Bitcoin ETFs Back In The Spotlight

Coinbase and the Future of Finance

The Signals That Matter

And more…

Market Data Prices as of 7:30am ET

This Update Is Brought To You By Bitbo

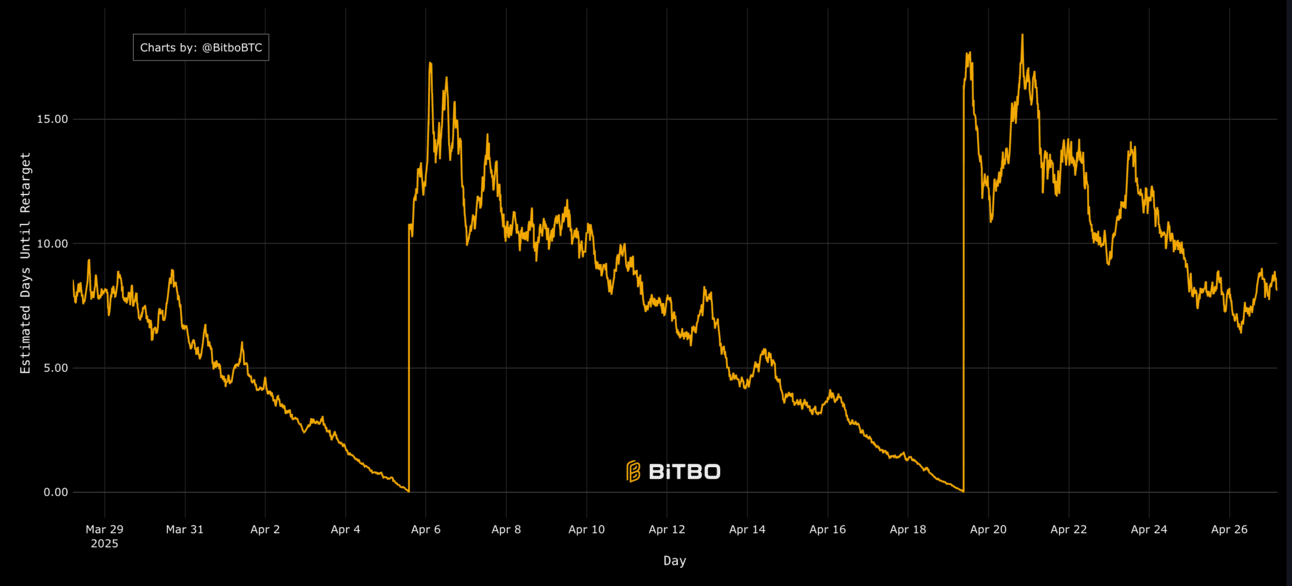

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the estimated time until the next difficulty re-target.

