New Bitcoin ATH?

Bitcoin Fund Sees $875M Inflows as Crypto Soars

Tracking Market Tops and Bottoms

And more…

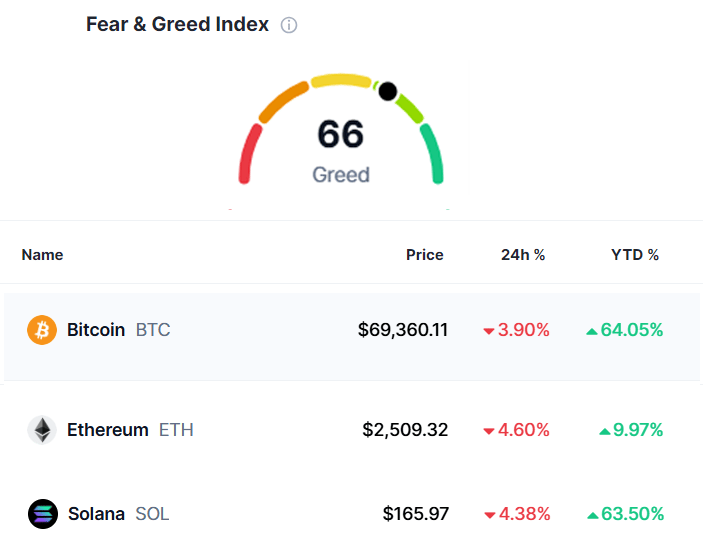

Market Data Prices as of 3:30am ET

This Update is Brought to You By Bitbo

We Are Excited to Announce the Release of Bitbo’s Newest Chart

Satoshi Nakamoto’s net worth:

This chart simply tracks the value of Satoshi Nakamoto’s bitcoin in USD

NEW BITCOIN ATH?

After teasing a record high, Bitcoin has settled into a relatively narrow trading range.

The cryptocurrency has fluctuated between $71,150 and $72,500, reaching just below $70,000 at time of writing.

In the U.S. afternoon on Wednesday, BTC climbed to over $73,500.

Meanwhile, the broader digital asset market remains subdued, experiencing a modest gain of just under 0.9% in the past 24 hours.

Notably, ETH saw a rise of about 1.15%, while SOL faced a decline of over 2.5%.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

BITCOIN FUND SEES $875M INFLOWS AS CRYPTO SOARS

On Wednesday, BlackRock’s spot Bitcoin ETF (IBIT) recorded impressive inflows of $875 million, according to data from CoinGlass.

This was the highest inflow day for IBIT since it launched on January 11.

This new total surpasses the former record of $849 million set on March 12, according to Farside data.

It also marked the 13th consecutive inflow day for IBIT, accumulating around $4.08 billion during this time.

Traders, such as noted crypto trader Trading Axe to their 70,300 X followers, are speculating that a billion-dollar inflow day may soon occur:

“I remarked billion-dollar inflows; it was NOT a joke,”

Additionally, crypto trader Cozy The Caller expressed to their 164,100 followers that it is going to be:

“Above 1B the day we surpass ATH for sure.”

BlackRock's performance overshadowed the other 10 US-listed spot Bitcoin ETFs, which brought in a total of $21.3 million in inflows.

The Fidelity Wise Origin Bitcoin Fund secured the second position with $12.6 million, while the Bitwise Bitcoin ETF experienced outflows totaling $23.9 million.

As of the publication date, Bitcoin (BTC) was priced at $72,410, just 1.7% lower than its all-time high of $73,679, reached on March 13.

The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

TRACKING BITCOIN MARKET

TOPS AND BOTTOMS

The Thermocap multiple chart provides crucial insights into the Bitcoin ecosystem by displaying the ratio of cumulative mined BTC (derived from the block subsidy) against its USD value, starting from the inception of Bitcoin to the current day.

To calculate the Thermocap, we examine the coinbase transaction of each block (note that this calculation has no relation to the the crypto exchange Coinbase), which includes the miner reward and transaction fees issued.

By multiplying the miner rewards by the Bitcoin price at the time of minting, we can determine the total outflows to miners, effectively representing their collective earnings.

The chart features two significant lines:

The Bitcoin price on any given day (measured on the right).

The Thermocap multiple for that day (measured on the left).

Investors can leverage the Thermocap multiple chart to anticipate the when the bull market is likely to end.

Historically, these markets tend to peak when the Thermocap multiple exceeds 400 * 1e-8.

In other words, when the yellow line in the chart below pushes over the Thermocap Multiple of 400.

In the visual you can see clearly how this rise tends to coincide with Bitcoin price highs.

To reach this threshold today, Bitcoin's price would need to soar to approximately $263,807.59.

Currently, the Thermocap multiple hovers just above the 0.0000015 mark.

This indicates that a 270% increase in this ratio is required to match levels previously observed during market blow-off tops.

Therefore, it suggests that we are some distance from the peak of the bull market yet and could see considerable upward price movement before concluding this cycle.

Follow The Link Below To View a Free Version of The Thermocap Multiplier:

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

Cryptosovereignty - Erik Cason

The Sovereign Individual - James Dale Davidson and Lord William Rees Mogg

Contributions to Philosophy (Of The Event) - Martin Heidegger

Liberty and Property - Ludwig Von Mises

Concept of the Political - Carl Schmitt

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.