Bitcoin Breaks The September Trend

Bitcoin ETF Inflow Surges Past $60BN💥

BlackRock’s Next Move Is So Bullish For Bitcoin

And more…

Market Data Prices as of 5:30am ET

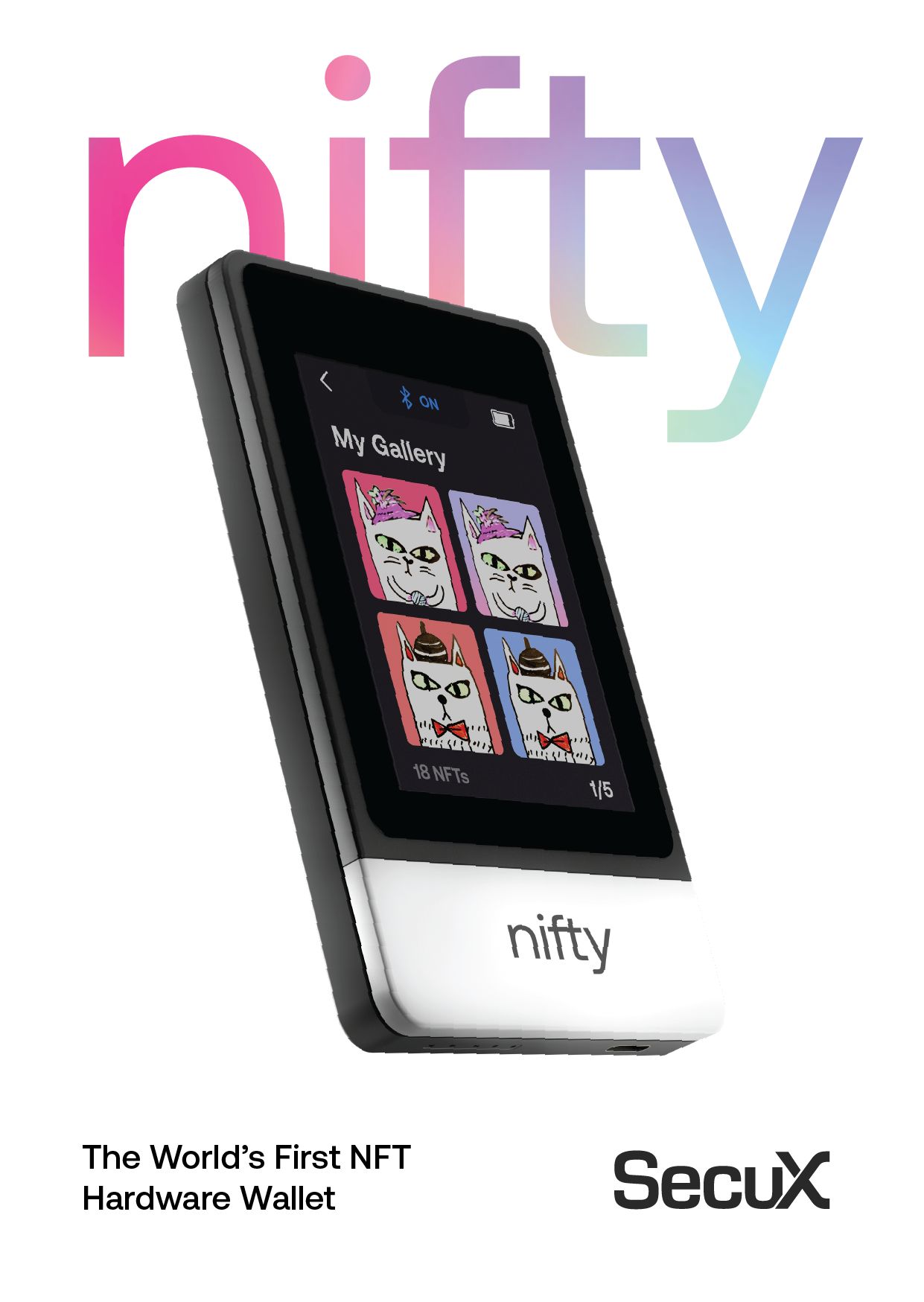

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

BITCOIN PRICE BREAKS

THE SEPTEMBER TREND

Bitcoin finishes September with a 9% increase, its best performance since 2013, setting the stage for a typically bullish October.

September is known as the worst month for Bitcoin price, but 2024 might be a game changer.

Historically, BTC has closed in the red for eight out of the last eleven years during this month (see below). Seasonality refers to the tendency for assets to undergo regular, predictable changes throughout the calendar year.

While these patterns may seem random, they often have logical explanations, such as profit-taking during tax season in April and May, which leads to market drawdowns.

On the other hand, the well-known "Santa Claus" rally in December represents a bullish trend often driven by increased demand toward the end of the year.

However, this year, Bitcoin seems poised to end September with a solid 7% gain, even considering today's price dip.

This bullish performance sets the stage for a potentially explosive October, a month that has consistently been one of Bitcoin's strongest.

While September has seen an average loss of 3.6% since 2013, October has boasted average gains of 23%.

