Ethereum Rallies 50%

Further Sell Offs Likely

UK Crypto Ad Ban and Exit Tax Horror

Mike Novogratz Lays Out The Crypto Future

And more…

Market Data Prices as of 03:30am ET

This Update Is Brought To You By Bitcoin Well

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

ETHEREUM RALLIES 50%

ETH just blasted through $4,600 for the first time since 2021, as demand from ETFs, treasuries, and institutions crushes available supply.

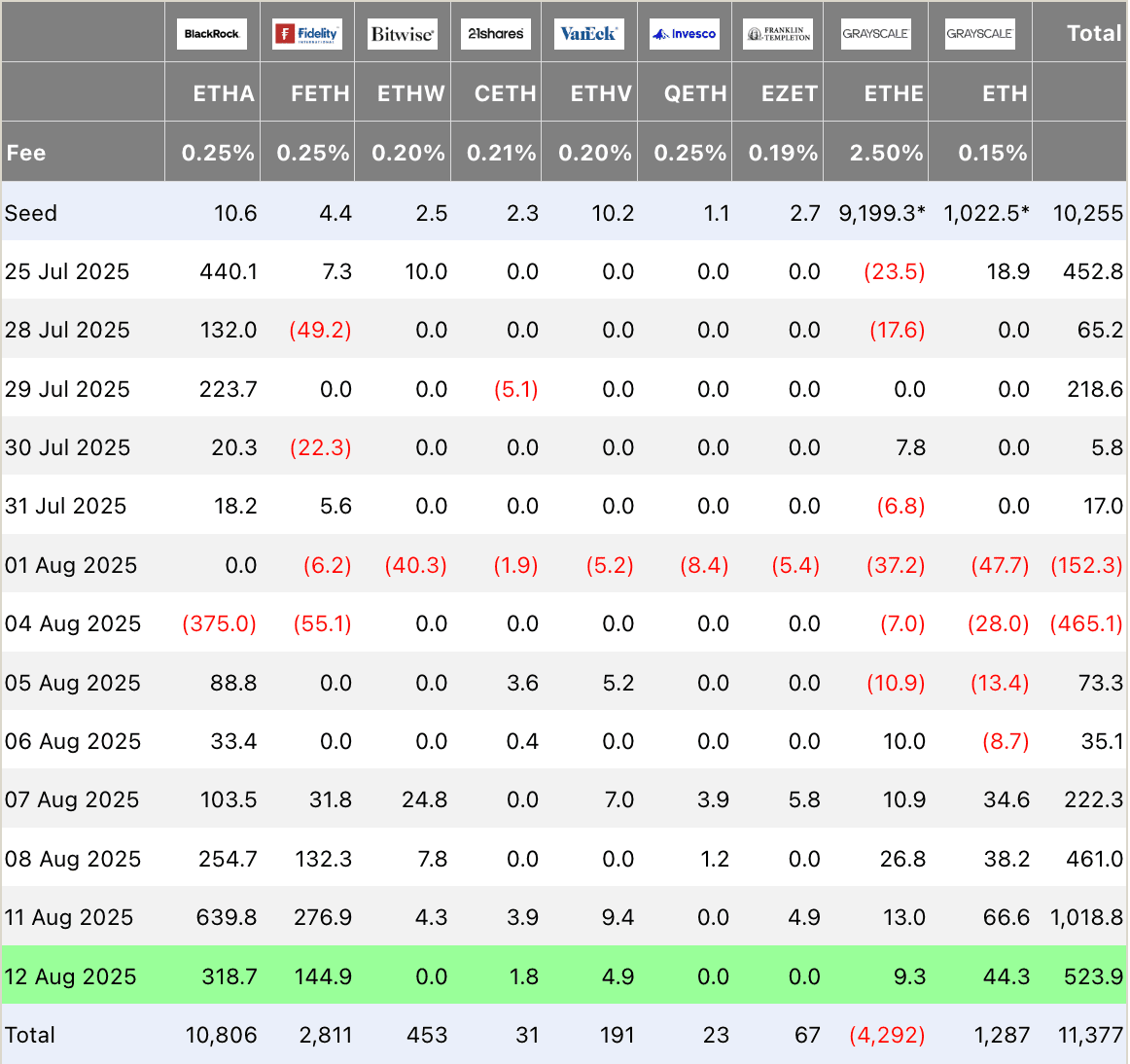

ETF flows are leading the charge: Monday saw over $1B in daily inflows to spot ETH ETFs, with BlackRock pulling in $640M.

Total assets under management now exceed $10B, with only three days of outflows since launch.

