Bitcoin Dips To $90K

Meta Shareholder Calls For BTC Treasury

Bitcoin Difficulty Reaches ATH

Seized Silk Road Bitcoin - All You Need To Know

And more…

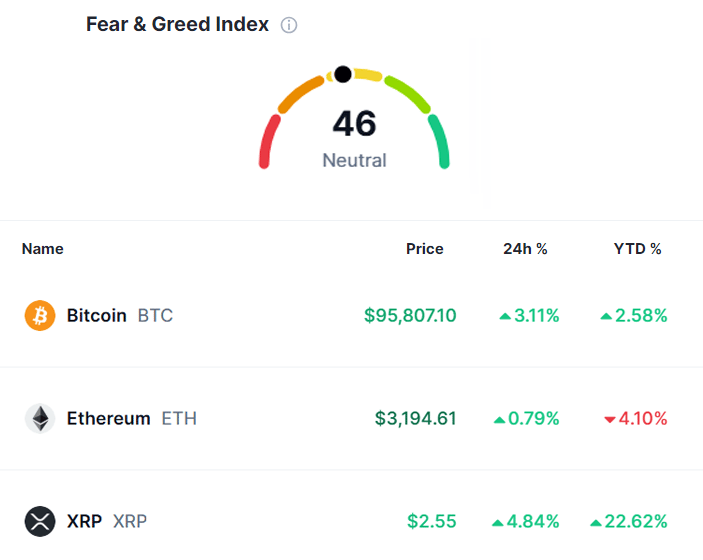

Market Data Prices as of 4:00am ET

This Update Is Brought To You By Glassnode

Bringing Unparalleled Insights Into Digital Assets:

Glassnode's expertise in on-chain data gives you a multi-layered view of core digital assets.

📈Understand novel asset fundamentals

⚡Follow capital flows with precision

💡Gauge true market sentiment

Glassnode empowers investors and researchers with blockchain and market intelligence, enabling users to uncover the key drivers of Bitcoin, Ethereum, and beyond.

BITCOIN RALLIES TO $95K

Bitcoin started the new week with a sharp decline as major investment banks recalibrated their expectations for Federal Reserve rate cuts in light of the strong jobs report released on Friday.

BTC dipped to $90,500 late in the European morning yesterday, marking a drop of over 4.4% compared to Friday.

The broader digital asset market, tracked by the CoinDesk 20 Index, saw a decline of around 3%, with major tokens showing red across the board.

Meanwhile, in traditional markets, futures tied to the S&P 500 fell by 0.3%, extending Friday’s 1.5% drop, which pushed the index to its lowest level since early November.

The dollar index climbed near 110 for the first time since late 2022, as elevated Treasury yields continued to drive its gains.

Since then however, Bitcoin has rallied to back over $95,000 at time of writing, signalling resistance.

It’s the final week before Trump takes office and we’re all holding our breath, hoping he can turn around this short-term market slump.

With that in mind, here are a couple of items to look out for this week:

1/ Macro 📊

Good news! This week we get a welcome break from obsessing over CPI and PPI data. While there are still some reports to pay attention to:

Tuesday brings the December PPI data, showing how much the cost of production has shifted.

Wednesday releases the December CPI data, giving us insight into household costs.

Thursday we’ll see how well retail sales performed in December, reflecting the festive spending mood.

However, unless there’s a drastic change in these figures, expect no surprises from the Federal Reserve’s interest rate decisions.

It’s been clear for some time now: rates are likely to stay steady.

2/ Earnings Season 💣

Ready to see the earnings BlackRock pulled in last quarter after Bitcoin hit new all-time highs?

On Wednesday, we’ll get that and more, with reports from key financial players.

META SHAREHOLDER CALLS

FOR BITCOIN TREASURY

Ethan Peck, a shareholder in Meta, has proposed a bold move to safeguard the company's $72 billion cash reserves from inflation by allocating part of the funds into Bitcoin.

The idea is to create a financial strategy that not only combats the eroding effects of inflation but also increases shareholder value through exposure to cryptocurrency.

The proposal, put forth by Peck on behalf of his family’s Meta holdings, was shared by analyst Tim Kotzman on social media platform X.

Peck argues that Bitcoin presents an opportunity for Meta to lead in the tech and finance sectors by taking a proactive role in shaping the future of institutional cryptocurrency adoption.

Peck highlighted that approximately 28% of Meta’s cash reserves are vulnerable to inflation, a scenario further compounded by underperforming bond yields.

He suggests replacing a fraction of these reserves with Bitcoin to protect the company’s assets and deliver superior returns in the future, despite Bitcoin's inherent short-term volatility.

Peck calls Bitcoin "the most reliable hedge against inflation" in today's financial climate.

Peck's proposal also stresses that Meta could follow the lead of major investors like BlackRock, which has already made Bitcoin a cornerstone of its treasury strategy.

He recommends a 2% allocation, similar to BlackRock’s approach, pointing to Bitcoin's stellar growth, which has outpaced traditional assets like bonds by an impressive 1,265% over the past five years.