BITCOIN ETFs BACK IN THE SPOTLIGHT

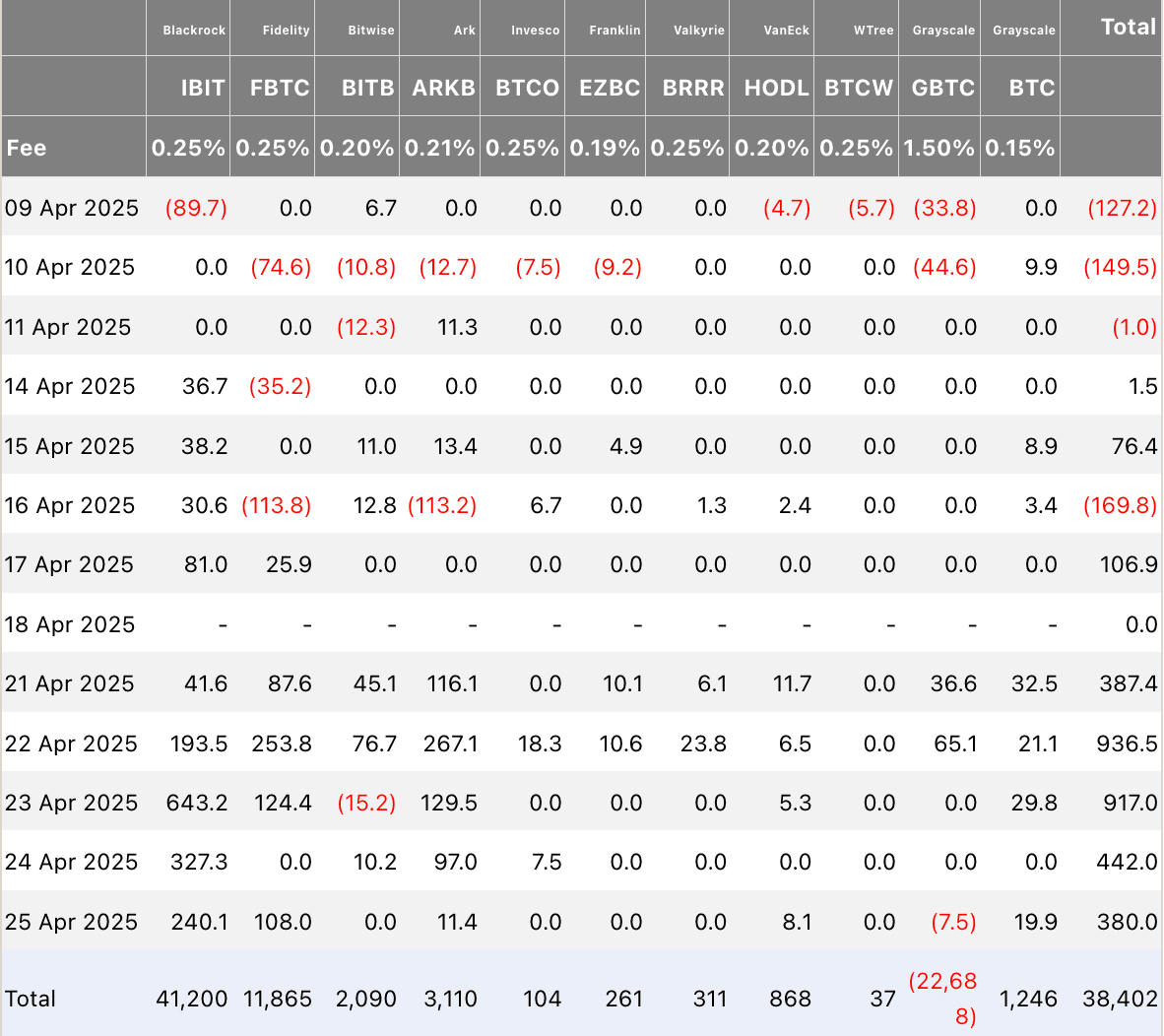

BREAKING: U.S. spot Bitcoin ETFs just saw a $3 billion weekly inflow — the highest in 5 months — after a major BTC price rally.

The Bitcoin ETFs are officially back...

And the inflows are coming fast and furious.

Last week, U.S.-based spot Bitcoin ETFs attracted a massive ~$3.06 billion — their strongest week since November 2024, and the second-largest weekly inflow ever.

Friday wrapped up a sixth consecutive day of net inflows:

BlackRock's IBIT dominated with $240 million added.

Fidelity’s FBTC followed up with $108 million.

Together, IBIT and FBTC made up 92% of Friday’s total inflow.

Thanks to the surge, Bitcoin ETF assets are now pushing $110 billion — with IBIT alone holding 2.97% of all Bitcoin supply.

(That’s even more than Michael Saylor’s legendary stash.)

US Bitcoin ETF Flows 📈

BlackRock’s Head of Equity ETFs, Jay Jacobs, put it simply:

"If the world stays uncertain, gold and Bitcoin will keep rising... Investors want assets that behave differently."

Translation?

Bitcoin is now the safe-haven of choice.

What’s fueling all this action?

Bitcoin’s price rebound.

From $75,000 back up to $95,000, BTC roared — rekindling risk appetite and supercharging ETF demand.

Meanwhile, spot Ethereum ETFs ended their 8-week outflow streak, pulling in $157 million last week. 🚀

US Ethereum ETF Flows 📈

ETF inflows are booming.

Prices are rebounding.

The bull market is back.

Let’s ride. 😎

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

COINBASE AND THE FUTURE OF FINANCE

THE FUTURE OF FINANCE is often portrayed as a world where blockchains eliminate the need for centralized companies, pushing everything — from social media to finance — into a decentralized, self-custody, permissionless ecosystem.

Some predict that centralized exchanges like Coinbase are doomed to fade away.

But in reality, this vision was never practical.

The true breakthrough of decentralized blockchains is that they introduce something revolutionary: choice.

Users now have the option to custody their own assets or rely on an institution to manage them.

