Bitcoin ‘Hot Supply’ Doubles

Strategy Buy Another $1.4BN Bitcoin

BlackRock Leading The ETF Surge

Why Gold Investors Should Be Worried

And more…

Market Data Prices as of 1:30am ET

This Update Is Brought To You By Glassnode

Stay Ahead of the Trend in Digital Assets..

Join Glassnode and Access a suite of metrics which describe the foundational components and performance of the Bitcoin blockchain. Metrics cover supply, on-chain activity, transfer volumes, mining performance, and transaction fees.

BITCOIN ‘HOT SUPPLY’ DOUBLES

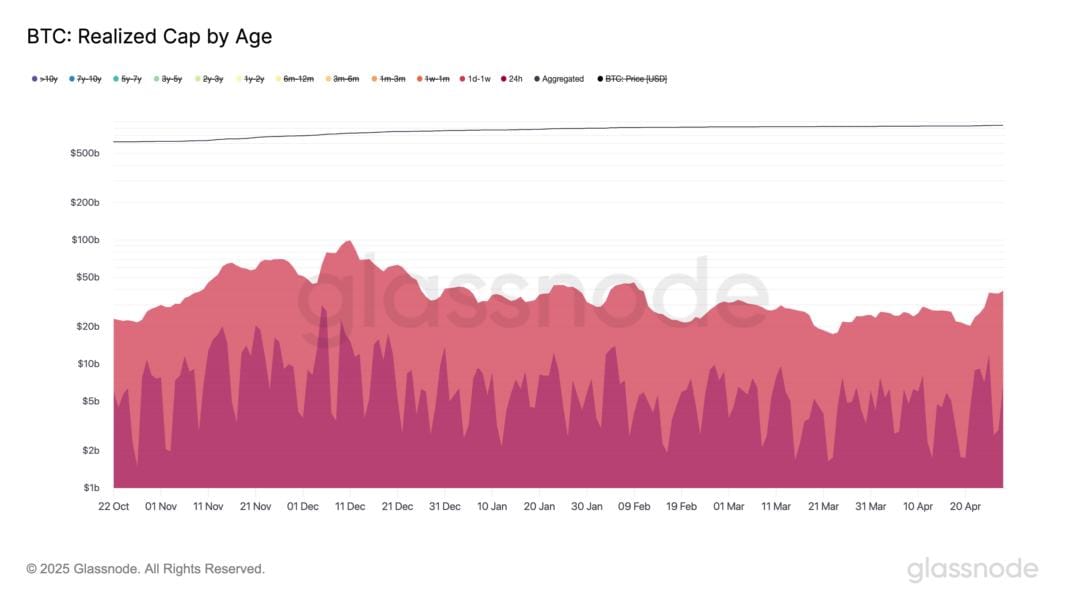

Short-Term Bitcoin Activity Explodes, Adding $21.5B in "Hot Supply"

Bitcoin's short-term holder activity is spiking, with the hot supply—coins moved in the last 7 days—reaching $40 billion, double the late March figure.

Glassnode reports this is the highest since February, underscoring a significant influx of speculative capital.

The firm cites a $21.5 billion increase in hot supply over the past five weeks, driven by a shift from long-term holding to speculation as BTC hovers near $95,000.

“In just 5 weeks, it has added over $21.5B, suggesting a rapid shift from dormancy to speculation among newer market entrants.”

In its April 28 “Market Pulse” analysis, Glassnode highlighted "early FOMO signals," citing a climb in the Hot Capital Share and notable growth in profitability metrics like Percent Supply in Profit (86%) and NUPL (0.53).

