Gensler Grilled Over Crypto Regulation

Crypto Surges After Rate Cut - Who Gained The Most?

Next 18 Months Will Bring Massive Crypto Gains

And more…

Market Data Prices as of 7:30am ET

This Update is Brought to You from MindLabPro

The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

GENSLER GRILLED OVER

CRYPTO REGULATION

BREAKING: Congress Unites to Grill SEC Chair Over Crypto Mishandling

Gary Gensler, head of the SEC, faced bipartisan scrutiny during a recent congressional hearing for his handling of the crypto market.

Both Republicans and Democrats took issue with the SEC's enforcement actions, particularly the DEBT Box and Stoner Cat NFT cases.

Leading the charge, Republican Tom Emmer ripped into Gensler for the SEC’s mismanagement of the Debt Box case.

A federal judge had previously criticized the agency for acting in bad faith, resulting in a $2 million sanction to cover legal costs—paid with taxpayer dollars.

Emmer’s blunt question, "Does this case embarrass you at all?" underscored the mounting pressure on Gensler.

On the flip side, Democrat Ritchie Torres raised concerns about the SEC’s approach to NFTs, specifically the Stoner Cat NFTs.

Torres challenged Gensler by asking whether an NFT tied to an animated series was any different from a Yankees ticket, which also offers a specific experience.

Once again, Gensler’s response was unclear, implying that any item purchased with the "anticipation of profit" could be classified as a security under current laws.

Torres, not satisfied, argued that this could apply to almost any consumer good or collectible, which complicates the SEC’s stance on crypto and NFTs.

The hearing exposed a broader issue: a lack of clear guidelines on cryptocurrency and blockchain-based assets.

Without consistent regulation, crypto businesses continue to face legal challenges, often without knowing which rules they’re expected to follow.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

CRYPTO SURGES AFTER RATE CUT - WHO GAINED THE MOST?

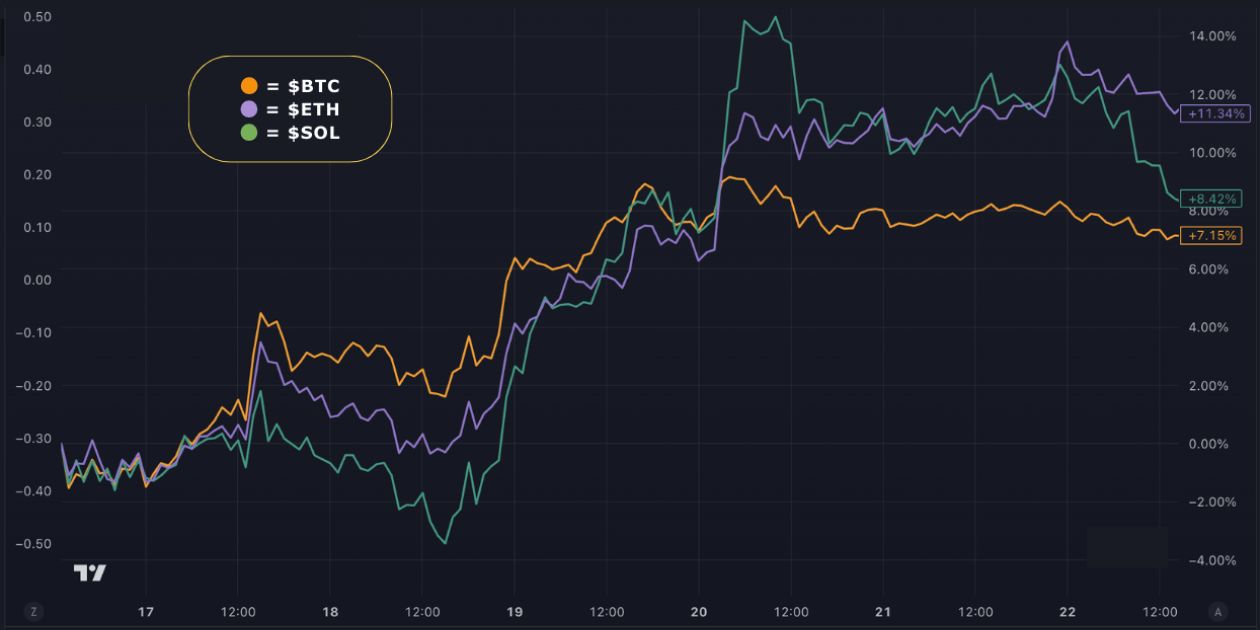

Last week's rate cut announcement provided much-needed fuel for the crypto market, sending prices soaring.

