Inflation On The Rise

Crypto, Inflation & The Fed: What You Need To Know

Bitwise: Bitcoin Supply Shock On The Way

Money May Soon Be Worthless

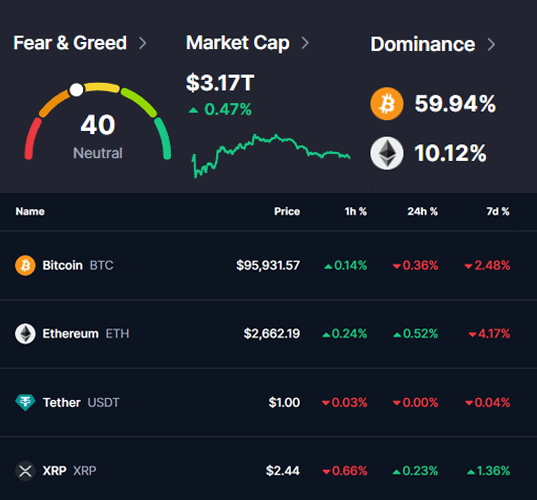

Market Data Prices as of 8:30am ET

This Update Is Brought To You By Bitcoin Well

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

INFLATION ON THE RISE

BREAKING: US Inflation Surges, Pushing Rate Cuts Further Into the Future

🚨 The Fed's worst fears have materialized…

Inflation wasn’t just above expectations—it was significantly hotter than expected.

This is the highest inflation report since 2023.

Headline CPI was projected to hold steady at 2.9%, but it jumped to 3.0% instead.

Core CPI was expected to ease to 3.1%, but it surged to 3.3%.

📈 It gets worse…

Month-over-month CPI soared by +0.5%, far surpassing the anticipated +0.3% rise.

The last time we saw an increase this steep was August 2023.

And here’s the kicker—these figures don’t even include the latest tariffs on China and other nations, which are likely to push inflation even higher in the coming months.

💰 Rate cut expectations? Slashed.

The market now anticipates just one rate cut in October 2025.

The next cut? Not until December 2026.

Under normal circumstances, this would trigger a market-wide sell-off.

But that’s not what happened…

📉 Bitcoin briefly tumbled below $95,000, but quickly rebounded to $96,000 at the time of writing.

This could indicate that sellers are exhausted and that strong demand is emerging at these levels.

Just like yesterday, this might be another signal that the local bottom is in. 😎

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

CRYPTO, INFLATION AND THE FED. WHAT YOU NEED TO KNOW

🚨 Inflation Stays Hot—And That’s a Problem

The Federal Reserve’s target inflation rate is 2%, but we’re still hovering around 3%.

Powell confirmed in his latest remarks that while inflation has come down, it’s still "somewhat elevated." That means:

Interest rates will stay high for longer

Borrowing remains expensive, slowing down spending and investing

Markets may remain volatile as investors adjust expectations

Powell also warned that proposed tariffs—such as those from Trump’s economic plans—could put upward pressure on prices, making it even harder for the Fed to justify rate cuts anytime soon.

🔮 No Rate Cuts in Sight—Markets Brace for Impact

Just a month ago, the market was expecting two rate cuts in 2025. Now? Powell has all but confirmed that’s still the case—at best.

And when asked about Quantitative Easing (QE), Powell’s answer disappointed investors:

💡 No QE until rates hit zero. That means the Fed won’t be injecting fresh liquidity into the economy anytime soon, which could weigh on risk assets like stocks and crypto.

So, when will rate cuts actually happen? 🤔

Powell made it clear that the Fed won’t act until inflation cools further or the job market weakens significantly.

“The economy is strong overall… Inflation has moved much closer to our 2% goal, although it remains somewhat elevated… With our policy stance now being significantly less restrictive than it had been, we do not need to be in a hurry to adjust our policy stance.”

That means upcoming inflation reports and employment data are more important than ever for market predictions.

💹 Crypto & Stocks Wobbled—But Recovered Fast

Under normal circumstances, this kind of hawkish stance from the Fed would have triggered a massive sell-off in the markets. Instead, the dip was far more muted than expected.

Even Bitcoin ($BTC) initially reacted negatively but quickly rebounded.

As of now, BTC is still hovering around $97K—suggesting that some investors believe the worst is already priced in.

But here’s the real kicker…

🌎 Global Rate Cuts = Good News for Crypto

Even if the U.S. holds steady on rates, other countries may not have that luxury.

Canada, China, Australia, and other economies are showing signs of weakness, meaning they may start cutting rates sooner.

And since crypto is a global asset, some of that fresh liquidity from foreign rate cuts and stimulus could flow into Bitcoin and altcoins, creating new market opportunities.

What Should You Do?

This isn’t a crisis—it’s a shift.

Yes, the Fed is holding firm, and yes, rate cuts aren’t coming soon. But markets have been surprisingly resilient, and global liquidity trends still favor long-term investors who understand how money moves across economies.

So, take a breath. This is just turbulence—not a crash. ✈️

Safer and Simpler.

Next-Gen Crypto Wallets.

Introducing SecuX Neo-X and NeoGold. Crypto for everyone. Security for all.

BITWISE: BITCOIN SUPPLY SHOCK

ON THE WAY

Institutions Face Growing Challenges in Securing Bitcoin

A recent Bitcoin supply report from Bitwise has sent shockwaves through institutional investors.

According to the data, roughly 7.5% of Bitcoin is lost, while 6.1% is controlled by funds and ETFs.