By adopting Bitcoin, Peck believes Meta would not only mitigate inflation risk but also position itself as an institutional leader in cryptocurrency, ensuring long-term financial success for its shareholders.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

BITCOIN DIFFICULTY REACHES ATH

BREAKING: Bitcoin Difficulty Surge Reflects Growing Hashrate, Signals Possible Market Shifts

Bitcoin: Difficulty Adjustment Percent Change

Bitcoin’s difficulty adjustment has reached a new all-time high of 110.45T, as the hashrate continues to rise.

This marks the eighth consecutive positive adjustment in difficulty, signaling increasing pressure on miners as it becomes harder to mine Bitcoin blocks.

What to know:

The Bitcoin difficulty has adjusted positively for the eighth consecutive time, corresponding with a rise in the hashrate.

The last two instances where we saw this many consecutive positive adjustments were in the bear market of 2018 and the bull market of 2021.

Notably, such long streaks of consecutive positive adjustments often occur near cycle tops and bottoms.

The difficulty level now stands at 110.45 trillion, meaning it is 110.45 trillion times harder than when Bitcoin's genesis block was mined.

This recalibration of difficulty occurs every 2,016 blocks to ensure that blocks are mined every 10 minutes on average.

As difficulty rises, miners face greater challenges.

This has pushed some publicly traded mining companies to explore other industries, such as high-performance computing (HPC) and artificial intelligence (AI), to diversify their revenue streams.

MARA Holdings (MARA), for example, has issued convertible bonds to purchase Bitcoin and even lends out its holdings for yield optimization.

Interestingly, this isn’t the first time Bitcoin has experienced such consecutive positive adjustments.

During the summer of 2021, shortly after the China mining ban, the hashrate dropped by 50%.

Bitcoin: Difficulty Adjustment Percent Change

Following this event, Bitcoin went through a streak of nine consecutive positive adjustments, with the last one coinciding with Bitcoin’s bull market top at $69,000.

The 2022 bear market followed shortly after that.

We also saw similar patterns in 2018, when Bitcoin experienced 17 positive adjustments, with the last one marking the bull market top at $20,000.

Following a brief negative adjustment, the network continued its positive streak before reaching its bear market bottom at $3,000.

Bitcoin: Difficulty Adjustment Percent Change

While there is no clear trend regarding what these adjustments predict, the continued strength of the hashrate is noteworthy.

The 7-day moving average has reached 775 EH/s, and research suggests that 1 zettahash per second could be reached before the next Bitcoin halving.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

SEIZED SILK ROAD BITCOIN

- ALL YOU NEED TO KNOW

The US government has recently received approval from the US District Court for the Northern District of California to liquidate 69,370 bitcoins (BTC) seized from "Individual X" tied to the infamous Silk Road operation.

This court ruling, made public on December 30, 2024, affirmed that the Battle Born Investments Company’s request to block the sale was denied.

Despite the announcement, confusion spread quickly across the crypto community due to the timing of the news.

Many misunderstood the ruling to mean the BTC had already been sold, but that is not the case.

The court ruling only granted permission for the government to proceed with the sale—it did not indicate that the sale has taken place yet.

The US Department of Justice (DoJ) still holds the 69,370 BTC, and it’s easy to confirm that these coins have not been sold through on-chain data.

Administrative steps are still required before the DoJ can proceed with selling the coins.

The announcement’s timing coincided with a brief dip in Bitcoin’s price, causing a 1.5% drop, which led to market speculation.

However, as of now, the seized BTC remains in government custody, with no sale imminent.

BTC’s price dropped from $94,900 at 9:06 PM to $93,439 by 9:12 PM, reflecting a $27 billion loss in market value.

In this complex legal battle, Battle Born Investments has also tried to assert ownership of the BTC, citing a claim that they purchased the coins from a bankruptcy estate associated with Raymond Ngan, believed to be Individual X.

However, the government denied their Freedom of Information Act (FOIA) request, preventing them from confirming their suspicions about Ngan's involvement.

In a related note, the US government has a history of selling Silk Road-related BTC.

Earlier, in March 2024, it transferred 2,000 BTC to a Coinbase wallet, and the US Marshals sold 9,861.17 BTC in March 2023.

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

OTHER NEWS

Pierre Poilievre, a Bitcoin Advocate, Tops Polymarket Predictions for Canada’s Next Prime Minister

Canadian Forum Admin Escapes ‘Kidnap-for-Bitcoin’ Scare

Chile Explores Building a Strategic Bitcoin Reserve with Push from Lawmakers

Czech National Bank Mulls Adding Bitcoin to Its Foreign Reserves Portfolio

Fidelity's New Report Forecasts Countries Will Begin Accumulating BTC to Offset Fiat Currency Struggles

Court Orders Bitcoin Investor to Relinquish Access to His Private Keys

Bhutan’s Special Region to Integrate Bitcoin into National Reserves Strategy

Phuket Set to Embrace Bitcoin as Thailand’s Crypto Plans Unfold in 2025

Oklahoma Senator Proposes Bill to Permit Bitcoin as a Legal Payment Method

Nick Szabo, Cypherpunk Icon, Appointed Chief Scientist at JAN3 to Drive Hyperbitcoinization

UK Court Dismisses $750M Bitcoin Landfill Retrieval Lawsuit

Standard Chartered Strengthens Its Position in the EU's Bitcoin and Crypto Market

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.