This Update Is Brought To You By Bitbo

We are excited to announce Bitbo’s newest trading chart:

The Mayer Multiple is used for technical analysis in Bitcoin investing.

It is used in order to determine whether Bitcoin is overbought (red), fairly priced (yellow), or undervalued (green).

The Mayer Multiple is calculated by taking the price of Bitcoin and dividing it by the 200 day moving average value.

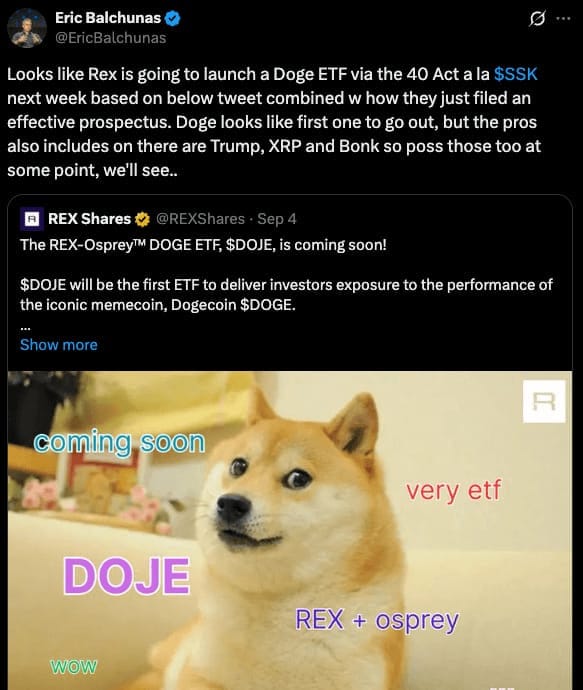

🚨 WALL STREET GOES DOGE

BREAKING: First Dogecoin ETF may hit the U.S. market this week.

According to Bloomberg’s Eric Balchunas, REX Shares is preparing to launch the first-ever U.S. Dogecoin ETF — possibly in just a matter of days.

The product will use the 40 Act structure, the same regulatory shortcut that allowed REX to launch its Solana Staking ETF. This move sidesteps the slower spot ETF approval process, giving DOGE a faster path onto Wall Street.

Why it matters: Despite trading around $0.21 (well below its December 2024 peak of $0.46), Dogecoin is up more than 116% year-over-year.

With its unique cultural relevance and ongoing attention from figures like Elon Musk, institutions are starting to take it seriously.

Other asset managers — 21Shares, Bitwise, Grayscale — also have altcoin ETF filings in the pipeline. But REX looks set to grab first-mover advantage.

Meanwhile, the SEC is currently reviewing 92 crypto ETF applications, covering tokens like Solana, XRP, and Litecoin. Final decisions are expected in October.

👉 The takeaway: ETFs are about access, and with Dogecoin set to gain its own Wall Street ticker, a flood of new capital could soon pour into the altcoin market. 🚀

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

WAS THAT THE TOP?

August was meant to be quiet.

Historically, the summer months bring low volumes, muted volatility, and a laid-back, almost holiday mood for markets.

Instead, the first half of August lit up the charts. Ethereum ($ETH) soared nearly 36%, dragging other crypto assets higher — though none with quite the same strength.

Then came the whipsaw: a sharp correction, a quick rally sparked by Jerome Powell’s dovish Jackson Hole comments, and finally another slide lower.

When the dust settled, August actually ended much like tradition would suggest — flat performance across most major assets.

But beneath the surface, the question remains: Was that the top? 🤔

The Business Cycle

Understanding the business cycle is critical for tracking the direction of markets — particularly in crypto.

One of the most important indicators? The ISM Manufacturing PMI:

📉 In August 2025, the PMI printed at 48.7, keeping the manufacturing sector in contraction for the sixth month straight. That said, the latest reading was up from 48.0 in July, a 0.7-point increase that suggests conditions are stabilizing.

Inside the numbers:

New Orders jumped to 51.4, showing demand is recovering.

Both Production and Employment edged lower, meaning new demand hasn’t yet driven higher output or jobs.

So far, the story is clear: manufacturing is still contracting, but the downturn is moderating. Historically, this type of shift has preceded broader economic improvement.

We’ll be keeping a close eye on whether global liquidity lines up with this early signal — potentially setting the stage for a market rebound.

