Bitcoin at $13M - Why You’re Not Bullish Enough

The $10BN Bitcoin Bet

Bitcoin Will Reach $500K

And more…

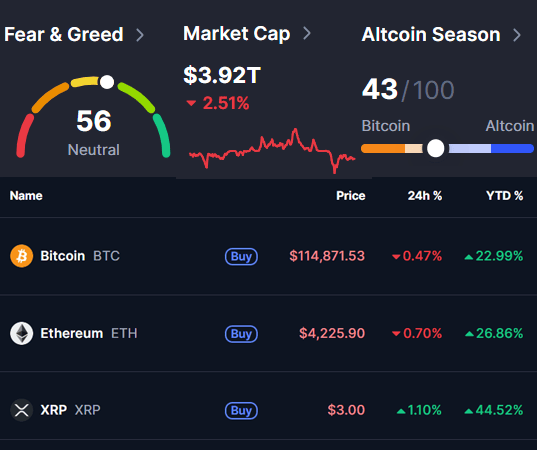

Market Data Prices as of 3:30am ET

This Update Is Brought To You By Bitbo

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

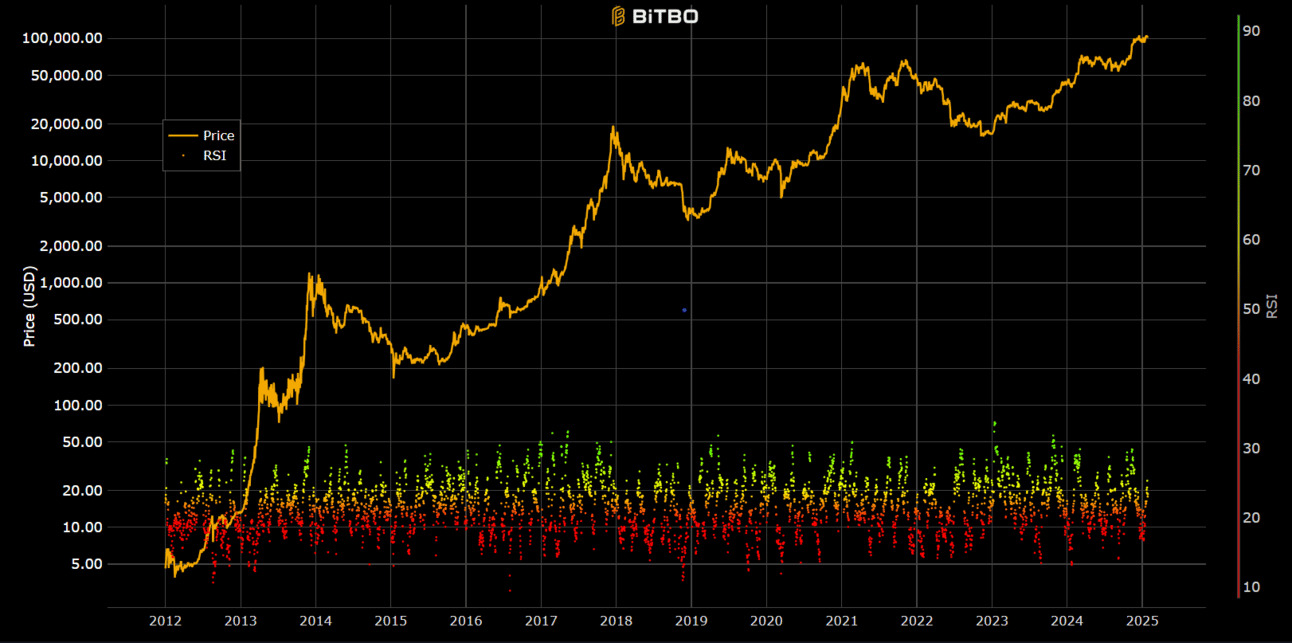

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

BITCOIN AT $13M - YOU’RE NOT

BULLISH ENOUGH🚀

Croesus BTC recently posted some staggering numbers related to Bitcoin’s growth potential!

The world holds roughly $1,000 trillion in global wealth.

Of that, $370 trillion sits in real estate, $318 trillion in bonds, $135 trillion in equities, $129 trillion in money markets, and $22 trillion in gold.

Yet only 0.2% of global wealth is in Bitcoin.

Michael Saylor argues that as investors search for a store of value, capital will increasingly flow from bonds, equities, and real estate into Bitcoin.

His conservative estimate assumes $280 trillion could migrate into Bitcoin by 2045 — supporting a price of $13 million per coin.

Saylor also assumes a declining CAGR (Compound Annual Growth Rate) of around 29%, far below Bitcoin’s historic CAGR of 114%.

Even with this conservative trajectory, Bitcoin outperforms every asset class:

Bonds: negative CAGR

Real estate: +1% CAGR

Equities: +2–3% CAGR

Bitcoin: far higher

Critics of Saylor’s model argue that scarcity dynamics will actually accelerate Bitcoin’s CAGR.