Ethereum ETF Flows

The rally has sent ETH up 26% in a week and 50% in a month, leaving Bitcoin in the dust.

Corporate treasuries are a growing force. BitMine Immersion now holds 1.15M ETH (~$5B) and aims for $24.5B in assets.

SharpLink Gaming added nearly $3B in ETH after a $900M raise.

In just four months, treasuries have gone from zero to controlling 8% of ETH’s supply — with analysts expecting 10% soon.

September Rate Cut Odds Now Up To 94.7%

Add in a macro kicker: post-CPI data, Fed rate cut odds for September have surged to 94.7%.

The result?

A historic supply crunch, where ETH is being bought faster than it can be minted.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

BTC WHALES SMASH RECORDS

The battle for Bitcoin dominance is heating up as the digital asset trades at $120,000, only 3% below its all-time high.

Glassnode reports that 18,996 addresses now hold over 100 BTC, the highest figure ever recorded.

This surpasses the February 2017 record and signals a growing concentration of BTC wealth in the hands of large-scale investors.

The surge is largely attributed to corporate treasury strategies, with firms rapidly adding Bitcoin as a reserve asset.

Since Donald Trump’s election win, Michael Saylor’s Strategy has doubled its BTC position, while other companies like Nakamoto and Twenty One Capital have executed or planned massive purchases.

Institutional adoption is accelerating, aided by pro-crypto policies and a rollback of restrictive measures.

With 21 million BTC as the hard supply limit, approximately 19 million mined, and 3 million lost, the available supply is shrinking.

As whales continue to buy aggressively, analysts suggest that price discovery above the current record could arrive sooner rather than later.

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

UK CRYPTO AD BAN AND EXIT TAX HORROR

The UK’s Advertising Standards Agency and major broadcasters have blocked Coinbase’s cryptocurrency ads, signalling increased regulatory resistance to crypto despite global adoption.

At the same time, Lord Ashcroft has warned that wealthy individuals are moving assets offshore to avoid a potential exit tax in October — a trend aligning with predictions from The Sovereign Individual, which foresaw technology empowering individuals to escape state control over money and taxation.

The backdrop is a century of fiat currency devaluation: the British Pound has lost over 99% of its value since 1914, the US Dollar over 97%, and the Swiss Franc more than 90%.

Even the Euro, only launched in 1999, has fallen 40% in just 26 years. For millennia, states have consolidated power through control of money — from Roman emperors to medieval monarchs — but cryptocurrencies threaten this model by offering alternative stores of value beyond government reach.

Meanwhile, the number of UK company directors emigrating has jumped by over 1,000 year-on-year, and thousands of high-net-worth individuals have already relocated to low-tax jurisdictions.

A UK exit tax, imposing capital gains or inheritance-style charges on leavers, could accelerate capital flight, undermining growth.

Unless the UK embraces innovation and competitive tax policy, it risks losing both wealth and economic relevance in an era where the sovereign individual can live, work, and transact anywhere.

Here more about this from Jacob Rees Mogg:

