Bitcoin Blasts By $111K

Will This Bull Rally Last?

Raoul Pal: Exit Before This Happens..

And more…

Market Data Prices as of 3:30am ET

This Update Is Brought To You By Bitbo

We are excited to announce Bitbo’s newest trading chart:

The Mayer Multiple is used for technical analysis in Bitcoin investing.

It is used in order to determine whether Bitcoin is overbought (red), fairly priced (yellow), or undervalued (green).

The Mayer Multiple is calculated by taking the price of Bitcoin and dividing it by the 200 day moving average value.

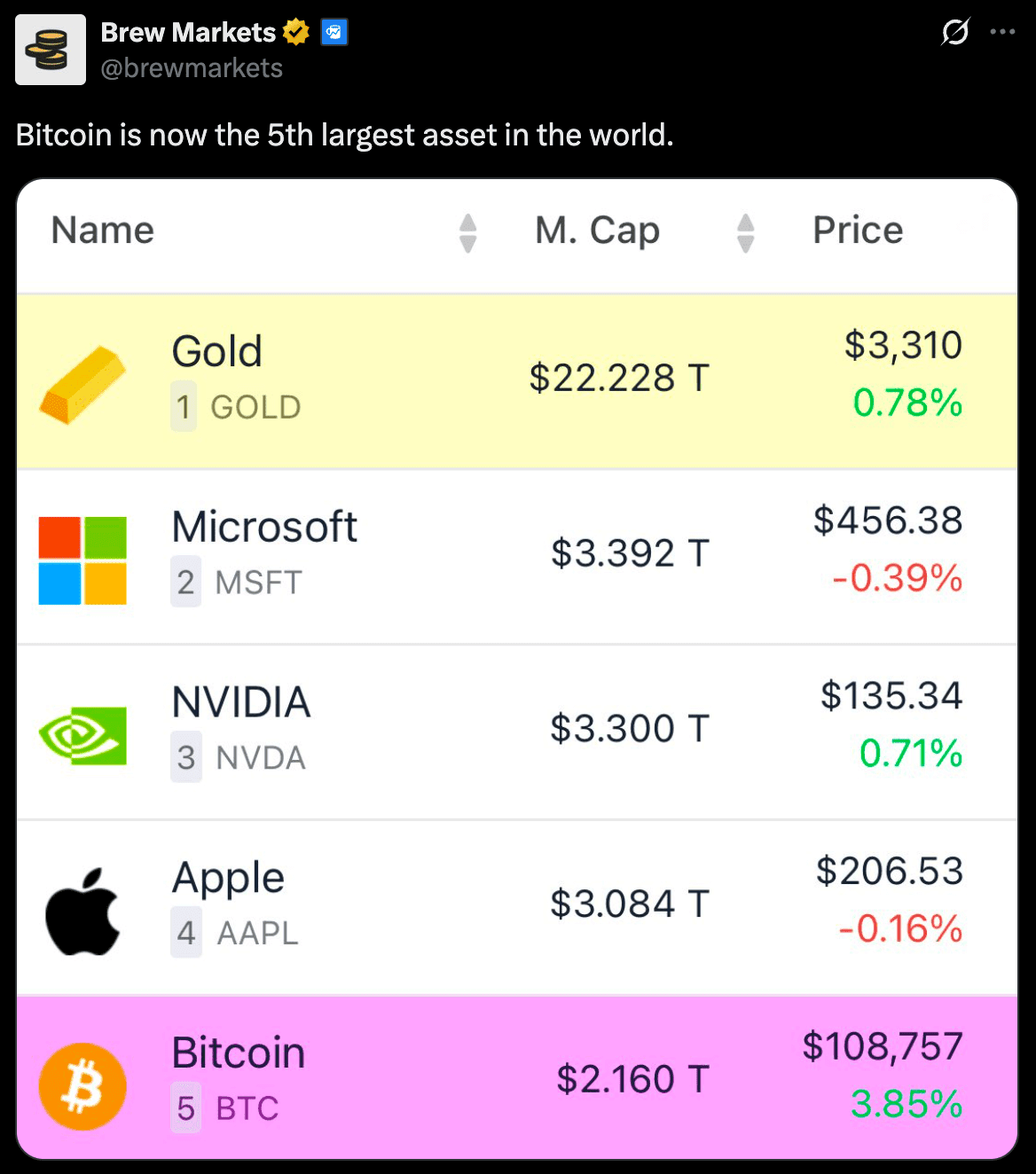

BITCOIN BLASTS BY $111K

BREAKING: Bitcoin hits $111,861.22, setting a fresh all-time high!

