Bitcoin Price Under Short Term Threat

This is When Bitcoin Will Reach $100K

Crypto DevOps Ahead of the Internet for the First Time

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $57,879 | -3.85% | +37.73% |

Ethereum (ETH) | $3,165 | -4.16% | +38.42% |

This Update is Brought to You By Glassnode

Stay Ahead of the Trend in Digital Assets

Metrics cover supply, on-chain activity, transfer volumes, mining performance, and transaction fees.

BITCOIN PRICE UNDER SHORT TERM THREAT

Repeated Bitcoin Transfers to Centralized Exchanges Suggest Government Plans to Sell $2.75 Billion in BTC Holdings

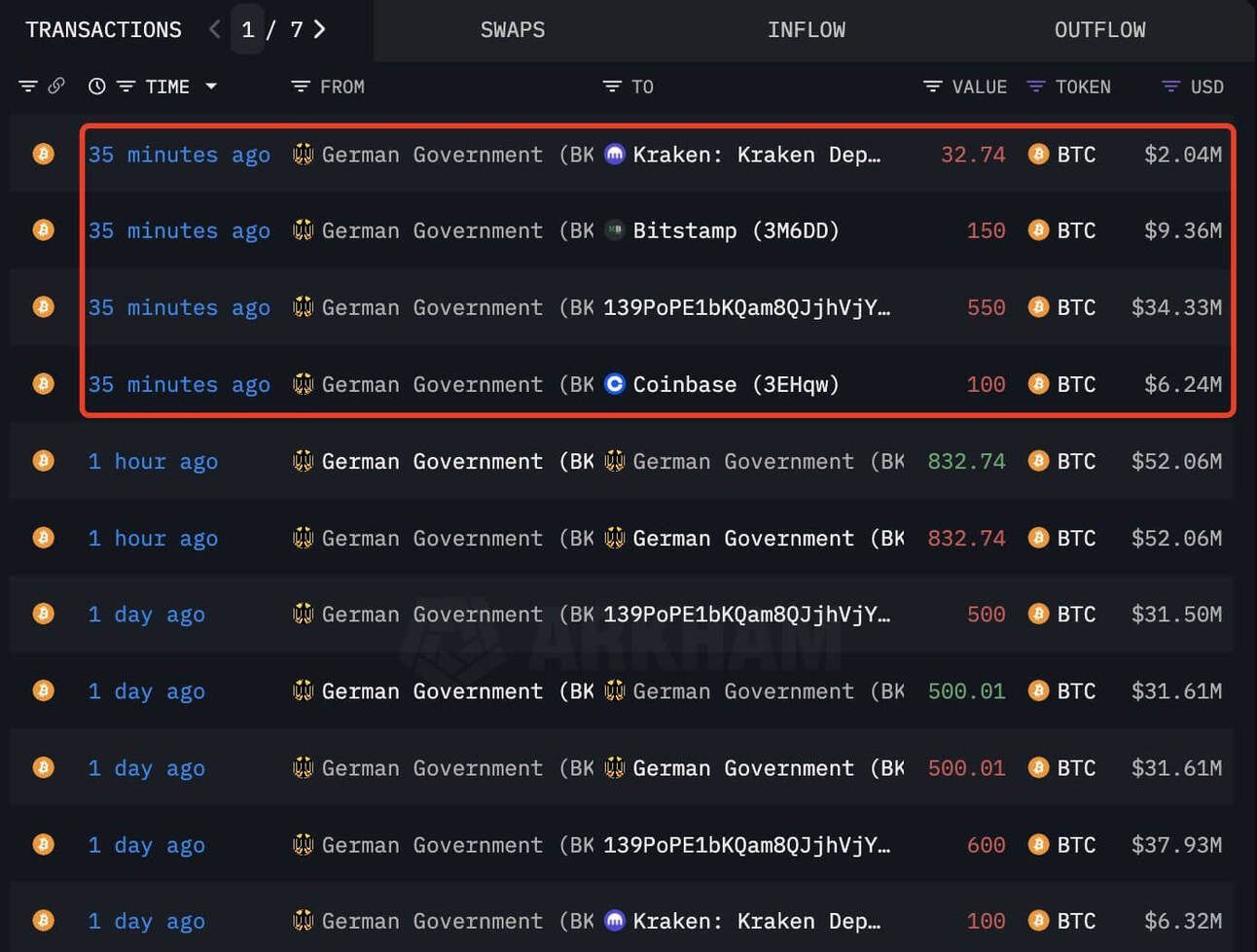

A wallet tagged as “German Government (BKA)” has just transferred another $52 million in Bitcoin, sparking speculation about a possible large-scale liquidation of the government's BTC holdings.