Global Liquidity

Global liquidity is one of the most important forces driving financial markets. The more liquidity flowing into the system — and the faster it rises — the better it is for risk-on assets like crypto.

Recently, we’ve seen some headwinds. Part of this is just seasonality and low trading volumes, and part comes from the Treasury Department refilling its General Account. The good news? These pressures are temporary and almost behind us.

Looking ahead, there are multiple reasons to expect a surge in liquidity in Q4:

China continues to inject capital into its markets.

The Federal Reserve is expected to cut interest rates, making debt cheaper.

The Fed may also halt the runoff of MBS holdings, ending quantitative tightening (QT) and signaling a shift back toward quantitative easing (QE).

In short: more liquidity is coming — exactly what crypto investors want to see. 🥳

But beware: a flood of liquidity could also reignite inflation, which the market may not welcome.

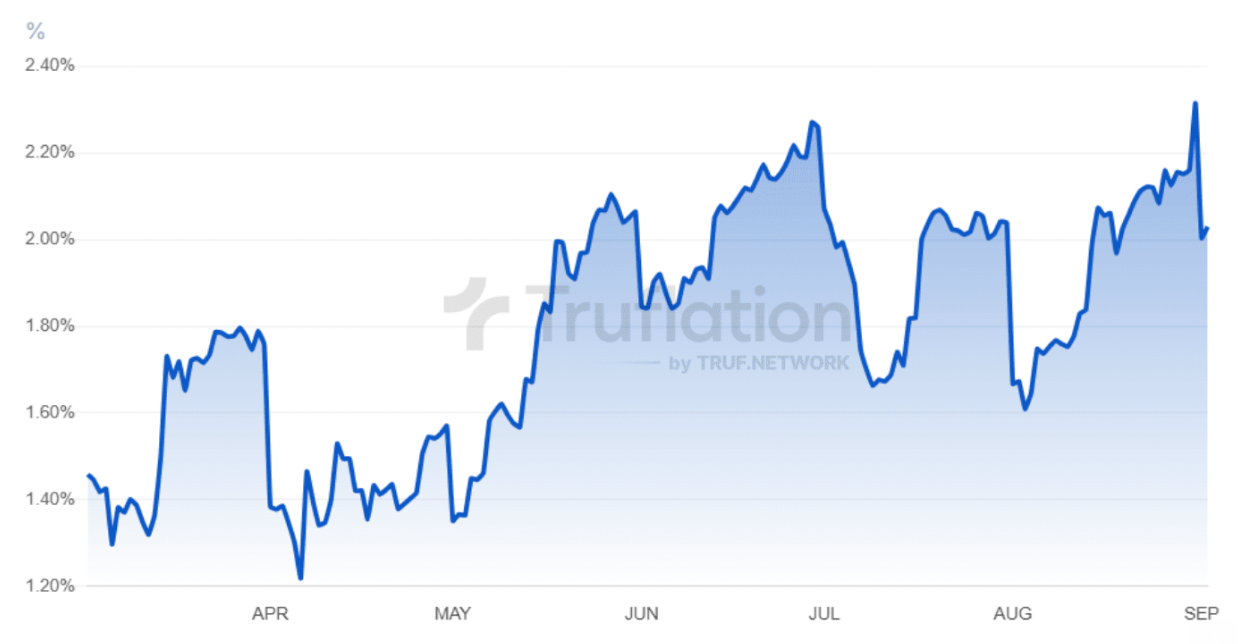

Real Time Inflation

Instead of relying solely on traditional inflation metrics, we’re turning to Truflation for a real-time snapshot of what’s happening across the economy.

Right now, inflation is still running hotter than the Federal Reserve would prefer, but crucially, it’s not spiraling out of control. While there are risks of upward pressure, we’re not seeing signs of a major spike.

This has given the Fed the space to focus on the labor market, signaling that they’re ready to cut rates to support growth. That’s a positive development for both the economy and investor confidence.

Bottom line? As long as inflation remains manageable, the outlook looks bullish and the rest of the year could be a strong one for risk assets.

Asset Price Performance

August gave us a mixed picture across major investment classes. The chart below makes it clear where the strength — and weakness — showed up.