But this isn’t your typical crypto frenzy.

This surge?

It’s not driven by retail traders or hype.

It's institutional—and it's massive.

Corporate treasuries, ETF demand, and Wall Street are the driving force.

Yesterday alone, BlackRock’s IBIT ETF took in $530M+—that’s over 10x the amount of BTC mined that day.

Total ETF inflows for May?

Now over $3.6 billion, with total assets surpassing $122B.

And the big players?

JPMorgan—yes, the same one that once trashed crypto—is now offering Bitcoin to clients.

Public companies like Strategy, Metaplanet, and Twenty One Capital are stacking sats.

Strategy alone holds over 576,000 BTC.

As OKX US CEO Roshan Robert says:

“A confluence of factors is driving this rally—corporate reserve strategies, surging ETF inflows, macro uncertainty, and favorable regulation… combined with Bitcoin’s scarcity… it’s the perfect storm.”

And the wildest part?

The Fed hasn’t even cut interest rates yet.

Analysts expect ETF demand to spike once cuts begin—unlocking more institutional capital.

Throw in bond market chaos, a weakening dollar, and rising geopolitical tensions, and the flight to Bitcoin is on.

Forecasts now point to $160K–$210K by year-end.

Long-term?

Some are calling for $1 million BTC by 2030.

The question: How far does this go?

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

WILL THIS BULL RALLY LAST?

Bitcoin has officially set a new all-time high (ATH) at $109,483.96 — but unlike previous euphoric breakouts, this one’s feeling... different.

Historically, ATHs are accompanied by:

A sky-high Fear & Greed Index in the ‘Extreme Greed’ zone

Spiking funding rates that scream “over-leveraged market!”

Buzzing mainstream interest (think: Uber drivers pushing altcoins)

Here’s what we’re seeing instead:

👉 1. F&G Index is in ‘Greed,’ not ‘Extreme Greed’

Currently hovering below 60 (Neutral is <60, Extreme Greed kicks in at 80+)