On July 2, the wallet moved 832.7 BTC in four transactions: 100 BTC to Coinbase, 150 BTC to Bitstamp, and 32.74 BTC to Kraken, according to data from Arkham Intelligence.

The largest transfer, 550 BTC worth over $32 million, was sent to the address “139Po,” which has a history of receiving Bitcoin from the German government, including 500 BTC on June 25 and 800 BTC on June 20.

The actions of large Bitcoin holders are often monitored closely by investors, as their selling patterns can create downward price pressure on Bitcoin.

Excluding the substantial $32 million transfer, the remaining Bitcoin was directed to centralized exchanges.

This move hints at a possible sale of Bitcoin by the German government.

Coupled with the Mt. Gox distributions starting this month, we may be in for a bit of downward price pressure in the short-term. (check our article on Mt. Gox here)

The best crypto app to secure your tokens: Ledger

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

These wallets physically store your private keys within a chip inside the device itself.

The beauty of using a crypto wallet is the security it provides to your private keys.

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys

THIS IS WHEN BITCOIN WILL REACH $100K

$100,000 by the end of the year.

And a top of $200,000 - $300,000.

That’s the prediction from investing expert Larry Lepard.

Introducing Larry Lepard

Larry is:

The Founder & Managing Partner of Equity Management Associates

A Harvard graduate with 40 years of finance experience.

A strong advocate for sound money (money that cannot be printed).

In a recent interview, Larry explained why he is confident about Bitcoin.

Larry explained:

“If one is trying to protect ones savings, one has to be in assets that the government can’t print. The government can’t print gold, silver & Bitcoin. The government can’t print stocks, but guess what, companies can print stocks, they can issue more shares.”

Larry is passionate about sound money. His Twitter handle is:

Previously, Larry’s focus was on gold and silver. Now, he’s all about Bitcoin. 👀

“Bitcoin is a better asymmetric bet than gold. I think gold will protect your purchasing power. Bitcoin will grow your purchasing power.”

Larry highlights the difference:

Gold is analogue sound money

Bitcoin is digital sound money

In a recent interview, Larry shared his price targets for this cycle:

“I’m hard-pressed to see how we’re not at $100,000 by the end of 2024. And I think this cycle takes us to $200,000 or $300,000.”

Watch the full interview here:

Larry isn’t concerned with the short-term price fluctuations of Bitcoin. He views this as a long-term investment. He’s not looking to sell soon and considers any dips as chances to buy more “cheap” Bitcoin.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

CRYPTO DEVOPS AHEAD OF THE INTERNET FOR THE FIRST TIME

The digital asset industry is on the brink of a significant growth phase, showing considerable advancement from its state two years ago.

That’s according to a quarterly Crypto M&A Financing report by Architect Partners.

The first half of this year saw the crypto industry value soar by over $750 billion.

This growth was propelled by an increase of more than $700 billion in the value of crypto tokens, the launch of spot bitcoin (BTC) exchange-traded funds (ETFs) in the U.S. which garnered upwards of $15 billion, and the appreciation of publicly listed crypto companies contributing an additional $11 billion.

The report emphasized the similarities between crypto and the internet as disruptive technologies.

Notably, the cryptocurrency market is recovering from the crypto winter at a much faster rate than the internet did after the dot-com bubble burst in 2000.

OTHER NEWS:

Polkadot community unhappy with heavy treasury spend. They spent $37M on marketing (43% of their $87M total H1 2024 spend). Critics argue the hefty spending exerts significant selling pressure on markets.

Ethereum poised to outshine Bitcoin after spot ETH ETF Launch. Experts foresee Ethereum outperforming $BTC, as Bitcoin contends with $8.5 billion in selling pressure from Mt. Gox repayments. Looks like ETH is ready to flex its muscles!

Blast allocates 10 billion tokens in phase 2 rewards.The Ethereum Layer 2 rewards will be distributed over the next 12 months to support mobile dapp development and user incentives. Rewards are split evenly: half in Blast Points, half in Blast Gold.

Decentralized AI network Bittensor halted after $8M hack dropping it’s value by 13%. The theft was discovered due to a potential private key leak, and the network is in "safe mode" while investigations continue.