Before crypto, there was no real choice — trust in institutions was the only route.

For the committed crypto natives, self-custody is paramount.

Yet, they make up less than 1% of the population.

For the remaining 99%, institutional adoption will dominate, for several reasons:

Managing your own assets feels riskier than trusting a reputable institution.

Users prefer the smooth UX of exchanges, banks, and fintechs.

Most people simply want a secure place for savings or access to credit cards.

On the institutional side, regulations require asset custody to be handled by trusted third parties.

Thus, both the onchain self-custody world and the custodial world are set to grow — and Coinbase is strategically positioned in both.

Today, Coinbase manages 15% of the total crypto market cap for both retail and institutional clients.

Major players like Microstrategy, Blackrock, Fidelity, crypto ETF providers, and even the US government trust Coinbase for custody.

On the self-custody side, Coinbase is expanding fast.

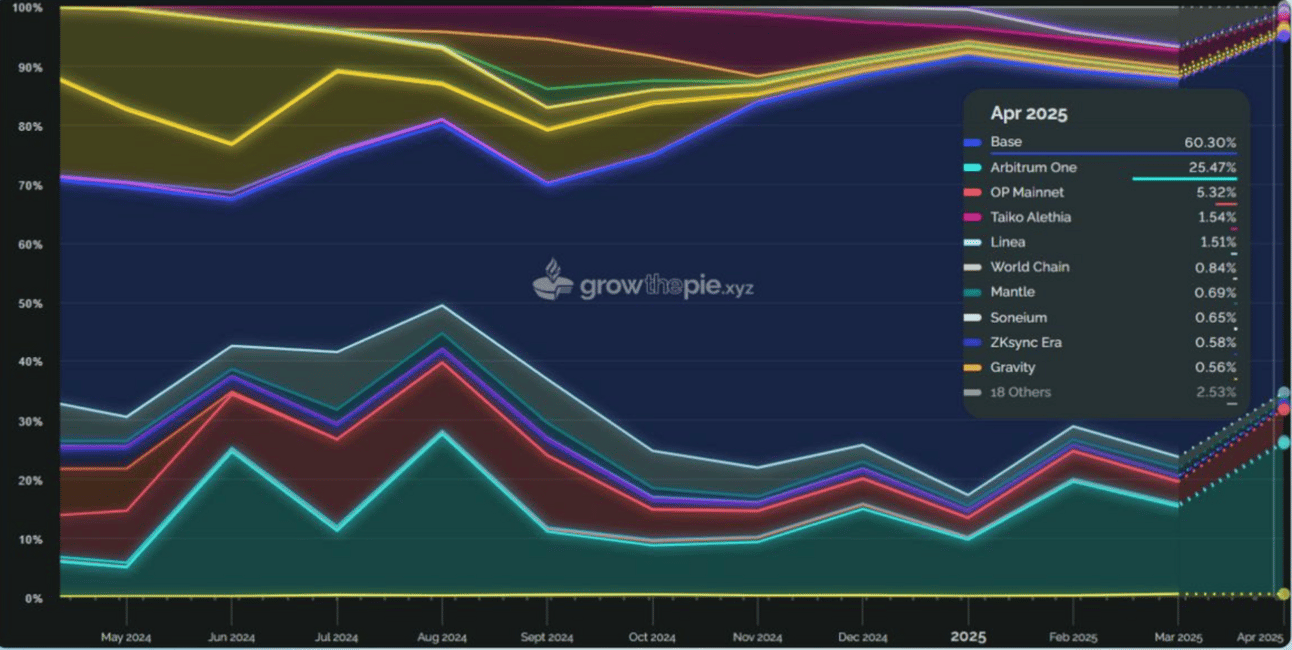

Base (Coinbase’s L2) now accounts for 55% of all active L2 addresses…

…and 60% of L2 revenue.

More impressively, Coinbase is blending custodial UX with onchain DeFi by integrating platforms like Morpho into its app.

Instead of users needing to navigate wallets, bridges, and DeFi apps, they can now access onchain lending directly inside the Coinbase app — all handled invisibly in the backend through smart wallet infrastructure.

By merging the best of both worlds, Coinbase is pioneering the future of mainstream crypto adoption.