Stocks, gold, and the total crypto market cap each moved almost in lockstep, posting modest gains of about 2–3%.

But Ethereum ($ETH) was the real standout. Thanks to the boom in DATs, $ETH surged far beyond the broader market, even though that initial hype has started to cool. The momentum it created, however, looks set to last.

Big voices in the space, like Tom Lee, are fueling speculation that Ethereum could hit five figures by year-end — keeping the buzz alive.

Meanwhile, Bitcoin ($BTC) lagged behind, finishing August down about 3%, a rare case of underperformance compared to traditional markets.

So while the broader market was flat overall, Ethereum’s breakout was impossible to ignore. The big question: Can ETH keep leading the pack?

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

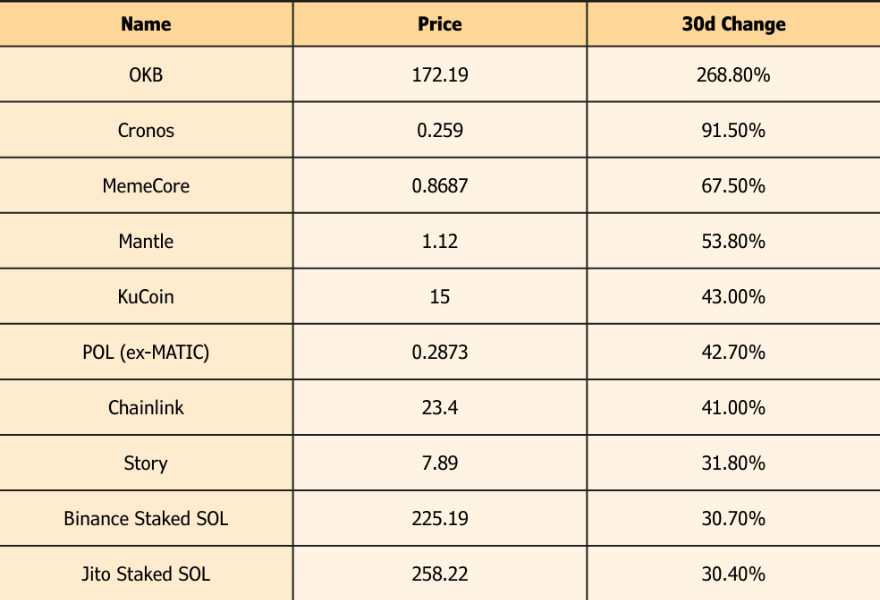

THE SUMMER’S TOP GAINERS AND LOSERS

Top Gainers

When analyzing performance, we’re focusing only on the top 100 tokens by market cap. This way, we avoid the endless stream of memecoins that surge thousands of percent only to fade just as quickly.

Source: CoinGecko

What stood out this time is the lack of apps among the leaders. Instead, the top gainers were dominated by centralized exchanges and blockchains.

The driver? Many investors may be looking at Ethereum’s ($ETH) breakout and the strong demand for ETH DA layers, speculating that other major chains or tokens could follow.

Still, we don’t see this being a lasting theme. Over time, we’d expect applications to re-enter the list of winners.

Top Losers

Source: Coingecko

Only one notable app appeared here: Sky ($SKY) — which we actually hold.

Should holders be concerned? We don’t think so. The project has been restructuring with accounting updates and protocol adjustments.

At first glance, these changes looked messy, but community discussions and developer calls clarified the picture.

What seems negative on the surface often comes down to perception. Many investors won’t bother digging deeper and will simply sell, even if the fundamentals are intact.

Our view: nothing to worry about with $SKY. The rest of the list is just memecoins, NFTs, and some underperforming L1s — not much to learn from.

But to really understand the market landscape, we need more than winners and losers — that’s where crypto breadth comes in.

Crypto breadth

Tracking crypto breadth means looking at how many assets are trending higher compared to key averages.

Here, we’re measuring against the 50-day and 200-day moving averages.

On the 200-day trend, roughly two-thirds (66%) of tokens are trading above their average — a strong macro signal.

Zoom in, though, and the 50-day chart looks far less stable. Only 38% of tokens are above trend, after volatility pushed the number from 50% → 80% → back down to 38%.

This contrast highlights why investors remain cautious: the long-term picture looks healthy, but the short-term outlook is still unsettled.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.