Satoshi Nakamoto’s wallet remains untouched, holding 4.6%, and businesses and governments own just 5.8%.

This leaves individual holders as the primary source of available Bitcoin liquidity, raising concerns over how institutions can continue acquiring the asset.

“Every new Bitcoin buyer must find a seller. It’s obvious but more important than ever,”

OTC Markets Are Running Out of Bitcoin

One of the primary ways institutions acquire Bitcoin is through OTC markets, which allow for large trades without directly impacting the spot price. However, recent reports suggest that only 140,000 BTC remains in these markets, creating an unprecedented liquidity crisis.

A crypto analyst explained that while ETFs purchased 50,000 BTC in the past month, prices didn’t see a significant jump. This indicates that institutional buyers were sourcing their BTC from OTC desks rather than exchanges.

“The Bitcoin supply crunch is real. If OTC markets dry up, institutions will be forced to buy from public exchanges, which will send prices soaring,”

Institutional Buying Pressures Bitcoin’s Limited Supply

Leading corporations like MicroStrategy (now Strategy) are aggressively accumulating BTC. The firm recently purchased 7,633 BTC for $742.4 million, marking its fifth purchase in 2025 alone.

BlackRock is also adding to the pressure, acquiring $1 billion worth of Bitcoin in January.

If institutions continue at this pace, the remaining OTC Bitcoin supply could be wiped out, forcing buyers to bid on exchanges—a move that could lead to a sharp Bitcoin price surge.

Bitcoin’s Adoption Rate Signals a Supply Shock

As supply tightens, Bitcoin adoption continues to accelerate. BlackRock recently reported that cryptocurrency adoption has surpassed 300 million users, outpacing both the internet and mobile technology in growth speed.

Coinbase CEO Brian Armstrong predicts that at the current pace, Bitcoin adoption will reach several billion users by 2030.

With increasing demand and limited supply, institutional buyers may face an uphill battle securing BTC in the coming years.

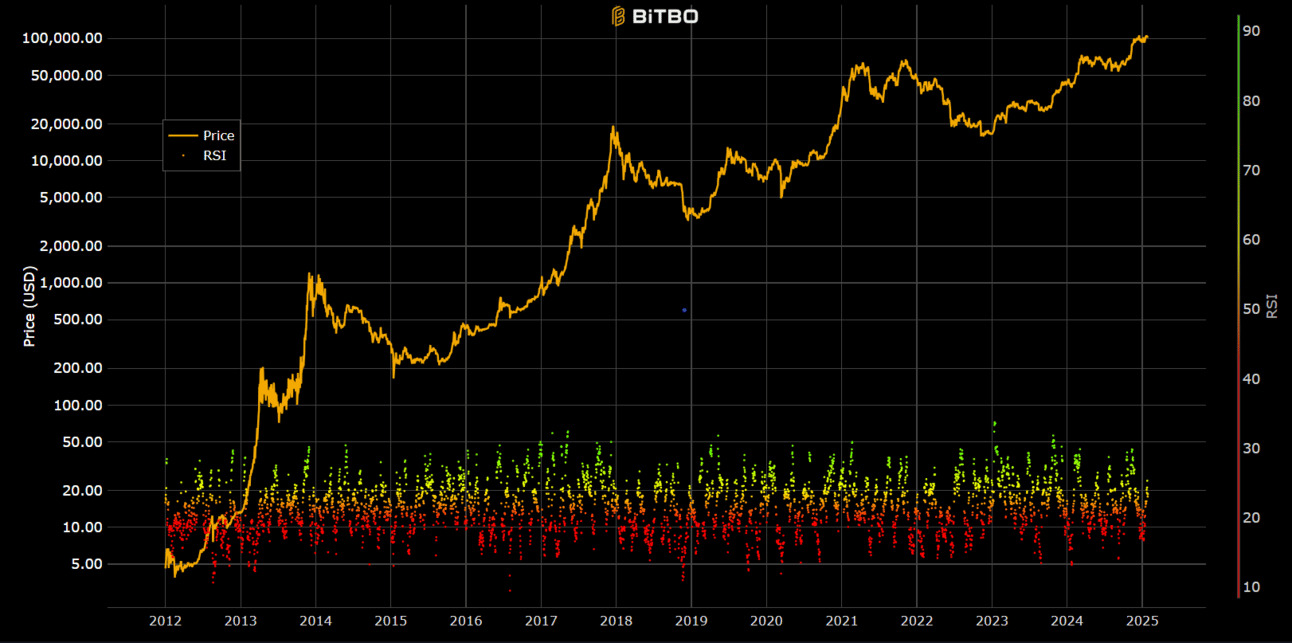

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the price of the S&P 500 index in bitcoin (BTC).

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the day being observed relative to the past 14 days.

A high RSI means that price movements are very positive relative to the past 14 days.

A low RSI means that price movements are very negative relative to the past 14 days.

MONEY MAY SOON BE WORTHLESS

In a recent interview Raoul Pal explores the possibility of money losing its value and what that means for our financial future.

From inflation to digital currencies and the evolving economy, he unpacks the key trends shaping the way we transact.

Is money on the verge of becoming obsolete? Raoul Pal delves into the forces driving financial transformation, including inflation, the rise of digital currencies, and major economic shifts.

Join him as he unravels what the future of finance could look like.

What if money became worthless? Raoul Pal breaks down the shocking reality of inflation, digital currencies, and the rapid changes in the global economy.

Watch now to uncover the future of finance and what it means for you.

Tune in to find out what’s ahead.

RECOMMENDATIONS

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.