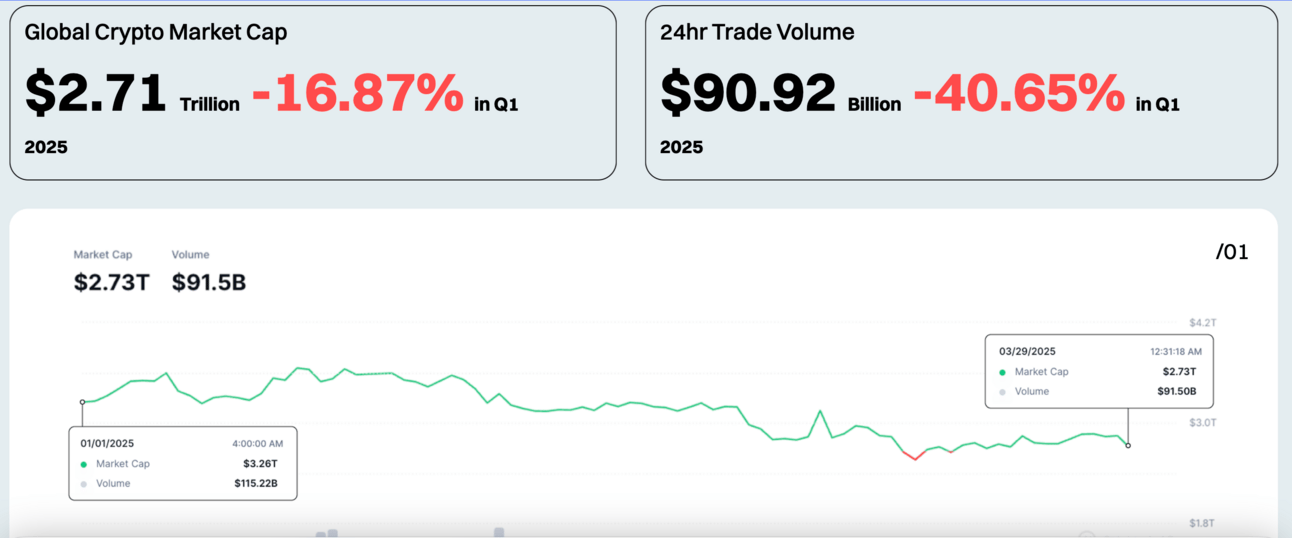

THE SIGNALS THAT MATTER

Q1 2025 has packed more drama into three months than most years see in twelve.

From intense macro turbulence to surprising breakout narratives and major shifts in power dynamics, the market has been a constant swirl of noise and movement.

With signals coming from every direction, Coinbase are here to cut through the chaos — highlighting what truly mattered and what’s likely to shape the story next.

OTHER NEWS

🔎 Swissblock analysis finds Bitcoin breaking away from US stocks, signaling bullish momentum and increasing safe-haven appeal.

📊 NYDIG highlights Bitcoin's strengthening role as a non-sovereign store of value amid US market swings and Trump-driven policy shifts, with clear signs of decoupling.

🏦 Swiss National Bank Chair Martin Schlegel dismisses BTC as a reserve option, citing concerns over liquidity shortfalls and extreme price swings.

📚 Author Adam Livingston claims Michael Saylor’s MicroStrategy is 'synthetically halving' Bitcoin, creating a supply shock poised to boost BTC prices.

🇸🇻 El Salvador quietly boosts its Bitcoin reserves with 7 new coins, tactfully navigating the IMF's $1.4B loan restrictions.

🏛️ Bitcoin reserves on centralized exchanges fall to their lowest levels since 2018, hinting at a looming supply crunch fueled by self-custody and institutional buying.

📈 Cantor Equity Partners' stock soars 220% after announcing a merger with Twenty One Capital to launch a Bitcoin-focused investment entity.

🎭 Comedian TJ Miller says Hollywood's '50-hour study rule' keeps stars from embracing Bitcoin, favoring conformity over disruptive innovation.

⚖️ Federal judge blocks California's $200 FinCEN border reporting rule, labeling it as arbitrary after a major legal challenge.

🚀 ARK Invest projects Bitcoin could skyrocket to $1.5M by 2030, driven by increasing institutional adoption and its rise as 'digital gold.'

🚔 Russian crypto exchange Mosca raided amid government moves to outlaw cash-to-crypto transactions, raising fraud concerns.

🕵️♂️ Researchers reveal North Korean hackers are crafting fake US firms like 'Blocknovas' to deploy malware against Bitcoin developers.

💵 Stripe begins testing its new US dollar stablecoin product for international firms, expanding beyond traditional borders.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.