Telegram CEO Arrest: What It Means For Crypto

Bitcoin ETF Pump And Dump

Jeff Booth: Why Bitcoin Is A Superior Asset

And more…

Market Data Prices as of 8:00am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $60,030 | +0.31% | +42.16% |

Ethereum (ETH) | $2,556 | +1.25% | +12.03% |

Solana (SOL) | $145.83 | -0.90% | +43.66% |

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

TELEGRAM CEO ARREST: WHAT IT MEANS FOR CRYPTO

This past weekend, Telegram CEO Pavel Durov was arrested by the French government over accusations that the platform did not effectively moderate illegal activities, including drug trafficking, child exploitation, and fraud.

This event underscores a critical debate between centralization and decentralization.

Centralized systems like Telegram have inherent weaknesses:

They depend on centralized infrastructure that can be easily targeted.

Their leadership, like a CEO, can be directly pressured or even arrested.

As a result, if authorities object to a feature such as Telegram’s encrypted messaging—used by 900 million active users—they know exactly where to apply leverage.

Decentralized systems, however, distribute control across a network, removing these vulnerabilities. No single person or entity holds the power to comply or resist, creating a more robust and resilient structure.

Why should this concern you?

Impact on Crypto Investments

Following the news of Durov's arrest, Telegram’s $TON token experienced an 18% drop over the past week.

This highlights the risk associated with centralized entities in the crypto space and underscores the importance of decentralization for investors.

Telegram’s Role in Crypto Culture

Despite the crypto community's preference for decentralization, many still use centralized platforms like Telegram and X (Twitter).

The arrest of Telegram’s CEO could signal potential threats to the community’s digital autonomy.

Decentralization Becomes a Necessity

As companies like Facebook, X, WhatsApp, Signal, and iMessage face similar regulatory pressures due to their end-to-end encryption, the adoption of decentralized blockchain technology is increasingly seen as a means of survival, not just a trend.

Ultimately, when considering the future of online privacy and security, we are presented with two choices:

Rely on centralized entities and hope they withstand external pressures.

Invest in decentralized systems that offer true security and privacy without centralized control.

In the long run, relying on hope is far riskier than building a foundation on certainty.

BITCOIN ETF PUMP AND DUMP

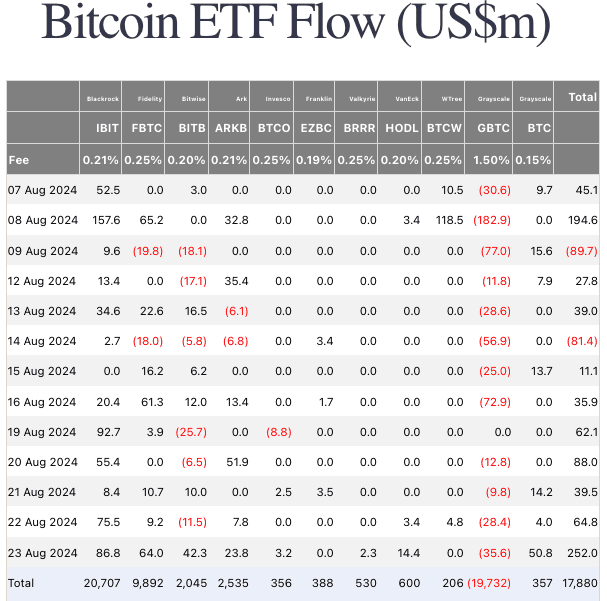

On Friday, U.S.-listed spot bitcoin (BTC) ETFs saw their highest daily net inflows since July 23, totaling over $252 million.

This uptick came after encouraging comments at the Jackson Hole symposium, which boosted sentiment across risk assets like bitcoin.

Data from SoSoValue revealed that trading volumes for the eleven ETFs soared to $3.12 billion, the highest since July 19.

BlackRock’s IBIT emerged as the front-runner with $1.2 billion in trading volume and $83 million in inflows.

Trailing BlackRock, Fidelity’s FBTC gained $64 million in new funds, while Bitwise’s BITB added $42 million to its coffers, pushing its AUM past the $2 billion mark for the first time.

Meanwhile, Grayscale’s GBTC faced net outflows of $35 million, though its "mini bitcoin fund" saw a positive turn with $50 million in inflows.

These movements coincided with Federal Reserve chair Jerome Powell’s announcement at the Jackson Hole symposium, indicating potential loosening of monetary policy.

This news helped propel bitcoin above the $64,000 threshold.

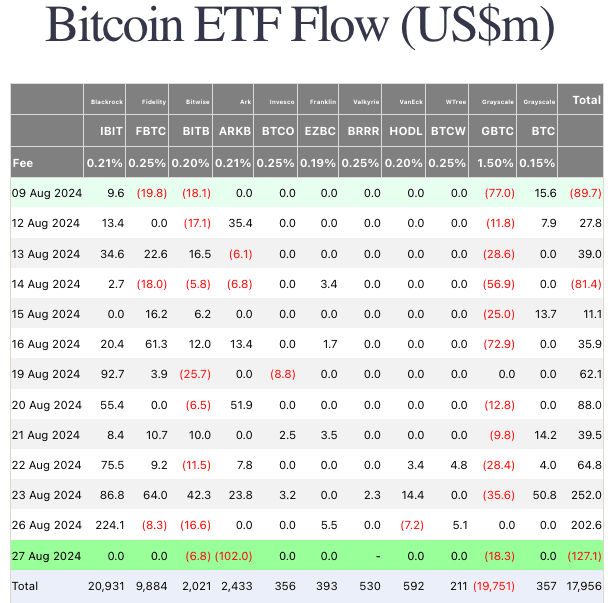

However, since Tuesday, the Bitcoin price has dumped, dropping down to $59,273 yesterday.

