Bitcoin Holds Steady

Trump Wants Bitcoin ETF

The US States Leading The Bitcoin Revolution

How To Spot The Next Big Trade💰

And more…

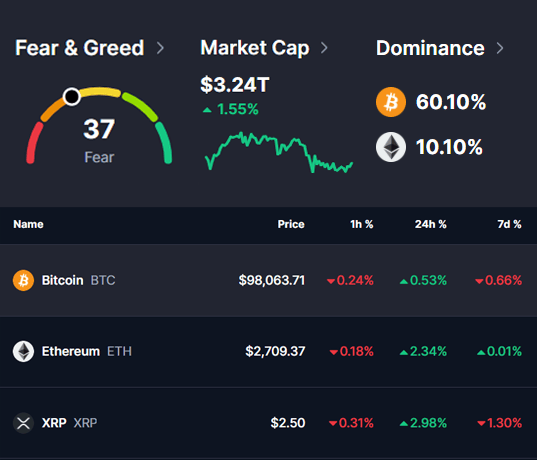

Market Data Prices as of 5:00am ET

This Update Is Brought To You By Bitbo

We are excited to announce Bitbo’s newest trading chart:

This chart analyzes the slopes of the two Pi Cycle Top moving averages—the 111-day moving average (111DMA) and twice the 350-day moving average (350DMA x2)—over the past 10 days.

Using this data, it projects their future trajectories to estimate when these lines might cross.

The extrapolation extends until the two lines intersect, potentially signaling an estimated future date for a Pi Cycle Top.

BITCOIN HOLDS STEADY

Bitcoin is maintaining its stability even as global foreign exchange risk indicators, such as AUD/JPY, show resilience amid expectations of further tariff hikes by President Donald Trump later yesterday.

This is in stark contrast to the risk aversion seen last week when Trump initiated the first round of tariffs.

Market analysts suggest that traders may believe Trump's aggressive stance is more of a negotiation tactic rather than a commitment to prolonged trade barriers.

This perspective gained traction after last Monday’s decision to temporarily suspend tariffs on Mexico and Canada for 30 days, hinting at a more strategic trade approach.

QCP Capital notes that the current market stability might encourage Trump to take an even firmer stance.

"A feedback loop is developing — Trump, who is highly reactive to market signals, may feel emboldened by a market that appears to be calling his bluff, potentially increasing volatility," QCP stated in a Telegram update.

According to Glassnode, Bitcoin’s 2025 market cycle is shaping up to be atypical, driven by deep liquidity and increasing institutional adoption. Since the 2022 market lows, Bitcoin’s market capitalization has surged 5.3x, surpassing the 4.7x growth seen in the altcoin market.

The rise of institutional inflows, the launch of Bitcoin ETFs, and Bitcoin’s role as a monetary hedge have fueled its dominance, which climbed from 38% to 59%. In contrast, altcoins have struggled to keep pace due to weaker investor confidence and a less favorable risk appetite.

This trend underscores Bitcoin’s growing position as the preferred store of value in the evolving financial landscape.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

TRUMP WANTS BITCOIN ETF

Picture this: Your friend pitches you three business ideas…

🐶 A puppy mill

👜 Purse snatching

🎰 A gambling platform

Weirdly, the gambling idea doesn’t sound so bad anymore, right?

That’s how Trump’s "Bitcoin Plus ETF" feels in comparison to his past crypto ventures.

🚨 Is it shady? Maybe.

💰 Is it less shady than pushing memecoins where insiders hold 80% of the supply?

Absolutely.

And honestly, having a former (or future?) U.S. president pushing Bitcoin ETFs? Probably good for crypto adoption overall.

So what’s going on?

1/ Trump’s Bitcoin ETF Plans Are Taking Shape

His company, Trump Media and Technology Group (TMTG), has filed trademarks for:

🔹 "Made In America"

🔹 "U.S. Energy Independence"

🔹 "Bitcoin Plus"

What might these ETFs include?

Made In America – Trump-friendly U.S. stocks

U.S. Energy Independence – Oil & nuclear companies

Bitcoin Plus – A crypto-heavy portfolio, likely dominated by $BTC

2/ Solana ETF: Finally Getting Attention

For the longest time, the SEC ignored any mention of $SOL ETFs.

But look what just happened..

Now, they’re actually engaging with issuers. That’s a big deal.

⏳ Final decision deadline: October 11, 2025 (unless the SEC drags it out).

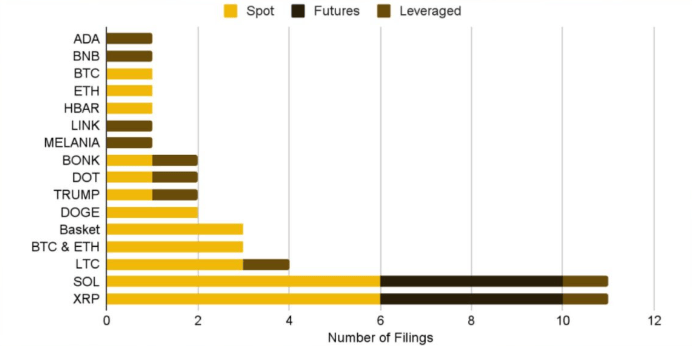

3/ ETF Filings Are Flooding In

Would you invest in a leveraged $ADA, $TRUMP, or $MELANIA ETF?

Like it or not, ETF applications are surging.

Here are the number of ETF application since January 31:

Not all will be approved. Some are straight-up dumb. But any increase in crypto exposure to institutions = a net win.

🚀 The ETF boom is happening. The question is: who benefits?