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

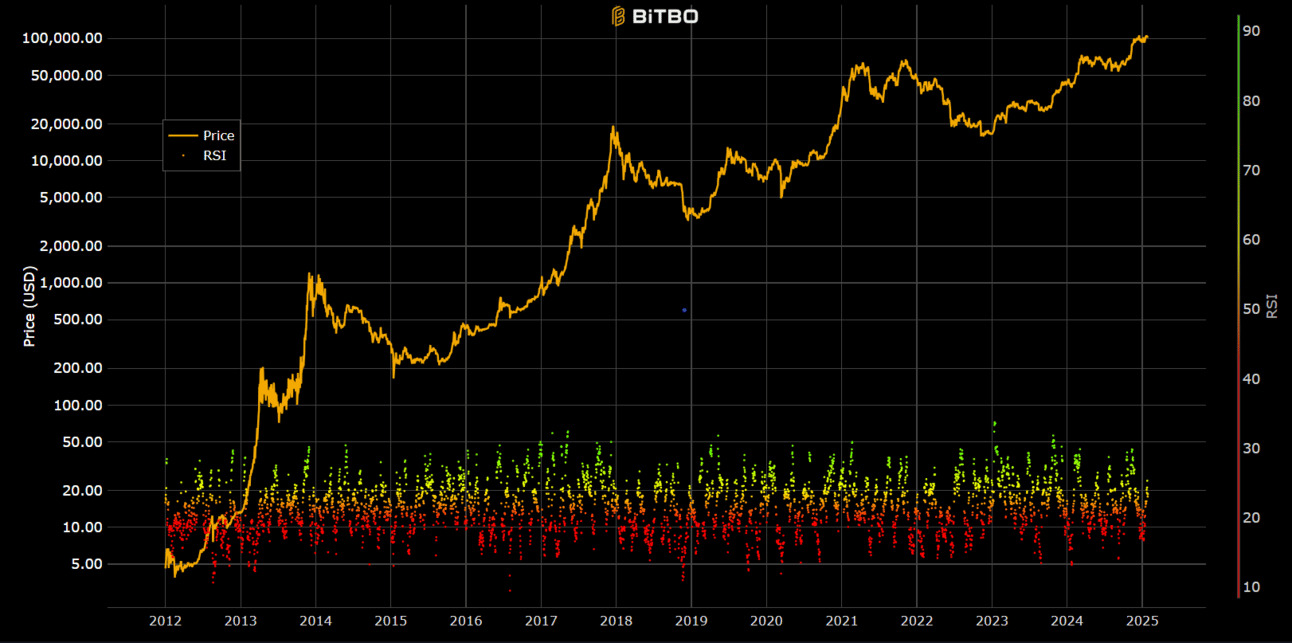

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

DEBT, BTC, ETH AND STABLECOINS NOVOGRATZ MAPS THE FUTURE

Debt, Bitcoin, Ethereum, and Stablecoins: Novogratz Maps the Future

For Mike Novogratz, the link between the macro economy and Bitcoin is simple: more debt equals higher Bitcoin prices.

As long as the US debt-to-GDP ratio climbs, the Galaxy Digital CEO expects BTC to remain on a bullish path.

Ethereum, he says, is telling a different story — one rooted in adoption and utility. Serving as the “base layer of trust,” Ethereum’s role in hosting stablecoins and DeFi applications is attracting large-scale institutional participation.

Publicly traded ETH treasury companies are creating new pathways for investors to earn staking yield and access crypto lending products.

Stablecoins themselves are set to expand beyond trading liquidity into mainstream payments and AI integration. While Circle and Tether dominate now, Novogratz predicts a crowded future market with big banks and tech firms launching their own tokens.

For investors, Circle’s stock — and Coinbase’s 50% USDC revenue share — offer rare public-market exposure to the sector.

Watch the video below to see Novogratz’s outlook for the future of Bitcoin:

OTHER NEWS

🇰🇿 Kazakhstan debuts Central Asia’s first spot Bitcoin ETF, now live on the Astana International Exchange.

🛠️ Bitcoin Core v30 rolls out three contentious updates, expanding arbitrary data limits and puzzling node operators aiming to restrict certain transactions.

⚖️ Do Kwon, co-founder of Terraform Labs, pleads guilty to two felony charges tied to the $40B Terra collapse, facing up to 25 years but likely serving 12 years under a plea deal.

🍔 Steak 'n Shake credits Bitcoin payments for an 11% same-store sales boost in Q2 2025, outpacing major U.S. fast-food rivals.

🔒 GrapheneOS unveils a duress PIN that lets users instantly wipe their phone when forced to unlock it.

⛏️ MARA Holdings, the largest Bitcoin miner by market cap, nears a $168M deal to acquire a majority stake in French AI firm Exaion from EDF.

💰 David Bailey, Bitcoin Magazine CEO and Trump’s Bitcoin advisor, set to make a large BTC buy via Nakamoto Holdings after securing $763M in private funding.

🌞 PowerBank Corporation announces a Bitcoin treasury strategy, backed by its 100 MW renewable energy portfolio.

🏛️ Wisconsin Senate pushes strict Bitcoin ATM rules—full KYC, photo ID, and $1K daily limits—fueling privacy debates.

👮 Jing Yaping, ex–Big Data chief in Guizhou, accused of mining 327 BTC on government servers, faces Party expulsion.

🌱 NY environmental groups urge Governor Kathy Hochul to end delays on the Greenidge Generation permitless Bitcoin mining case.

📈 Sequans Communications adds 13 BTC for $1.5M, bringing total holdings to 3,171 BTC valued near $370M.

🏦 Metaplanet buys 518 BTC for $61M, lifting its stash to 18,113 BTC worth roughly $1.85B.

📊 MicroStrategy adds 155 BTC for $18M, bringing total reserves to 628,946 BTC valued at almost $76B.

🏭 Cango Inc pivots from auto sales to Bitcoin mining with a $19.5M purchase of a 50 MW Georgia facility.

💻 The Smarter Web Company acquires 295 BTC worth $35.2M, now holding 2,395 BTC valued close to $284.8M.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.