Bitcoin’s Fall: An Opportunist Perspective

Ethereum v Celestia Heating Up

XRP Reserve Strategy Sparks Criticism

Trump: Unleashes Bitcoin Boom

And more…

Market Data Prices as of 5:30am ET

This Update Is Brought To You By Bitbo

We are excited to announce Bitbo’s newest trading chart:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

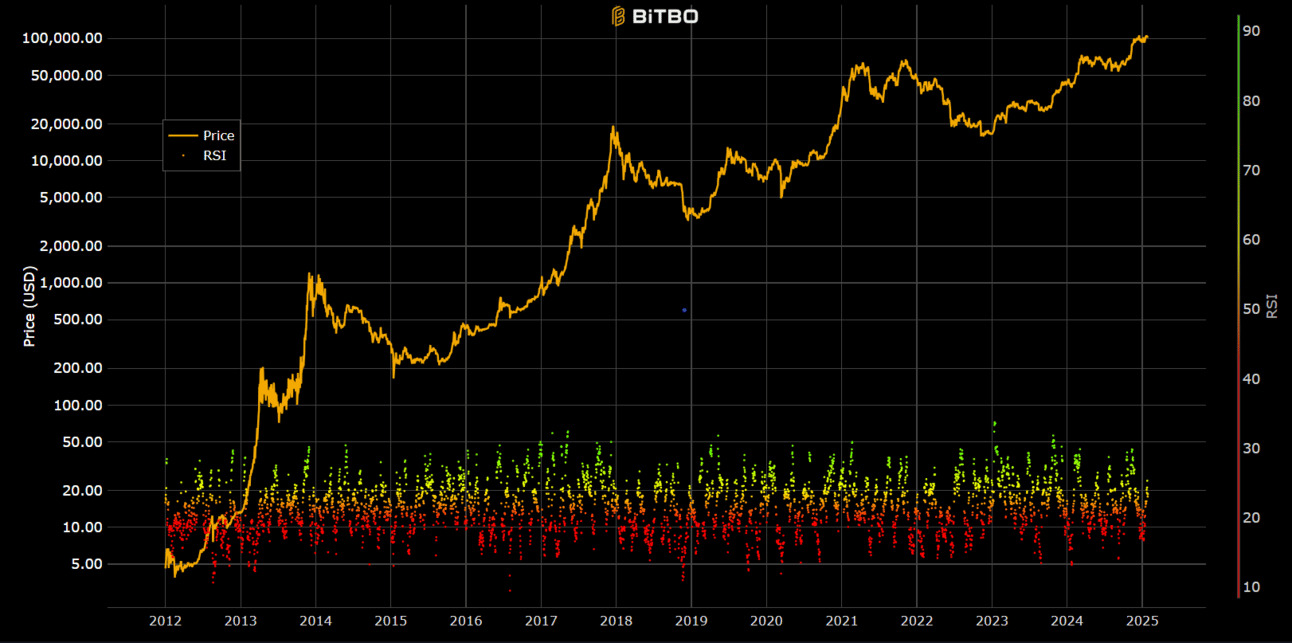

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

BITCOIN’S FALL:

AN OPPORTUNIST PERSPECTIVE

Bitcoin’s Dip: Temporary Panic or Long-Term Gain?

In a dramatic overnight selloff, bitcoin (BTC) tumbled from $105,000 to below $98,000 before recovering to around $100,000.

This sharp decline was mirrored by a 15% drop in Nvidia (NVDA) and a 3% slide in the Nasdaq 100, driven by concerns over DeepSeek’s AI advancements.

While some fear this signals a deeper correction, Geoffrey Kendrick of Standard Chartered Bank sees opportunity.

“Buy the dip, as much of the downside has likely played out,”

Last week, Kendrick forecasted a 10%-20% correction due to high market expectations surrounding Trump’s digital asset initiatives.

Kendrick believes short-term pain could persist due to looming U.S. tech earnings and the Federal Reserve’s meeting results.

However, he cited falling U.S. Treasury yields, now nearing 4.5%, as a sign the worst may be behind us.

Institutional flows, spurred by the administration’s crypto policies, are expected to benefit the sector in the coming months.

Analysts at LondonCryptoClub agree.

They attribute the selloff to a “knee-jerk reaction” to DeepSeek FUD while urging investors to remain cautious amid potential further derisking.

“These events often mark local lows in an otherwise bullish market,”

At time of writing, bitcoin trades at $99,800, down over 4% in 24 hours, while tech-heavy stocks remain under pressure.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

ETHEREUM V CELESTIA HEATING UP

The battle for dominance in the smart contract blockchain space is heating up.

For years, Ethereum and Solana have commanded the spotlight, but now a fresh contender is making waves: Celestia.

If you believe in the app chain thesis—the idea that leading apps or successful fintechs will evolve into their own blockchains—you’re probably rooting for Ethereum.

And honestly, we get it. 😫

Why? Because Ethereum’s vision and roadmap are perfectly aligned with this philosophy. It’s ambitious, exciting, and brimming with potential.

But let’s be real—Ethereum’s journey is far from complete, with its big plans likely requiring years to materialize.

Enter Celestia. 🚀

This rising star in blockchain has the same lofty ambition as Ethereum:

👉 To be the foundation for hundreds or even thousands of interconnected chains, all collaborating to create a seamless user experience.