The sudden drawdown in the crypto market has triggered a massive wave of liquidations, erasing significant amounts of leveraged positions.

Over the past 24 hours, more than $100 million in Ethereum (ETH) positions and around $95 million in Bitcoin (BTC) positions have been liquidated.

Although there is no single explanation for this abrupt crash, BTC Markets' crypto analyst Rachael Lucas points to several contributing factors.

Lucas explains:

“There isn't a single catalyst for today’s downturn in the crypto markets, but it seems to be a combination of factors… Technical indicators show that the U.S. Dollar Index (DXY) is oversold on the daily chart, which could suggest a potential rebound in the dollar, traditionally leading to downward pressure on risk assets like cryptocurrencies.”

Lucas also highlighted the possibility of the “September effect” playing a role in the downturn.

Historically, September has been known as the worst-performing month for the stock market, and this trend could be spilling over into the crypto market.

In addition to these factors, Bitcoin ETFs have also faced significant setbacks today. After enjoying eight straight days of inflows, they experienced net outflows of $127.1 million.

Surprisingly, ARK Invest was the major outflow contributor this time, not Grayscale, with $102 million in net outflows reported for the day.

At the current moment, Bitcoin prices have managed to stabilize slightly, holding just above $59,000. We will keep you posted on any significant market developments as they arise.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

JEFF BOOTH: WHY BITCOIN IS A SUPERIOR ASSET

In a recent interview on Walker - The Bitcoin Podcast, Bitcoin entrepreneur and author of The Price of Tomorrow - Jeff Booth, spoke about Bitcoin's superior store of value to all other assets.

For Booth, even Real Estate Investments, which traditionally have provided one of the most stable store of value, cannot compete with the superiority of the digital asset Bitcoin.

He notes that in just 7 months during 2024, the Crypto market has surged by $623 billion, as the market value of Bitcoin has risen by over $20,000.

That's around a 36% increase in net value, with significant inflows coming, thanks in large part to the Bitcoin Spot ETF launches.

Booth emphasizes the importance of early adoption in the Bitcoin ecosystem, arguing that although the market is rapidly expanding, it is still in its infancy.

Booth goes on to note how significant it is to have an asset that is decentralised and secure.

Essentially, in the Fiat System wealth is concentrated within an elite of the population and monopolies are allowed to flourish.

Rampant money printing to service a debt ridden system, allows for the elites that hold the assets to make enormous fiat gains at the cost of those at the lower end of the socio-economic pyramid (pensioners, low income workers, etc).

For Jeff, all of the gains created by technological advances that make our lives easier and more efficient are syphoned away, ie stolen at the base layer.

However, with Bitcoin, abundance is shared across all of the users on the network.

The more that we use Bitcoin and all of the applications that are currently being develop on top layer 1, the more that we share in this abundance, and the stronger and more decentralised the network becomes.

He goes on to provide insight into how he uses Bitcoin, and some of the challenges that still exist when trying to move to a fully Bitcoin centred economy in his native Canada.

Jeff Booth is a true visionary. Anyone trying to understand the full potential of Bitcoin should spend time listening to Jeff…

Here are a few other clips from his interview, so you can see what we mean!

OTHER NEWS:

Jameson Lopp scrutinises Coinbase over its high withdrawal fees, including a striking $60 charge despite low on-chain fees, highlighting issues in fee estimation and business practices in their Bitcoin transactions

Christos Makridis in a new research paper reveals that countries adopting central bank digital currencies (CBDCs) experience decreased well-being, particularly among youth and low-income individuals, challenging the assumption that CBDCs enhance financial inclusion and stability

Matt Black, CEO of Atomic Finance, explores how a Bitcoin fee spike led to Lightning force closures and discusses upcoming improvements, particularly package relay, to enhance user experience and prevent these disruptions

Che Kohler of The Bitcoin Manual writes why Fountain FM’s recent integration of Nostr is such a milestone as it combines various open-source technologies and demonstrates innovative leadership in the realms of digital payment and content sharing

Tom G. Meling, Magne Mogstad & Arnstein Vestre publish a working paper on crypto tax noncompliance which remains widespread even among users of exchanges reporting to tax authorities, calling for targeted and cost-effective enforcement strategies due to the generally low tax liabilities of most crypto users

Justin Bins, Founder & CIO of Cyber Capital writes how Ethereum's reliance on Layer 2 (L2) solutions is leading to its downfall by fragmenting the ecosystem, pushing users towards centralized L2s, and undermining the original promise of decentralization

Matt Hougan, CIO of Bitwise, writes that Bitcoin ETFs are rapidly gaining institutional adoption, outpacing retail investments, with a record $17.5B in net flows, affirming their status as the fastest-growing ETFs in history

TOP MEMES THIS WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.