Optimistic traders are now eyeing a potential rally that could push Bitcoin up to $70,000 in the weeks ahead.

Historically, whenever September has closed in the green, Bitcoin has continued to post higher prices through October, November, and December.

BITCOIN ETF INFLOW SURGES PASSED $60BN

Bitcoin ETFs See Major Inflows as SEC Approval Stirs Market

Spot Bitcoin ETFs in the US have recorded seven consecutive days of inflows, with Friday marking the highest single-day inflow in nearly four months.

This surge has pushed the total asset value of these funds to a two-month high of $61.21 billion, as reported by SoSoValue.

Friday's inflows amounted to $494.27 million, led by a massive:

$203.1 million to Ark and 21Shares' ARKB fund.

$123.6 million to Fidelity’s FBTC

$110.8 million to BlackRock’s IBIT

$26.1 million to Grayscale’s GBTC

$12.9 million to Bitwise’s BITB

The total net asset value of these ETFs, $61.21 billion, represents the highest figure since July, closing in on the $61.73 billion recorded on July 29.

With inflows peaking, the market is responding positively to the SEC's approval of BlackRock’s proposal to list options for its spot Bitcoin ETF.

Analysts expect the approval to spark a wave of new filings from other firms, although some warn of the possible downsides, particularly the impact of increased "paper Bitcoin" on the market for the underlying cryptocurrency.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

BLACKROCK’S NEXT MOVE IS

SUPER BULLISH FOR BITCOIN

Last week the SEC granted approval for BlackRock's Bitcoin ETF to list and trade options, making it the first and only Bitcoin ETF with such a distinction.

Grayscale and Bitwise, however, are still awaiting their approvals.

ETF analyst Eric Balchunas has provided insights into why this could be a game-changer.

But what exactly are ETF options? 🤔

In essence, stock options allow investors to buy or sell a stock at an agreed-upon price on a future date.

They come in two varieties: puts (betting the price will drop) and calls (betting the price will rise).

For a deeper understanding of options trading, check out this detailed article from Investopedia.

Mathematician Fred Kreuger believes that there will be a whole load of excitement around bitcoin options, and that's great news for bitcoin's price.

The Options ETF will lead to new ways for people to invest and hold bitcoin, which bodes incredibly well for its future outlook.

The SEC has already given the green light, and now they are just waiting for more regulatory approvals.

Once that happens this latest ETF could be yet another catalyst for an upwards Bitcoin price movement.

Fred Krueger’s video also offers insights into why these options might boost Bitcoin's value.

Make sure to watch to the end of this video where Fred Krueger provides more insight into why he thinks Bitcoin is poised to explode in value.

This is very bullish for Bitcoin.

Analysts predict these options will become wildly popular on Wall Street.

OTHER NEWS:

A Republican-controlled Senate would boost digital assets, according to Sen. Cynthia Lummis. She highlighted Bitcoin-friendly Sen. Tim Scott's potential chairing of the Senate Banking Committee, replacing crypto-skeptic Sen. Sherrod Brown. Lummis emphasized the need for clear regulations over SEC enforcement actions.

CoinTelegraph explores: why is Bitcoin down today? Bitcoin dropped 2.9% to $63,735 as escalating Middle East tensions, including Israel’s bombing of Beirut, spooked investors. Traders are de-risking ahead of U.S. jobs data and Federal Reserve guidance, further dampening risk appetite.

Coinbase re-enters the top 400 most downloaded apps on the U.S. Apple App Store, signaling a Bitcoin retail resurgence. Coinbase hit 385th place on Sept. 28. Coinbase was the #1 app in the Apple App store during the last two bull markets. Traders and investors watch the Coinbase app’s ranking closely.

U.S. spot Bitcoin ETFs saw their largest single-day inflows since June, with $494.27 million added on Friday. Total assets held by these funds hit a two-month high of $61.21 billion. Leading the inflows were Ark and 21Shares' ARKB fund with $203.1 million.

Polymarket predicts a 61% chance of Bitcoin reaching a new all-time high by the end of 2024. However, only 17% believe it will hit $100,000. With BTC currently trading near $63,600, the community remains optimistic about October's potential.

PlanB forecasts Bitcoin's 2024-2028 halving cycle to have a $500K average price, with a range between $250K and $1M. His earlier 2020-2024 projection of $50K averaged at $34K. A hypothetical scenario suggests Bitcoin could hit $1M by July 2025, followed by a drop to $500K.

Michael Saylor predicts 99% of Bitcoin will be mined by January 2, 2035. 2040 is generally the target year for 99% of Bitcoin to be issued. With 94.10% of Bitcoin already mined, Saylor’s forecast suggests a very strong growth in Bitcoin mining activity. If accurate, Bitcoin’s scarcity could increase, potentially driving up its price as demand outpaces supply.

CleanSpark CEO Zach Bradford predicts Bitcoin could peak near $200,000 within 18 months. He emphasized that pure-play Bitcoin miners are underrated compared to AI-diversifying rivals. CleanSpark focuses on efficient mining, holding nearly 8,000 BTC, and plans to use immersion cooling to improve mining efficiency.

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.