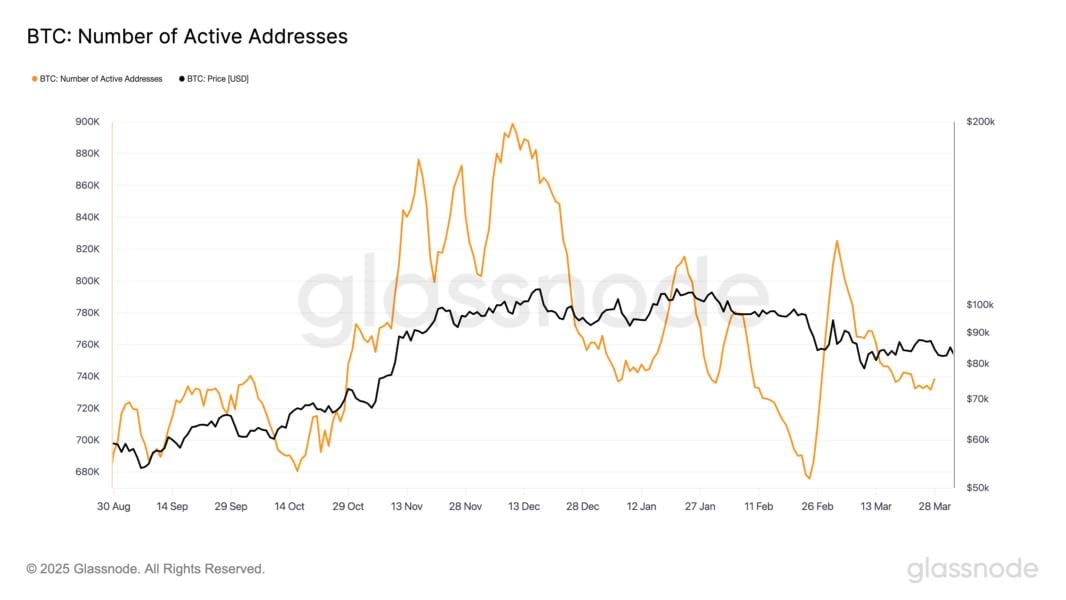

However, despite rising profitability metrics, the broader network usage remains underwhelming.

Daily active addresses are yet to show a full rebound, signaling a gap between price enthusiasm and real engagement.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

STRATEGY BUY ANOTHER $1.4BN BITCOIN

Big Bitcoin buy alert: Strategy just scooped up 15,355 BTC for a whopping $1.42 billion, according to an April 28 announcement.

The buys occurred over the week of April 21–27, averaging out to about $92,737 per Bitcoin.

That brings Strategy’s total stash to 535,555 BTC, now worth over $50 billion, and bumps up their holdings by 3%.

This is their biggest move since March, when they picked up 22,048 BTC for $1.92 billion at a slightly lower average of $86,969.

Their BTC yield — a gauge of how their Bitcoin holdings are growing relative to share dilution — hit 74% for 2024. They’ve set sights on 15% for 2025.

Meanwhile, the price of Bitcoin jumped 8% during the week, rising from $87K to nearly $94K.

On April 25th, Strategy co-founder Michael Saylor tweeted, “you can still buy BTC for less than $0.1 million.”

Two days later, he followed up with the classic line: “stay humble. Stack sats,” sharing a chart of their buys.

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

BLACKROCK LEAD THE ETF SURGE

Earlier this week we reported on the Bitcoin ETF comeback.

Here’s what has happened since..

BlackRock’s IBIT ETF continues to make headlines with a $970.9 million inflow on April 28—the second-largest since its inception.

This follows the $1.12 billion single-day record from November 2024.

While competitors like Fidelity, Bitwise, and ARK are showing signs of investor retreat, BlackRock is firmly in accumulation mode.

The broader picture?

Since April 21, U.S. spot Bitcoin ETFs have brought in a total of $3.83 billion, suggesting a renewed wave of institutional interest.

As noted by Bloomberg’s Eric Balchunas:

“ETFs are in two steps forward mode after taking one step back...”

Thanks to these inflows, IBIT has climbed the ranks to become the 33rd-largest ETF globally, cutting across both crypto and traditional markets.

The trend is clear:

Bitcoin’s rebound is closely tied to institutional demand.

Investors wondering where the smart money is going?

The answer: straight into spot Bitcoin ETFs—and especially IBIT.

WHY GOLD INVESTORS SHOULD BE WORRIED

We are on the cusp of a new monetary era.

Bitcoin at $200,000 is no longer a fantasy; it’s the start of a monumental shift. As it climbs to $300,000 and then to $500,000 — propelled by powerful Omega candles — the world will begin to understand: this isn’t just price movement.

It’s a paradigm shift.

At $500,000, Bitcoin’s market cap approaches 50% of gold’s.

That’s when the old guard begins to fall.

The demonetization of gold begins as capital flows to the new, digital standard.

The world watches as Bitcoin, once dismissed as a fringe experiment, is now the global reserve asset.

This isn't just growth — it's monetary evolution. And the final leap to $1 million is no longer a question of if, but when.

Samson Mow believes this is the trajectory, and for those who hold Bitcoin, the implication is clear: you could be witnessing a 100x explosion in value.

Find out more from Samson Mow in the video below:

OTHER NEWS

📈 Nasdaq moves to list 21Shares Dogecoin ETF, aiming to bring DOGE into the mainstream investing world with reduced speculative exposure.

🚀 Bitcoin typically surges 50% or more when these two historical patterns align—setting the stage for another possible rally.

🏦 SoFi doubles down on crypto, eyeing growth opportunities in a shifting U.S. regulatory climate, says CEO Anthony Noto.

🔥 Ex-Rep. McHenry forecasts a 'wicked hot summer' for crypto regulation, calling it a pivotal moment for digital asset policy in the U.S.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.