a massive breakout, one that will see prices soar to new all-time highs.

In a recent tweet, Hougan made a super bullish projection of a 6-figure price target for Bitcoin.

He bases his prediction on several key factors that are aligning in the macro environment:

ETF flows are accelerating

The upcoming US election

Infinite deficits (coupled with bipartisan political consensus)

Economic stimulus in China

Global rate cuts by the Fed and ECB

The Bitcoin halving supply shock starting to take effect

Whales accumulating more crypto assets

Despite a turbulent period in the market and sideways price movement for Bitcoin for most of this year, Hougan believes that these factors are starting to converge.

Make sure to watch this video where Hougan explains why this is just the beginning of a major rally, the current state of play for spot ETFs, and his bold 2025 prediction for both Bitcoin and Ethereum.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

The Conservative Case For Bitcoin - Mitchell Askew

Digital Gold: Bitcoin The Untold Story - Nathaniel Popper

Contributions to Philosophy (Of The Event) - Martin Heidegger

Liberty and Property - Ludwig Von Mises

Concept of the Political - Carl Schmitt

Theory Of The Multi-Polar World - Alexander Dugin

On Tyranny - Leo Strauss

OTHER NEWS

Eric Council Jr. was arrested for hacking the SEC's X account to falsely claim Bitcoin ETF approval, causing a brief $1,000 spike in Bitcoin's price.

Metaplanet raised $66 million through its 11th stock acquisition rights series, and plans to buy more BTC.

Denver’s The Space is a community-run Bitcoin hub focused on collaboration, education, and decentralization.

Bitcoin's impending "golden cross" signals a bullish outlook despite concerns over rising U.S. Treasury yields.

The Bank of Canada cut its key interest rate by 50 basis points to 3.75%, citing inflation control and a focus on boosting economic growth.

Cryptographer Peter Todd has reportedly gone into hiding after being linked to the invention of Bitcoin in a recent HBO documentary.

River, a U.S.-based financial services firm, has unveiled a new product offering a 3.8% interest rate on USD deposits, with returns paid in Bitcoin.

Tesla likely still retains around $780 million worth of Bitcoin, according to Arkham Intelligence, despite recent transactions that caused speculation in the market.

A $4.2 billion Bitcoin options expiration set for Friday could lead to increased market fluctuations in the short term.

Bitcoin futures open interestsurged to a record $40.5 billion on October 21, signaling heightened market activity.

Vitalik Buterin, Ethereum co-founder, recently criticized Michael Saylor’s stance on regulated Bitcoin custody, calling his views "insane."

Bernstein Research has projected that Bitcoin could reach $200,000 by the end of 2025, labeling this forecast "conservative."

MEMES OF THE WEEK

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.