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

THE US STATES LEADING THE BTC REVLUTION

Breaking: The United States of Bitcoin? These States Are Considering BTC Reserves

Bitcoin adoption is accelerating, and while Trump’s team is “studying” a national Bitcoin reserve, several U.S. states are already taking action.

Since election day, multiple states have begun pushing for their own strategic Bitcoin reserves.

Here are three of the most significant:

Texas: A Bold Move Toward a Bitcoin Reserve

The second-largest economy in the U.S. recently introduced a Bitcoin bill proposing a state-held BTC stockpile.

One key aspect? The Bitcoin must be held for at least five years.

“A strategic Bitcoin reserve aligns with Texas’s commitment to fostering digital asset innovation and providing financial security to Texans.”

The proposal even allows Texans to donate Bitcoin to the state fund, helping grow Texas’s BTC treasury. However, details on the state’s investment amount remain unclear.

Florida: A Potential $1.5 Billion BTC Investment

The fourth-largest economy in the U.S. is also joining the Bitcoin reserve conversation.

Senator Joe Gruters has introduced a bill allowing Florida’s Chief Financial Officer to allocate up to 10% of certain public funds into Bitcoin.

“Florida has always been a leader in financial innovation, and this proposal ensures we stay ahead of the curve by embracing digital assets in our investment strategy.”

With a $14.6 billion total reserve, a 10% Bitcoin allocation could mean a $1.5 billion BTC investment.

Pennsylvania: Aiming for a $1 Billion BTC Allocation

The sixth-largest economy in the U.S. is taking an approach similar to Florida.

Pennsylvania’s proposal would allow the State Treasurer to invest up to 10% of three major state funds into Bitcoin:

State General Fund

Rainy Day Fund

State Investment Fund

This could result in nearly $1 billion in BTC reserves.

“Bitcoin, which has appreciated significantly over the years, can help Pennsylvania keep pace with inflation and economic shifts.”

Final Takeaway: The Bitcoin Movement is Gaining Momentum

Statewide Bitcoin adoption is only just beginning.

In total, 19 states have active Bitcoin reserve bills in progress.

The future of state-backed BTC reserves is looking more bullish than ever.

Swan Bitcoin is a Bitcoin-only company that offers the best way to accumulate Bitcoin through automatic recurring purchases and instant buys using your bank account or wire transfers of up to $10M.

Their goal is to off the most accessible and user-friendly way to acquire Bitcoin.

The Swan team is also very focused on educating Bitcoiners of all experience levels.

Join today to get $10 of free bitcoin in your account if you sign up through our referral link here.

HOW TO SPOT THE NEXT BIG TRADE💰

The crypto market moves in fast, high-velocity cycles of creative destruction.

When assets crash by 95%, the key is identifying which ones have strong network effects and real utility.

In a recent interview Macro-Investor Raoul Pal revealed the strategy that he uses for spotting Crypto projects with the most potential.

Many chains die off because they were artificially propped up by funding, but winners like Ethereum (ETH) and Solana (SOL) emerge with strong communities, developer activity, and real-world use.

Solana, in particular, has demonstrated resilience and innovation, making it a top-performing blockchain.

It is expected to outperform Bitcoin and Ethereum due to its rapid development, DeFi ecosystem, and on-chain activity.

Meanwhile, Ethereum, though still dominant, is struggling because its Layer 2 scaling solutions have led to overbuilt capacity, resulting in reduced mainnet activity.

Despite this, Ethereum remains the most secure and trusted platform for institutional finance, making it the likely choice for large-scale tokenization of financial assets.

While Solana may be leading in innovation and efficiency, Ethereum remains the "Microsoft of blockchains"—the safe and reliable choice for enterprises.

Take a look at the video to find out more from Raoul Pal:

OTHER NEWS

Debate Ignites Among IRA Customers and Industry Leaders Over Trump’s Potential Bitcoin Capital Gains Tax Plan

Hong Kong Grants Bitcoin Status as Acceptable Asset Proof for Investment Immigration Applications

Florida Senator Joe Gruters Proposes Bill Allowing State to Invest in Bitcoin

Seventeen U.S. States Explore Bitcoin Reserves with New Legislation from Maryland, Iowa, and Kentucky

BlackRock Increases Investment in Michael Saylor’s Strategy to 5%, Expanding Bitcoin Exposure

Michael Saylor Reveals $742.4M Bitcoin Purchase of 7,633 BTC, Boosting Total Holdings to 478,740 BTC

Metaplanet's Bitcoin-First Strategy Drives 4,000% Stock Surge, Aims to Acquire 10,000 BTC

UK Orders Apple to Develop Backdoor for Encrypted iCloud Backups, Prompting Global Privacy Backlash

Tornado Cash Developer Alexey Pertsev Granted Conditional Release After 64-Month Sentence for Money Laundering

China Imposes 11-Year Sentence on Ex-Regulator in Bitcoin Money Laundering Case Amid Regulatory Uncertainty

Experts Assess MiCA's First Two Months, Raising Concerns About Impact on Smaller Crypto Firms, Stablecoin Regulation, and Privacy

Stablecoin Legislation Forces Tether to Decide Between US Compliance or Offshore Operations Amid Regulatory Pressure

Coinbase CEO Brian Armstrong Advocates for Blockchain-Backed US Treasury, While Elon Musk’s DOGE Saves $36B, Sparking Calls for More Transparent Government Spending

Winklevoss-Founded Gemini Considers IPO This Year, Marking New Milestone in Crypto Industry

Newport Landfill, Site of Lost 8,000 BTC Hard Drive, Set to Close Amid Ongoing Recovery Efforts by James Howells

Canadian Crypto Founder Firoz Patel Sentenced to Additional 3.5 Years in Prison for Hiding 450 BTC in Money Laundering Scheme

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.