Mt Gox Sell Off Begins

Why Is Bitcoin Price Falling?

We Are Entering The Bitcoin Gold Rush

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $55,291 | -4.88% | +31.99% |

Ethereum (ETH) | $2,930 | -7.65% | +28.01% |

This Update is Brought to You By Swan Bitcoin

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

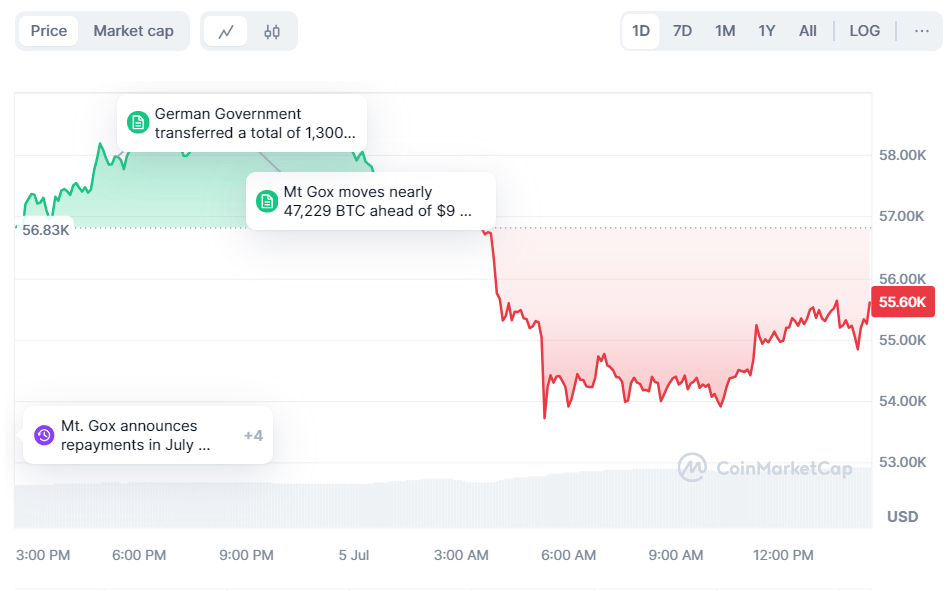

MT GOX SELL OFF BEGINS

BREAKING: Bitcoin Crashes Below $54K as Mt. Gox Transfers $2.6B in BTC

Bitcoin The Mt. Gox repayments have begun…

According to Arkham Intelligence, 47,288 BTC ($2.7 billion) has been moved from cold storage to a new wallet by Mt. Gox, ready for distribution to creditors.

And…

Unsurprisingly, the market did not take kindly to this news.

The resulting price drop triggered the largest long liquidation event since the FTX crash.

In the past 24 hours, more than $670 million in leveraged longs have been liquidated.

Last month, Mt. Gox announced repayments would start in July.

Since then, the market has feared creditors might sell their coins immediately.

At the time of the Mt. Gox hack, Bitcoin was trading at ~$600.

With current prices around $55,000, it’s understandable that these forced HODLers might want to take profits…

If you need some optimism, here’s some.

Alex Thorn, head of research at Galaxy Digital, thinks the concerns about a mass sell-off are overblown:

“Even if I’m right that these coins are not going to be dumped en masse by creditors, the fear is palpable, particularly with the Germans also dumping on us. We’ll get through this overhang and never have to talk about it again.”

Alex Thorn

Check out our full article on just how many coins Thorn believes Mt. Gox creditors will sell here.

Nonetheless, Bitcoin's price has dropped sharply…

Down ~5.53% in the last 24 hours and 10.25% over the past week.

Remember - corrections are opportunities. 🎁 🫡

The best crypto app to secure your tokens: Ledger

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

These wallets physically store your private keys within a chip inside the device itself.

The beauty of using a crypto wallet is the security it provides to your private keys.

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys

WHY IS BITCOIN PRICE FALLING?💥

Renowned Bitcoin analyst Willy Woo has linked Bitcoin's recent price drop to speculators opening new long positions, triggering a series of liquidations.

Woo further mentions that Bitcoin miners are selling more BTC to cover hardware upgrade costs post-halving, which has cut block rewards to 3.125 Bitcoin.

This miner-driven selling pressure, especially from less profitable miners shutting down, has exacerbated the price decline.

In a June 24 update, Woo forecasted a price rebound, suggesting that the removal of weaker miners will ultimately benefit the market.

Nevertheless, he emphasized that Bitcoin must purge Bitcoin futures open interest before we can see a sustained price increase.

Bitcoin is currently trading between $58,000 and $60,000, with Woo pinpointing $54,000 as a possible next liquidation threshold,

And here we are - touching the $54,000 price mark overnight.

Question remains - is this a bear trap?

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

WE ARE ENTERING THE CRYPTO GOLDRUSH ERA

WHY $20 Trillion IS EXPECTED IN MARKET GROWTH BY 2034

Despite the recent Bitcoin price pressure - here is some positive news to end the week and an outlook to look forward to…

Heads up, it’s raining cash, and Gen X and Millennials are set to get soaked! 💦

As of last year, Boomers in the US held a staggering $78.3T in wealth. 🤯

Here’s how it’s distributed:

Baby Boomers (1946-1964): 55.93% ($78.3T in assets)

Generation X (1965-1980): 34.14% ($47.8T in assets)

Silent Generation (Before 1946): 12.93% ($18.1T in assets)

Millennials (After 1980): 10.14% ($14.2T in assets)

According to a recent BofA report, this number is set to rise. Over the next decade, Baby Boomers are expected to pass down a colossal $84T to Gen X and Millennials.

Yes, you heard that right, 84 TRILLION. Enough to buy all the avocado toast and fancy lattes you could dream of, with plenty left over for a crypto splurge. 🥑☕

So, what assets will the younger generations favor with this new wealth?

Here’s the lowdown 👇

The younger crowd is all about internet-native finance.

A whopping 28% of people aged 21-43 are investing in crypto and digital assets. This is in stark contrast to just 4% for those aged 44 and up.

Sorry, Boomers, but we’re into decentralized and onchain finance. 💔

A quick calculation suggests that about $20.2T could flow into crypto over the next decade, leading to an 11x increase from the current market cap…

Here’s the recap:

Wealth Transfer: Boomers will hand down $84 trillion to Gen X and Millennials over the next decade.

Crypto Craze: Younger generations are significantly more enthusiastic about crypto compared to their elders.

Investment Preferences: Approximately $20 trillion of this inherited wealth could flow into crypto, shaking up the financial landscape.

This enormous influx of capital into crypto could propel Bitcoin and other digital assets to new heights.

Imagine Bitcoin at $600K... It’s no longer just a dream. 💫🚀

The generational wealth transfer is the financial event of our lifetime. For crypto enthusiasts, the moon isn’t just a target; it’s the next stop. So, get ready and keep your wallets handy. The crypto train is about to depart as the younger generation takes over!

OTHER NEWS:

This CRASH Is An Opportunity, Why Bitcoin Is About To 10x | Mathematician Fred Krueger Prediction: The future of money is here and why in over the next 3 to 4 years or so we will see a total of 300 to $400 billion allocated to the Bitcoin ETFs.

Fed’s ‘Critical’ Warning Sparks Serious $50,000 Bitcoin Price Crash Alert As $200 Billion Is Wiped From Ethereum, XRP, Solana And Crypto

German Government Still Holds Over 40K Bitcoins After Recent Sale, Onchain Data Shows