Like water in a desert, each remaining unit becomes more valuable as supply dwindles. In a finite supply system, scarcity drives exponential value appreciation, not decline.

Even the “bearish” case paints a staggering picture: $13M Bitcoin, powered by the slow but relentless migration of global wealth.

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

THE $10BN BITCOIN BET

This isn’t a blip. It’s a reshaping of Bitcoin’s ownership structure.

SEC filings confirm billions in Q2 ETF buys:

Goldman Sachs: $3.3B in Bitcoin ETFs + $500M in ETH ETF.

Brevan Howard: $2.6B in IBIT.

Harvard University: $1.9B Bitcoin allocation.

Jane Street: $1.46B stake, making Bitcoin their #2 equity position after Tesla.

Wells Fargo & Cantor Fitzgerald: aggressive ETF and stock positions.

International flows tell the same story:

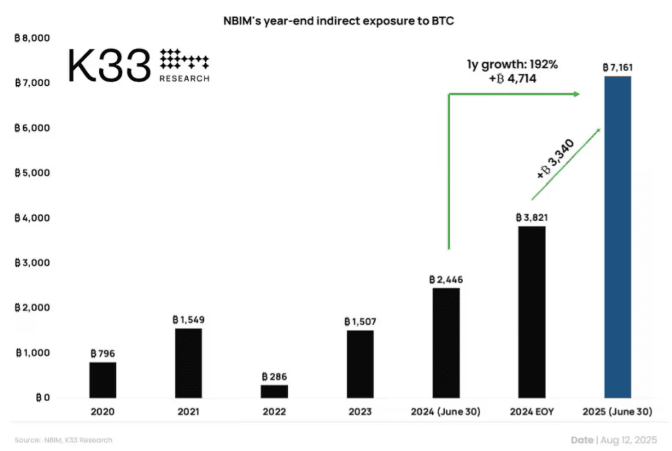

Norway’s sovereign wealth fund, the world’s largest at $2 trillion, lifted its exposure by 192% YoY.

At today’s price of $117,500/BTC, their holdings are worth $841M. Still less than 0.05% of assets — but the trendline is only going up.

Bitcoin cycles always evolve:

2017 was retail ICO mania.

2021 was stimulus, NFTs, and Tesla.

2025 is the era of institutions and sovereigns.

This isn’t speculation. It’s structural adoption. 🚀

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

BITCOIN WILL REACH $500K

Bitcoin WILL REACH $500K — that’s the bold prediction from Rick Edelman now gaining traction as the U.S. introduces its first-ever crypto legislation.

With the passage of the Genius Act, the rules of the road for stablecoins have finally been set, unleashing a tidal wave of institutional interest.

Banks, insurance companies, Fortune 500 giants, and even retailers like Walmart and Amazon are now entering the stablecoin ecosystem, signaling the beginning of mass adoption.

Since most stablecoins operate on the Ethereum blockchain, this creates an extremely bullish outlook for Ethereum, which is expected to see usage and demand surge as stablecoin adoption accelerates.

In parallel, the Clarity Act is moving through Congress, aiming to define the oversight roles of the SEC and CFTC.

This second piece of legislation could unlock trillions in new inflows from traditional finance into Bitcoin and digital assets.

With clear regulatory frameworks finally in place, many analysts see Bitcoin on a trajectory to $500,000 — a move that could reshape global finance.

Make sure to watch this video where Edelman explains why the new Crypto Law is so bullish for Bitcoin and Ethereum:

MindLabPro: The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

OTHER NEWS

⚠️ Peter Todd Warns of Looming Bitcoin Crackdown

🎓 Harvard Bets Big: $116M Bitcoin ETF Allocation via BlackRock

🏛️ White House Crypto Policy Chief Carole Hines Steps Down

🧑💻 Turkish Authorities Detain Developer Linked to Tornado Cash Study

🛰️ Blue Origin Opens the Door: Pay for Space Flights in Bitcoin

📉 Glassnode: Bitcoin’s Link to Money Supply is Statistically Weak

💰 Norway’s Sovereign Wealth Fund Quietly Expands Bitcoin Holdings

☠️ Monero Faces Alleged Hostile Majority Control Attempt

🐳 Record Surge in Bitcoin Whale Wallets Spotted

📵 Google Play Bans Custodial Wallet Apps from Platform

📈 Bitcoin Sets Fresh Highs in Global Risk-On Market Rally

🇯🇵 Metaplanet’s Bitcoin Strategy Outshines Japan’s Corporate Titans

🔧 Jack Dorsey’s Block Reveals Next-Gen Modular BTC Mining Rig

🏦 Bessent: No Bitcoin Buys Yet, But Reserve Position Still Strengthening

⚡ Tether & Lightspark Supercharge Bitcoin Lightning Infrastructure

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.