Source: CoinMarketCap

👉 2. Funding Rates Are Surprisingly Low

A heated market usually sees funding at 0.05–0.08

Right now? A cool 0.005

Source: Crypto Quant

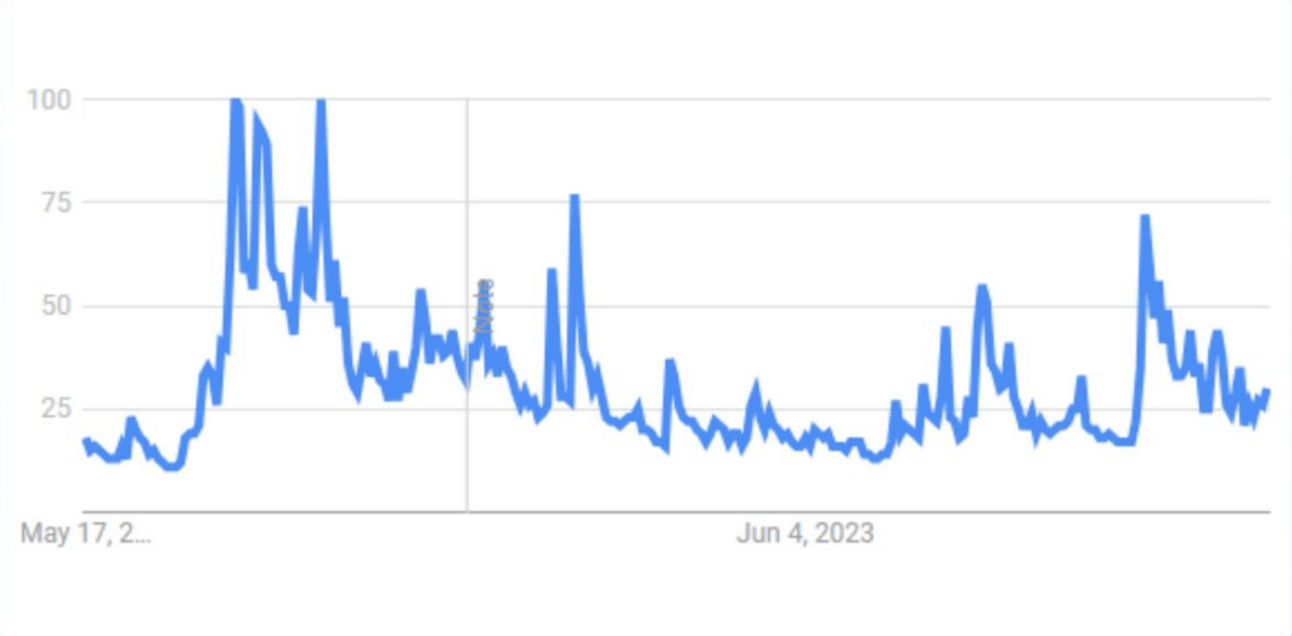

👉 3. No Spike in Bitcoin Search Volume

Google Trends data shows no meaningful rise in search interest

That’s wild, considering we just printed a new ATH

Source: Google Trends

🚀 Why This Matters

Greed isn’t out of control

Leverage isn’t stacked to the ceiling

Mainstream FOMO hasn’t kicked in yet

Translation? The market may still have room to run. If this rally continues, it’s doing so on relatively solid footing.

Our take: Still bullish. (Higher.)

P.S. Remember the panic last month? Look at you now. Stay frosty, Roadies.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

RAOUL PAL SAYS EXIT BEFORE THIS HAPPENS

Bitcoin’s surge above $100K has caught the attention of institutional investors once again—but caution is now warranted.

Raoul Pal, Real Vision CEO and former Goldman Sachs executive, sees familiar patterns from past market cycles.

According to Pal, Bitcoin has entered the second leg of its "Banana Zone"—a period of intense upward movement that typically precedes a significant correction.

Historical data supports this behavior, and macroeconomic pressure from interest rates and sovereign debt only adds to the complexity.

Pal’s advice?

Begin scaling out of positions gradually, even if sentiment remains bullish.

While the rally may have room to run, preserving gains now could prevent costly mistakes later.

Take a look at the video below to here Raoul Pal’s market roadmap outlining what’s coming next and how investors can position themselves wisely.

OTHER NEWS

Zack Shapiro, Head of Policy at the Bitcoin Policy Institute, outlines a strategic framework for US leadership in the Bitcoin era, emphasizing its potential to enhance economic resilience, refine energy strategy, and expand geopolitical influence.

Andrew R. Chow, TIME magazine correspondent, details Jamie Dimon's evolving stance on Bitcoin, highlighting how the JPMorgan CEO, once a fierce critic, now permits client BTC purchases in response to institutional adoption and pro-Bitcoin political momentum.

Valerio Dalla Costa, founder of Villaggio Bitcoin, contends that entrepreneurs, not governments or banks, are driving true Bitcoin adoption by integrating BTC into business operations across global markets.

Neha Narula, Director at MIT’s Digital Currency Initiative, explains how Ark facilitates Bitcoin scalability by enabling multiple users to share UTXOs with non-custodial exits, reducing on-chain congestion and bypassing the limitations of the Lightning Network.

Mark Goodwin, author of ‘The Bitcoin-Dollar’, cautions that tribalism and debates over filtering mechanisms obscure the real threat of stablecoins, which risk distorting Bitcoin's incentives and accelerating dollarization.

River Financial’s latest report argues that the United States’ early Bitcoin adoption grants it a unique economic edge, solidifying its position as the leading Bitcoin superpower and engine of national prosperity.

Aleksandar Svetski, author of 'Bushido of Bitcoin', claims Bitcoin will usher in a new era of CEO-Kings, merging monarchical leadership with corporate efficiency to rebuild civilization through ownership incentives, excellence, and beauty.

Crrdlx, a prominent Bitcoin writer, offers a unique reflection by linking the biblical concept of keys to cryptographic keys, exploring how public/private key systems mirror ancient symbols of authority and transfer in the context of Bitcoin and Nostr.

Che Kohler of The Bitcoin Manual breaks down dark mempools, which allow private transaction pathways between miners and large participants, offering front-running protection while raising concerns over network fairness and transparency.

Luis Lopez of Bitcoin News recounts the significance of Bitcoin Pizza Day, commemorating the first real-world BTC transaction—10,000 BTC for two pizzas—as a symbol of Bitcoin’s transformation from digital experiment to functional currency.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.