Prior to the news, risk assets like crypto had been underperforming. However, the promise of fresh liquidity entering the market sparked a rally, with Ethereum ($ETH) emerging as the top performer among the majors.

Here's how the majors fared over the past 7 days:

$ETH: +11.34%

$SOL: +8.42%

$BTC: +7.15%

But it’s not just the big players making moves. In the broader crypto space, some projects have seen impressive gains:

$TAO: +55.26%

$IMX: +42.65%

$SUI: +37.33%

$APT: +30.86%

$POPCAT: +25.08%

The winners reflect 2024's key narratives: AI ($TAO), high-throughput layer 2s and gaming ($IMX), high-throughput layer 1s ($SUI, $APT), and memecoins ($POPCAT). While these gains may be short-lived, short-term trend reversals like these could signal the early stages of a broader bull market. A strong start to the week for crypto!

Stay Ahead of the Trend in Digital Assets with Glassnode

Join Glassnode and Access a suite of metrics which describe the foundational components and performance of the Bitcoin blockchain. Metrics cover supply, on-chain activity, transfer volumes, mining performance, and transaction fees.

NEXT 18 MONTHS WILL BRING MASSIVE CRYPTO GAINS

Bitcoin and the broader cryptocurrency market are poised for a major upswing, with the next 18 months expected to deliver exceptional returns.

That’s the latest message out from Raoul Pal.

According to macroeconomic expert Pal, even those with little investing experience could see significant gains in this environment.

In a presentation at Cayman Enterprise City last week, Raoul explained the forces driving this surge.

He highlighted that global liquidity is on the rise as central banks lower interest rates and increase money supply.

This isn't a reflection of assets becoming more valuable but rather a depreciation of fiat currencies.

In such a landscape, Pal believes that the key to outperformance lies in picking the "fastest horse" in the race—and historically, that horse has been cryptocurrency.

Have a listen to a few highlights from Pal’s Keynote speech:

OTHER NEWS:

Parker Lewis of Zaprite in a new piece explores Bitcoin's Exchange Theory of Value, arguing that Bitcoin mainly derives its value through exchange, enhancing its utility as money while facilitating trade and economic activity among participants

Daniel Batten, Bitcoin ESG analyst, argues that measuring Bitcoin's energy use ‘per transaction’ is fundamentally flawed because Bitcoin's energy consumption is independent of transactions, which misleads regulators and environmentalists and distorts the discourse around Bitcoin's scalability in the media

Shinobi critiques Fractal Bitcoin as a misleading project, highlighting its lack of a proper peg mechanism, distorted mining incentives, and the pre-mine structure that benefits insiders at the expense of Bitcoin's security

Blink publishes a real-life story that emphasizes the importance of securing your custodial Bitcoin wallet, highlighting how using email login and two-factor authentication could have prevented a tragic loss of funds

Alex Bergeron, a chaos maximalist, explores how Bitcoin's future in payments may thrive through the innovative ‘fiatless fiat’ model, leveraging the Lightning Network to challenge stablecoin dominance and promote financial sovereignty

Daniel Ramirez-Escudero of Cointelegraph analyzes how Bhutan's $750M revenue from Bitcoin mining presents a compelling model for developing nations, showcasing the potential for economic growth through Bitcoin adoption

Che Kohler of The Bitcoin Manual reviews the Braiins Mini Miner, a compact, energy-efficient, and user-friendly Bitcoin mining device designed for hobbyists and beginners, offering an affordable entry point into pleb mining with minimal setup

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

Cryptosovereignty - Erik Cason

Liberty and Property - Ludwig Von Mises

The Conservative Case For Bitcoin - Mitchell Askew

Debt: The First 5000 Years - David Graeber

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.