Here’s the twist—Celestia isn’t waiting.

Its Lazybridging solution is set to launch this summer, outpacing Ethereum’s estimated five-year timeline by a significant margin.

Could Celestia be the true game-changer of the app chain era? Time will tell, but the competition just got a lot more intense.

What’s more, Celestia’s Data Availability (DA) solution is already demonstrating its strength.

Here’s a staggering fact:

Celestia’s DA solution is seeing 1.6x more demand than Ethereum’s.

With 62% of the market share, Celestia has quietly but firmly established itself as the leader in data availability.

Its costs?

An incredible 99x lower than Ethereum’s—a difference that speaks volumes about its efficiency and innovation.

This level of performance highlights why Celestia is quickly gaining ground in the crypto space. The takeaway? It’s time to take notice.

💡 Solana and Sui may have captured attention before, but Celestia is the challenger to Ethereum that truly matters now.

For those looking to stay on the cutting edge of blockchain developments, Celestia is undoubtedly a project worth tracking closely.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

XRP RESERVE STRATEGY SPARKS CRITICISM

Jack Mallers Targets Ripple, Accuses Them of Undermining Bitcoin's Strategic Role

Prominent Bitcoin advocate Jack Mallers recently criticized Ripple, claiming the blockchain company is doing "everything they can to destroy the USA’s bastion of strategic Bitcoin reserves."

Mallers alleged that Ripple is spending millions of dollars on corporate lobbying, presenting it as technological progress.

In a fiery statement on social media, he described these efforts as a direct threat to the United States’ financial freedom and economic stability.

Mallers’ main concern revolves around Ripple’s push for a crypto reserve that isn’t exclusively Bitcoin-based. Instead, it incorporates other tokens such as XRP, USDC, and Solana.

This strategy has reignited debates within the crypto community. Bitcoin maximalists argue that Ripple’s move is an attempt to dilute Bitcoin’s dominance as the ultimate reserve asset.

Mallers criticized this as a "shrewd manipulation" that prioritizes Ripple’s corporate agenda over the decentralized and secure principles of Bitcoin.

According to Mallers, Ripple’s actions threaten to undermine American prosperity and freedom.

He accused the company of "spending millions of dollars actively trying to stop a strategic Bitcoin reserve in America."

Mallers’ criticism echoes sentiments from other prominent crypto figures, including Ryan Selkis.

Selkis recently accused Ripple of deliberately opposing the idea of a Bitcoin-only reserve and targeting Bitcoin’s standing as the bedrock of a U.S. strategic reserve.

He even called out Ripple’s leadership, including CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty, for allegedly coordinating efforts to shift the focus away from Bitcoin.

The ongoing tension highlights a growing rift within the crypto industry about what role Bitcoin and other cryptocurrencies should play in the broader financial system.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

TRUMP UNLEASHES BITCOIN BOOM

During a crypto and digital assets panel at the World Economic Forum in Davos, Coinbase CEO Brian Armstrong and Skybridge Capital's Anthony Scaramucci explored the potential impact of the administration's crypto-friendly policies.

Armstrong highlighted the U.S. government's commitment to establishing a strategic Bitcoin reserve, suggesting that this move could set a precedent for other G7 nations.

He emphasized how such initiatives could foster widespread adoption of cryptocurrencies and bring much-needed regulatory clarity to the industry.

Scaramucci echoed these ideas, underscoring the importance of progressive policies in shaping the global financial landscape.

He pointed out how these efforts could position the United States as a leader in the crypto space, driving innovation and attracting investment on an international scale.

Watch highlights from Brian Armstrong’s latest interview below:

OTHER NEWS

Petrobras, the Brazilian oil giant, unveils a project to utilize excess natural gas for Bitcoin mining, aligning with its decarbonization strategy.

Rosseti, Russia's largest electricity grid operator, plans to leverage underutilized energy centers for Bitcoin mining, aiming to boost tariff revenues and tax contributions.

Pierre Rochard calls for a comprehensive supply audit of Ripple's XRP ledger, questioning whether anyone has thoroughly analyzed the figures.

Michael Saylor teases another Bitcoin purchase, sharing the Bitcoin tracker for the 12th consecutive week.

MicroStrategy acquires 10,107 Bitcoin for $1.1B, raising its total holdings to 471,107 BTC after 12 weeks of consistent buying.

Elon Musk withdraws support for Roger Ver's pardon, referencing Ver's renounced U.S. citizenship amid ongoing extradition proceedings for alleged tax evasion.

Bitcoin mining sees its first difficulty drop in four months due to tight profit margins and a slowdown in institutional hash power growth.

Poland surpasses El Salvador in global Bitcoin ATM count, securing the position as the fifth-largest hub for Bitcoin ATMs worldwide.

Ray Youssef, CEO of NoOnes, confirms an $8M exploit, validating findings from on-chain investigator ZachXBT.

The Bank of Japan raises interest rates to a 17-year high following December's fastest price increase in 16 months.

MicroStrategy could face taxes on $19B unrealized Bitcoin gains under the corporate alternative minimum tax, despite never selling any BTC.

MicroStrategy announces a $1.05B debt buyback, addressing concerns about potential tax implications on its Bitcoin holdings.

Michael Saylor introduces $STRK, a new convertible preferred stock offering by MicroStrategy targeting institutional and select retail investors.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.